Options trading is a fascinating way of making money through stock investments. Selling a call option is just one of many options strategies that an option trader can use. But what are the pros and cons of trading a call option? Is it right for me? In this blog, we will be discussing the benefit of selling a call option and why you may want to use it in your options trading strategy!

What are Sell Calls

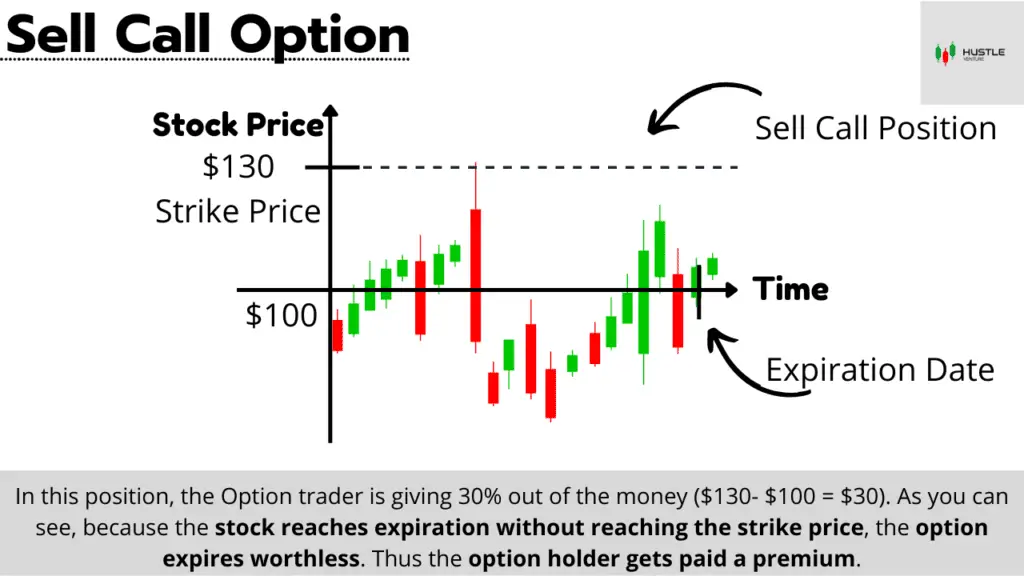

Selling calls is just one of many strategies for options trading. When you write a sell call position, you are selling the right, but not the obligation, to someone else to purchase an underlying security at a set price before a certain date. For committing to provide the underlying security for a predetermined price ahead of a predetermined date if the buyer wants it, the seller receives a premium.

For sellers of call, they are either predicting that the prices of the underlying security will either fall lower or stay below a certain strike price.

Naked Call

A naked call writing is somebody who doesn’t own the underlying security is not owned and options are written against this phantom security position. This means that the naked call investor is able to premium income without selling his/her underlying asset. For this strategy to work, investors placing naked calls often place their position way out of the money to prevent getting hit by the strike price upon expiration.

Naked call positions are often considered high risk or as they call it ‘has an unlimited amount of risk‘. Because of its risk, this strategy is often condemned and not recommended by options traders. Therefore, to ensure limited downside risk, experience traders would often place stop losses to close the contract.

Covered Call

A financial transaction is known as a “covered call”. It occurs when a call option seller also holds an equivalent quantity of the underlying securities. An investor who has a long position in an asset can then carry out this strategy by writing (selling) call options on that same asset to create an income stream.

In essence, the investor of the underlying asset wishes to either sell his stock at the strike price to get paid a premium and his underlying securities. Or he/she is feeling bearish about the market and is trying to hedge his/her position to make a profit.

Knowing Why Wealthy Investors love Selling Calls

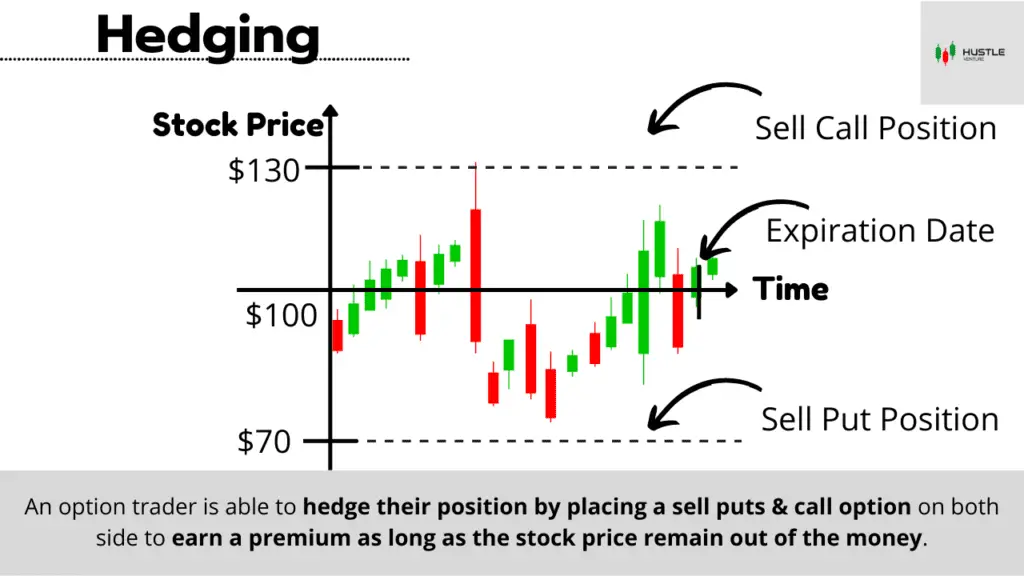

In Rich Dad Poor Dad, the author Robert Kiyosaki talks about why rich investors stay rich even during a bear market. The answer is that rich investors know the importance of hedging their investment position. While there are statistics that show a bear market often lasts between 9 to 12 months. A rich investor knows to never time the market, Dollar-cost-average into their favorite investment, and build a consistent income from their underlying asset.

As they would like to call it “money makes money.”

Hedging is a technique used by hedge fund managers and large financial corporations as these institutional investors have larger capital. However, with enough capital, even retail investors are still able to do it themselves. Ultimately, the reason hedging is such a useful tool for options traders is that 80% of options expire worthless. Traders often place stop losses on both ends so if one side of the stock goes bad, either will expire worthless and still earn a premium.

Is Selling Call Options the Right Strategy for you?

In every investing strategy, there is no size-fit strategy that people should be following. Instead, they should be looking into the amount of money they are willing to risk (*don’t put all the eggs in one basket*) and their risk tolerance before making an investment choice before being committed to selling options.

Selling call option generally works best when an investor already has underlying security and doesn’t mind selling the stock at a given price. Therefore, you should only be using this strategy when you have reached the capacity to do so. Until then, slowly build up your investment asset so that you can one-day start trading options.