It’s crazy how the craze for investing in high growth and speculative investment has dominated the market in 2020 and 2021. But they have all now stayed quiet with the looming recession taking out some of these investments such as Luna, Meme stock, and many cryptocurrencies. With the rising interest rates by the FED, growth for any investment will slow down or drop significantly. During times like this, we have been reminded of the importance of long-term investing. But how can investors keep sane when they look at their current portfolio? Is it true that investing your money should be boring.

That is why as a long-term investor, it’s usually better to keep your money boring. In this article, we will be discussing the importance of long-term investing. The ways to keep your vision in the investment long-term, and how to make it as boring as possible!

The importance of long-term Investing

Long-term investing is a term mostly used to describe an investment that is longer than 5 years. It is the best strategy that most beginner investors should follow because of anything below that. Volatility will still be at an all-time high. However, with the recent hype of cryptocurrencies and high-growth stocks, dutifully dollar cost averaging into good value stocks seem to be not in favor. With news of people turning into millionaires investing in meme cryptocurrencies such as Dogecoin, it’s no wonder many have jumped on the bandwagon and invested their money into the cryptocurrency.

Why boring is better!

Sorry to say that investing is never a get-rich-quick if you would like to try getting rich instantly. You may try your luck with gambling. However, if we were to put it into statistical real numbers. You have a one in 302,575,350 chance of winning the jackpot and a one in 12,607,306 chance of winning one million dollars. You have a better chance of getting struck by lightning (1 in 1,222,000) than of randomly selecting an active NASA astronaut from the whole US population (44 in 331,893,745 or around 1 in 7,543,040). Is that worth the risk for the reward?

Investing is a long-term process. It took me over 4 years to accumulate a total networth of over $100,000 at age 24. Although most of these came from growth stocks, I have not touched or made any changes to the portfolio. Instead, all I did is DCA (Dollar-cost averaging) into my investment portfolio and make it as boring as possible.

5 Ways to condition yourself to invest in long-term

The trick to keeping your money boring is not letting it emotionally affect you. As some seasonal investors would say, “Invest money that you are willing to lose. If the investment goes to zero, it shouldn’t be the end of the world for you.” But wait, shouldn’t the purpose of investing be to make money? Investing has its risk to reward, and knowing how to control that risk is what makes a great investor. Here are some ways that I did to keep my emotion in check when investing.

1) Research heavily and set a realistic time horizon for your investment

If you are planning to invest in a company or business, be sure to research it in-depth into the business. Here is what you should look at:

- Cap table. A cap table will provide information on the percentage of holding each investor has.

- Quarterly earnings report. Tracking the growth of the company based on its earnings and whether growth is an uptrend.

- Future potential. Whether the product or service would be useful in the future.

- Competitors. Whether the business is able to strive in a highly competitive environment.

Once the heavy lifting is done, finally set a time horizon you would expect to would like to withdraw your investment(preferably at least 5 to 10 years). All you now have to do is either invest lumpsum or DCA monthly into your investment to grow the portfolio.

2) Have a diversified portfolio

As Kelvin O’Leary would often tell investors on diversification to never invest more than 5 percent. A simple way to do that is to invest in an index fund like the S&P500 which is the US top 500 companies. By diversifying your investment, it would great reduce volatility. Thus, you would be more comfortable holding onto the investment. Do read our article on what a diversified portfolio looks like to learn more about a diversified portfolio,

3) Set Investment reviews yearly

Whether it is a family affair, sudden large expenses to cover, or having income being affected. There are many problems or changes that can happen in a year. That is why it is important that investors do a yearly investment review of their portfolios. During this review, here is what you should focus on:

- Risk appetite. Are you in a position to take more or less risk?

- Setting a timeline for some investments to mature

- Am I still able to hit my investment timeline horizon?

- Do I need to diversify my investment portfolio?

- Am I comfortable with my investment?

- Is there any investment that I need to cut my losses

Apart from this summary, if you would like a full elaboration on how to do proper financial planning, be sure to check other our other article on “How to do a Complete Personal Financial Planning.”

4) Automate your investment

These days, with Robo-advisor and mobile phone notifications, to constantly remind you to invest your income monthly. It is a lot easier to automate your investment. Apart from that, investors will need to learn how to set aside some money for their own investment. By building all these small habits to automate your investment. It would help to control the urge of having to look at your investment portfolio. Thus, reducing the chances of you changing it.

