Investing in real estate is one of the most popular ways to grow wealth and secure financial stability. With Singapore being one of the most vibrant real estate markets in the world, many investors are considering investing in real estate in Singapore.

Every Singaporean and our neighboring countries all have the same mindset when it comes to investing properties in Singapore. Which is a must-buy!

Singapore property is known as the most valuable property to own in the South East Asia market. The average cost of a lower-end 3-bedroom condominium in Singapore cost upwards of $900,000 to $1.5 million. It crazy to even think that private property prices in Singapore have actually increased by 8.4% over the last 2 years. So are you excited for the opportunity?

In this article, I will discuss the benefits, statistics, types of investments, factors to consider, and tips for investing in real estate in Singapore. By the end of this article, you will have a better understanding of whether investing in real estate in Singapore is a smart financial move for you.

Real Estate in Singapore

Investing in real estate in Singapore has many benefits. One of the main benefits is the high rental yield. Singapore has a high population density, foreign workers are always constantly looking for long-term stays, and the demand for rental properties is always high. Therefore, investors can enjoy high rental yields, which can provide a steady stream of passive income.

Another benefit to consider is capital appreciation. Over the years, property prices in Singapore have been increasing steadily. Therefore, investors can expect a good return on their investment when they sell their property.

Property prices in Singapore are also relatively stable. The government has put in place policies that ensure the stability of the real estate market. Therefore, investors can enjoy peace of mind knowing that their investment is secure.

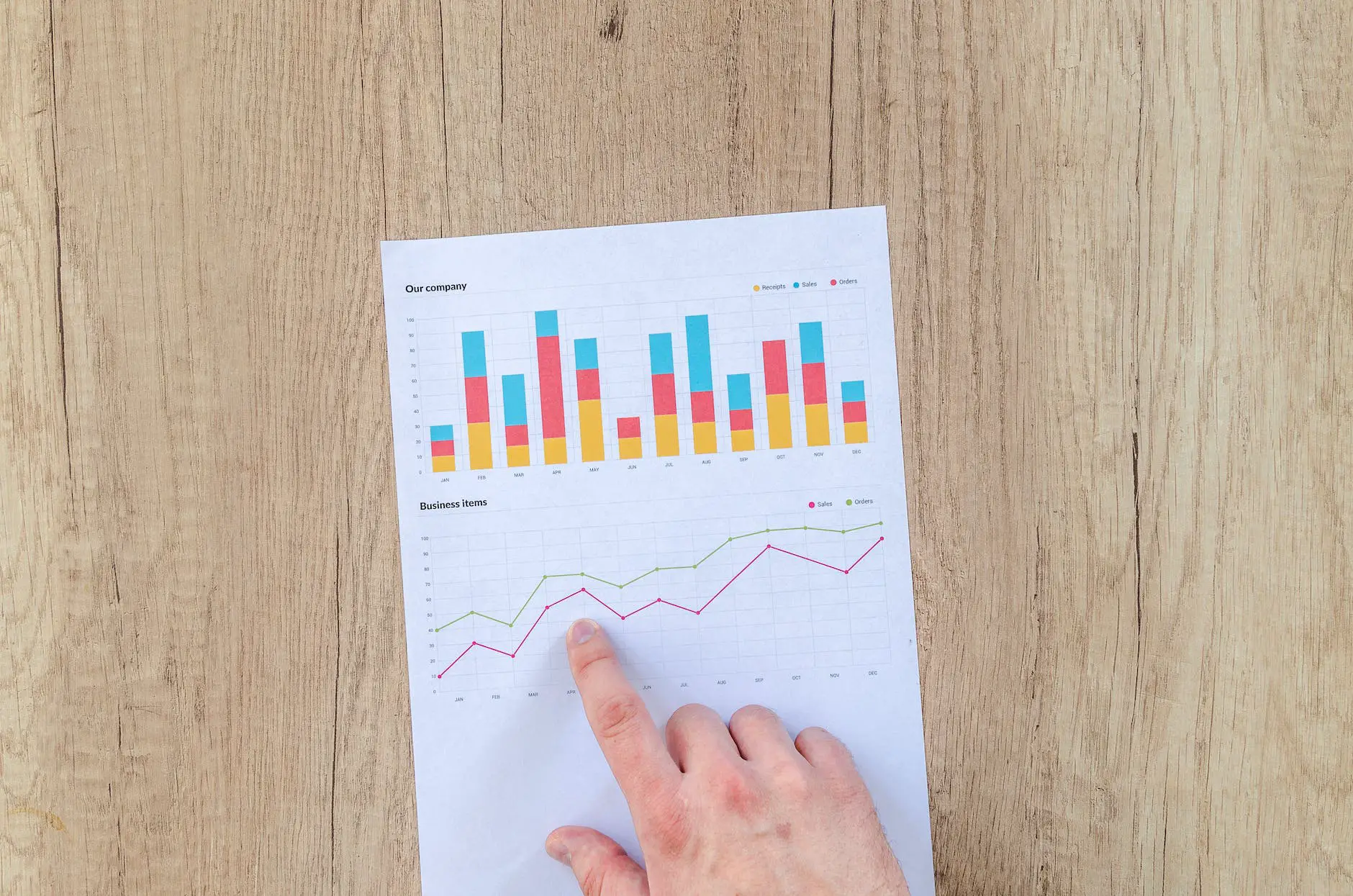

Real Estate Investing Statistics in Singapore

According to data from the Urban Redevelopment Authority (URA), the private residential property index increased by 2.2% in Q1 2021. This marks the fourth consecutive quarter of price increases. The data also shows that the number of private home sales increased by 17.2% in Q1 2021 compared to the previous quarter.

