Personal financial planning is a process that helps you track your income, expenditures, and savings so that you can make informed decisions about your finances. It can also help you plan for short-term and long-term financial goals. Most people will need to create a budget at some point in their lives. A budget is a tool that allows you to track your income and expenses so that you can see where your money is going. Creating a budget can be helpful if you are trying to save money or pay off debt.

There are many different ways to save money. Some people like to put money into savings accounts, while others invest in stocks, bonds, and other investments. Whatever method you choose, saving money is a good way to secure your financial future. Investing is another way to grow your money. When you invest, you are putting your money into something that has the potential to grow in value over time. This can be a great way to build your wealth over time.

Why is it important to understand Personal Finance

Personal financial planning can help you make informed decisions about your finances and reach your financial goals. If you are not sure where to start, there are many resources available to help you get started. You can talk to a financial planner, read books or articles about personal finance, or even use online tools. Whichever method you choose, getting started is the first step to success.

One important thing to remember is that personal finance is a lifelong process. You will need to review and update your plan on a regular basis. This is to make sure it is still on track. Life changes, such as getting married, having children, or changing jobs, can all impact your finances. By staying on top of your finances, you can make sure that you are always making the best decisions for your situation.

Personal financial planning is an important part of achieving your financial goals. If you take the time to create a plan and stay disciplined. You can reach your goals and secure your financial future. There are many ways to get inspiration, you can get it from reading books, watching Youtube videos, or talking to people that have reached the goal you are aiming for.

Here are the top 3 books we recommend you start out with to understand personal finance better

Why most people will not be rich. And how you can with your personal finance planning

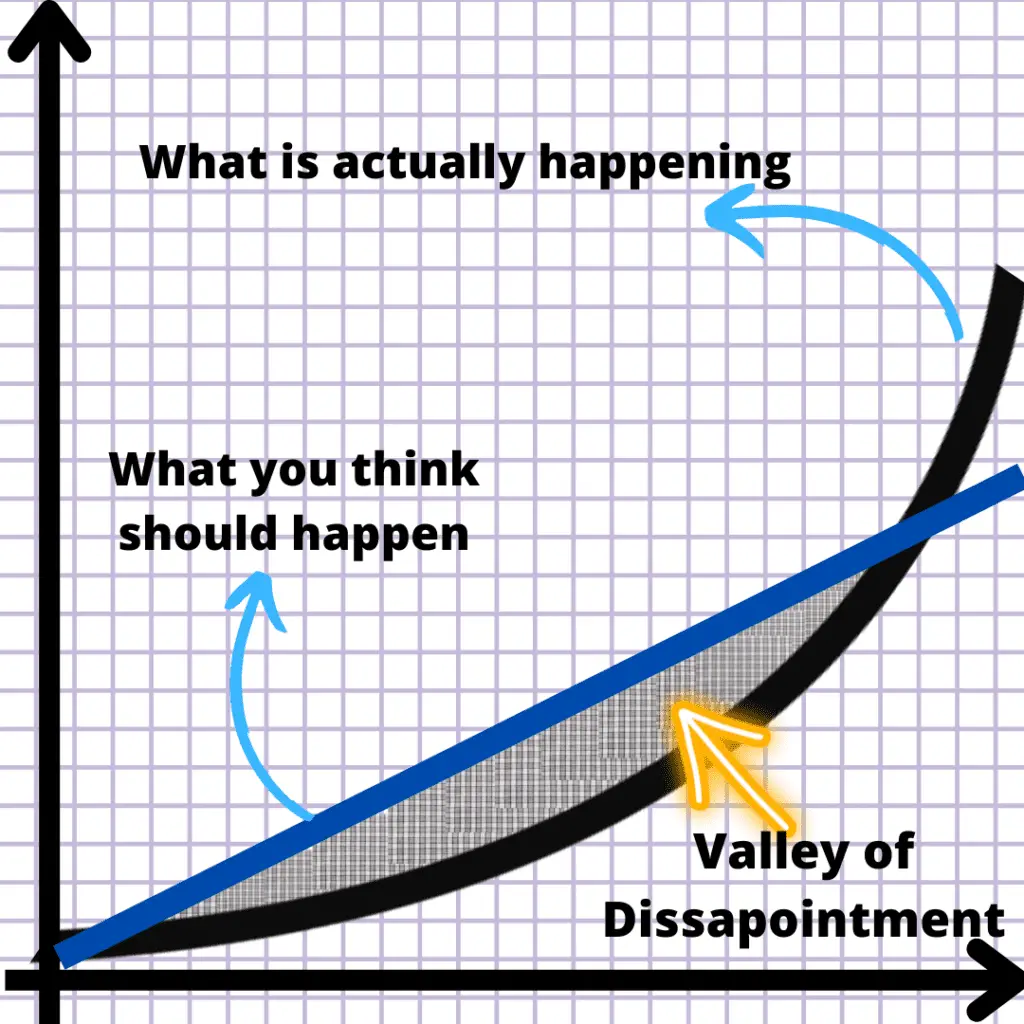

If you have read Atomic Habits, you would understand the graph above on self-improvement. Most people believe that growth is a linear line but in actual fact, it grows in a curve line. The growth shows that whatever things you are looking to improve on, it takes time. Sad to say that most people quit their passion or business too early when they are unable to see success or progress. This is known as the Valley of Disappointment.

You don’t go to the gym 3 days straight and expect to be jack like Arnold Schwarzenegger. You can’t expect to learn investing in a month and be able to financially retire with investing. Money takes time to grow. Therefore, you have to take personal finance planning as a slow curve.

What you need for your Finance

You will need a timeline for each of the incomes on what you may need. That can be for 6 months of emergency expenses, your future expenses on having an upcoming child, or investing in the stock market to retire at a later age.

Not only that, having a diversified portfolio is crucial for every personal finance portfolio. That can be from investing in different asset classes such as stocks, real estate, crypto, or your business. These asset classes may produce different levels of growth and risk. Therefore, the investor needs to know the level of risk they partake in and the time horizon of their investments.

Using online tools to get better at Personal finance

Whichever method you choose, getting started is the first step to success.

One important thing to remember is that personal finance is a lifelong process. You will need to review and update your plan on a regular basis to make sure it is still on track. Life changes, such as getting married, having children, or changing jobs, can all impact your finances. By staying on top of your finances, you can make sure that you are always making the best decisions for your situation. Personal financial planning is an important part of achieving your financial goals. If you take the time to create a plan and stay disciplined, you can reach your goals and secure your financial future.

There will always be new investment tools that will be better than the previous ones. Take for example how it was in the past which make investing in stock so costly due to high upfront and transaction fees. With the help of online mobile investment brokers like Robinhood, Tiger broker, or Moomoo, investing can be done anywhere in the world. Investing has really come a long way, and to get ahead of our investing game, we will need to keep ourselves updated and relevant.

Conclusion

Personal financial planning is a process that helps you track your income, expenditures, and savings. Take your time to learn and research as much as you can to make better-informed decisions about your finances. It is important to remember that personal finance is a lifelong process. You will need to review and update your plan on a regular basis to make sure it is still on track. Life changes, such as getting married, having children, or changing jobs, can all impact your finances. By staying on top of your finances, you can make sure that you are always making the best decisions for your situation.