Commercial real estate is often overlooked in Singapore’s property investment. We often only focus on the residential area and never actually focus much on other real estate investments. Therefore, many of them may be poorly understood. However, once you understand the things to consider when buying commercial property, it isn’t as complicated as it seems.

Reason Why Commercial real estate is gaining popularity

Since the effect of increased ABSD (Additional Buyer’s Stamp Duty) in 2021 for private residential properties, foreign investors still interested in Singapore’s real estate are now moving into the less restrictive commercial market.

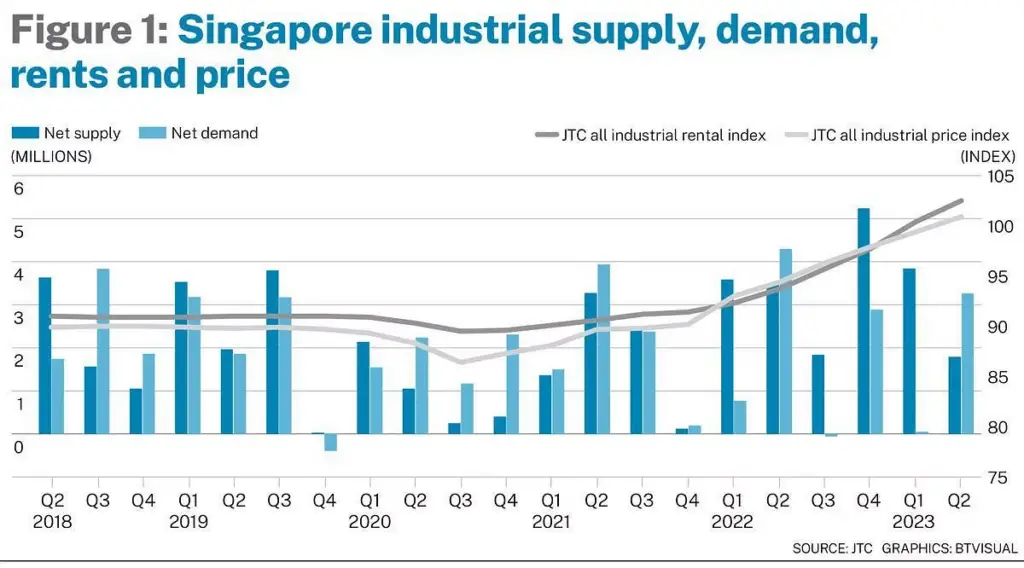

JTC reported that in Q2 2023, all industrial price and rental indices continued to rise for the eleventh straight quarter, hitting their highest points since Q1 2016 and Q1 2015, respectively.

This brings us to the next question of whether with businesses coming back to normal here in Singapore, will this space be a good investment over the next few years.

Is it Worth Investing?

Investing in commercial real estate is far more laid back than in residential real estate. Less taxes and regulations apply, and the market is kept reasonably lively by a constant flow of new projects and developments as well as Singapore’s appeal as a business hub economy. There are three different types of commercial for sale in Singapore you need to know, they are:

- Retail – shops, shophouses and malls

- Industrial – offices and warehouses (B1), factories (B2)

- Hotel – Hostels, hotels

Just like with residential properties, investors can purchase commercial real estate and lease them out to generate rental income. However, it’s important to understand the difference between commercial and residential property investment here in Singapore.

Differences between Commercial and residential property

The demand factor is one big difference between commercial and residential property in Singapore.

Unlike residential property, Singapore has a weaker commercial real estate demand and renting is a more preferred choice. Here are a few reasons why this is the case:

- shorter leasehold duration (can go anywhere from 20 ~ to 60 years)

- may require a number of licenses in order to operate the property

- location is usually not near MRT

- have not been appreciated as much as residential property

Over the years, Singapore’s astute commercial real estate developers have ingeniously embraced the concept of integrated projects known as mixed-use developments. This contemporary trend in property development seamlessly amalgamates various real estate components, including

- residential

- commercial

- hospitality

- office spaces

This innovative approach not only creates a dynamic blend of diverse offerings but also fosters a vibrant community with a plethora of activities to engage in, drawing people in and solidifying mixed-use development as an increasingly favored and popular choice.

But don’t let the latest trend solidify your investment process.

Future Anticipation for property investing in commercial real estate

While we have been seeing a decrease in supply and an increase in demand for commercial real estate, there is a trend that shows interesting potential over the next few years.

