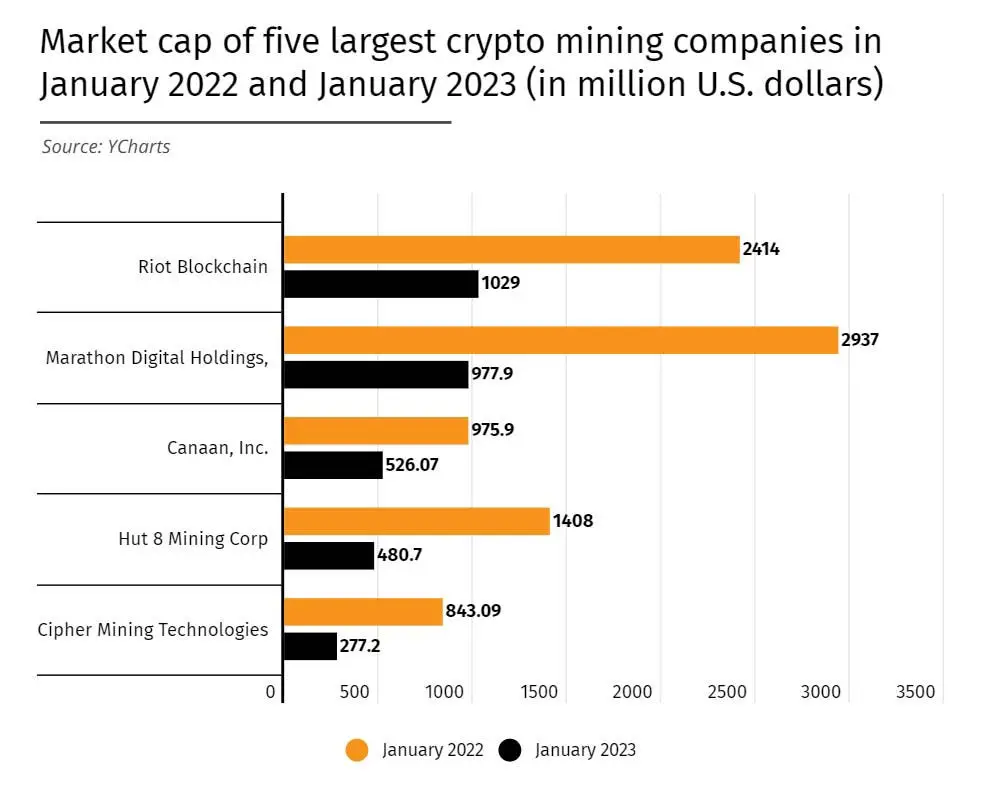

There is a ton of speculation on the crypto market. The market cap of all cryptocurrencies has increased by a factor of 23, passing $3 trillion. The value of cryptocurrencies has skyrocketed with the DeFi and NFT industries, both of which have seen rapid growth. With digital real estate becoming a potential for future wealth building, it seems that crypto mining company will be at the forefront of this new development.

Digital assets are utilized globally for investment, operations, and transactions, contributing to the rapid expansion of the crypto sector as a whole. An estimate from the World Economic Forum suggests that by 2027, blockchain will be used to record 10% of global GDP.

In the next few years, we may see companies looking to buy over successful crypto firms to grow the business. Hence, they will need to learn how crypto mining company valuation works and the various methods to value crypto mining companies in detail.

What is Crypto Mining?

The common understanding of cryptocurrency mining is that it is merely a means of producing fresh currency. On the other hand, crypto mining also includes the process of verifying and recording the use of bitcoins on a blockchain network.

When one party spends crypto, the digital ledger has to be modified by deducting one account while crediting the other, just as it would be with real money. The problem with digital money, though, is that it is simple to manipulate digital platforms. As a result, only certified miners may make changes to the Bitcoin distributed ledger.

Understanding Crypto Mining Company Valuation

When doing quantitative analysis, financial analysts have historically relied on a company’s financial statements. Traditional approaches are often useless when dealing with crypto assets since they do not supply this kind of information.

Because of the importance of attracting institutional investors, the sector must continue to investigate and create innovative crypto-mining company valuation methodologies.

