Want make money? Get BTO, comfirm make money!

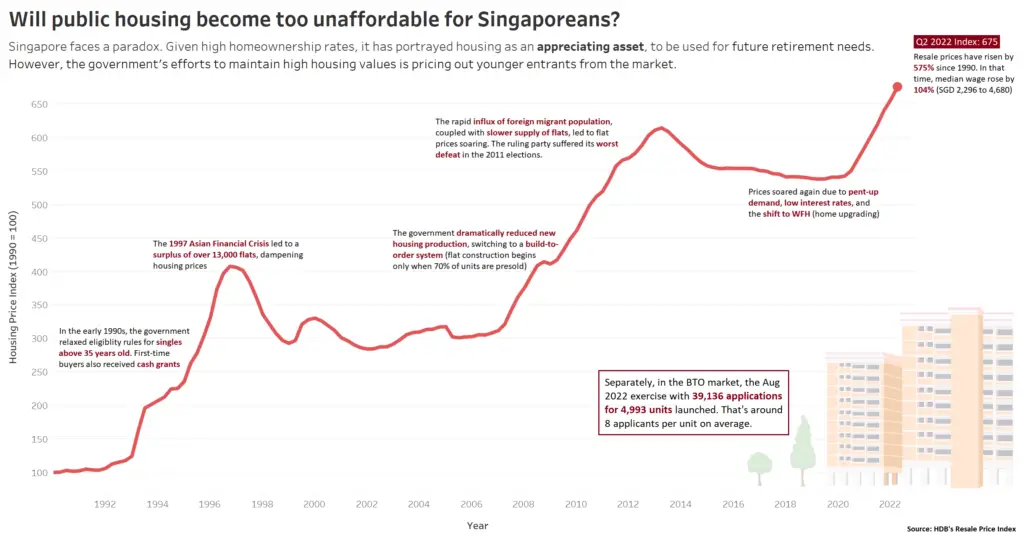

The battle between BTO vs Resale on asset progression has been a one-sided win over the last few years. While many buyers are not “investing savvy”, BTO seems like the best choice given how no buyers have ever lost money in this investment.

In fact, the Singapore government recently ramped up the supply of BTO flats by 35%, from 17,100 flats in 2021 to 23,200 flats in 2022, and 23,000 flats in 2023. With high demand and limited supply for BTO, we would definitely see prices for BTO increase over the years.

However, we shouldn’t discount the perks of jumping right into resale flats as a means of asset progression. With all the hype for the latest BTO and couples rushing into BTO, we might just be following everyone else and lose sight of other opportunities happening in the resale market.

The goal of Asset Progression

If your goal is to grow your wealth through property investing, your end goal should be the “Buy 1 Rent 1 strategy”. A strategy that allows property buyers to stay in one unit and have rental income from the other to cover the monthly expenses.

To do that though, requires years of building your asset and being patient with your investment. Buying public housing requires homeowners to fulfill the MOP (minimum occupation period)

Let’s Compare BTO Vs Resale Flats

To make the right purchase investment, let’s look at what potentials and risks you could be getting from BTO vs resale flats.

Get a BTO FLAT

The traditional advice of getting a BTO seems fair since it’s a safe approach to making your first pot of gold.

It’s almost always a guaranteed 5~6 figures in property gain, so why not right?

In addition to the aforementioned points to consider, such as the absence of a COV and the possibility of reduced remodeling expenses, the following should be kept in mind:

Affordable housing for an established neighborhood [Pros]