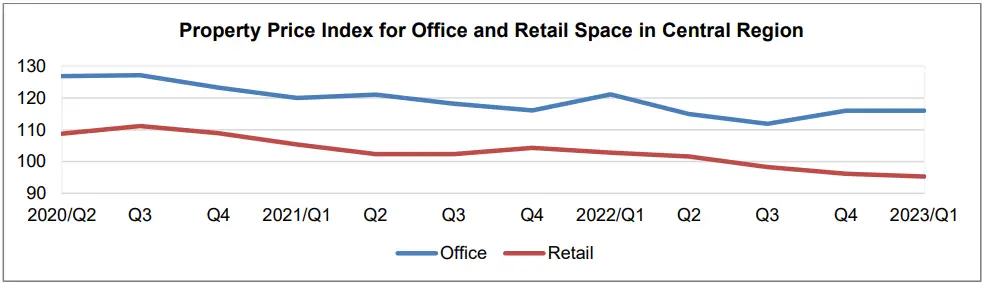

Since 2020, the Central Region’s office and retail property values have been declining. This indicates that the average cost of commercial real estate in the region is lower today than it was two years ago. The last two quarters of 2022 saw a slight recovery for office properties; however, the rally tapered off in the first quarter of this year.

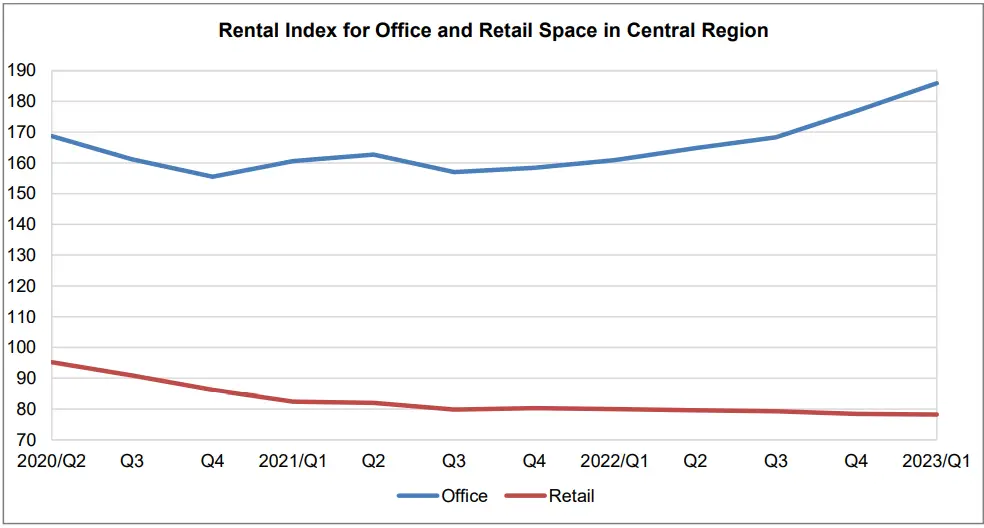

Rental rates have been rising since Q3 2021, and the last nine months have seen an acceleration in this rate of increase. This suggests that despite today’s already exorbitant rents, there is still a strong demand for office space in the central region.

These two chart shows that there is a healthy demand for commercial real estate but buyers aren’t so eager to own the property, instead, they are more willing to rent.