Important Factors Pushing the Market Forward

While the popularity of the crypto market is evident in recent times, it is crucial to understand the factors pushing the market forward.

The following are key market drivers you should know before conducting a crypto mining company valuation.

The openness of distributed database systems

In Asian countries, withholding information and conducting secret transactions, often involving the unauthorized withholding of budgeted funds, lead to frequent unlawful and fraudulent acts.

Customers might lose a lot of money as a consequence of anything as simple as a typo, a faulty machine, or even data tampering at some point in the transaction process. Furthermore, financial institutions seldom admit blunders. The current monetary system has been criticized for being opaque, which has led to widespread dissatisfaction.

Regional volatility and a focus on preventing financial crises

Financial services and financial businesses are vulnerable to financial disasters. Since the value of the currency has dropped, economic uncertainty has become a hindrance to the economy.

Due to their stable value, Bitcoin and other cryptocurrencies were mostly unaffected by the global financial crisis. Cryptocurrencies provide an attractive alternative to countries with fragile economic systems during times of financial upheaval.

Increased Bitcoin use will lead to a boom in the cryptocurrency industry

Increased funding, public awareness, and supportive policies are all factors in the industry’s growth. The maturing bitcoin dollar number and the capacity to pay transaction incentives are contributing to an increase in the digital currency market value.

The widespread preference for digital currency is not limited to the developed economies of the United States, Japan, Europe, or any other region. It is expected that this tendency will help the Bitcoin business grow in the next few years.

Crypto Mining Company Valuation Methods

Here is a rundown of the most common approaches of crypto mining company valuation in use today.

- Price/Net-Asset-Value

In crypto mining company valuation, P/NAV is the single most significant valuation statistic. The “net asset value” of a mining asset is its discounted future cash flows less its debt and cash on hand, also known as its net present value (NPV).

Here is the formula:

P/NAV = Market Cap / (Net Asset Value -Total Debt)

For the purpose of calculating NAV, each mining asset is appraised separately before being added to the total value. Final adjustments are made for corporate expenses and liabilities.

- Price/Cash Flow Ratio

P/CF, short for “P-cash flow,” is another popular metric. It employs the present cash flow for that year as a ratio to the security’s price. However, this metric is often used exclusively to produce mines.

The ratio compares the current share price to the company’s adjusted cash flow in a specified year. Here is the formula:

P/CF = Share Price / Operational Cash Flow Per Share

Cash flow from operations excludes capital expenditures but includes cash flow from operations, which is a measure of equity.

- EV/Resource

In order to calculate the EV/resource ratio, one must divide the company’s enterprise value by the sum of all of the resources found underground. Early-stage development projects (where there isn’t enough information to complete a DCF analysis) often employ this statistic.

The ratio is simplistic in that it does not include the expense of setting up the mine or the cost of running it.

Here is the formula:

Enterprise Value (EV) / Total Units of Resource

- Total Cost of Acquisition (TAC)

Total Acquisition Cost, or TAC, is another measure used in the mining sector, especially in the early stages of a project’s development.

On a per-ounce basis, this is what it will cost to buy the asset, construct the mine, and run the mine. Here is the formula:

TAC = [Acquisition + Construction + Operating Expenses] / Total Ounces

A Systematic Approach to Crypto Mining Company Valuation

A thorough and accurate appraisal may be ensured by using a systematic approach. Here is what you can follow to arrive at an accurate value in your crypto mining company valuation.

- Find out how much money and how much the firm is worth right now on the market. Consider the current share price and the total number of shares remaining in order to calculate the company’s market value.

- Examine the company’s financials to determine its profitability. Learn more about the company’s income streams, operational costs, and profit margins by perusing its financial statements.

- Examine the mining equipment and facilities of the company. Evaluate the mining gear, software, and facilities of the firm, all of which have a direct bearing on the company’s operational performance.

- Analyze the power and running expenses of the business. Look into how much power the firm uses and how much it costs, since these are major expenses that may make or break a cryptocurrency mine.

- Keep the legal and regulatory climate in mind. The company’s operations and value might be affected by present and future rules, so it’s important to keep tabs on them.

- Determine how competent the company’s leadership is. Evaluate the management team’s credentials, since their choices will have far-reaching effects on the company’s success.