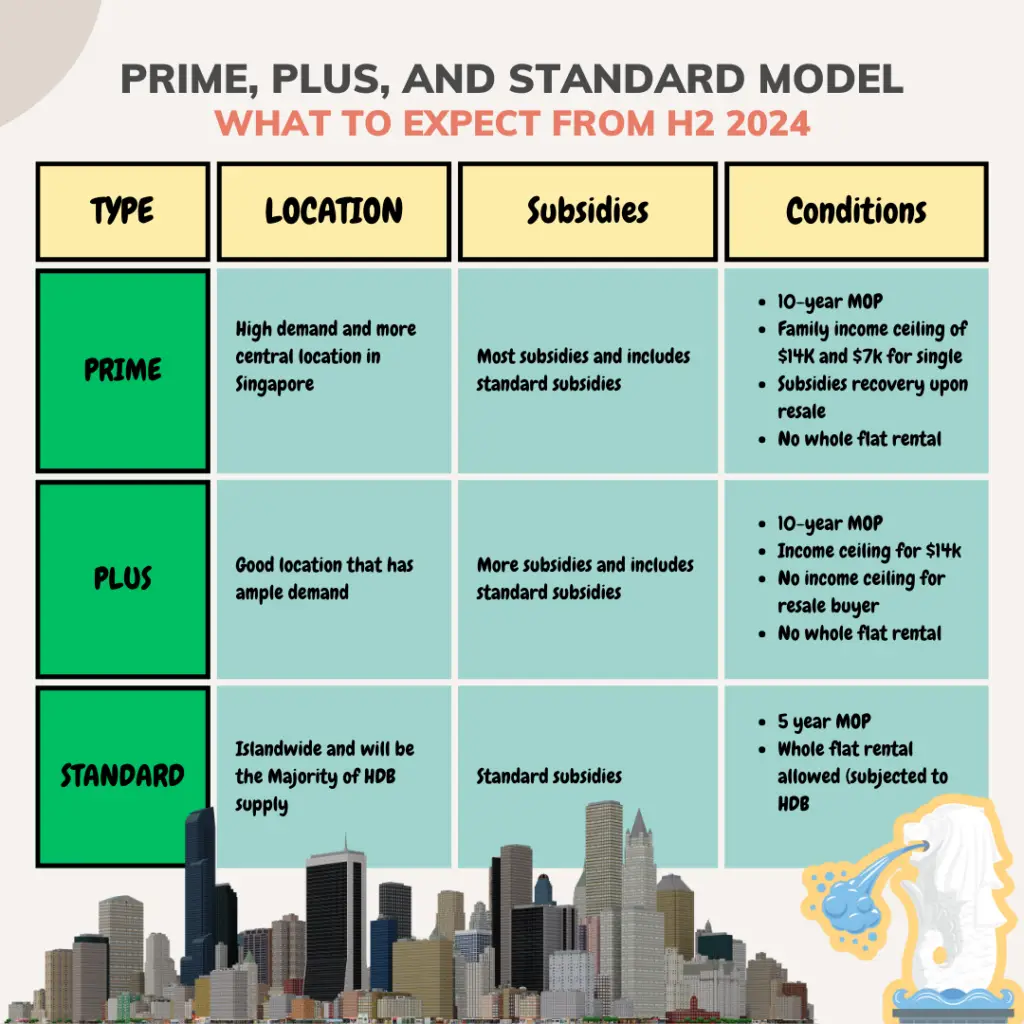

With the new HDB classification, buyers looking to stay in established neighborhoods can have a higher likelihood thanks to the new Prime, Plus, and Standard models.

With this new model, buyers looking to stay in a central location would avoid having the “lottery effect” affecting their property investment.

Also, this new model keeps property investors away from buying and flipping properties.

You can count this as a pro because houses in prime and plus would get more subsidies and once your property reaches its MOP, there will be demands for such property within these types of locations.

MOP almost always results in a profit [Pros]

BTO always comes at a discount compared to the resale market and often shows a profit when sold after 8 years. Since it is brand new, the buyers may avoid the hassle of lease deterioration and move in immediately.

Also, since you would be staying in the home for 8~13 years (depending on the prime, plus, and standard model) and only be able to sell after the term has ended, your investment has a high likelihood of making good capital appreciation.

If you would like to know more about the timeline from BTO to the next asset progression, here’s a full timeline breakdown⬇️

So while you can definitely earn capital appreciation and gains from inflation on your real estate asset, it’s important to consider your financial future over the next few years.

If you are expecting to make money income in the near future, waiting out to leverage on a higher TDSR (Total debt servicing ratio) isn’t a bad financial decision either.

Can gain from the maturation of undeveloped land into estates [Pros]

Anyone remembered back in 2010 when speculators were saying that Punngol property wouldn’t do well? That it was far from anything and everything.

News flash, some of Punggol’s HDB are transacting at over $1 million.

Oftentimes, buyers forget that investing in property isn’t about how the location currently is, but what’s to come in the future.

