FWD Term Life Plus is a type of insurance policy that provides coverage for a specified term or period. It offers financial protection to the policyholder’s beneficiaries in the event of the policyholder’s death and it offers flexible coverage options and additional riders. This policy is great for someone who would like more flexibility with their coverage and the lower premium as compared to a hospitalization plan.

We all want the best protection whether it is for our kids, our loved ones, or our fur ball. However, the cost can be one of our driving concerns among Singaporeans looking to be assured. Thankfully, term life insurance is genuinely more affordable than regular hospitalisation plans. So it could be something for you to consider.

Key Takeaways

- Term life insurance provides coverage for a specified term or period

- FWD Term Life Plus offers flexible coverage options

- Additional riders can be added to enhance the policy benefits

- Conversion options allow policyholders to convert their term policy to a permanent policy

- FWD Term Life Plus is suitable for young professionals, families with dependents, and business owners

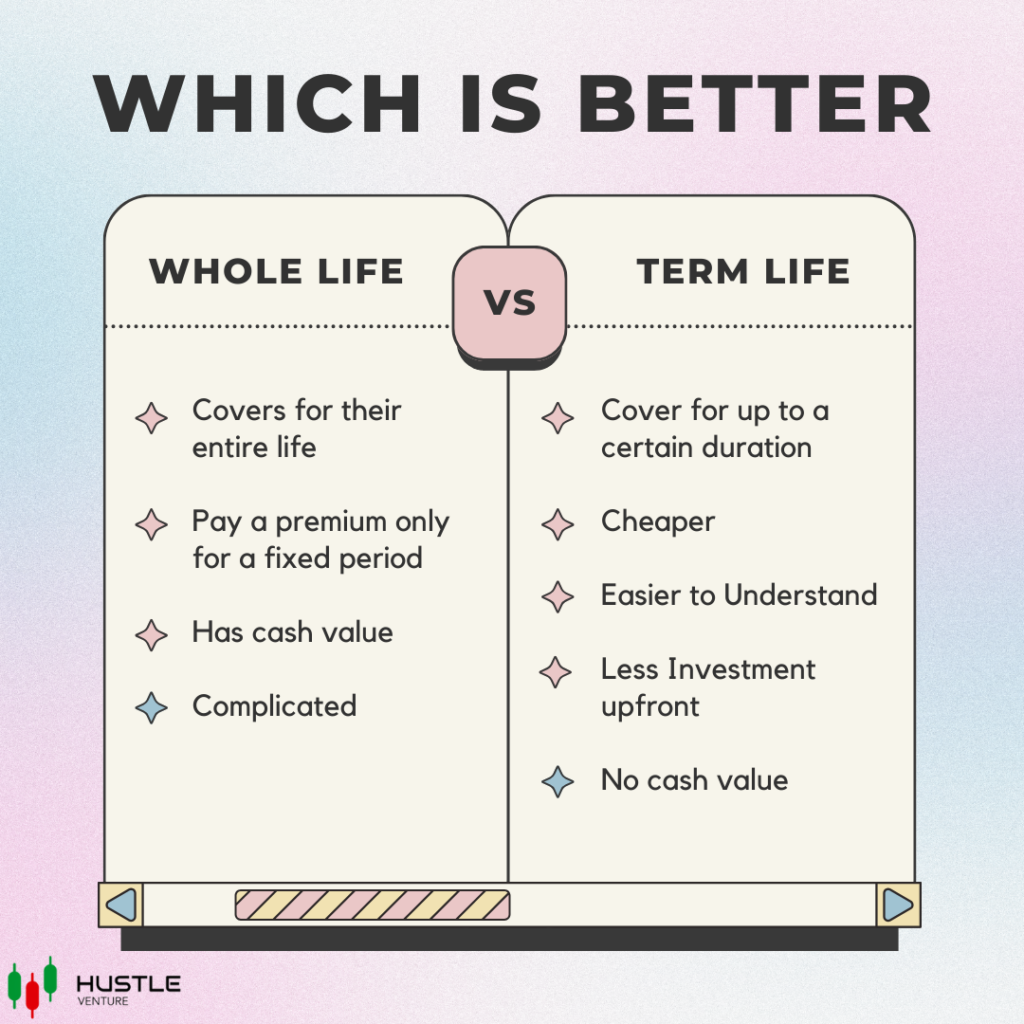

What is Term Life Insurance?

Term life insurance is a type of life insurance that provides coverage for a specific period, typically ranging from 10 to 30 years. During this term, if the insured person passes away, their beneficiaries will receive a death benefit. The death benefit is a lump sum payment that can be used to cover expenses such as

- Funeral costs,

- Outstanding debts,

- Mortgage payments,

- Provide financial support to dependents.

It is important to note that term life insurance does not accumulate cash value like some other types of life insurance policies, making it a more affordable option for individuals who need coverage for a specific period.

Within our Hustle Venture Team, we’ve encountered a family grappling with this exact scenario—forced to downgrade from a private condominium to a government-subsidized property due to inadequate financial planning when the sole breadwinner passed on and there is still a balance mortgage payment outstanding. The inclusion of a term life insurance policy acts as a vital shield, preventing such distressing situations and providing families with essential financial protection during challenging times.

How Does Term Life Insurance Work?

Term life insurance works by paying regular premiums to the insurance company. The premium amount is based on factors such as the insured person’s age, health, and the desired coverage amount.

