Common Economic inequality, pollution, corruption, climate change and affordability, low-paying jobs, and no upward mobility. These are just a few of the issues that the world has been grappling with for years. But believe it or not, all these issues have a shared cause and that’s inflation. More accurately the ability to create money out of thin air with the help of a central or commercial bank. Inflation is no longer the slient killer we once thought. In this article, it will reveal where all this inflation is coming from. Explaining exactly how this inflation is causing these issues and why the solution might require just a single step.

Why the Financial System is causing such High Inflation

Imagine you were given a bank account with an unlimited amount of money. What would you do? Well, you’d probably start by buying a nice house going on a fancy holiday, getting yourself a very silly car, and all the other things that the average person would do. Once you’ve had your fun, you would start doing the same for your friends and family buying them houses, cars, holidays, the whole shebang.

Next, you’d probably start donating your money to charities investing in startups building cutting-edge tech and all the other kinds of stuff rich people do. Now I think we can all agree that spending money on all of the above is an effective allocation of that capital. In other words, it’s the right way that money shouldn’t be spent improving the quality of life for yourself and others and then trying to take humanity itself to the next level.

Given enough time. However, you’ll inevitably start spending your money on stupid stuff. Maybe you’ll start buying shit coins that you know will probably go to zero, marry a reality TV star or construct a secret underground lair and try and take over the world. Why? Because you can or rather because you’ve run out of ways to allocate that capital effectively.

What I’ve just described is the financial system in a nutshell.

Poorly Managed Currency

When a currency is first created, its purpose is to improve the quality of life of the people using it. The institution that issues the currency is often instructed to ensure that it operates in accordance with this purpose when it is established. Now this currency-issuing institution is a central bank or a commercial bank.

The central bank has the power to print currency while the commercial banks have the power to create currency out of thin air. The commercial banks are able to do this through fractional reserve banking, aka lending out more than they have on their balance sheets. The people with exclusive access to these money sources basically have their own bank accounts with unlimited money supplies. This isn’t a problem at the start because the private sector uses its accounts to invest in innovation. While the public sector uses its accounts to develop infrastructure.

Too much ‘dumb money’ in the system

As time goes on. However, the stupidity sets in the people in the private sector engage in reckless financial speculation and enforce their ideologies. The people in the public sector purchase political popularity through public programs and increase for surveillance and control of their citizens. All these endeavors require creating lots of currency and that eventually results in inflation.

It also results in a collapse in the confidence of the institutions that issue the currency. Including the ones in the private sector that have exclusive access to the institutions that issue the currency. This is why every fiat currency that’s ever been issued has eventually failed and it’s why any form of currency created by people is destined to fail. And yes, it is the cause of all the issues I mentioned in the introduction.

War

Any student of history out there will know that when countries go to war, their governments take on unbelievable amounts of debt to finance that war. When a government must borrow massive amounts of money to do something that it wants. Then it’s often if not always, because it’s something it knows that its citizens do not want or do not need. It’s something that it knows its systems would not fund with its taxes. If it was something that citizens wanted or needed, then the government would have a much easier job of selling the idea to them, raising taxes to pay for things people actually want is a lot more straightforward than doing so for something they don’t. Not surprisingly, war is very low down on the list of things that citizens of any country want or have ever wanted.

However, it has always been and will always be high on the list of things that the powerful public and private people and institutions that wanted because they always want more growth. Now, of course, this urge to grow bigger and better is often a good thing. When you throw the ability to create money into the mix. However, it can become a very bad thing because it opens the door to reckless spending and war. Without the ability for people to create money to finance these wars, they would happen a great deal less frequently.

Climate Change

Inflation ultimately comes from excessive money creation driven by public and private institutions that are abusing their infinite money bank accounts. In practical terms, inflation means that a currency is losing value by the day. This is simply because the gradual increase in the supply of that currency makes it gradually less valuable. It’s basic economics, the more of something you have, the less it is worth relative to other things.

