Most people believe from listening to their family, friend, or other people that making money is really hard. Not many people realize or read up on ways to improve their financial position, this is why most people are stuck in the rat race. In this blog, I would beg to differ that it is easier to reach financial freedom than you think!

Introducing the FIRE Movement

When reading up on financial freedom, everyone will stumble across the FIRE Movement. FIRE stands for financially independent retire early. It involves leaving aside as much money to invest early to retire ahead of most people. There are a total of 7 levels of financial freedom.

Most people are scared to get started early on their financial journey to reach FIRE because it seems too far-fetched. But If you set yourself some goals and hustle hard for the next 5 years financially. You will see the difference in your financial asset.

In order to reach FIRE, most FIRE activists actively work more than their 9 to 5. Doing a side hustle every day for at least 2 hours to build additional income to save and invest. You can check out this video below!⬇️

How to Calculate Your FI Number?

Find out how much is required to reach your FI (Financial Independence). The formula required is as follows:

Financial Independence = Monthly Expenses ✖ yearly ✖ 25 years

The FI formula is used with the 4% rule where the money you invested into the S&P500 index fund generates about 10% per annum. Once you achieved your FI number, It is said that by using the 4% rule of withdrawal rate, you essentially will have enough to live off that yearly income.

The cost of living in Singapore for an average family of 4 need $6,426 a month for basic standard of living in 2021. So using the FI formula to determine the amount you need, we will need:

Financial Independence for family of 4 = $6,426 ✖ 12months ✖ 25 years

= $1,927,800

4% Rule = (4% / 100) ✖ $1,927,800 = $77,112 (which is $6,426 per month)

Having almost $2million invested into the stock market, sounds almost impossible, right? Let me give you some steps to follow for you to take so you will be able to achieve your FI much easier and stress-free!

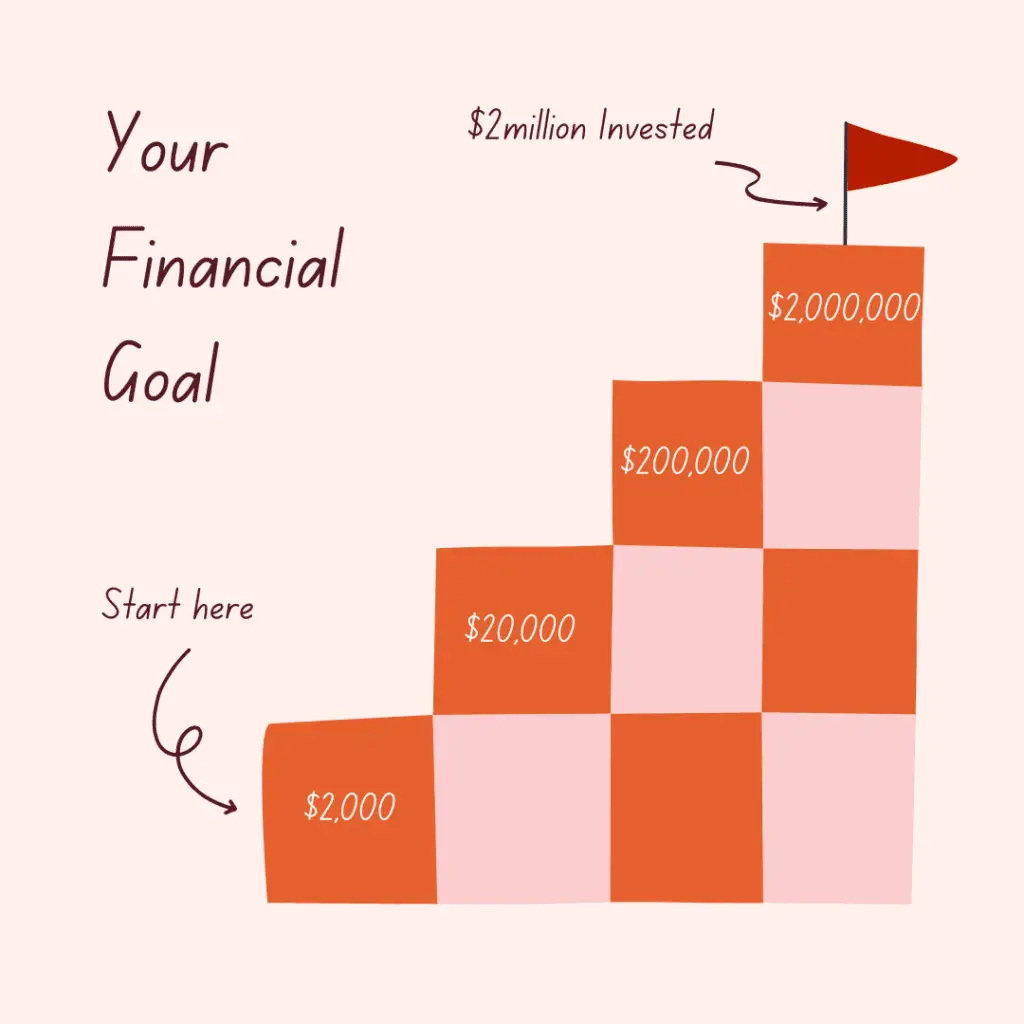

Step 1: Know your FI

Your FI number is a clear goal to follow, will use $2million as an example. Next break down the goal into smaller more achievable targets such as reaching $2,000 investing, then $20,000, then $200,000, and so on and so forth. This will keep you motivated to DCA (Dollar-cost average) into your investment.