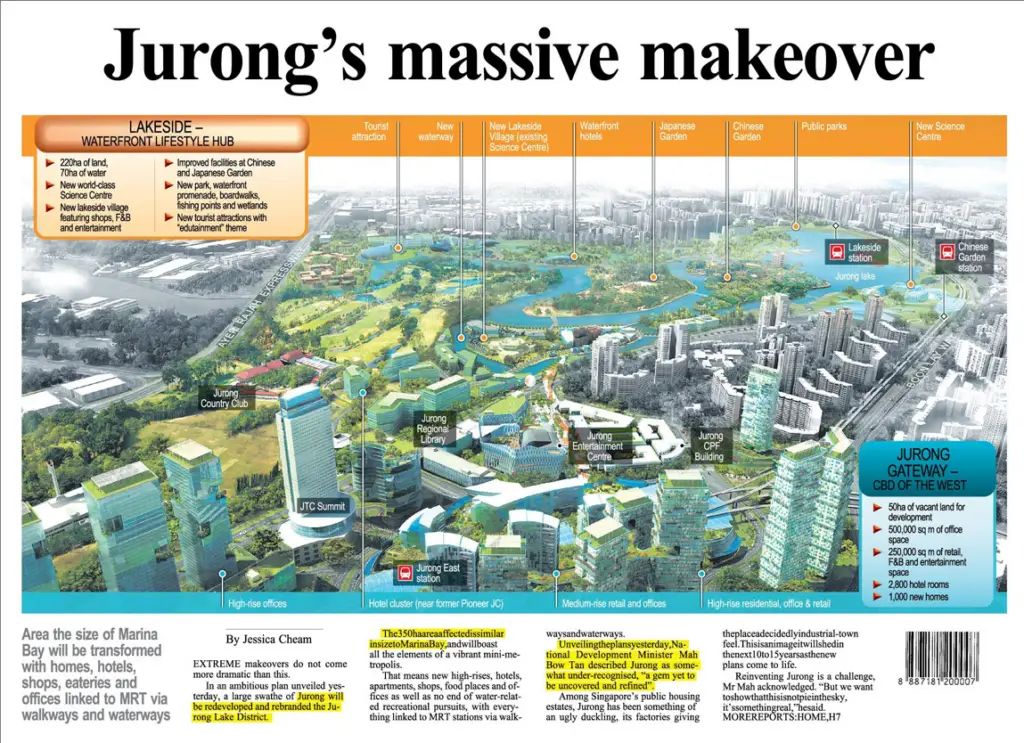

Something we all can look forward to right now in 2023 is JLD (Jurong Lake District) where a massive project will be to make Jurong the next CBD(central business district) in Singapore.

This means that over the next few years until 2027, we can start to see huge changes in the JLD. The areas that will benefit the most are likely to be Clementi, Boon Lay, Bukit Batok, and Tengah.

In our opinion, Clementi looks to be the most promising one over the next few years.

Once a tranquil suburb, Clementi has benefited greatly from the expansion of neighboring Buona Vista and the Holland Village identity cluster. So much so that Clementi has had over the last few years, a number of million dollar HDB.

In another article, we covered why Clementi will be a new up-and-coming highly sought-after property in the West. Breaking down what this area will look like over the next 5 years. If you are looking for a property in the West of Singapore, be sure to check out the article.

Prime, Plus, and Standard [Con]

