Do you know the importance of having good money habits even before entering the workforce? Starting work is an exciting time for most individuals. It is a step towards independence and building a career.

No more schooling, no more homework, and definitely no more exams!

However, this set of freedom brings in a new set of responsibilities and financial obligations. It is crucial to develop money habits that will help you stay financially stable and manage your finances well. In this article, we will discuss the money habits that you can adopt to ensure financial stability and security.

Step 1 – Set Financial Goals

Having clear financial goals will help you stay focused and motivated. It is essential to set both short-term and long-term financial goals.

Long-term goals may include planning for retirement or buying a house.

Short-term goals

Your short-term goals may include saving up for a vacation or paying off a credit card debt. Credit card debt is dangerous and you want to avoid it at all cost. If you are already stuck in it, you may want to look into using the debt snowball method to tackle each debt at a time.

If you are looking to maximize your saving rate, you can check out Money Manager. It is a free app that lets user key in their income, expense, and networth to track where every dollar is going. This lets you optimize and focus on increasing your savings rate.

Money Manager helps increase my Saving Rate!

When I first started getting serious with my finance, I needed some way for me to track my expenses hassle-free. Back then, I had a low saving rate of less than 20% and I knew with better planning, I could bring it up to at least 50%. Money Manager is a great tool for beginners first starting out to …

Long-term Goals

Your long-term goals should be hitting your FI (financially independent) number. Everyone has a different amount they are looking to retire. But the goal is always the same, which is to make, save, and invest the rest. Here’s how to make a long-term financial plan that is 10,20, or 30 years down the road.

Investing should always be your end goal once you have set aside enough savings. Be sure to sign up through an online brokerage or open up an investment bank account. Here are my affiliate links to different online brokerages that I use. P.S. If you sign up using my referral link, you may get a chance to earn a free stock, cash coupon, or discount on your next investment purchase!

If you want to find out more about online brokerage, here is in-depth information on how to invest in stocks as a beginner.

Step 2 – Create a Budget

Creating a budget is an effective way of managing your finances. It helps you track your expenses, avoid overspending, and save for your goals.

