Inflation has been running wild in recent months. At 8.3% the annual rate of inflation for the US in April was down from 8.5% in March but remains at a level unseen since the 1980s. Over the year the CPI’s food index increased 9.4%, the largest 12-month increase since April 1981. Countries such as Argentina currently have an absurd amount of inflation at 55.1%. Worse still, Sri Lanka is currently bankrupt with its citizen creating chaos and fighting for daily necessities. This has led Americans and the rest of the world to struggle to afford necessities, including food, shelter, and fuel. In this blog, you will find out what is inflation, why it has become a big deal, and how you can get ahead of it.

What is Inflation

Inflation is the rate at which the price of goods and services in a given economy rises. The results can have a detrimental influence on society if it leads to higher prices for fundamental necessities such as food. Inflation can affect almost every commodity or service, including necessities like housing, food, medical care, and utilities, as well as luxuries like cosmetics, automobiles, and jewelry. Once inflation has spread across an economy, people and companies alike are concerned about the possibility of future inflation. Inflation is monitored by central banks in industrialized economies, including the Federal Reserve in the United States. The Federal Reserve has a 2% inflation target and alters monetary policy to combat it if prices rise too much or too quickly.

Why it is a necessary Evil

While inflation improves the economy to some extent by increasing consumer demand and spending and lowering unemployment, it has a negative impact on the purchasing power of the average person. It could have a significant influence on his or her savings, assets, and retirement fund. Inflation becomes a necessary evil to keep the working force tied to working for income longer.

One might think that a deflationary economy would be better off. However, that can only be further from the truth. Consumers may benefit from a price drop at first since prices have dropped. In the long run, this may have a negative impact on traders, raise unemployment rates, and impede the country’s economic development.

Can you feel the price increase?

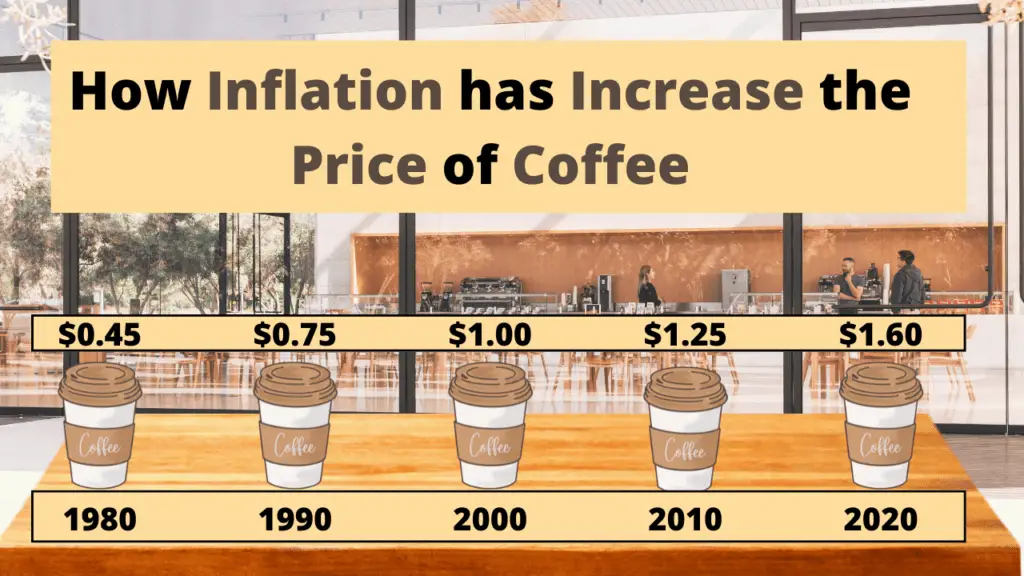

Inflation is a silent killer that affects us all. We only feel it once it affects our daily livelihood. The price of coffee back in 1980 cost $0.45. Now, it costs $1.60 for it. Most of us don’t realize it. But the price of coffee has more than 3 times in the past 40 years. These price increases will affect the lower-income groups as the cost of living rise faster than their income growth.

What are the Causes

In 2022, we are facing a global commodity crisis with prices soaring 50%, the fastest pace in 27 years. Commodity prices are rising across the board, particularly for crude oil and other fuels. 9 of the 22 key commodities saw price increases of more than 50%. including well-known commodities like coffee, which increased by 91%.

Not only that, China shut down due to rising Covid-19 cases has to lead to a supply chain disruption. This causes businesses to slow down their production numbers and create tough times to be doing business. With low supply and high demand for certain items, the prices of the product have to increase. This is to meet the raising demand. Companies such as Tesla have raised their prices by 5 to 10% as a result of China’s slowdown.

The danger in the Economy with High Inflation

Inflation can screw up all the savings that you have in the bank. In a high inflationary economy, there are few places to invest money into. Money invested into businesses such as stocks will be hard to have good earnings. The prices of businesses need to catch up or do better. Such examples of how high inflation has affected our everyday life are such as the export ban of chicken from Malaysia to Singapore due to the raising prices amid a supply shortage and soaring oil prices due to the Russia-Ukraine war.

With more and more issues regarding businesses not being able to keep up with inflation. It would raise some eyebrows on whether businesses are able to withstand the macro changes that will affect their business. These businesses that support one another will feel the snowball effect of price raises from all around.

How to lower Inflation with Interest rates

The only hope of slowing and lower inflation is the addition of interest rates. With the increase in interest rates, the price of borrowing money costs more. The interest rate for each different type of loan depends on the credit risk, time, tax considerations, and convertibility of the particular loan. This prevents businesses from over-leveraging and taking on too much debt. In turn, this protects the bank by compensating the risk of not paying back the loan.

How to get ahead and make money

Making money in a high inflationary economy is tough but it’s not impossible. As Rich Dad, Poor Dad Guide to Investing Book quotes. The poor lose money as the stock market goes up or down. The average investor only earns when the market goes up. But a smart or rich investor is able to earn money even if the stock market goes up or down. A smart or rich investor knows there are many ways to get rich, but they all have one thing in common. Knowledge is key to their success. During such tough times, a good investor knows how the world would react (macroeconomic changes). Plans in-depth into how to invest during these times, and how they can increase their income source.

Government Intervention

The economy will cease to run properly once inflation runs out of control. As mentioned, the government would push for an increase in interest rates. This forces the economy to fall into a temporary recession. Businesses will be unable to take on cheap loans from banks. During such times, businesses that show weak profit margins or bad business models will reveal as they wouldn’t be able to stay afloat. These businesses will fall as can be seen during the China Evergrade crisis when the company wasn’t able to pay off its debt to lenders. This can be a good thing as this gives the government power to restructure the current economic market to better ensure that no future event of such will happen.

Stay Invested

During times of turmoil, this gives a good look into your investment portfolio on whether it is properly diversified and whether there is another investment asset to invest into. Like all recessions before, these times will come and go. Take these opportunities to invest heavily more if possible to catch great value stocks that are at a discount. Also, do more research and find other investments out there that show good potential because good companies arise during economic changes. These businesses are Airbnb, Instagram, and Tesla. That is why Edmund, one of HustleVentureSG’s co-founders took a large sum to invest in Tesla during the 2020 pandemic downturn.

Have more income sources

Sad to say, these days having a secondary source of income is necessary for preserving and growing wealth. Only approximately 5% of employed employees have more than one job, and at least half of those have full-time and part-time employment. Since 1994, the percentage of people who work several jobs has shifted; currently, women and those with postgraduate degrees are the most likely to do so. Working online has become a common norm as work-from-home becomes mainstream. This is why many working adults are now finding ways to make money online for additional income.