If you’re looking to invest in the stock market, it’s essential to educate yourself first. Knowledge about the stock market will help you make informed decisions that can lead to long-term financial success. However, with so much information out there, it can be challenging to know where to start. Fortunately, several books can help you understand the stock market and how it works. In this article, we’ll introduce you to the best books to learn about stocks.

Scared of the stock market?

The stock market can be a daunting place for beginners, but with the right resources, anyone can understand it. Reading books about the stock market is an excellent way to start. Not only can they help you understand the jargon and terminology, but they can also provide you with strategies and insights that you can use to make better investment decisions.

Here are the ten best books to learn about stocks:

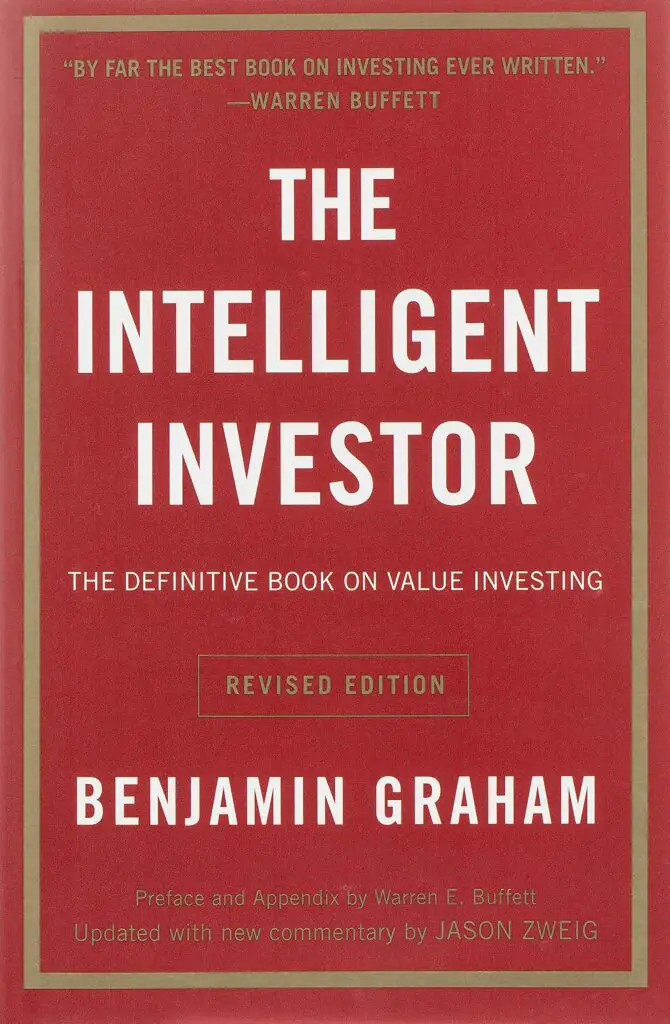

1. The Intelligent Investor by Benjamin Graham

“The Intelligent Investor” is often considered the Bible of value investing. Written by Benjamin Graham, one of the most successful investors of all time, this book provides a solid foundation for understanding the stock market.

Since its original publication in 1949, Benjamin Graham’s book has remained the most respected guide to investing, due to his timeless philosophy of “value investing”, which helps protect investors against the areas of possible substantial error and teaches them to develop long-term strategies with which they will be comfortable down the road.

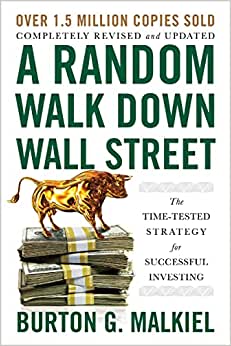

2. A Random Walk Down Wall Street by Burton Malkiel

“A Random Walk Down Wall Street” is a classic investment book that has been revised and updated several times since it was first published in 1973.

In this book, Burton Malkiel explains the basics of investing and emphasizes the importance of diversification. He also introduces readers to the concept of efficient markets, which states that stock prices are always fair and reflect all available information.

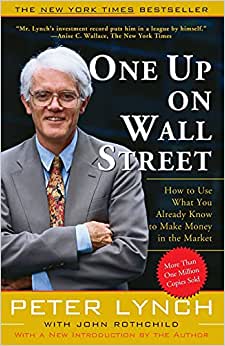

3. One Up On Wall Street by Peter Lynch

Peter Lynch is a legendary investor who managed the Fidelity Magellan Fund for 13 years when it became the world’s largest mutual fund.

In “One Up On Wall Street,” Lynch shares his investment strategies and explains how he beat the market consistently.

According to Lynch, investment opportunities are everywhere. We encounter products and services from the supermarket to the workplace all day. By paying attention to the best ones, we can find companies in which to invest before professional analysts discover them.

When investors get in early, they can find the “ten baggers,” the stocks that appreciate tenfold from the initial investment. A few ten baggers will turn an average stock portfolio into a star performer.