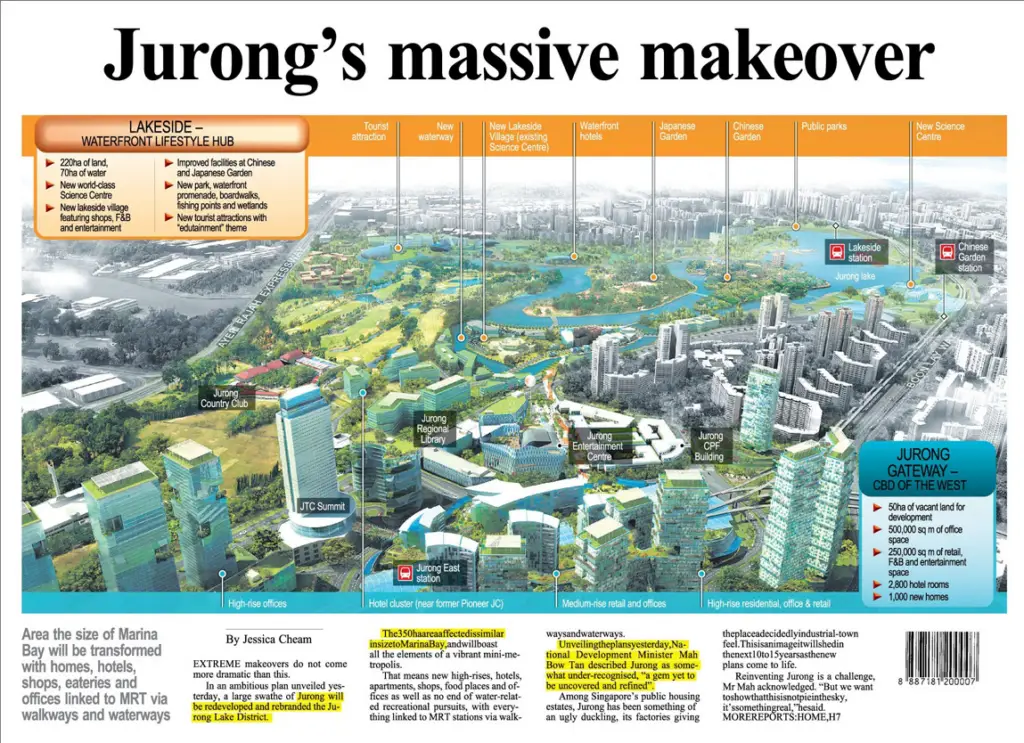

Partly the reason for slower growth in the central region has to do with more development for the OCR (outside the central region). Over the last few years, we will see more major developments in places like Jurong La became known as the second CBD (Central business district).

While we can expect more growth throughout the OCR, we as investors need to understand many considerations before buying a commercial property.

Things To Consider When Buying Commercial Property

When considering the purchase of commercial property, there are several key factors to take into account:

1. Location

The property’s location can significantly impact its value and potential for business success. Here are a few keynotes to consider:

- Proximity to target demographics, suppliers, and transportation hubs.

- Accessibility and visibility for customers and employees.

- Local economic and employment trends.

While it’s possible to build yourself a community of buyers to your area, it would make it a lot easier to do business where it’s centralise for everyone.

2. Zoning and Land Use Regulations

The best way to keep up with and understand the government plans for each zoning, you can check out the land use and zoning by going to URA Masterplan to check for any restrictions or requirements that could affect your plans such as:

- Verify that the property complies with zoning laws and regulations.

- Check for any restrictions on how the property can be used.

- Research potential changes in zoning laws that might affect the property in the future.

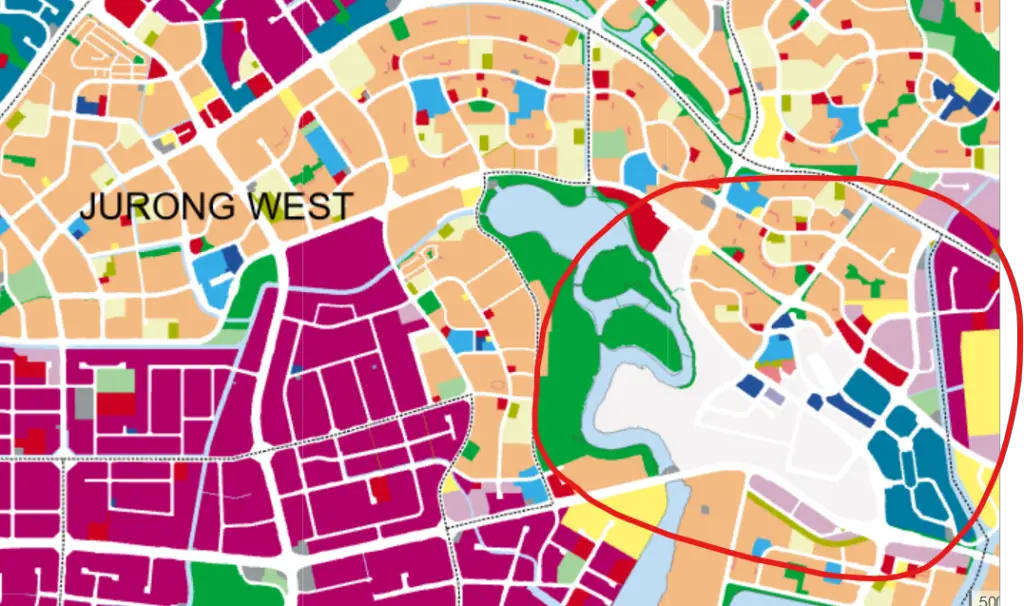

There are a few techniques to look into potential commercial investment, you can do this by understanding what the Singapore government plans to use white spaces (which can be use for anything). A good example would be the ongoing development of Jurong Lake District.

The recent mixed-use development J’Den that was launched in October had over 88% sold during launch week as many buyers anticipate future development of a number of large plot shown in the image.

With more potential growth within the area, it make sense that investors would be interested to be part of the early mover.

