We moved to Playa del Carmen on December 5, 2022, after a stressful and expensive relocation from Dubai. Like many expats, digital nomads, and retirees who relocate to Mexico, we had the same reasons and motivations:

- A cheaper cost of living compared to North America and Europe

- Warm year-round weather

- Amazing food

- A slower, more chilled pace of life

As a fan of the FIRE movement (Financial Independence Retire Early), I had been voraciously reading about the cost of living in PDC for several years. Compared to Dubai, where our average monthly budget was just over $6K USD per month, we anticipated being able to cut our budget in half.

Geoarbitrage MY WAY IN pLAYA DEL CARMEN

Geoarbitrage or the concept of living in a lower-cost area is a popular method to make your money work harder and last longer.

One source I referred to often was International Living, a respected publication specializing in retirement planning in lower-cost countries. According to their annual Global Retirement Index, for 2023, Mexico ranks #2 according to a number of factors, with the cost of living, proximity to North America, and fairly easy visa processing top of mind for many North Americans.

While lifestyle variables can vary widely, generally the blog budgets I saw ranged from $2,100 USD to $2,600 USD per couple, per month.

Since I knew we’d likely incur additional costs, I padded our budget to $3K as an additional safety net.

What I’m here to tell you is that those $2,000 budgets are absolute horseshit.

If you’ve read my Dubai budget and savings rate blog, you’ll know that I am a big fan of detailed spending tracking for accurate budgeting. I track EVERYTHING. By the end of December, I noticed our spending was out of control, so I created a tracker and documented every single purchase.

You can imagine my shock when I discovered that by the end of January, we spent nearly $4,000 USD.

To be clear, we have a pretty basic lifestyle. We don’t have kids, and there were no fancy dinners, travel excursions, or big splurges.

So, what is actually going on?

Why is our monthly spending nearly twice the amount as what is reported on these websites?

I’ve spent a lot of time thinking about this, researching, and talking to people.

Here’s what I learned:

- There is a massive influx of retirees, digital nomads, and families relocating to Mexico. Not only Americans but also Europeans and Canadians are arriving in droves. Everyone, including us, is seeking a lower cost of living and a slower pace of life. Thus ironically, we are driving prices sky-high.

- PDC is one of the fastest-growing cities in Latin America. Therefore, the prices are increasing to meet the demand.

- Like almost everywhere, Mexico is facing significant inflation, in the range of 8%.

- In Mexico, everything is pegged to the USD. While Americans are dancing with joy, Canadians are faced with a 34% markup due to the current exchange rates. Like us, most of the Canadians I’ve talked to are definitely feeling the pain.

What this means for many of the big publications and blogs is that:

- Many of these budgets, even the recent ones, are outdated and no longer reflect the current economic reality.

- As I’ll outline below, the budgets exclude important annual costs like health insurance, flights home, visa and legal services, and other unexpected costs (like getting your haircut and the odd manicure).

How Much I Spent

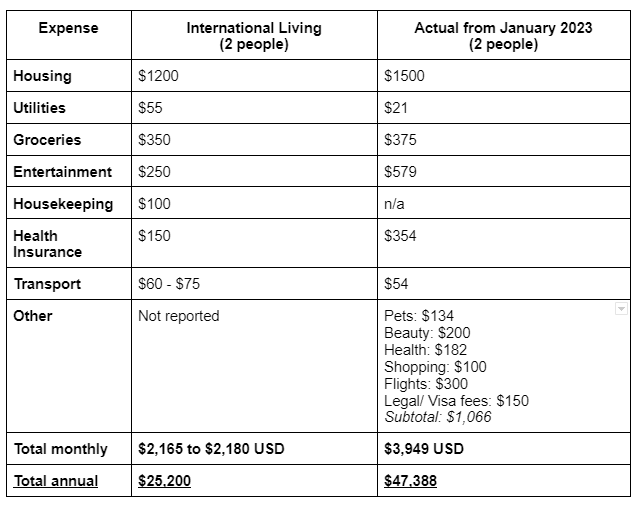

To make things crystal clear for you, I’ve done a line-by-line comparison using International Living’s PDC budget post for 2 people compared to my actual spending in January 2023.

