On social media these days, hearing about ways to make big sums of money from this or that investment has become so common. However, the majority of the content shared on these sites is part of a larger scam known as the Get-rich-quick scheme. This con portrays a low-barrier-to-entry scheme that requires little effort and generates a large sum of money.

To those that know the road to wealth, it takes time, a lot of time. One of HustleVentureSG Co-Founder Edmund took 4 years to reach a $100,000 investment portfolio. And he says that he is nowhere near the level where he can safely say he is financially free. In this blog, will discuss what it takes to get that high net worth and how anyone can work towards it.

How Money is Created

If you have read Rich Dad Poor Dad’s Guide to Investing, you will have a better understanding of how money is made. But you haven’t, here is what you need to know. Banks create money by lending excess reserves to consumers and businesses. As funds are deposited and re-loaned, the total amount of money in circulation increases. The rich use debt to build wealth because debt is non-taxable. That is why billionaires uses debt in many forms such as collatoral, margin, leverage, mortgage or loan.

What you need to Grow Wealth Fast

Unless you hit the jackpot or find a treasure chest somewhere, getting rich requires a lot of time and dedication. For most people that are just start their wealth building journey, getting to know the 7 levels of financial independence helps individual gauge where they stand.

Secondly, they need to learn the basic to advance level of building wealth by either reading, watching videos or going for classes to learn. Individual aiming to building wealth need to read up on tough in-depth subjects on building of wealth. Which can be learning subjects such as how to achieve financial indepedence, what type of investments asset to build or early retirement strategies.

Thirdly, after enough intensive reading on growing wealth. It is time to act upon the research. At this stage, it would be a tough trail and error to learn to invest on what suits you. It could be investing in real estate, stocks, crypto, art or maybe even card collection. Pick an investment asset that you are willing to hold long term. That is because investors need to be willing to stomach any up and down swing the market has to over.

Investing in assets takes time to build. Therefore, setting a yearly time horizon to reach small steps of financial goal is critical. Celebrating each financial milestone keep wealth builder motivated to grow their investment long term. Whenever investment talks about 30 days to get rich or do this or that now to make X amount of money. It’s sad to see people falling victim to such frauds. The best way to make money is through compound interest, one of the 8th wonder of the world.

Ways I can Increase my Speed to building wealth

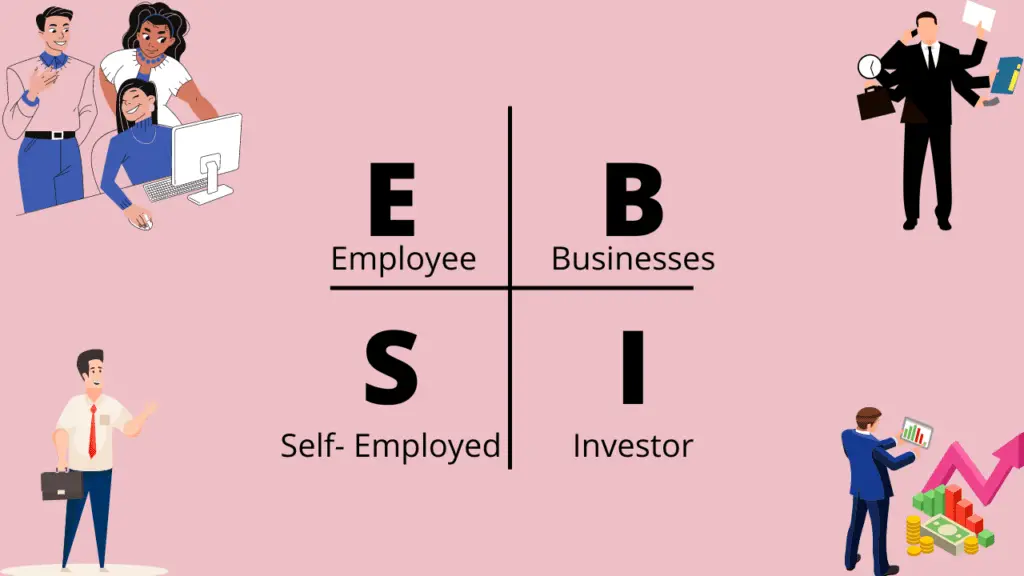

In this digital age, there are many ways for individual to grow their income fast. In Rich Dad Poor Dad, Robert Kiyosaki formulated the ESBI Quadrant to let readers understand where the most of the money goes. The ESBI stands for E (employee), S (self-employed), B (business) and I (investor). To get rich, striving to work toward the B and I is crucial. The reason is those forms of income doesn’t require amount of time spend to build income. Instead it focuses heavily on spending huge amount of time at the start and money will flow in at a compounded rate.

Full-time Employment

Although the best building wealth strategy is through creating businesses or investing. Creating a business can be highly risky and investing require huge sum of money. A full-time job creates a good level of financial security every month. This allow a peace of mind that individual can focus on maybe their side hustle or start building a small business. And even if the business flops, you are in your day job having income.

Even though a full-time job can provide stable monthly income, investing is still important for retirement. Having enough set aside for retirement and emergency is important. In a case of event that you are force to quit the job or being in an accident that left you without income, at least your life raft is with you.

Self-Employed

Being your own boss. That’s what being a self-employed means. The greatest benefit of being self-employed is the ability to concentrate solely on self-improvement.. Whether it is on sales talks, work habit or communication skills. By improving oneself, self-employed individual are best at knowing their weakest and know what they must invest in. Themselves.

Improving oneself is great and all. However, self-employed are still tied to money equals to time. That is why they are stuck in the rat race chasing after money.

Business

Building a business is hard. Most businesses fail within the first 5 year. However, building a business can be one of the best income generating asset for oneself. Creating a business takes a lot of effort and time. Once completed and customer comes in, it can be one of the best cashflow generating asset.

Investing

Money is best made through investment that grow and produce income (dividend/rental income/option premium). Finding the right investment can greatly forthfold your wealth. This comes with extensive research and understanding of the business. If investing in other company is not what you are looking for, investing in yourself or your business may be a better alternative.

To get started on investing, there are multiple platform that allow individual to get started on their investment journey. In this digital era, robo-advisors such as Syfe and StashAway are becoming widely popular. If individual stocks is more of your think, online stock brokers such as MooMoo or Tiger broker are great way to invest! Click on the icon to instantly get referral when signing up and deposit the required amount to get started.

Time in the Market beats Timing the Market

Learning to set aside spare cash to invest is important. Dollar-cost averaging in growing asset to build wealth long term is crucial. To get rich, learning to consistantly do good at one task (can be simply just investing every month) can build great wealth. Invest a $1000 per month for 25 years compounded at annual rate of 10% will be a million dollar. As the saying goes “time in the market beats timing the market”.