3. Market Conditions

A great example of the importance of understanding market conditions is knowing the cause and effect of what would happen to commercial real estate market after the COVID-19 pandemic. Back then, commercial real estate was down 34% and many were worried this effect would last quite some time. While many predicting correctly that office space business would be badly affected, not many investor knew the opportunity the pandemic provided.

During the pandemic, industrial spaces grew more than 4 times from Q2 2020 to Q3 2021 as space constraints for storage affected many businesses.

As investors, there’s a huge opportunity to make a profit by selling and renting these spaces.

This is why understanding market conditions can be a powerful edge to make a profit for investors.

Especially right now where interest rates and the real estate market has bit more volatile, it is the job of an investor to:

- Analyze current and future market trends.

- Consider the demand for commercial space in the area.

- Research the vacancy rates and absorption rates in the market.

Most importantly, understand all that and be prepared to make any financial commitment.

If you are interested to find out more about the market condition and what to expect over the next few years, feel free to sign up for a free 1-to-1 consultation session to get you started in commercial real estate investing.

4. Tenancy and Lease Agreements

If you plan to buy commercial real estate for rental income, you will need to understand the basics of the lease agreement.

Some investors simply buy existing properties from others because they have real estate transactions to work around to understand whether a property may be profitable or not in the long run. Investors understand that all they need to worry about for commercial estate is having tenants pay for the rental. And if the property has existing tenants, all they will need to do is:

- review the lease agreements to understand the rental income

- calculate the remaining lease duration

- Evaluate the financial stability and creditworthiness of current tenants

- find out if there are any obligations you may have as a new landlord

- Consider the potential for lease renewals or renegotiations

While you could make money from renting out residential units, commercial real estate in Singapore does not tax buyers for owning additional commercial units and making it much easier to scale!

5. Physical Condition

Which one are you more likely to invest?

Probably the refurnished one at a cheaper price if you are looking to buy. Unlike residential property, commercial real estate requires a lot of work put into it to refurbish and safety regulations in order to rent out. But that’s not to say you won’t make money from renting out a bare office, it just requires more effort to refurbish it.

They require:

- A thorough inspection of the property for any structural issues or necessary repairs.

- Assess the condition of major systems such as HVAC, plumbing, and electrical.

- Estimate the cost of maintenance and potential renovations.

This is why commercial real estate may require facility management and property management to check up on the property. If you are planning to invest in a commercial real estate that’s bare, you may want to consider finding out the cost of renovation and refurbishment.

If you are interested to have a facility and property management, feel free to reach out to us and we will support you with the right person.

6. Potential for Appreciation

Who isn’t here to make money?

Just this year, a report by EdgeProp announce the shophouse market in Singapore grew close to 50 shophouses were sold in 2Q2023, 45.5% higher than 1Q2023’s 33 deals. The total transacted value came up to to $512.3 million in 2Q2023, up 53.6% q-o-q. The sharp climb is speculated to be coming from foreign wealth diverting to commercial real estate as a means for another investment vehicle.

A way you can evaluate the property’s potential for value appreciation based on factors such as future developments in the area and economic growth projections are:

- Research the historical property value appreciation in the area.

- Consider future developments and infrastructure projects that could impact property value.

- Evaluate the overall economic growth potential of the region.

While we can’t speculate the future of the commercial real estate market, it’s great to share some insights and what are some expectations over the few years.

7. Financing

Commercial real estate is generally more expensive than residential property and investors looking to buy these real estate generally have deeper pockets. However, there are things to consider before we make any decision such as:

- Explore financing options and interest rates.

- Assess the loan terms, down payment requirements, and potential for refinancing.

- Understand the impact of financing on the property’s cash flow.

A mere 1% interest rate increase of a $10 million is worth $100,000 more which can be quite a hefty price to pay extra for.

8. Operating Costs

A key reason why many commercial businesses fail is they do not take into account of the operating cost to run the office. There are many miscellaneous cost that goes inside business expenses such as:

- operating expenses – If not done correctly you won’t be able to make a decent profit

- property taxes – Non-residential properties such as commercial and industrial buildings and land are taxed at 10% of the Annual Value

- maintenance costs – services such as plumbing, electrical, and air-con repair are a yearly maintenance cost that needs to be calculated

- insurance – In case of any damages or issues, you can claim back some of the cost

- management fees – you may need to hire a property and facility manager to support

If not managed correctly, most businesses would pay the price of earning profit and suffer over the long run.

9. Legal and Tax Implications

Be aware of the legal and tax considerations, including the Buyer’s Stamp Duty and property tax rates for non-residential properties.

