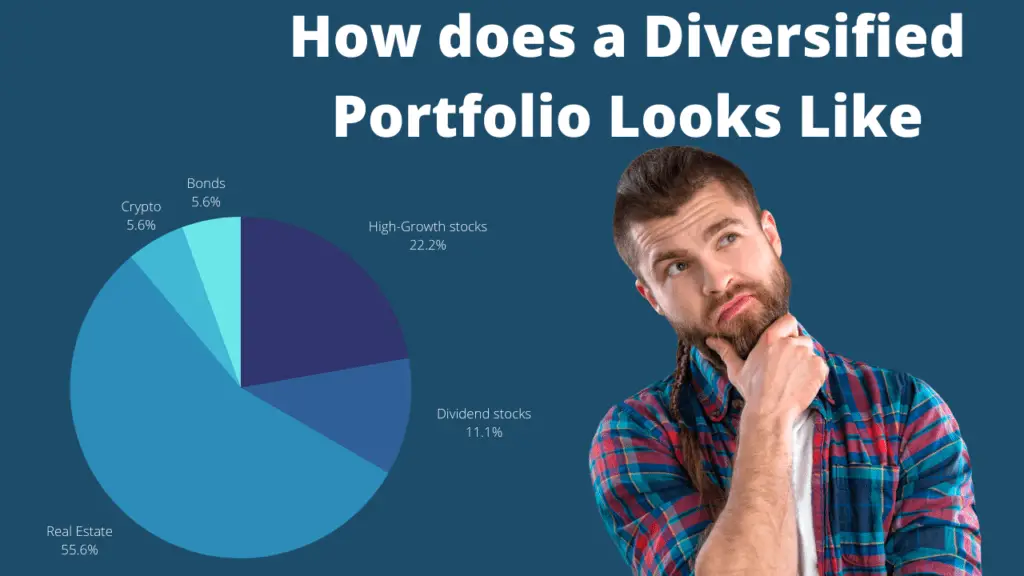

A diversified portfolio is a way to lower your risk and protect any downside when the market dips. These investors either have a high conviction on 1 stock or do not know how to properly diversify their portfolio. A diversified portfolio should have a well-adjusted level of high-growth stocks, dividends stocks, real estate, bonds, or crypto.

A well-diversified portfolio should include a diverse range of investments. Many financial consultants have suggested establishing a 60/40 portfolio, which allocates 60% of capital to equities and 40% to fixed-income instruments like bonds, for years. Others, on the other hand, have advocated for greater equity exposure, particularly among younger investors.

At HustleVentureSG, most of our members are around 25 years old. Our investment portfolio is mostly catered towards growth stocks and high-value growth stocks. Having time on our site is a great opportunity to watch our investment compound long-term. However, we still do our own index funds such as VOO and VTI as a means of diversification.

Why do you need a Diversified Portfolio?

It is perfectly okay to be investing more into growth stock in your early 20 and 30s. However, do take into consideration of your roles and responsibility as you age. As you get older, chances are you will gain more responsibility. Whether it is having to now have a child to raise, paying for a mortgage, having to care more for your parents, or paying more home bills. Having a diversified portfolio that provides financial stability gives investors more peace of mind knowing that their investment wouldn’t crash overnight.

How easy it is to get a Diversified Portfolio

Most investors do not want to know more about the current market or read stock news, but that’s okay. Investing in the S&P500 index fund is a great way to have a diversified portfolio in itself. The S&P500 consists of the top 500 companies in the US. These 500 companies come from different sections such as manufacturing, tech, healthcare, and F&B.

If you wish to invest in a more growth area sector to see more growth, you may try investing in SCHG or VUG. If you would like more of a dividend income portfolio, you may try SCHD, VIG, or VYM.

Why Singaporeans have a Distinct Advantage

For us Singaporeans, our government has already helped us invest in bonds. Which is our CPF (Central Provident Fund Board). Our CPF provides a fair interest rate of 2.5% up to 5.5% as you grow older. The good thing is if your CPF OA has over $20,000. Investors are entitled to invest the remaining into an investment vehicle such as Endowus. Endowus Lion Global Infinity US 500 stock index fund has a US ETF similar to owning the S&P500. Over a 10-year history, the index has grown 13.03%.

Apart from investing in CPF, Singaporeans have SRS (Supplementary Retirement Scheme) which allows Singaporean and PR to invest up to $15,300 and $35,700 respectively. By depositing into the scheme, Singaporean are able to avoid and lower their taxes. Robo-advisor such as Syfe and StashAway allow investing in SRS to allow Singaporeans to invest.👍

How do I Begin Investing

Getting started in investing is one of the most scariest and thrilling things every adult has to go through. This is why we post multiple articles related to inventing at investing 101. Having the right knowledge and investment tools can greatly benefit you as an investor on how to earn passive income.

Investment Tools

Need a brokerage app to start investing in stocks? At HustleVentureSG, we do product reviews on multiple brokerage apps to let readers learn and understand the pros and cons of each investment brokerage app. Letting individuals choose which product they would like to get.

I remember back 5 years ago buying stock required you to go to a bank to create an account. Apart from having to spend a huge sum of money just to open an account. You have to have a large sum of money to even begin investing. What’s wrong is the crazy expensive transaction fees and conversion fees involved. Thank go we are now in a digital era!

Now there are plenty of investment brokerage apps popping out. Investing has become a lot easier in this digital era we live in. Making money through our phones is increasingly common. An online broker such as Tiger Broker or MooMoo begin to become a common investment tool for the everyday user to invest their money. Many individuals have hopped on the bandwagon to build their passive and even active income through these brokerages.

Investing in stock can seem to be a daunting task. There are hundreds of investment choices to choose from. Not picking the right stocks can put your investment journey back as investment loses value. That is why at HustleVentureSG, we provide an investment 101 and have money talk to learn and understand more about building wealth. It talks not only about stocks, but other investment assets such as real estate, crypto, and other assets that can grow your wealth.