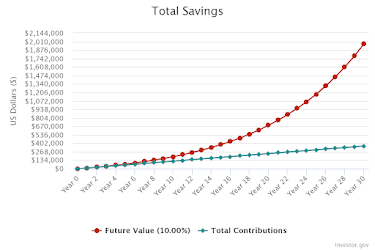

Next, we find out when we wish to retire and how much we need to invest per month to reach our goal. Do use the compound interest calculator to find out exactly how much you need to be invested per month to retire.

Adding in the numbers, you will find that you would need to invest $400 per month for 40 years or $1,000 per month for 30 years, or $2900 for 20 years to get your FI number. This shows that the early you start and let time do the work for you, the easier it is for you to achieve financial independence.

Step 2: Calculate your finances

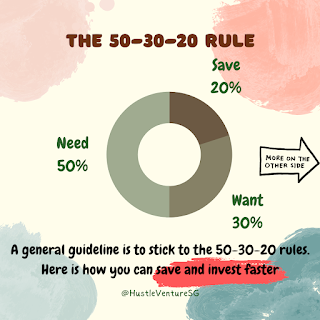

We need to work on your finances so you are able to invest more. Track your monthly expenses and look into what are your needs, wants, and savings. Typically, most people would use the 50-30-20 rule for their needs, wants, and savings. Here is the classification for determining your needs, wants, and savings.

By reducing the amount needed to buy your needs and wants, you can put more of that money to work into your investment. If you need to track your expenses, I use Money Manager to write down all my personal income and expenses. That way I know where all my money is going. If you need help increasing your savings rate, here are some tips and tricks that I recommend to increase your savings rate.

Step 3: Pay off bad debt

It’s important to know which debt is bad to take on. Debt with a high-interest rate or providing no personal growth or wealth accumulation is generally classified as bad debt. This includes personal, credit card, or student loans.

The best method to tackle bad debt is using the debt snowball method. The method for tackling it is as follows:

- making a list of debts owed, and categories them from high to low-interest rates

- Calculate the monthly minimum payment required

- Create a budget to tackle debt which is ranked the easiest to hardest debt to remove

- Once the debt is repaid, rollover to the next debt to repay

- Repeat the process until all debts are fully paid off

If possible, the best strategy for controlling bad debt is not taking any debt that does not provide wealth accumulation.

Step 4: Invest your money and time

Set milestones to reach your financial freedom. Find out what types of FIRE you plan to chase. Invest consistently over the required years depending on your savings rate. Invest more to retire early!

My Take on Reaching Financial freedom faster

Step 4 is the usual way for most people to take the less risky way to reach financial freedom. But if you don’t plan to stay in your 9 to 5 job for over 5 years then listen up. Here is my trick on how I was able to invest a lot more⬇️

Invest your time to make money

When I say invest your time for money, It means finding ways for you to make more money without having to spend more time in the long run. You see, most people believe that the longer you work, the more pay you will get. However, there is a limited amount of money you can make with time and at some point, you will need to rest (can’t be working for 24hour straight right?). Use your time to pick up quality skills and knowledge to add more value to increase your wage.

Get to the B and I Quadrant

The ESBI quadrant is a good indicator of what kind of work or skill you are providing. Spend your time learning to build skills that will allow you to join the B (Business) and I (Investor) quadrant. Start off by committing your business as a side hustle and slowly creep towards the business aspect.

Employee trades their time (employer hired them for their skills and knowledge) to grow wealth. Whereas the rich trade value(employee’s time) to grow their wealth. The rich do not look at having income as income is time=money, instead, they look at generating free cash flow. Free cash flow happens when you put in the required amount of work for your business and get paid monthly without having to put in much work.

Step 5: Celebrate every Financial Milestone

To keep yourself motivated and dedicated to achieving financial freedom, it is important that we celebrate every financial milestone with our loved ones. Go, treat them to a meal and learn to enjoy the process of financial freedom.

Cheat Code to Reach Financial Freedom Faster:

This is advice, not many financial institute or advisor wants you to know. As mentioned before on the ESBI quadrant, if you are able to focus on growing your B (Business) and I (Investment), this allows you to build cash flow. Most people will never know what is cash flow because they are working for money.

To get to financial freedom faster, it will be a lot easier to build multiple assets that provide you income. For example, as mentioned we need $6,426 a month to comfortably cover the cost of living in Singapore. If we were to build a side hustle that is able to provide an income of $1,000 per month. We will be able to cut down the amount needed to invest to grow our wealth, which means we will need an investment that provides $5,426 per month.

Find Cash Generating Asset

In HustleVentureSG, our goal is to educate and teach how everyone can reach their own financial freedom. We provide side hustle ideas, tips, and tricks to help you get started. If you would like to read more of our content, make sure to subscribe to our website for more notifications.