- Value the firm using acceptable techniques. Use market capitalization, discounted cash flow analysis, and ratios compared to similar companies in the industry to arrive at an estimate of the company’s worth.

Put Strategies in Place for Efficient Value

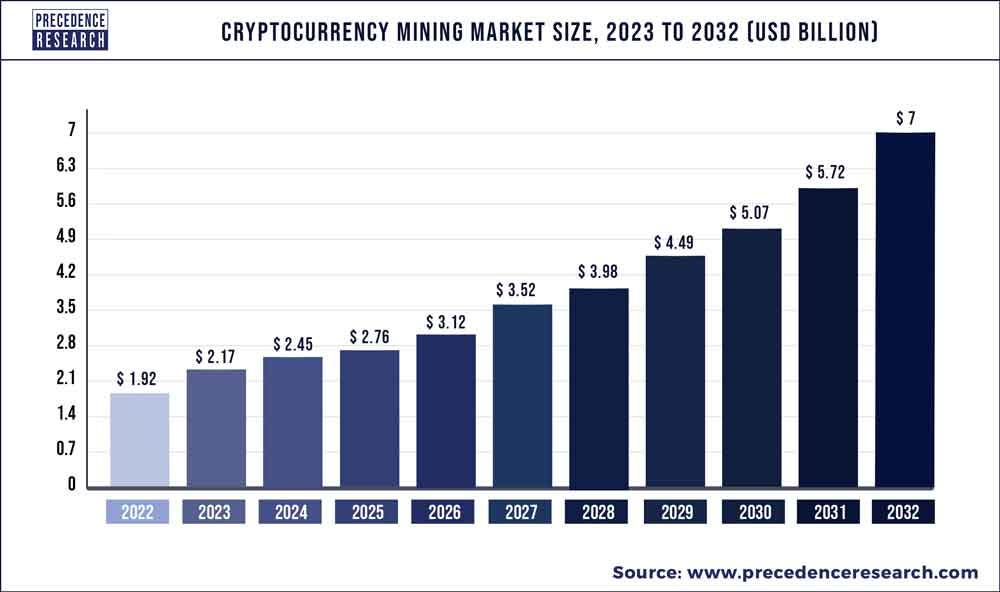

The popularity of cryptocurrencies, the improvement of mining equipment, and the spread of blockchain-based applications have all contributed to the industry’s meteoric rise in recent years.

Assessing the worth of crypto assets and enterprises is still a challenging endeavor. However, some of the aforementioned strategies may assist both novice and seasoned investors in getting started and determining whether or not an investment fund is the best route to go.

FAQ

How do you value a Crypto mining company?

Net Asset Value (NAV): This calculates the total value of a company’s assets, minus its liabilities.

Discounted Cash Flow (DCF): Evaluates the present value of future cash flows expected from the mining operations.

Comparative Market Analysis: Compares the company’s financial metrics, such as price-to-earnings ratio or enterprise value to EBITDA, with similar publicly traded mining companies.

Reserve Valuation: Values the mineral reserves of the company based on current market prices and estimated extraction costs.

How do you value a crypto company?

Similar to traditional companies, crypto companies can be valued using methods such as DCF or comparative analysis. Additionally, one can consider metrics specific to the crypto industry, like active user base, transaction volume, token economics, and network value.

How do you value a Bitcoin mining company?

Valuing a Bitcoin mining company involves understanding its operational efficiency, cost structure, and expected future Bitcoin production. DCF can be used, considering future Bitcoin rewards and potential increases in difficulty. Comparing the company’s hash rate, energy costs, and profitability margins with industry peers can also provide insights.

How do you value a company’s worth?

A company’s worth can be determined by assessing its assets, liabilities, cash flows, growth prospects, and market position. The valuation methods mentioned earlier, such as DCF and comparative analysis, are commonly employed to determine a company’s worth.

What determines Bitcoin mining profitability?

Bitcoin’s price: A higher price increases mining rewards in dollar terms.

Mining difficulty: A higher difficulty requires more computational power and increases costs.

Block reward: The number of Bitcoins awarded for each mined block.

Transaction fees: Additional rewards miners earn from transaction fees.

Operational costs: Including electricity, hardware, and maintenance expenses.