So what happens when people can see that their currency is slowly losing value by the year by the month or even by the day? Well, obviously they’re incentivized to get rid of that currency by buying something. That’s because they know everything else will be more expensive in the future. Now the effects of inflation are arguably felt most by those with massive amounts of money. That’s because a 1% devaluation on $100 is just $1. A 1% devaluation on $100 million, however, is $1 million.

That’s an amount of purchasing power, anyone would notice losing. And because the only way to preserve this purchasing power is to buy something else with that money. That’s exactly what the rich do. They use their money to buy assets and then they borrow money against these assets to buy even more assets, which continue to appreciate in value due to inflation.

Overconsumption of Mother Earth

As we’ve learned, this infinite money glitch inevitably results in misallocation. of capital, specifically, overconsumption. Now overconsumption is what lies at the core of climate change and all other environmental issues were experiencing and the rich are the largest consuming class. Now don’t get me wrong, the urge to consume can be a good thing in as much as it keeps the economy going. When you throw an inflation-based infinite money glitch into the mix, however, it quickly becomes a very bad thing, because it leads to the kind of overconsumption that destroys the environment.

Currency creation but Depressed Wages

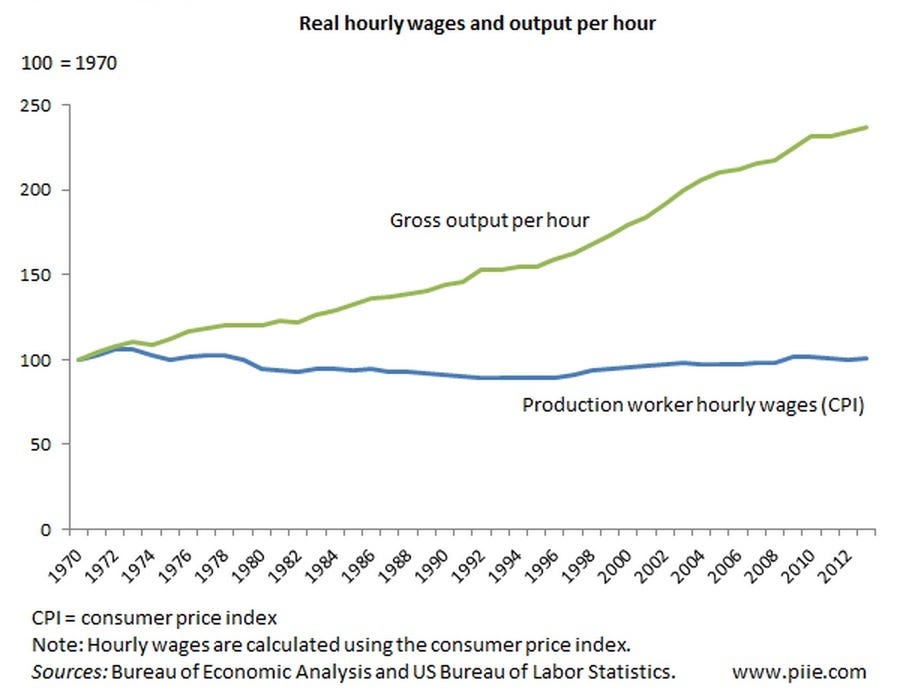

In 1971 is when fiat currencies officially stopped being backed by gold to be clear, there was already lots of unbag fiat currency supply in circulation prior to 1971. The thing is that it hadn’t been officially sanctioned, so to speak. Going off the gold standard effectively gave the green light to central banks and commercial banks to create as much money as they wanted. This allowed a handful of corporations with close connections to both types of banks to get their hands on easy money.

Taking on more debt

They use this easy money to expand their empires into other countries and lobby politicians to pass regulations that would prevent any competition from catching up. So what happens when a corporation can borrow almost as much money as it wants? Obviously, that corporation is less incentivized to care about its actual operations that generate actual income.

This includes the employees of the company, if corporations were not able to borrow almost as much money as they wanted, then they would be forced to pay extra close attention to what employees want. This is because they would need to create favorable conditions for productivity. But I suppose this incentive falls apart when globalization comes into play.

