We recently wrote an article about BTO vs resale for asset progression and found that our readers enjoyed the breakdown and insight we provided. Given the intense controversy around this subject, we sympathize if you’re feeling overpowered by the multitude of conflicting advice you’re receiving from friends, family, agents, and even Google.

As the real estate market in Singapore begins to stabilize from the high demand for BTO back in 2020. We are now slowly starting to see healthy demand and supply for both resale HDB and BTO. The question that is always on everyone’s head is:

Which should I pick? BTO vs resale?

Buying a property shouldn’t simply be about investing, rather, if you are someone who is looking for a property that suits your needs. Choosing between Resale HDB and BTO (Built-to-Order) is a monumental decision for many Singaporeans. Each option offers unique benefits and challenges. Whether you prioritize location, price, or future resale potential, understanding the intricacies of each can guide your decision.

What is Resale HDB?

Resale HDB; as the name suggests, refers to Housing & Development Board (HDB) flats that have been previously owned and are being sold in the open market by their current owners. These flats are not acquired directly from HDB but are purchased from existing homeowners.

What is BTO?

BTO stands for “Build-To-Order.”

In the context of Singapore’s public housing landscape, BTO refers to a system where new Housing & Development Board (HDB) flats are built in response to demand. Instead of constructing flats speculatively, the HDB launches BTO exercises at specific locations and announces the number of units available for potential homeowners.

Interested buyers can apply for these BTO flats during specified application periods. Once the application window closes, the HDB assesses the applications, and flats are allocated through a balloting system. Successful applicants can then proceed with the purchase of their chosen flat.

BTO flats are popular among first-time homeowners and young families for various reasons, including affordability, modern designs, and the opportunity to select preferred locations or unit types. These flats typically come with a minimum occupancy period (MOP) during which owners are not allowed to sell or rent out the entire flat.

