Not knowing where the current inflation is going to be, whether the FED will be even more hawkish, or even whether war might break out. Uncertainty in the market makes great opportunities for options sellers. Over the last few months, I have been making more from my options trading side hustle because there is more volatility in the market(mainly due to recession sentiments) and I have been building my investment portfolio quite sizeable. Opportunities come once in a lifetime, in this article, I will share why an uncertain market means options traders can make money.

How does an Option work?

Options trading allows investors to speculate on the future direction of the stock market as a whole or particular instruments such as stocks or bonds. Options contracts allow you the option, but not the duty, to buy or sell an underlying asset at a predetermined price by a predetermined date. So during an uncertain market, buyers and sellers typically are either too afraid to buy or sell stock.

I as an option seller take advantage of that by providing these buyers and sellers a level of insurance. If the stock goes down, I’m willing to buy. And if the stock goes up, I can sell some of my stocks to them. A win-win in both scenarios!

Why I love Selling Option

In the book Rich Dad Poor Dad by Robert Kiyosaki, he mentioned this quote that sticks with me on how I should invest:

Poor investor loses their money when the market goes up or down.

The average investor loses money when the market goes down and wins when the market goes up.

The sophisticated investor wins even if markets go up or down

To be a great options trader, you will need to know how to trade options so that whichever way the market goes you are still in a profit or making money. Hedging is the tool option trader use to make a profit during an uncertain market.

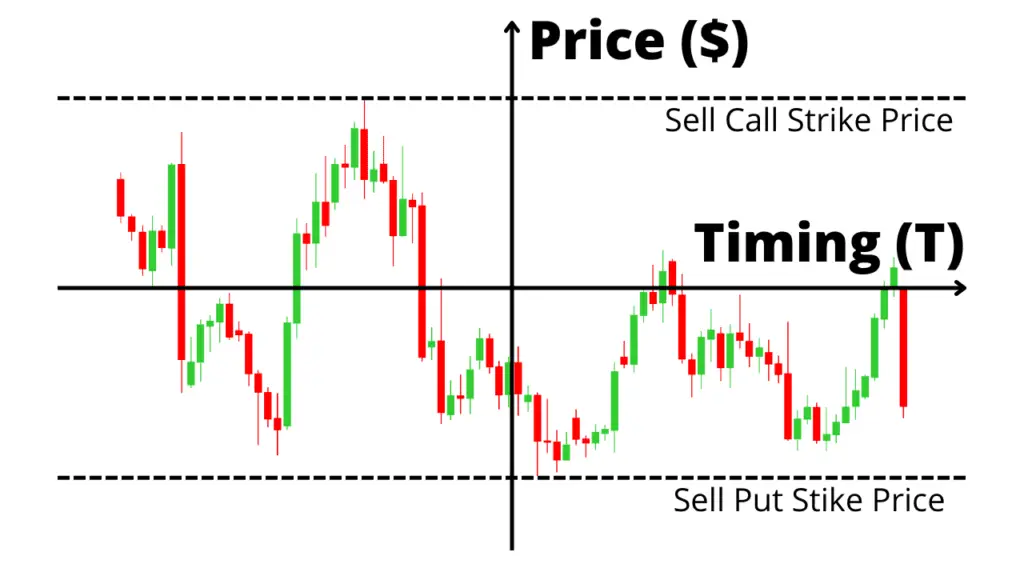

To make a profit even if the stock market goes up or down, hedging both sides of the market gives options trader income to earn whichever ways the market goes.

Acting as an Insurer for Businesses

To put it into essence, options sellers are insurers who sell insurance to investors that if the stock ever were to hit the strike price placed. In times of uncertainty, option sellers are able to benefit more in the market downturn as premium increases. If you would like to find out how to trade options or how to sell an option, be sure to check out my options trading side hustle page.