Here are a couple of important points about my expenses:

- Housing: For rentals of 6 months or longer, you can generally find cheaper options through Facebook marketplace or a rental agency. Anything below 6 months is considered short-term. Typically, this means you need to book through Airbnb, where you’ll be paying 20%-40% more. Since I needed to rent for 3 months, this was my only option. As well, many owners will not accept pets anymore! This is a relatively new trend that is happening in 2023, and I suspect it’s connected to the surge in demand. The place I found was the cheapest 1 bedroom I could find that would allow pets and was close enough to the key amenities I need.

- Groceries were purchased at a budget grocer. My husband is away for work which means that 3 of the 4 weeks are based on my groceries only! I have no idea what groceries will cost when he gets back, but I suspect it will be at least $500. I generally always make my own breakfast and lunch. Most nights I have dinner at home, but I definitely like to go out and people-watch.

- Entertainment is mostly dining out. I analyzed our spending by week and discovered that the first week of January (when Steve was still here) represented 60% of our monthly total. Taking an average of the other three weeks and using that as a baseline, the total projected cost would be around $350 / month, which will be my February target. Meals were mostly away from the tourist areas.

- Health insurance. While I’ve seen some bloggers reference private health insurance in Mexico for as low as $100 USD per person per month, I have never actually met anyone who pays this. Even long-term residents are paying at least $125 USD. In our case, we need global health coverage to cover us in Mexico and Canada (as Canadian non-residents, we are not eligible for health insurance). I shopped this quote around and considering our age, by far, the cheapest I could find was $177 USD per person per month. That’s for catastrophic coverage only. Any routine medical or dental care would need to be paid out of pocket. So, the total monthly cost is an additional $354 USD per month! Double what I read in the blogs. It’s also notable that many of the big players (Cigna etc.), imposed price increases this year.

Other Category: The fact that I have 6 additional categories under ‘Other’, while International Living has none, tells me their budget tracking is generic and therefore incomplete.

If you want a true picture of your monthly spending, you have to track everything! It’s interesting to note that the subtotal for the ‘other’ category is a full 25% of my total budget, and thus accounts for the bulk of the overage.

- Beauty: I had my hair and nails done once. Highlights, toner, and a cut for medium-length hair will set you back $180 USD! I was shocked but was able to negotiate a 10% discount. From speaking to other people, this seems to be the norm for salons. I’m definitely going to see if I can find a cheaper salon though. The other $20 was for shampoo and nail polish remover.

- Pets: We are traveling with 2 senior chihuahuas so needed to include their food and medication costs. Technically I excluded their dental cleanings which were an additional $529. I consider this an outlier cost as it’s not recurring.

- Health costs are supplements that I ordered through iHerb.

- Shopping included 3 clothing items.

- Flights: While we are temporary residents of Mexico, we still plan to travel back to Canada annually. We might also fly domestically when we come back in the fall. Conservatively, I’ve assumed an additional $300 USD per month to cover our annual flights.

- Visas and legal services: Many long-term expats opt for temporary residency. It is recommended to use a legal service as it is very challenging to navigate the local bureaucracy. The firm we used charged us $1,765, which was very competitive, and includes both the legal and government fees. Monthly that equates to $150 USD that we need to budget for our renewal next year.

With everything tracked and compared, it is obvious why my actual spending is nearly double what International Living has reported.

If I feel misled, I’m certain there are others as well. If you are considering relocating to a cheaper country, definitely do your homework! While Mexico is still cheaper than North America or Europe, the costs are definitely increasing.

Since the first step of financial mindfulness is to know where you’re spending your money, on that front, I feel good. Knowing where your money is going, gives you agency at least.

All in all, I’m glad we’re here. At the macro level, we still saved $2K / month compared to living in Dubai. We’re committed to staying for 5 years, and I’m especially looking forward to learning more about the culture as well as exploring the country.

I’d love it if you’d consider following me on Medium!

As well, feel free to check: www.mindfulfirelife.com and IG: @mindfulfirelife