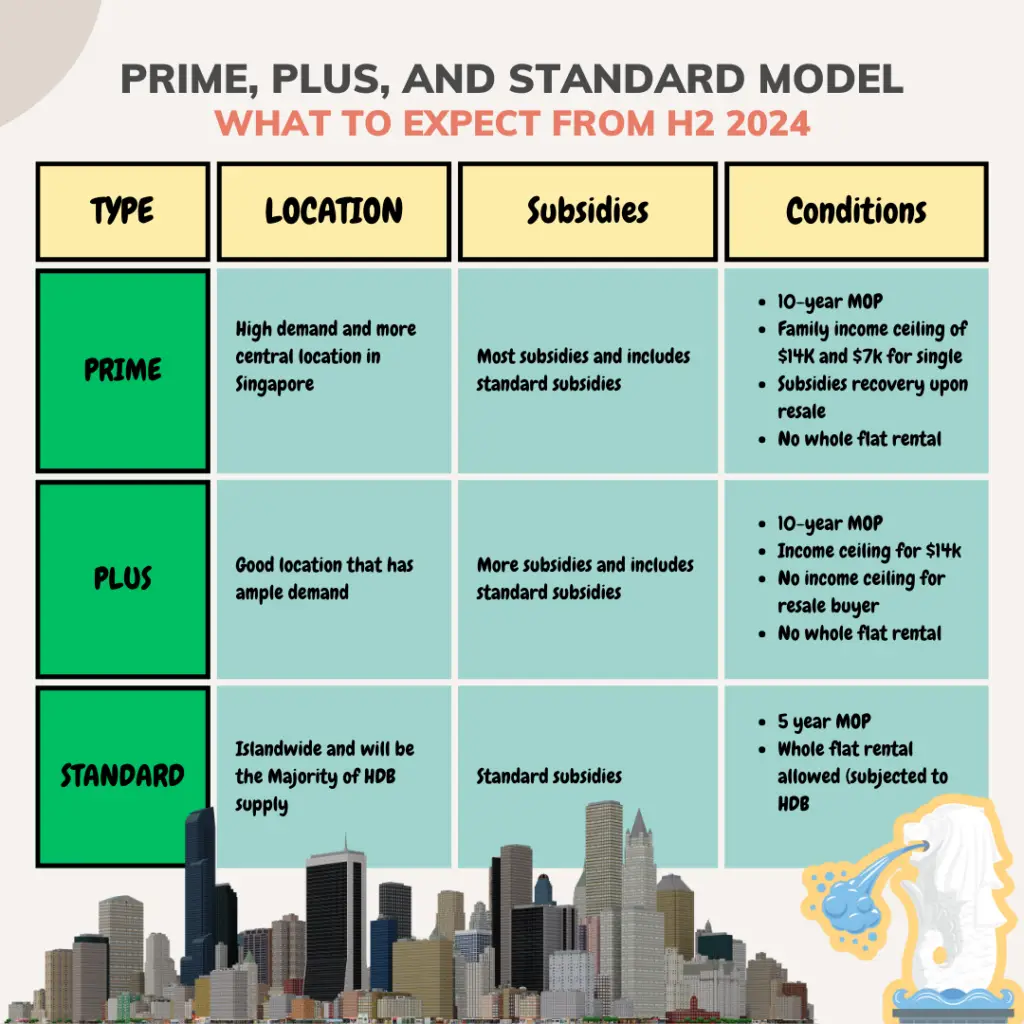

The Singapore government just announce the prime, plus & standard model that will be implemented in Q2 2024. This will help better reflect the locational attributes of HDB’s Build-To-Order (BTO) projects and to reduce the lucky draw effect when it comes to balloting for BTO projects.

Buyers should take note of these new condition set into place as prime and plus property owners will face a 10-year MOP(Minimum occupation period) for their property. While it may not affect some buyers, upgraders may face a challenge of having to delay their property investment by over 5 ~ 7 years.

BTO vs Resale

One of the biggest challenges face for potential home owners is choosing between resale HDB or BTO. Understandably so…

The best way to get started and understand more about what you can do right now is applying for HFE (HDB Flat Eligibility). It is completely free of charge and will help you visuallize financially which property is best suited for your financial needs. This step is also important to make sure that you are eligible for both BTO and resale property.

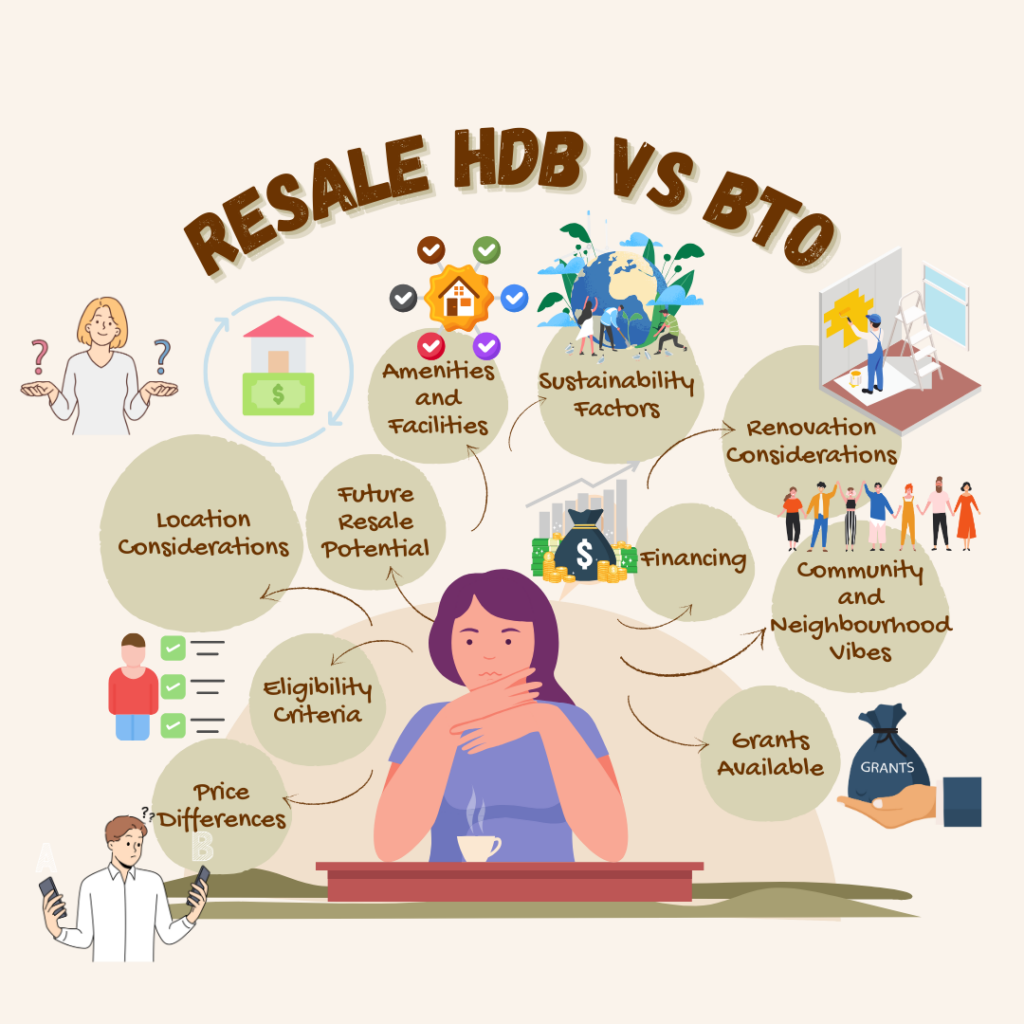

Next, when it comes to picking either type of property, buyers will need to consider these 10 considerations before finalizing their ideal property. They are:

- Price Differences: Resale HDB units often come at a premium due to their immediate availability and location advantages. In contrast, BTO units are priced more competitively, catering to first-time homeowners and young families.

