2022 had a rocky start. From the Russia Ukraine war, China shutdown to increase inflation fears. The stock market is down significantly from it year on year. On 20 May, the S&P500 fells 20%, signaling a recession. With fear running all around in the stock market, has the bull market rally ended? In this blog, you will find out why I believe that the bull market will slow down and further pain will be in coming.

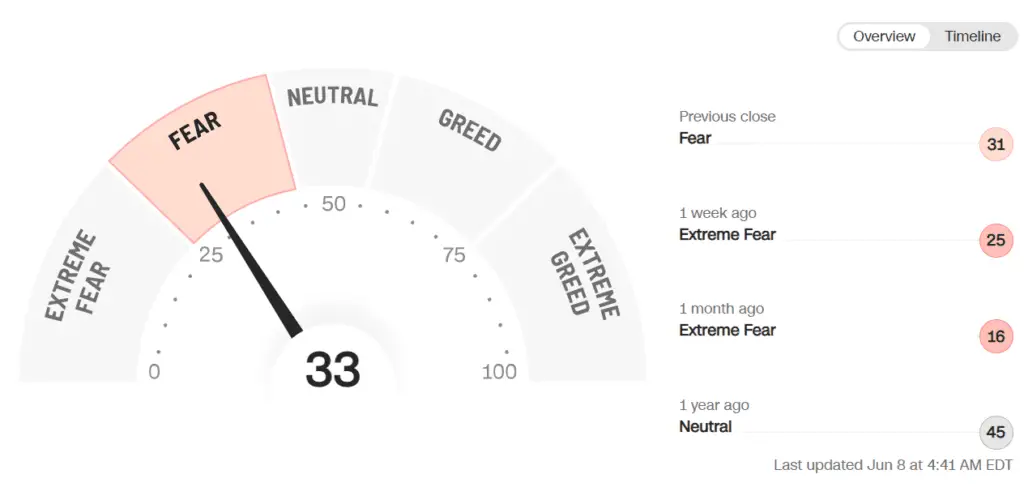

Current Fear in the Market

If you have been looking into the stock market trend and the news media, everything’s bad. Over the past 5 months, the stock market has been ringing fear the market, with extreme fear as low as 16. This is because of the recent interest rate hike to suppress rising inflation. However, even with the rise in interest rate in May by 0.5%, inflation is still at a record high of 8.3%.

Inflation destroying Everything

Governments around the world are scrambling to curb the raise in inflation that has been caused by a number of chains of events. With the ridiculous amount of stimulus into the market, consumers increased demand spending even during the lockdown, this made the value of the dollar is losing rapidly. Many large companies such as Amazon are purchasing all their goods in advance. Stocking up supplies such as household products and groceries. The demand for all these items causes the prices of such items to increase multiple folds. With face mask prices up over 166% during the height of the pandemic. purchasing in advance made manufacturing scrabble to get hold of supplies they need. With these 3 factors affecting the economy, the government had to step in to manage expectations to lower inflation.

Supply Chain Issue

The Supply chain issue has been an ongoing problem since the start of the Covid pandemic situation. As lockdown created a standstill in production factories, the shipping industry slowed down their product delivery and most workers were laid off in preparation for the pandemic able to last for years. With the world converting the new norm of Covid-19, new jobs are appearing while some jobs become obsolete. With the new shutdown in China from raising Covid-19. The US is bracing for more inflation due to higher demand for production products coming from China. For many manufacturing companies such as Tesla production was almost at standstill for 2 months.

Russia-Ukraine War

Even though most people are fortunate enough to not be a part of the war. This war has in some way affected the global supplies. Regards this, Russia and Ukraine both supply wheat for 29% of the world, and they are also the largest supplier of metal and other commodities. This has caused nations around the world to rapidly increase their production to cater to the markets.

What will it take for the Stock Market to Recover?

Everyone is wondering with so many worrying signs in the market and what will it take for the stock market to recover. As Analysts are cutting down companies’ future price predictions. Here is what I believe will lower fear in the stock market, and what will it take to recover.

FED indicating slowing Inflation

As soon as CPI (Core production index) data show slowing and lower inflation, the FED would control the increasing amount of interest rate. During such time, more investors will come into the market as lowering inflation and less government intervention is a great sign for the economy.

Companies Growing

Company growing demand, increasing workforce and higher deliveries are great tell-tale signs that the company is doing well. I believe that most companies with factories coming off from China if they are able to show the production numbers increasing and workforce recovering. I believe the next company’s earnings would show a large rebound.

Resolving & having Alternative solutions to Supply chain Issues

Countries around the world are now learning to adapt to having multiple sources to prevent the country’s supply chain from being disrupted. Even though Singapore is having a chicken ban on imports from Malaysia. The country has reached out to Thailand for its chicken import. Thus, Singapore is able to quickly accommodate supply chain issues. Countries are now finding alternative solutions to combat supply chain issues, a new norm of having less dependency on Russia and Ukraine.

What Should Investors do during this Bear Market, will a Bull Market Rally Come?

The everyday advice from all financial advisors is Dollar-cost averaging (DCA) to not time the market. However, I foresee the bull market rally not happening anytime soon. For now, the stock market now has few good signs, will be using the money earned to build my war chest. And commit towards lump sum investing once i have better confidence in the market.

If you haven’t already started investing, here are some investment tools to help you get started.

Investment Tools

Need a brokerage app to start investing in stocks? At HustleVentureSG, we do product reviews on multiple brokerage apps to let readers learn and understand the pros and cons of each investment brokerage app. Letting individuals choose which product they would like to get.

I remember back 5 years ago buying stock required you to go to a bank to create an account. Apart from having to spend a huge sum of money just to open an account. You have to have a large sum of money to even begin investing. What’s wrong is the crazy expensive transaction fees and conversion fees involved. Thank go we are now in a digital era!

Now there are plenty of investment brokerage apps popping out. Investing has become a lot easier in this digital era we live in. Making money through our phones is increasingly common. An online broker such as Tiger Broker or MooMoo begin to become a common investment tool for the everyday user to invest their money. Many individuals have hopped on the bandwagon to build their passive and even active income through these brokerages.

Investing in stock can seem to be a daunting task. There are hundreds of investment choices to choose from. Not picking the right stocks can put your investment journey back as investment loses value. That is why at HustleVentureSG, we provide an investment 101 and have money talk to learn and understand more about building wealth. It talks not only about stocks, but other investment assets such as real estate, crypto, and other assets that can grow your wealth.