To better understand how term life insurance works, let’s take a look at an example:

| Age | Term Type | Coverage Amount | Premium |

|---|---|---|---|

| 25 | 30 Years Fixed Term or Covers to Age 55 | $1,000,000 | $26.89/month ($38.41./month from 2nd year onwards) |

In this example, a 25-year-old male purchases a term life insurance policy with a coverage amount of $1,000,000. He pays a monthly premium of $26.89. If the insured person passes away during the term of the policy, their beneficiaries will receive the $1,000,000 death benefit.

It’s important to carefully consider the term length and coverage amount when choosing a term life insurance policy. Additionally, it’s recommended to review and update the policy periodically to ensure it aligns with your current needs and circumstances.

Benefits of Term Life Insurance

Term life insurance offers several benefits that make it a popular choice for individuals and families.

Financial Protection is one of the key advantages of term life insurance. In the event of the policyholder’s death, the insurance payout can provide a financial safety net for the beneficiaries, helping them cover expenses such as mortgage payments, education costs, and daily living expenses.

Another benefit of term life insurance is Affordability. Compared to other types of life insurance, term life insurance premiums are generally lower, making it more accessible for individuals on a budget. This affordability allows policyholders to obtain a higher coverage amount for a lower premium, providing greater peace of mind.

Additionally, term life insurance offers Flexibility. Policyholders have the option to choose the coverage period that best suits their needs, whether it’s 10, 20, or 30 years. This flexibility allows individuals to align their coverage with specific financial obligations, such as paying off a mortgage or ensuring their children’s education expenses are covered.

In summary, term life insurance provides financial protection, affordability, and flexibility, making it an attractive option for individuals and families seeking peace of mind and security.

Features of FWD Term Life Plus

Flexible Coverage Options

When it comes to choosing the right coverage for your term life insurance, FWD Term Life Plus offers a range of flexible options to suit your needs. Whether you’re looking for a short-term policy or a longer coverage period, you can customize your coverage amount and duration to ensure it aligns with your financial goals and obligations.

Additional Riders

FWD Term Life Plus offers a range of additional riders that can be added to your policy to enhance your coverage and provide extra protection. These riders allow you to customize your policy to meet your specific needs and circumstances.

One of the additional riders available is the Total and Permanent Disability Benefit, which provides an additional benefit if you become totally and permanently disabled while the rider is active,

Another rider option is the Critical Illness Benefit, which provides a lump sum payment if you are diagnosed with a covered critical illness. This rider can help alleviate the financial burden associated with medical expenses and loss of income during a critical illness.

Another rider option is the Premium Waiver Benefit, which waives off future premiums while still giving you coverage upon a diagnosis of critical illness or if you become totally and permanently disabled.

Adding riders to your term insurance plans can give you peace of mind knowing that you have comprehensive coverage for various life events and circumstances.

Who Should Consider FWD Term Life Plus?

| Insurance Plan Features | Young Professionals | Families with Dependents | Business Owners |

|---|---|---|---|

| Customization | – Tailor coverage to evolving needs | – Flexible coverage options | – Flexible coverage options |

| Long-term Security | – Ensures financial protection | – Ensures financial protection – Additional riders for extra protection | – Ensures financial protection – Additional riders for extra protection |

| Applicability | – Ideal for career starters | – Tailored for families with dependents | – Suited for both business and personal needs |

How to Apply for FWD Term Life Plus

Application Process

To apply, you will need to follow a simple process. Here are the steps:

- Fill out the online application form with your personal information and coverage preferences.

- Submit the required documents, such as identification proof and income verification.

- Undergo the underwriting process, where your application will be reviewed and assessed.

Once you have completed these steps, your application will be processed, and you will be notified of the outcome. It’s important to provide accurate and complete information to ensure a smooth application process.

Required Documents

When applying, there are certain documents that you will need to provide. These documents include:

- Proof of identity, such as a valid passport or driver’s license.

- Proof of address, such as a utility bill or bank statement.

- Proof of income, such as pay stubs or tax returns.

It is important to ensure that all the required documents are accurate and up to date. Providing the necessary documents in a timely manner will help expedite the application process and ensure a smooth experience.

Underwriting Process

During this process, the insurance company evaluates the applicant’s health, lifestyle, and other factors to determine their insurability and premium rates. The underwriting process typically involves the submission of medical records, and completion of a health questionnaire, and may also include a medical examination.

Should You Get FWD Term Life Insurance?

It’s important to carefully review the terms and conditions of the policy and consult with a financial advisor to determine the best course of action. With FWD term life plus, individuals can have peace of mind knowing that their loved ones will be financially secure in the event of their untimely passing.

Here at Hustle Venture, we support individuals looking to build their wealth.

If you would like one of our team members to support you on this, feel free to schedule a call and we would like to support you in your journey!

Frequently Asked Questions

What is term life insurance?

Term life insurance is a type of life insurance coverage that protects for a specified period, usually 10, 20, or 30 years. It pays a death benefit to the beneficiaries if the insured person passes away during the term of the policy.

How much term life insurance coverage do I need?

The amount of term life insurance coverage you need depends on various factors, including your income, debts, and financial goals. It’s recommended to consider your current and future financial obligations when determining the coverage amount.

What happens if I outlive my term life insurance policy?

If you outlive your term life insurance policy, the coverage will expire, and you will not receive any death benefit. It’s recommended to consider your financial needs and consider renewing or converting the policy before it expires.