- Location Considerations: Location plays a pivotal role in decision-making. While resale units offer choices in mature estates, BTO units may be available in upcoming or developing regions.

- Eligibility Criteria for Both Options: Understanding eligibility is crucial. While both options have specific criteria, BTO flats often come with more stringent requirements, especially for first-time buyers.

- Financing: Financing options vary. While bank loans are common for resale units, BTO buyers can opt for HDB loans with favorable terms.

- Future Resale Potential: Both options have resale potential. However, factors like location, unit condition, and market trends influence resale values.

- Comparing Amenities and Facilities: Mature estates with resale units often boast better amenities. However, new BTO projects are increasingly incorporating modern facilities.

- Grants Available: Staying updated with market trends helps buyers gauge potential returns and make informed decisions.

- Renovation Considerations: While resale units might need renovations, BTO buyers should also factor in customization costs.

- Sustainability Factors Sustainability is gaining traction. New BTO projects often incorporate eco-friendly features, while older resale units might require upgrades.

- Community and Neighbourhood Vibes: The sense of community varies. Mature estates may offer a more established community feel, while new BTO projects foster fresh community bonds.

Take into consideration of these 10 pointers. Now, let’s go through the pros and cons of both resale HDB vs BTO.

Advantages of Choosing Resale HDB

Now if you prefer a property that allows you more flexibility, resale HDB is the way to go!

- Immediate Availability – No waiting time; move in or rent out right after purchase.

- Established Communities and Connectivity – Enjoy mature estates with established amenities and facilities.

- Price Negotiation – Room for negotiation exists, unlike BTO flat prices.

- More Grants – There are more grants available for buying resale such as CPF Housing Grant and Proximity Housing Grant

- Older Flats have Larger Size – More space for buyers to play around with when renovating

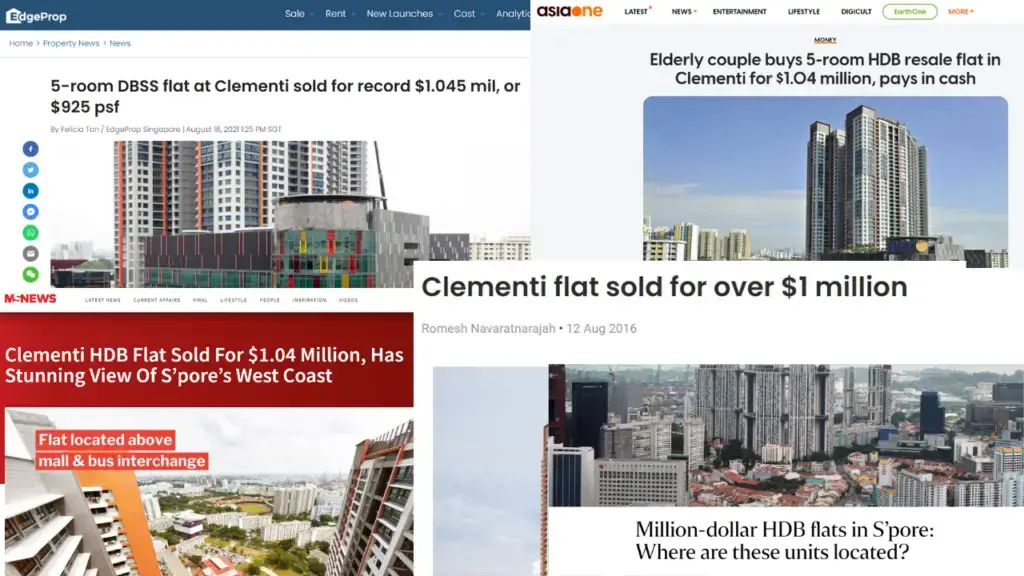

Buyers of HDB resale flats are typically older folks with huge lupsump of cash saved up. They prefer established communities since they may have already been around the place or have enjoyed the area compared to others. A great example is Clementi, this location is highly sought after by buyers for it locality, future developments, and schools around the area.

