Everyone wants to know how to achieve financial independence early. Financially independent retire early, in short, FIRE Movement. Has gained widespread attention over the past few years as people are finding ways so they can escape the rat race.

There are multiple ways to achieve FIRE. The most well-known way to invest is to leave aside as much money as possible to invest in the S&P500 which historically provides an annual compound interest rate of 10%.

However, this method of achieving FIRE takes a long period of time (usually more than 20 years). It kills the driven momentum to invest heavily (most would quit after their first year). The strategy I use is an unconventional approach how to achieving financial independence early, which entails creating multiple sources of income to live off.

How to get started in the FIRE movement

Let’s go over the basic fundamentals first.

The first step is knowing what you plan to achieve by achieving FI; or financial independence. Most working adults slave their lives away working a 9 to 5 job aimlessly without knowing what they want to plan out in their life for the next 5 to 10 years.

I started FIRE with the intention to achieve $100,000 before 25, setting up the goal allows you to know which direction you are heading. Think of what you plan to achieve when you reach FIRE. Be it traveling around the world, spending more time with loved ones, or doing more charity work.

- Educate Yourself: Start by educating yourself about personal finance and money management. Read books, attend seminars, and follow reputable financial blogs to gain knowledge about budgeting, saving, investing, and debt management.

- Set Clear Financial Goals: Define your financial goals and create a roadmap to achieve them. Having specific and measurable goals will help you stay focused and motivated on your journey to financial independence.

- Live Within Your Means: Practice frugality and avoid unnecessary expenses. Live below your means and save a portion of your income regularly. This habit will allow you to build a financial cushion and invest for the future.

- Create a Budget: Develop a monthly budget to track your income and expenses. A budget will help you allocate your money wisely and identify areas where you can cut back on spending.

- Eliminate Debt: High-interest debts can be a significant obstacle to financial independence. Make a plan to pay off debts systematically, starting with the highest interest ones. Being debt-free will free up more of your income for saving and investing.

- Build an Emergency Fund: Establish an emergency fund with three to six months’ worth of living expenses. This fund will provide a safety net during unexpected financial setbacks.

- Invest Wisely: Learn about different investment options, such as stocks, bonds, real estate, and mutual funds. Diversify your investment portfolio to spread risk and increase potential returns.

- Take Advantage of Retirement Accounts: Contribute to retirement accounts like a 401(k) or IRA to benefit from tax advantages and employer matching programs. Starting early and contributing consistently can have a significant impact on your retirement savings.

- Increase Your Income: Look for opportunities to increase your income through career advancement, side hustles, or entrepreneurship. The more you earn, the more you can save and invest toward financial independence.

- Stay Disciplined and Patient: Building financial independence is a long-term process that requires discipline and patience. Stay committed to your financial goals and make consistent progress over time.

- Seek Professional Advice: Consider consulting with a financial advisor to get personalized guidance and recommendations tailored to your specific financial situation.

Remember that financial independence is not a one-size-fits-all concept. It may look different for each individual based on their circumstances, goals, and aspirations. The key is to take proactive steps, be consistent in your efforts, and continue learning and adapting as you move toward financial freedom.

Setting Financial Goal

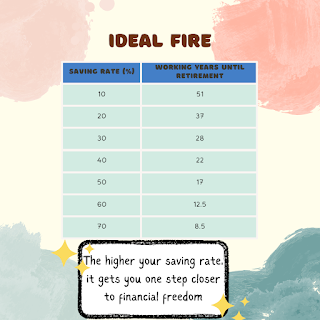

Finding out the percentage of income to save, work towards increasing your savings rate. Having no savings for investment means you will never be able to retire. (chart reference to S&P500 10%p.a. compound interest for FIRE)

Knowing how much to invest per month to retire is just as important as knowing each individual savings rate. The 4% Rule allows anyone to live comfortably on their investment without having to lose any value. Do read my article on how much you need to retire in this blog.

How to Achieve Financial Independence [Myself]

My plan is to retire in my mid 30. Sounds crazy right?

I get that a lot from my family and friend whenever we were talking about finance. Sticking to your goal during part of the stages can be really hard. I recommend having a friend or partner join your conquest to reach early retirement together. That way you will be able to motivate one another.

The Sacrifice

Sacrifices need to be made in order to reach early financial independence. Though I wouldn’t recommend most people to take my path to accelerate their wealth, I believe if anyone wishes to retire early, these are also the drastic steps they can take to reach early retirement. Here is the list of items to cut back on to invest more.

- Expensive food (this includes cutting down on dining out as much, ordering takeaways)

- Convenience services (Having food delivered, DIY instead of calling for service, taking a taxi to get to places faster)

- Entertainment (Most entertainments nowadays require payment)

- Delay Gratification (Not buying a house, car, the shoes you always wanted)

- The time needed to spend learning to grow wealth (read books, watch Youtube videos, go for courses)

Journey to Achieving Financial Independence Early

First 2 years

My national service was a high-paying job and the perk of having most of my meals paid for. That saved me a ton of money and I was able to get a saving rate of about 70%. During those days, I also focused on my side hustle to build some side income. In totality, I was able to invest about $1000 per month.

After finishing serving my national service, I went on to pursue my degree (early 2020 to mid-2021). During my time in school, I begin to heavily invest my time researching, learning, and testing different investments. The hard work paid off. unlocking other forms of income sources such as crypto coin farming, NFT trading, and Options trading to have an easier source of income-generating assets. My time in school made realizing money does not only come from working a full-time job.

Side hustle building year

Quit school halfway through as the education provided wasn’t irrelevant. Pursuing my passion to work in the real estate industry as a Property Manager. The job is very enjoyable, it provides flexibility to not work in the office, visit multiple expensive houses and talk to people of a different perspective on investing.

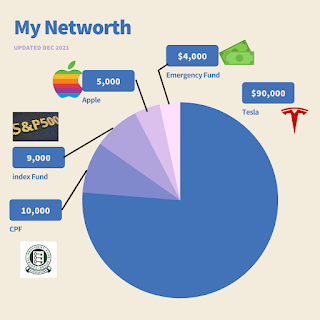

Learning about growing passive income

With a higher salary and multiple sources of income, I was investing 1200 to 1500 a month into Tesla stock during that time. During the times in 2020 and 2021, my portfolio returns were above the S&P500 average because of my bet on Tesla. At the end of 2021, my net worth grew to over $118,000. By earning an extra $500 per month in passive income, the free cash flow it provides will eat less into the investment portfolio. This is the strategy that allowed me to achieve financial independence early.

What 4 years of the FIRE movement have taught me

FIRE has taught me you don’t need to be wealthy to build wealth. It also taught me to enjoy the simple things in life and not be influenced heavily by materialistic objects. I am glad I joined the FIRE movement early and find my way how to achieve financial independence early. I still have another decade before I choose whether to retire and I can’t wait to enjoy my retirement.

Can Anyone learn to build financial independence?

Absolutely! Anyone can learn to build financial independence. Achieving financial independence is not limited to a select few; it is a goal that can be pursued by individuals from all walks of life. Building financial independence requires dedication, discipline, and a willingness to learn and adapt.