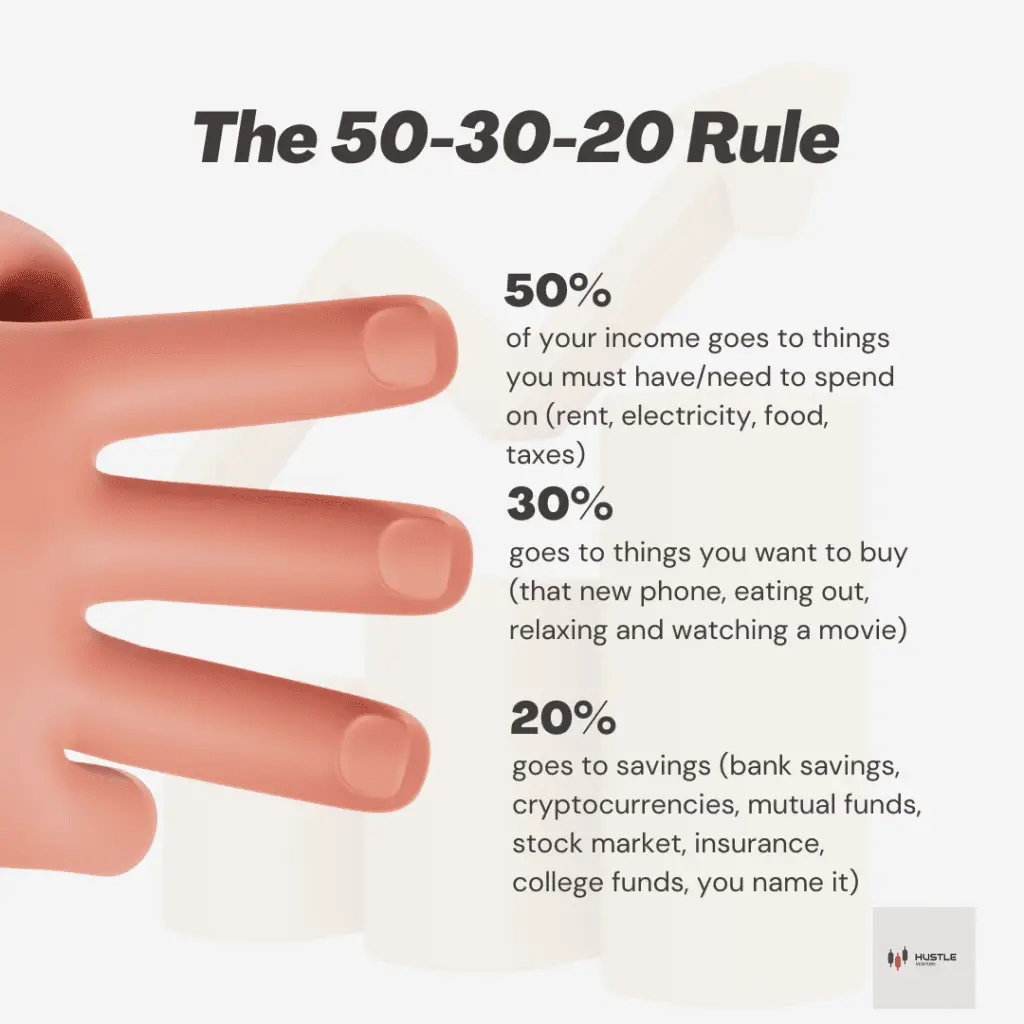

Use the 50/30/20 Rule

The 50/30/20 rule is a popular budgeting method that can help you manage your money and achieve financial stability.

Here’s how it works:

- 50% of your income should go towards things that you need to live on a daily basis.

- 30% of your income should be allocated to your discretionary spending.

- 20% of your income should be saved or invested for your future financial goals.

By following this rule, you can ensure that you’re meeting your basic needs while also setting aside money for your future. It’s a simple yet effective way to manage your finances and create a solid foundation for your financial well-being.

Step 3 – Save Money

Saving money is an essential money habit that will help you build an emergency fund, save for your goals, and secure your future. Get yourself that peace of mind.

6~12 Months Minimum

The reason why you need 6 to 12 months of living expenses saved is because it provides you with enough time to recover from any unexpected financial shocks or setbacks. For example, if you were to lose your job, having 6 to 12 months of living expenses saved would give you enough time to find a new job without having to worry about how you will pay your bills and expenses during that time.

Statistics show that having an emergency fund can make a significant difference in financial stability and security. According to a survey conducted by Bankrate, only 41% of Americans have enough savings to cover a $1,000 emergency expense. In addition, a study by the Federal Reserve found that nearly 40% of Americans would struggle to cover a $400 emergency expense.

Having an emergency fund can also help you avoid going into debt or relying on credit cards to cover unexpected expenses, which can lead to high-interest charges and a cycle of debt. It can also provide you with peace of mind and reduce stress levels knowing that you have a safety net in case of unexpected events.

Step 4 – Manage Debt

Debt is a significant financial obligation that can affect your credit score and financial stability. Managing debt is a crucial money habit that you should develop. And most people don’t even know there is a significant difference between good debt and bad debt.

Good debt is debt that is used to purchase assets that can increase in value or generate income, such as a mortgage or student loan.

Bad debt is debt used to purchase items that lose value over time, such as credit card debt for unnecessary purchases.

Having good debt can help you build credit, increase your net worth, and potentially generate income, while bad debt can lead to financial instability and high-interest payments.

Step 5 – Invest in the Future

Investing in the future is an excellent way to build wealth and secure your financial future. In this section, we will discuss the importance of investment planning and the different investment options that you can consider. We will provide tips on how to invest wisely and make informed investment decisions.

When your investment finally overtakes your full-time income. Congratulations, you have successfully escaped the rat race.

Start EARLY ➡️ Less Work in the Future

In conclusion, developing good money habits is essential for individuals starting work. It will help you stay financially stable and secure your future. We have discussed the money habits that you can adopt, such as setting financial goals, creating a budget, saving money, managing debt, and investing in the future. By following these habits, you can achieve financial success and live a fulfilling life.

FAQs

What are money habits?

Money habits refer to the regular actions and behaviors that individuals adopt regarding their personal finances, such as spending, saving, investing, and managing debt.

How do I set financial goals?

To set financial goals, you should first determine your current financial situation and identify what you want to achieve. Then, you can establish specific, measurable, achievable, relevant, and time-bound goals and develop a plan to achieve them.

What are the different budgeting techniques?

Some common budgeting techniques include the envelope method, the 50/30/20 rule, and zero-based budgeting. These techniques differ in their approach but all aim to help individuals manage their finances effectively and reach their financial goals.

How do I create a budget?

To create a budget, you should first track your income and expenses and identify areas where you can reduce spending or increase income. Then, you can develop a plan for allocating your money based on your financial goals and use a budgeting tool or spreadsheet to track your progress.

How do I implement saving strategies?

Saving strategies can include setting up automatic savings transfers, creating a savings goal, reducing unnecessary expenses, and increasing income. These strategies can help individuals build an emergency fund, save for a specific goal, or invest for the future.

What are investment options?

Investment options can include stocks, bonds, mutual funds, real estate, and other types of assets. The best investment options for individuals depend on their financial goals, risk tolerance, and personal preferences. It is important to research and understand the risks and potential rewards associated with each investment option before making any investment decisions.

Contact a Financial Advisor

If you need a financial advisor in Singapore to help in managing your finances, here’s Benjamin!

He is a financial advisor who is actively on Instagram sharing valuable information and helping his readers understand more about having better personal finance.

If you would like his help, feel free to reach out to him at [email protected] or check out his Instagram