Investing with StashAway

Description

StashAway is a Robo-advisor platform that allows you to buy, sell and hold your investment portfolio Investing via a Robo-advisor platform is a great way to start investing. Investing with StashAway makes investing so simplified by providing users the expected return over a certain duration horizon and all the user has to do is dollar-cost average into their investment.

2020 was a year when multiple investment platforms got popular. Investing at that time was a sure way of making money. This was due to the low-interest rate and FED money printing to stimulate the economy. These made beginner investors wanted to find ways to learn and get started investing.

How Investing Used to be

I remember back 5 years ago buying stock required you to go to a bank to create an account. Apart from having to spend a huge sum of money just to open an account. You have to have a large sum of money to even begin investing. What’s wrong is the crazy expensive transaction fees and conversion fees involved. Thank go we are now in a digital era!

Now there are plenty of investment brokerage apps popping out. Investing has become a lot easier in this digital era we live in. Making money through our phones is increasingly common. An online broker such as Tiger Broker or MooMoo begin to become a common investment tool for the everyday user to invest their money.

How Robo-Advisor has redefined the Investing Market

As mentioned how challenging it was to start investing. Robo-advisor has really made investing so simple. All users have to do is adjust the risk tolerance and how much they are willing to invest and wish to achieve by the end of the allocated time horizon.

What Makes StashAway Great!

For investors with a tight budget and who have zero knowledge of investing, StashAway provides low capital to start, low fees, and no lock-in period for your money. Essentially, StashAway is a great way for new investors to take the time to learn about investing with low capital and low fees, great!