Don’t be scared by the huge price tag for these properties, they are actually really rare.

A perk of being a resale buyer not commonly shared is the ability to have a price negotiation. Buyers can have more flexibility to choose from many other property. This means a wider range of choices to choose from and possibly, lower cost!

Challenges with Resale HDB

That being said, resale HDB are not meant for everyone and as the image above suggest. Resale HDB can be a bit more pricey!

- Higher Initial Costs – Resale units may have a higher price tag than BTO.

- Age and Condition – Older units might require renovations or repairs.

- Limited Choices – Availability is based on what’s on the market at a given time.

- Lower probability of capital appreciation – Using Bala’s law, a 99-year leasehold loses its value as time decay

When it comes to buying a resale property, buyers are expected to pay the downpayment of 25%(5% cash + 20%CPF) up-front. This can be quite a huge sum if you are looking to buy a 5-room HDB with average cost about $608,000. This means that you would be paying $152,000 ($30,400 cash + $121,600 CPF/Cash).

While prices of resale property are expensive, buyers are more understanding about their financial decision. Most of these buyers are looking longer term of 10 ~ 20 years ahead. Whether its for their job, kid’s education, or future development in the area.

But what makes resale properties more exciting is the ability to play around with its larger psf. While some may argue that renovation cost will be pricer with the added cost of repair, others will be alright with this decision since its a one-time payment.

You want to come to your own home feeling relax and nice to see right?

Advantages of Choosing BTO

BTO flats are aim towards first-time homeowner. For them, it is an exciting milestone worth bragging!😊

PS. if they aren’t able to get BTO, there is still the SBF open booking that happens every May and November. During this process, applicants may pick the flats that are unsold units from previous BTO launches.

Here are some perks when it comes to BTO:

- Lower Initial Cost – More affordable than resale units.

- Customization – Choose layout, finishes, and fixtures based on personal preferences.

- Warranty and Newness – Enjoy the benefits of new construction and associated warranties.

- Capital Appreciation – With a fresh new 99-year lease, BTO has higher odds of capital appreciation

Most Singaporean citizen would go with the BTO route for their first home purchase to take advantage of its grants and affordability before making other huge financial decisions (e.g kids, cars, or pet) in the future. While waiting for their BTO to be build, they could also be saving up for the renovation.

Drawbacks of Opting for BTO

Yes, BTO are made for most Singaporean buyers as a platform to get to their next stage in life; adulthood. However, here are some challenges when it comes to getting a BTO:

- Waiting Period – A longer 3 ~ 6 year-long waiting period before moving in compared to resale units.

- Location Limitations – Limited to areas where new BTO projects are underway.

- Price Fluctuations – Prices can increase due to market demand or changes in government policies.

- Require Strong Holding Power – Prime and Plus owner will have to hold the property for at least 10 years before they are able to sell their flat

This drawback heavily depends on whether you would like to asset progress to other larger property investment such as the private property market. If you are looking for own-stay, BTOs are one of the best ways to live in affordable housing.

With the new prime, plus, and standard model set into place, we may see a cool down in the number of million dollar HDBs for now.

should you choose BTO or Resale Property?

Ultimately, the decision is up to you!

Both BTO and resale property satisfy different buyers needs and wants in their homes. But if you do have any questions for enquiries, feel free to comment down below or reach out to Aaron through his Calendy link below:

Aaron Oon is a Senior Associate Director at Propnex and Founder of Real Estate Insider. A consistent Top Producer in the competitive world of real estate, Armed with a Finance degree from NUS, Aaron is more than just a real estate agent; he’s a strategic thinker and a creative problem solver.

If you are looking to invest in a property here in Singapore or would like to know more about Singapore’s property market. Be sure to reach out through the Calendy video link below:

What are the key differences between Resale HDB and BTO?

Key differences include availability, pricing, customization options, and location choices.

What factors should I consider when choosing a location?

Consider proximity to amenities, transportation links, future developments, and personal preferences.

Why BTO instead of resale?

Choosing between a BTO flat offers newness and potential grants, while a resale flat provides immediate availability and diverse locations.

What is the difference between HDB and BTO?

HDB is the government agency in Singapore responsible for public housing, while BTO is a scheme allowing buyers to book new flats under construction by HDB.

Is the resale of HDB worth it?

If you are looking for an immediate own-stay that is still more affordable than private housing, resale properties are a great way to own a real estate proeprty in Singapore.

Is BTO better than resale for singles?

With resale properties, there are less restrictions for singles to own a property. This means they can look into buying a larger property and not having to meet the BTO requirement of 35 years old to be eligible for purchasing a public housing.