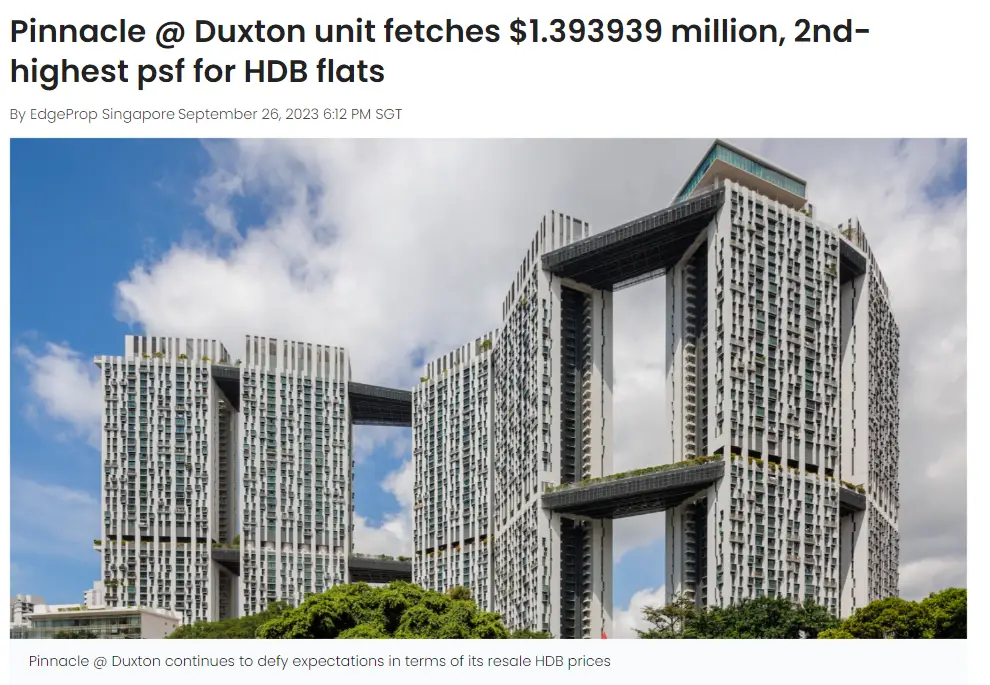

The lottery effect was first mentioned in 2019 when homebuyers were lucky enough to ballot for properties such as Pinnacle Duxton which has seen many over $1 million in record sales over the last few years.

To prevent the idea of “buy and sell quickly”, the Singapore government came up with this model to prevent buyers from raising the prices of HDB rapidly in prime and plus locations. This means that for future buyers in H2 2024, prime and plus homeowners will have to meet the 10-year MOP requirement before they can look to upgrade their property.

With more restrictions coming for BTO homeowners, they will need to carefully consider their property investment decision wisely for the next decade.

Long Waiting Time [Con]

Are you willing to wait 8 to 13 years before growing your investments?

Probably the biggest hurdle when it comes to property investing is processing your property investment timeline accordingly. There’s a lot that can happen within that 8~13 years and homeowners may have to work in different regions of Singapore.

The question you need to ask yourself before committing to a BTO is:

Are you ready to wait?

Since many homeowners are getting married later and have more income by then, the alternative, which has seen increasing demand would be the resale market.

Benefit of Resale Flats

Today’s first-time buyers favor secondhand apartments over brand-new ones in most cases. Buying a resale apartment in a desirable area and selling it after the MOP has passed is a typical piece of advice.

In fact, it might just be the better investment decision for the future.

Unlike other countries around the world, Singapore has one of the highest homeownership rating scores of 89.3% in 2023. This means that our property does not have a shortfall in demand, rather, we are consistently affected by low supply. Thus, many residents have raised the issue of properties being unaffordable in the near future for Singaporeans.

With the pandemic teaching the value of owning larger real estate, there are new homeowners looking for older flats for own-stay. During that time, maisonette, jumbo, and executive HDB were trendy places to stay in.

While this may mean homeowners looking for their own stay will not be earning capital appreciation, it certainly helps property investors looking to take the opportunity of using their subsidies entitlement to move on to their next property.

Can purchase in an established neighborhood [Pros]

Following the news of the prime, plus, and standard model happening in H2 2024, homeowners are now snatching for resale HDB within the established neighborhoods.

Homeowners who are buying flats in more established neighborhoods like Bishan, Queenstown, Toa Payoh, etc., believe these types of property tend to maintain their value better over time. It may also increase in value more quickly over the next five years than a flat in a developing region like Sengkang, Punggol, Pasir Ris, etc.

In addition to this, Mr. Luqman Hakim, Chief Data & Analytics Officer at 99.co, highlighted the significance of the 54 HDB flats transacting for a million dollars or more in August, which marks the highest number of million-dollar transactions to date.

Impressively, 50 of these flats were situated in Mature estates. Mr. Hakim’s comments reinforce the observation that more buyers are willing to pay a premium when purchasing larger public HDBs in prime locations compared to more expensive private properties.

When BTO apartments are made available in established areas, they are typically in high demand. If you want to live in a densely populated area, buying a resale apartment may be your only option.

Can Upgrade FAST [Pros]

The MOP is determined not at the time of sale but at the time of key collection. The whole 8 to 13 years would pass (3 years for construction plus 5 to 10 years for MOP) before the apartment could be put up for sale after the first purchase.

If you are getting a BTO, you are spending too much time waiting.