5) Have a large amount of emergency fund

If you constantly need to look at your investment portfolio, chances are you are either a full-time investor or treat your investment portfolio like a piggy bank. Never treat your investment portfolio like your savings, always set aside an emergency fund that you can use at a moment’s notice. Your emergency fund should be at least worth 6 months of your monthly expense.

Unpredictable circumstances can be both life-changing and costly, resulting in financial emergencies. An emergency fund provides the cushion you need to pay out-of-pocket expenses, preventing you from having to rely on loans or credit cards to meet a short-term cash shortage.

You won’t even realize it!

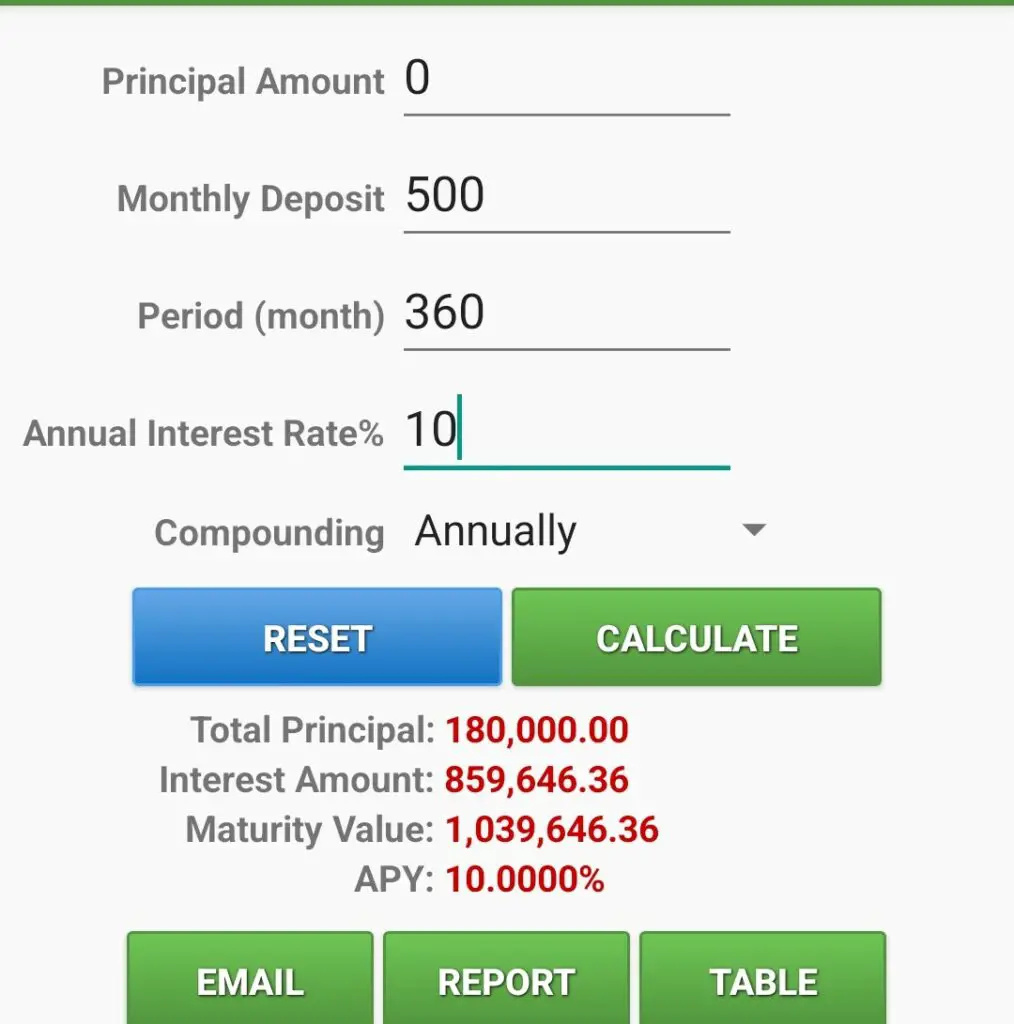

If you follow these strategies and invest consistently. You would soon realize it is easier to reach financial freedom. Here is a figure for you to picture.⬇️

- $500 a month for 30 years invested is a million

- $1,000 a month for 23 years invested is a million

- $1,500 a month for 20 years invested is a million

- $2,000 a month for 17 years invested is a million

Investing to become a millionaire in Singapore is not impossible, but it does take commitment. Now that you know this early retirement investment strategy, be sure to set your investment goal and most importantly. KEEP IT BORING!