Why employee(the lower and middle income group) ultimately suffer

In any case, the employment issues caused by inflation are even worse in the public sector. That’s because when a government can borrow as much money as it wants to finance its operations, it doesn’t need to care much if at all, about the productivity of its employees to make things worse, many governments have policies to reduce funding for a department if it manages to do its job within its annual budget. This inadvertently creates an incentive for these departments to spend more money so they can keep their budgets or even increase them.

Economic Inequality

Now another significant issue is caused by money creation is economic inequality, economic inequality in almost every country around the world exploded to record highs during the pandemic. And that is not a coincidence. In response to the pandemic central banks around the world dropped interest rates on borrowing to zero. By now you’ll know that the entities with close connections to central banks and commercial banks were the only ones who were able to borrow at a near 0% rate, otherwise known as free money.

These entities use this borrowed money to buy up all the assets they could get their hands on. That’s why the prices of houses stocks and cryptocurrencies went vertical. As the primary holders of assets, the rich got richer and everyone else saw their hopes and dreams become that bit further out of reach. The worst part is that this dynamic didn’t start with the pandemic.

It started as soon as the current financial system was created in the aftermath of the Second World War. And it was significantly accelerated by the dropping of the gold standard that I talked about earlier. Now there’s even a phrase for this phenomenon by borrow die. The elites start by making it big usually through legitimate means and then they buy up as many assets as they can buy. Now you’ll know that the elites will then borrow against their assets to buy more assets until they own all the assets.

How BlackRock force the ESG Ideology to the investment world

The best example here is Blackrock forcing its ESG ideology into every institution in the world despite it being inherently unprofitable. only possible thanks to money printing. The best part is that they pay no tax as part of this process. That’s because you only pay tax on something when it’s sold in most countries anyhow. borrowing against an asset is therefore tax-free because that money didn’t come from the sale. It came out of thin air at a low-interest rate courtesy of the banks.

High Inflation will become a Sticky Mess

The high inflation caused by all this money creation has been destroying the purchasing power of the average person. In 2020 and 2021, 40% of US currency was printed in the hopes to kick start the economy from the pandemic. The unprecedented money creation we saw in response to the pandemic, put the pedal to the metal on inflation. And we are continuing to feel the effects of that.

Now, as messed up as all these issues are, there are many idea proposed worldwide on the ways to combat inflation. That’s to take away the ability of central banks and commercial banks to create unlimited amounts of money. However, as you continue reading, you will learn and understand why most of these propose ideas will never come to fruiton.

Have a Supply Constrain Money Supply

One way to do this would be to move to a sound money system such as one where currencies are once again, backed by gold. It doesn’t necessarily have to be gold either. I reckon there are ways to back currencies with other commodities and even cryptocurrencies with gold-like attributes such as BTC. In a sound money system, the only way you can really create money is to produce something of value that someone will give you money for. Because the supply of sound money isn’t constantly expanding. That means that the purchasing power will be preserved over time. And not only that, but you’ll be able to preserve your purchasing power by just saving you won’t have to invest in high-risk assets that are being manipulated by well-capitalised speculators.

Why it won’t work

The elites that have their wealth in these assets that they borrowed against would be wiped out. That’s because borrowing in a sound money system would be much more expensive. It would no longer be possible for those with close connections to banks to borrow money for free at close to 0%. This includes governments that have taken on unbelievable amounts of debt to mostly do things that their citizens do not want, and do not need.

Now the rich could probably find a way to unwind their debts, but the government, not so much. They would almost certainly default and it will result in regime change in every country along with a complete restructuring of government operations. As an added bonus, unaccountable international organizations that are sustained by made-up money would completely dissolve and their explicit plans to create a centralized global government would dissolve with them. Remember, world domination is only possible through money manufacturing.

Removing out excess or stimulated currency in the Economy

40% of US currency is printed out in 2020 and 2021, can this excess cash be removed from the system? Well it isn’t as easy as it sound. In order to remove equity in the economy, interest rate is needed to be present. The FED increase interest rates in order to maintain inflation(which they have not since 2020) and stabilise the financial markets. So the question people would wonder is whether the FED should just simply raise interest rate to the maximum to remove any excess or stimulated currency in the economy.

