Building a startup from scratch isn’t simple. Any business venture, regardless of the size, needs commitment and dedication to survive and expand in today’s competitive market. In our current recessionary times where inflation is still high and interest rates are still kept higher than usual, borrowing funds might not be ideal for startups.

Well, good for those with sufficient capital to fund the initial expenses needed to launch a startup. However, for those wanting to enter the market on a shoestring budget, it might be challenging to find your foot quickly.

The capital you’ll need will depend on the type of business you are trying to build. But if you are trying to start small with barely enough money to spend on initial expenses, we have prepared this guide for you.

Search for Funding Options

I remember when I first started a few of my businesses, I thought having to save up and start a business was the right approach. However as I become an entrepreneur myself, I realize the importance of having a network to grow your business.

Searching for funders can help to build your network in return for selling shares of the company. This builds a network for businesses to work with one another.

If you think you have a sound business plan and strategies and only lack the resources to start your business, checking out funding options can be one way to get started. There are many options to choose from. You must be prepared to pitch your plans and secure your needed funding.

Here are some funding sources to consider:

Loans

Loans are popular options for small to medium-sized businesses. It may be more difficult for startups to secure loans than established businesses.

However, the approval process will be quick if you have a solid business plan and a good credit rating.

Moreover, shopping for loan products is important before signing up for a specific lender. Remember that each lender has its own loan terms. You can get the best offer by shopping around.

Consider seeking loan offers online. If you have not-so-impressive credit, you can find CreditNinja bad credit loans online, among other personal loan products you can avail of. Each lender will ask for different requirements and offer different interest rates and repayment periods. Pick the lender that offers the best terms for your current needs.

Love Money

If you aren’t ready to sign a loan contract from a lending institution, you might ask for love money.

This refers to the funds you can ask for from family and friends. Just remember that families and friends may not be eager to lend you money for your business, or they might only be able to contribute limited resources to you.

In some cases, they would ask for an equity in your business. If that’s the case, it’s best to settle with those who don’t ask this as a condition. When your profits increase, assure them you will return the money borrowed from them.

Venture Capital

If you are mapping out a high-risk business venture in the fields of information technology, biotechnology, or communications, among many other technologically-driven businesses, you should consider the help of venture capitalists.

Make sure to partner with venture capitalists with experience and knowledge of your business since you will be giving up equity or some level of ownership of your business to them.

Angel Investors

You may also look into angel investors, mostly retired company executives who want to expand their leadership and management experience.

They usually offer an investment of $25,000 to $100,000 for startups. In return, they will ask to become part of the board of directors to supervise the business’s management practices.

Crowdfunding

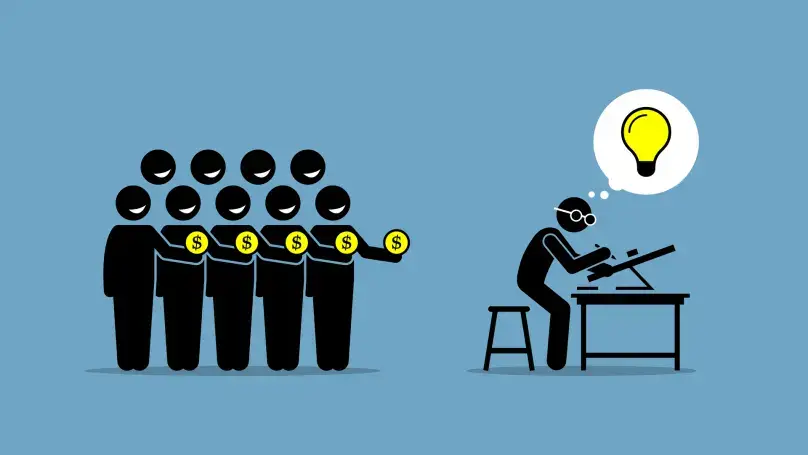

Crowdfunding involves raising funds from a large number of supporters.

Your supporters will receive equity with a more relaxed assurance of transparency compared to the expectations of venture capitalists and angel investors.

Grants and Subsidies

The government also offers grants and subsidies to startups meeting the program requirements. With government grants and subsidies, you will not be required to repay the grant. However, if you are guilty of misusing the funds, you will be asked to repay it. The funds you can get from this can be used for marketing, research and development, and even salaries.

Growing Clients Rapidly From There

Clients are not easy to get, but once you are able to show your investors a growing interest in your business. They will have more likelihood of investing in them.

Here are some notes for you to remember when building a client-base business:

Choose a Niche

Besides considering funding options, you must also choose a niche to focus on. Because you are starting small, look into a specific segment of customers to reach out. This way, you can focus your limited resources on marketing your products and services to specific target customers.

Leverage Social Media

You can practice social media marketing all for free. Create business pages and establish your branding guidelines to be unique among competitors. You may leverage short-form video content like Facebook and Instagram Reels to engage your target audience. You can compress key details of your products and services in these byte-sized videos and hook your audience with professional copies.

Listen to Customer Feedback

As a startup, it’s advisable always to listen and observe. This means taking feedback seriously, working out the areas that need improvement, and getting back to your customers with improved products or services.

Final Thoughts

Navigating today’s highly competitive market can be intimidating for newcomers to managing businesses. However, with guidance from your experts and mentors, you can definitely find your adapt and thrive. Launching a startup is partly about money. But beyond funding, it takes motivation, creativity, and optimism to get started.