User-Friendly

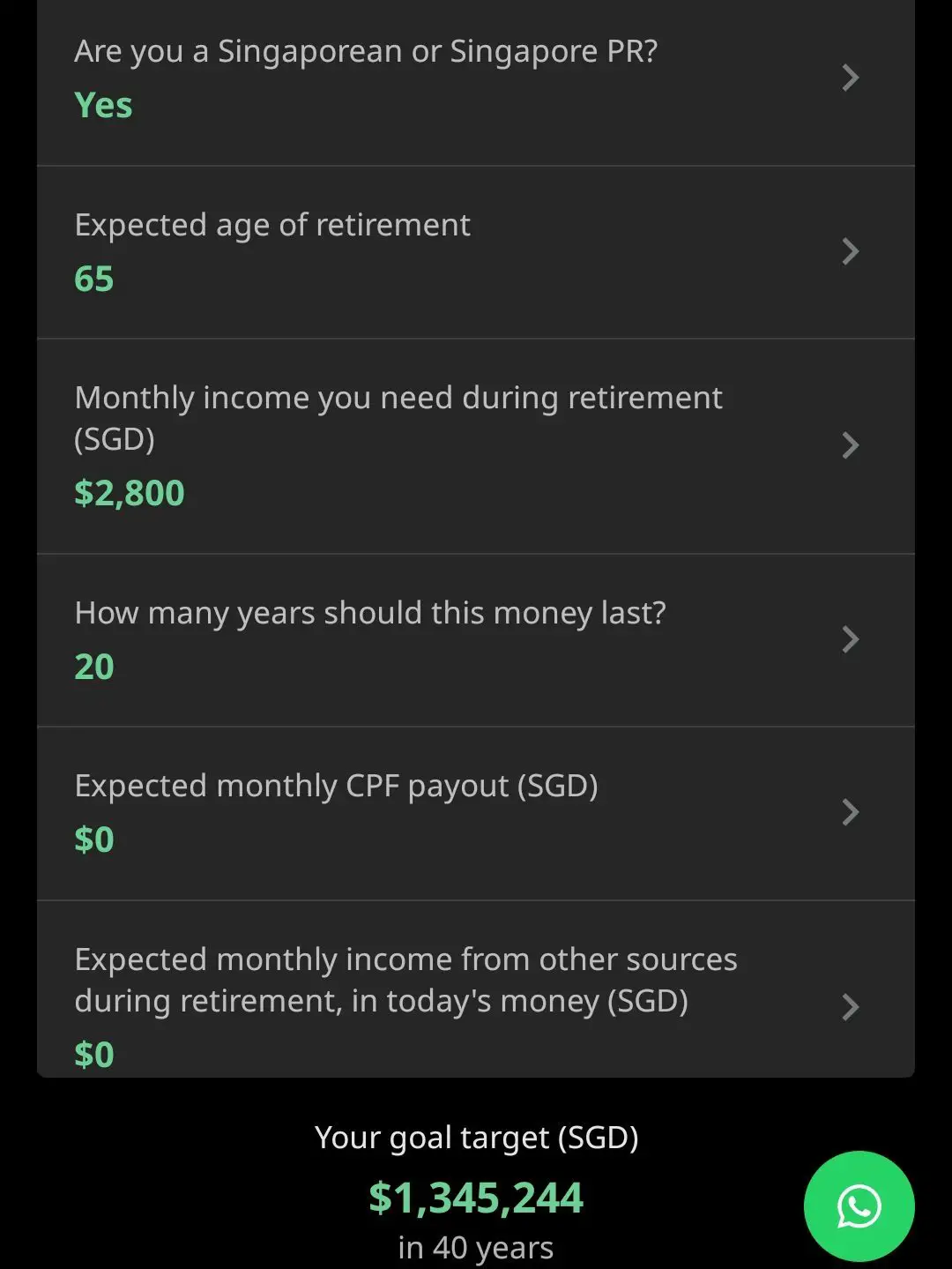

Sign up using the referral link down below! When starting an account in StashAway. The platform will ask multiple questions regarding your finances. This is to ensure you have enough money to invest and to determine how much money you’ll need to retire at your desired age.

Next, choose a fund that meets your requirements, such as investing for retirement or buying a house. The app calculates the required given amount and calculates how much is required to be invested per month to reach the targeted goal.

Well Diversify Risk Profile

StashAway Has a well-diversified portfolio in multiple sectors such as Small Cap, Healthcare, Europe, US, China, and commodities. As a result, the investment portfolio will be less affected by daily volatility than individual stocks.

You can diversify your risk by choosing the risk appetite that suits your investment horizon. StashAway also gives thorough details on the investment they have made in order to provide complete disclosure and ensure that the investor is aware of their investment.

Setting Realistic Expectations

Following the amount required to invest given by StashAway, provides the probability of achieving your target return with different types of probability. The 4 categories are super bull case (5%), best case (50%), base case (75%), and bare case (95%). These metrics help set investor ideas on investing for the long term and visualize the act of how compound interest is able to work in their favor as long as they stick to their long-term investment time horizon.

Low Fees

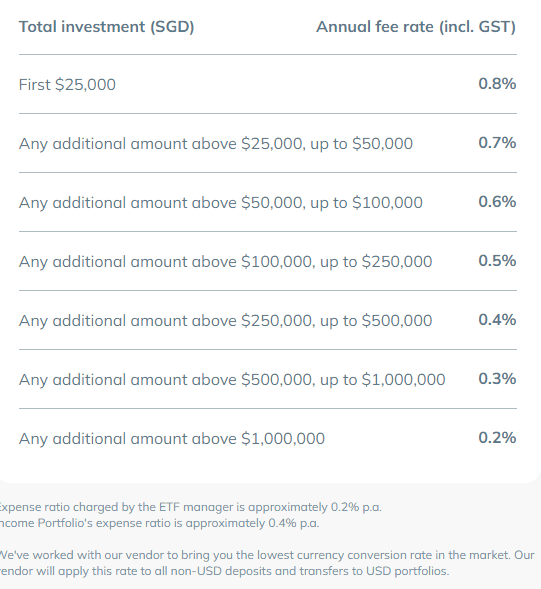

If you have invested in the old school investment, you will know how much of a pain in the ass the fees are. Deposit fees, transaction fees, and various hidden or tiny costs are all part of the traditional investment process. Well, it’s true that there is a platform out there that has zero commission or fees. However, I believe that StashAway fees are relatively low cost when you realize that the barrier to entry is low.

What in StashAway could be better?

As a long-term user of their platform, I have a number of takes on what I believe the company may be able to improve itself on. StashAway’s rewarding system may not be attractive to most. Its incentive for others to join compared to other Robo-advisor platforms (which usually gives cash reward) is not as appealing. Apart from that, its weekly news podcast is not as entertaining nor highly informative to watch. I believe if StashAway is able to provide higher quality content on their Podcast and better referral for first-time investors, it will boost StashAway number of active users.

Is it a Safe Investment Platform?

StashAway received a Capital Market Services License (license no. CMS100604) for Fund Management by the Monetary Authority of Singapore in May 2017. This means that they meet the capital, compliance, audit, and reporting requirements from MAS. In an unlikely bankruptcy event, any money held in a trust or custodian account can’t be touched. Deposits first go to a DBS trust account. Then, purchased securities go to a custodian account through Saxo Capital Markets.

Start Investing with StashAway!

StashAway is a great way to start off your investment journey with minimal risk. Its well-diversified portfolio into ETF (Exchange-Traded Fund) allows users to not be as affected by the market volatility as compared to owning individual stocks.

Related products

-

Investing with Syfe | Probably the best Robo-Advisor

0 out of 5Download Syfe Now! -

The Complete Guide to Options Selling

0 out of 5Buy the Book Now! -

Money Manager helps increase my Saving Rate!

0 out of 5Click to get Free Referral Link -

“The Complete Guide to Buying and Selling Apartment Buildings

0 out of 5$35.00 Buy product

Reviews

There are no reviews yet.