Why it won’t work

Now the only issue a sound money system could possibly create is something called a deflationary death spiral. This is when everyone realizes that their purchasing power is increasing over time. So they reduce their spending to a bare minimum. This does serious damage to the economy which destroy the economy entirely as most businesses uses loan to grow their businesses. A sudden steep rate hike would create turmoil and fear in businesses. Which may results in companies taking equity out and terminating employees. The thing is that this is an issue that’s only ever existed in theory.

How Inflation will go back to normal (2% inflation rate)

Inflation will be sticky for quite some time, as the market start digesting the stimulated currency in the financial market. In order for inflation to lower back to the ideal 2%, multiple issue needs to be resolve from the financial market. This is why many economist believe that a recession is a good thing. As more cracks within the system is exposed such as the Luna stable coin crash, Celsius bankruptcy and Credit Suisse impending bankruptcy. There are 3 other information that will help lower inflation in the economy

Zombie Company needs to Exit the Market

With the crazy amount of money printing and stimulus pumped into the economy. Many ‘investor’ with extra cash or have a gambling tendacy started investing their money into businesses with low or negative revenue growth. Adding on with the low interest rate provide by the FED. Businesses started taking a huge amount of cheap loan to invest in the company.

This created the raise of ‘zombie companies‘. A great example of such business is a company called Peloton, a streamed workout platform for user to exercise. The company made huge success during the Covid-19 lockdown as people needed a form of entertainment and fitness. The stock skyrocketed over 800% in 6months due to its popularity.

However, as soon as the lockdown eases off and people were able to travel. Peloton stock fall below its Covid-19 lows. With huge inventory placed(invested debt) for more equipment. Peloton is not able to sell their product well and it is back to where it once was. On a brim of survival.

Greed Dies Off

Stock on go up, a common analogy used during the stock market rally in 2020 and 2021. It was created to illustrate the crazieness within the stock market as the money printing has lead to stock market climbing to new highs. This has lead to many first timer investor entering the market due to FOMO(fear of missing out). Many of these newcomer became greedy and find the fastest way to make money.

As a result, most of these investors lose money i in this recession. With raising interest rates, the amount of people losing their equity through margin will expose them. Over time if high interest rates persist. Individual who are not able to repay their loans will find themselves in tough position. As what the famous investor Warren Buffet once said, the stock market is a voting machine in the short run and a weighing machine in the long run.

Wealth is build in the long run and is usually silent. To make a profitable amount investing, proper research and deep analyse of a company needs to be done.

Businesses need to focus on creating more Value

In every recession, we always will see the rise of new dominant businesses overtaking dinosaur businesses.

A great example that has shine the light in innovation is Tesla. As gas prices around the world increases to overbearing figures. The need for new alternative is needed to revolutionise the world. Tesla became the craze in the 21st century as many people never imagine the possibility of a smart system in cars. With rising demand for electric vehicle, this can destroyed the automobile business. The dinosaurs of the 21st century.

Unable to innovate and grow a business as fast, new innovative businesses will start to take over. The companies that have shown great growth in recessionary period are the one with:

- Focus on core competency

- Market your more to stay relevant and notice

- Protect and find ways to grow cashflow

- Invest and provide more value for existing customer

- delegate and automate

Why you need to be ahead of Inflation

Inflation raises the prices of the goods you buy over time. Failure to keep up with inflation can lower the buying power of your retirement assets. In general, the effects of inflation are gradual and consistent. Certain consumer goods and services may have annual price increases of only a few cents or dollars. In order for you to keep yourself ahead of inflation and build wealth, there are only 2 solutions. Invest more and earn more money.

If you would like to learn more about investing to grow wealth, be sure to check out our investment 101 where we cover stocks, real estate and cryptocurrency. If you are short of income, building wealth should be your number 1 priority. You can start by learning ways to earn more money from your full-time job. Or start a side hustle where you can make additional income.