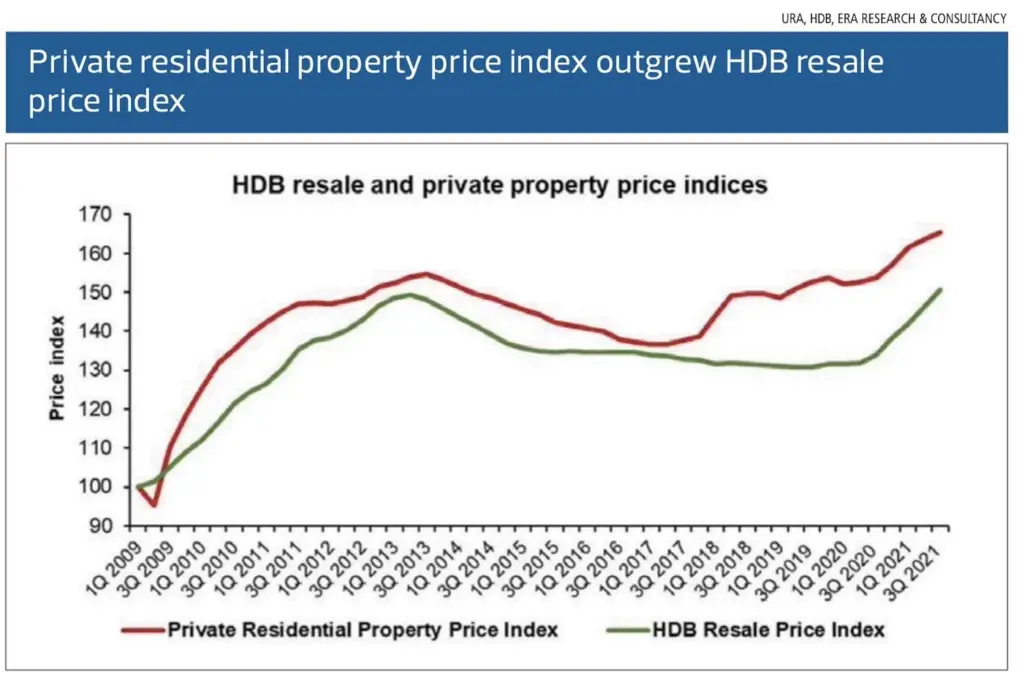

Remember that private real estate prices have been steadily rising this decade. Each new condo complex always has greater prices than the neighboring properties. HDB apartments have historically lagged behind privately owned ones in terms of price appreciation.

Over the last few years, we have seen a widening gap for HDB resale and private property prices increase. Therefore, the longer you wait, the more challenging it may be to bridge this gap.

Save up on Cost [Pros]

While you save up on renovation costs for your BTO over the next 3 years, inflation would have eaten a portion of that amount. Instead, getting a resale flat can instantly shorten your waiting time by 3 years (no TOP), and sometimes even the previous homeowner might have already renovated the home that’s to your liking.