The Singapore government is strict with the legal and tax implications.

We are a “fine city” after all!

So while you invest in commercial real estate, it’s important to take into consideration the tax implications of the investment and any pending litigation or environmental concerns. Singapore cares a lot about the environment and having green approval helps to boost business creditability.

By also paying your taxes, the government is able to understand your business and see what grants are available in the market for you.

For example, the statutory board under Singapore’s Ministry of Trade and Industry actively provide grants and subsidiary to local businesses to support their growth by funding up to 80%.

Thanks to it, some businesses are now working hard to achieve good ESG scores While compliance with the Environmental, Social, and Governance (ESG) criteria. It is now becoming a standard practice in the industry, as it can lead to benefits such as improved reputation, increased investor confidence, and potential cost savings through energy efficiency and sustainability measures.

10. Exit Strategy

Now that you have made your money or feel like doing other investments, you need a good exit strategy!

It’s important to have a clear exit strategy so you won’t feel like you would lose future value. If you don’t wish to sell, you will need to consider the future potential of selling later and earning from leasing the property for a steady income stream.

Interested in Investing in Singapore’s Commercial space?

These considerations will help you make an informed decision when investing in commercial real estate, while it may not be everything that you are looking for, it should help you to give a rough guide as to what you will need to consider before investing in Singapore’s commercial space.

If you are interested in finding out more, feel free to contact Aaron.⬇️

Aaron Oon is a Senior Associate Director at Propnex and Founder of Real Estate Insider. A consistent Top Producer in the competitive world of real estate, Armed with a Finance degree from NUS, Aaron is more than just a real estate agent; he’s a strategic thinker and a creative problem solver.

In his company Real Estate Insider, he shares the latest market updates and trends happening in the world and Singapore to keep us within the loop.

If you would like to know more what other potential growth happening around the area, be sure to contact Aaron or fill in your contact information here or feel free to schedule a Calendy video call with me using the link below.

what is the minimum down payment for commercial real estate?

The minimum down payment for commercial real estate can vary depending on the lender and the country’s regulations. In many cases, it is common for lenders to require a down payment of 20% to 30% of the property’s purchase price. However, this can be influenced by factors such as your creditworthiness, the type of commercial real estate, and the overall economic conditions.

how much can I loan for commercial real estate?

The loan amount you can secure for commercial real estate is influenced by factors such as your credit history, the property’s value, and the lender’s policies. Typically, lenders may offer loans covering 70% to 80% of the property’s value. It’s essential to have a good understanding of your financial situation and engage with lenders to determine the specific loan amount you qualify for.

how to avoid paying GST on commercial real estate

To minimize or avoid paying Goods and Services Tax (GST) on commercial real estate transactions in Singapore, individuals and businesses can explore several strategies. These include considering exempt supplies or zero-rated supplies, especially for international transactions. Businesses engaged in international trade may benefit from the Global Trader Program, while GST relief for the Transfer of a Going Concern (TOGC) is an option for sales of businesses as a going concern.

Another approach is engaging in GST-registered activities, allowing the buyer to claim input tax credits. Negotiating the sale price and seeking professional advice from tax experts are also recommended to navigate the complexities of GST regulations and ensure compliance with Singaporean tax laws.

how to own commercial Real estate in Singapore?

In Singapore, owning commercial real estate involves navigating legal and regulatory processes. Foreigners may need approval from the Singapore Land Authority to buy commercial properties. Singapore citizens and permanent residents typically do not face such restrictions. Engaging a real estate agent and seeking legal advice can help you understand the specific requirements and steps involved in owning commercial real estate in Singapore.

how much to buy commercial real estate

The cost of buying commercial real estate varies widely based on location, size, and other factors. It’s crucial to conduct thorough market research and work with real estate professionals to determine the current market value of properties in the desired area. Be prepared for additional costs such as taxes, legal fees, and maintenance expenses.

Is HDB shophouse commercial or residential?

HDB shophouses in Singapore are typically a combination of both commercial and residential spaces. The ground floor is designated for commercial use, such as shops or offices, while the upper floors may be used for residential purposes. It’s important to adhere to the usage guidelines set by the Housing and Development Board (HDB) to maintain the proper balance of commercial and residential activities.

Can I buy HDB if I own commercial real estate?

In Singapore, HDB flats are generally meant for residential purposes, and there are restrictions on the ownership of both HDB flats and private residential properties for certain individuals. If you already own a commercial real estate, you may still be eligible to buy an HDB flat under specific conditions. It’s advisable to check with the HDB and seek professional advice to understand the eligibility criteria and any limitations based on your existing property ownership.