This book is an excellent choice for beginners looking for practical advice on investing in the stock market.

4. The Little Book of Common Sense Investing by John C. Bogle

“The Little Book of Common Sense Investing” is written by John C. Bogle, the founder of Vanguard, the world’s largest mutual fund company.

Bogle is a strong advocate of passive investing, which involves buying and holding a diversified portfolio of low-cost index funds. In this book, he explains why passive investing is a sound investment strategy and provides readers with a step-by-step guide to building a low-cost, diversified portfolio.

5. How to Make Money in Stocks by William J. O’Neil

“How to Make Money in Stocks” is a comprehensive guide to investing in the stock market. William J. O’Neil, the founder of Investor’s Business Daily, introduces readers to his CAN SLIM strategy, which involves identifying stocks with strong earnings growth, excellent management, and solid market demand. O’Neil also provides readers with tips on how to analyze stock charts and use technical analysis to make better investment decisions.

6. The Essays of Warren Buffett: Lessons for Corporate America by Warren Buffett

Warren Buffett is widely regarded as one of the most successful investors of all time. In this book, Buffett shares his thoughts on investing, business, and life in a series of essays.

The book covers a wide range of topics, including the importance of value investing, the benefits of long-term thinking, and the dangers of excessive leverage.

7. The Dhandho Investor by Mohnish Pabrai

“The Dhandho Investor” is a book that teaches readers how to apply the principles of value investing to their investment decisions. The author, Mohnish Pabrai, is a successful investor who has generated impressive returns by investing in undervalued stocks. In this book, he explains how he identifies opportunities in the market and how he manages his portfolio.

8. The Four Pillars of Investing by William J. Bernstein

“The Four Pillars of Investing” is a comprehensive guide to investing that covers all the essential topics, including asset allocation, diversification, risk management, and portfolio construction. William J. Bernstein, the author, is a neurologist turned investor who has written several books on finance and investing.

In this book, he provides readers with a framework for building a successful investment portfolio.

9. The Psychology of Money by Morgan Housel

“The Psychology of Money” is a book that explores the role of psychology in financial decision-making. The author, Morgan Housel, is a well-known financial writer who has written for publications such as The Wall Street Journal and The Motley Fool.

In this book, he explains how our emotions and biases can affect our financial decisions and provides readers with strategies for making better investment decisions.

10. Common Stocks and Uncommon Profits by Philip A. Fisher

“Common Stocks and Uncommon Profits” is a classic investment book that was first published in 1958. In this book, Philip A. Fisher, a legendary investor, explains his investment philosophy and provides readers with practical advice on how to invest in the stock market.

Fisher emphasizes the importance of doing a thorough research and finding companies with strong growth potential.

Why READ THESE BOOKS?

Many people hate reading books, I was like that too! However, after I learn the importance of reading and how it significantly impacted my perspective of investing. It completely changes how I should be viewing about money and I learn to be a better investor. So if you are interested to read books on personal finance or side hustle; click on the link here.

FAQs

What is the best book to learn about stocks for beginners?

If you’re new to investing, “The Intelligent Investor” by Benjamin Graham is an excellent place to start. It provides a solid foundation for understanding the stock market and teaches readers how to develop long-term investment strategies.

What is the best book to learn about value investing?

“The Intelligent Investor” by Benjamin Graham is widely regarded as the Bible of value investing. It provides readers with a framework for identifying undervalued stocks and teaches them how to develop a long-term investment strategy.

What is the best book to learn about technical analysis?

“How to Make Money in Stocks” by William J. O’Neil is an excellent book for learning about technical analysis. It provides readers with practical tips on how to analyze stock charts and use technical indicators to make better investment decisions.

What is the best book to learn about passive investing?

“The Little Book of Common Sense Investing” by John C. Bogle is the best book to learn about passive investing. It explains why passive investing is a sound investment strategy and provides readers with a step-by-step guide to building a low-cost, diversified portfolio.

What is the best book to learn about the psychology of investing?

“The Psychology of Money” by Morgan Housel is an excellent book for learning about the psychology of investing. It explores the role of emotions and biases in financial decision-making and provides readers with strategies for making better investment decisions.

What is the best book to learn about growth investing?

“Common Stocks and Uncommon Profits” by Philip A. Fisher is the best book to learn about growth investing. It emphasizes the importance of finding companies with strong growth potential and provides readers with practical advice on how to identify these opportunities.

Conclusion

Investing in the stock market can be a daunting task, but reading books by successful investors can provide a wealth of knowledge and help build the confidence needed to make sound investment decisions. The best books to learn about stocks are those that provide a solid foundation in investing principles and teach readers how to develop long-term investment strategies.

Reading books on stocks is an excellent way to gain knowledge and build confidence in investing. The best books to learn about stocks are those that provide a solid foundation in investing principles and teach readers how to develop long-term investment strategies. By reading these books, investors can learn how to make informed investment decisions and achieve their financial goals.