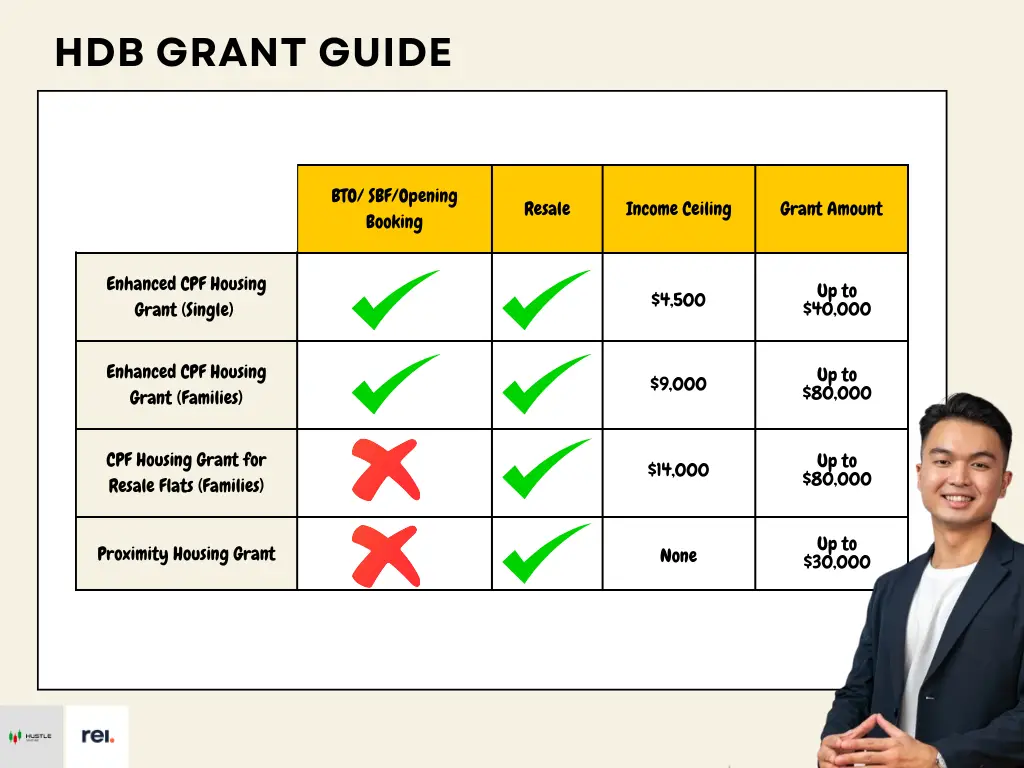

Wider Range of Grants [Pros]

In addition to the current Enhanced Housing Grant (EHG), there are now the Proximity Housing Grant (PHG) and the Family Grant for resale apartments. BTO apartments do not have access to these. The grant’s total value and your eligibility are both subject to certain conditions.

A resale apartment may be the most cost-effective option if you are eligible for more grants than a BTO apartment would be. If you can put away more money, you’ll have a higher chance of making that upgrade. However, for resale properties, you are required to pay more cash upfront.

More Cash Upfront [Cons]

A seller of a resale apartment could try to get more money from the buyer than the apartment is worth. The term “Cash Over Valuation” (COV) is used to describe this surplus. It’s important to keep in mind that the value won’t be made public until after you’ve finalized the deal on the Option’s pricing, etc.

No housing loan, whether from a bank or HDB, will pay for the COV.

This means your up-front costs may be more than anticipated. With BTO apartments, however, the selling price and the value are the same because HDB sets both. A resale flat will cost more than a BTO unit in the same area, regardless of any COV that may be in effect. There are two main causes for this:

The first is the flat’s increased value on the open market, which may occur if the preferred neighborhood has finally reached its full development potential.

The second reason is that there is a lot of rivalry for resale flats since many people want to buy them but can’t acquire BTO apartments. People who have incomes over the HDB’s limit, Permanent Residents whose families aren’t eligible for BTO flats, those who require a place to live immediately rather than wait for a building, etc.

Depreciation and lease deterioration [Cons]

![Depreciation and lease deterioration [Cons]](https://hustleventuresg.com/wp-content/uploads/2023/09/image-48-1024x576.png)

As really old flats don’t sell very often, the outcomes might vary widely from what the data suggests.

If a resale property is 40 years or more, it’s probably not a smart idea to pay a premium price for it because of the possibility of little to no appreciation due to depreciation. The unit’s marketability suffers as a result; it may take older apartments longer to sell for a fair price.

This means even with grants provided, you may still be losing money from depreciation.

The Price of Remodeling [Cons]

![The Price of Remodeling [Cons]](https://hustleventuresg.com/wp-content/uploads/2023/09/pexels-photo-834892.jpeg)

An older apartment will often cost more to remodel, however, this is not always the case. Potential interior renovations include demolishing walls, removing cabinets, and laying down new flooring. Unlike a BTO apartment, which often comes with the essentials already installed and can be lived in with simple furniture, this one requires extensive remodeling.

Additionally, older apartments may have additional repair and maintenance needs. Therefore, the cost of renovation for older HDB can be a lot higher than you expect and you will need to factor these into your investment consideration.

Build-to-Order or a Resale?

In the end, it’s the particular unit, not broad guidelines, that should guide your choice. Buying your first property is a tough investment consideration and shouldn’t be taken lightly.

When it comes to real estate, the rule is always that there will be an exception. Although it is more common for BTO units to have increases immediately after MOP, both new and old resale flats can achieve record profits.

Hope you have gotten a rough idea of what you can look out for.

If you would like to know more what other potential growth happening around the area, be sure to contact Aaron or fill in your contact information here.

Aaron Oon is a Senior Associate Director at Propnex and Founder of Real Estate Insider. A consistent Top Producer in the competitive world of real estate, Armed with a Finance degree from NUS, Aaron is more than just a real estate agent; he’s a strategic thinker and a creative problem solver.

In his company Real Estate Insider, he shares the latest market updates and trends happening in the world and Singapore to keep us within the loop.