The data indicate that the Singapore real estate market is still strong, despite the COVID-19 pandemic. Therefore, investing in real estate in Singapore can be a smart financial move.

Types of Real Estate Investments to Consider

There are several types of real estate investments in Singapore. However, residential properties are the most popular type of real estate investment in Singapore. This includes apartments, condominiums, and landed properties. Commercial properties include office spaces, retail spaces, and warehouses. Industrial properties include factories and warehouses. Retail properties include shopping malls, supermarkets, and shophouses. Let’s take a deep dive to understand more about them.

Residential Properties

Residential properties are a popular choice among investors, especially those who are looking for a long-term investment. They include properties such as apartments, condos, and landed houses. Residential properties are typically purchased for rental income and capital appreciation.

In Singapore, there are two types of residential properties that investors can consider:

Public Housing

Public housing, also known as HDB flats, are affordable homes that are built and managed by the government. They are popular among investors as they provide a stable rental income and are located in well-established residential areas. However, investors must comply with the government’s regulations on renting out their HDB flats.

Private Residential Properties

Private residential properties include condominiums, apartments, and landed properties. They are more expensive than HDB flats but provide higher rental yields and capital appreciation. Private residential properties are popular among foreign investors due to Singapore’s favorable policies on foreign ownership of property.

Commercial Properties

Commercial properties are properties that are used for commercial purposes, such as offices, retail spaces, and industrial parks. They are typically purchased for rental income and long-term capital appreciation.

In Singapore, commercial properties are divided into three categories:

Office Spaces

Office spaces are popular among investors who are looking for a stable and long-term investment. They provide a high rental income and are located in well-established business districts. However, investors must be aware of the risks involved, such as fluctuations in the office rental market.

Retail Spaces

Retail spaces include shops, shopping malls, and restaurants. They are popular among investors who are looking for a stable rental income and long-term capital appreciation. Retail spaces are typically located in high-traffic areas and have a high potential for capital appreciation.

Industrial Properties

Industrial properties include factories, warehouses, and logistics hubs. They are popular among investors who are looking for a stable rental income and long-term capital appreciation. They are typically located in well-established industrial areas and have a high potential for capital appreciation.

Industrial Properties

Industrial properties are properties that are used for industrial purposes, such as factories and warehouses. They are typically purchased for rental income and long-term capital appreciation.

In Singapore, there are two types of industrial properties that investors can consider:

Business Parks

Business parks are purpose-built facilities that provide office spaces and industrial spaces for businesses. They are popular among investors who are looking for a stable rental income and long-term capital appreciation. Business parks are typically located in well-established business districts and have a high potential for capital appreciation.

Flatted Factories

Flatted factories are multi-story buildings that provide factory and office spaces for businesses. They are popular among investors who are looking for a stable rental income and long-term capital appreciation. Flatted factories are typically located in industrial areas and have a high potential for capital gains.

Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) are an excellent investment option for individuals who are looking for a diversified real estate portfolio without purchasing physical properties.

REITs are companies that own, operate, or finance income-generating real estate assets, such as residential properties, commercial properties, and industrial properties. By investing in REITs, individuals can benefit from rental income and capital appreciation without the hassle of owning and managing properties.

In Singapore, there are various REITs available on the stock exchange, such as Mapletree Commercial Trust and Ascendas Real Estate Investment Trust. They are one of the top 5 best dividend stocks to own in Singapore that many Singaporeans are actually invested in. If you want to learn more, check out this article here.

Co-living Spaces

Co-living spaces are a relatively new type of real estate investment in Singapore. They are designed to provide affordable and flexible housing solutions for young professionals and students.

Co-living spaces typically include shared living spaces and facilities, such as kitchens, bathrooms, and lounges. Investors can purchase co-living spaces and rent them out to individuals or groups for a stable rental income.

Co-living spaces are gaining popularity in Singapore due to their affordability and flexibility.

5 Factors to Consider Before Investing

Before investing in any type of real estate in Singapore, it is important to consider several factors to make an informed decision. Below are some of the factors to consider before investing in Singapore property:

1. Location

The location of the property is one of the most important factors to consider before investing. Properties located in prime areas, such as the Central Business District (CBD) and Orchard Road, tend to have higher rental yields and capital appreciation. It is important to research the surrounding amenities, such as schools, hospitals, shopping malls, and public transportation, as they can impact the desirability of the property.

Although Singapore is known to be a really small country. The people here prefer to live in close proximity to amenities since the country is pretty humid and hot in the afternoon and evening. And at night, it’s a lot more convenient to have a 24-hour food service underneath their doorstep.

2. Property Type

Investors should also consider the type of property they want to invest in, whether it is residential, commercial, or industrial. Different types of properties have different rental yields, capital appreciation, and risks. For example, residential properties are popular among investors due to their stable rental income, while commercial properties tend to have higher rental yields but may have longer vacancy periods.

3. Budget

Investors should have a clear understanding of their budget and financial goals before investing in real estate. The cost of properties in Singapore can vary widely depending on the location, property type, and size. Investors should also consider the additional costs involved in purchasing and owning a property, such as stamp duty, property tax, and maintenance fees.

4. Market Conditions

The real estate market in Singapore can be affected by various factors, such as economic conditions, government policies, and global events. It is important to stay informed about the market conditions and trends before investing in property. Investors should also consider the supply and demand of properties in the area, as oversupply can lead to lower rental yields and capital appreciation.

5. Professional Advice

Investing in real estate in Singapore can be complex and challenging, especially for first-time investors. It is advisable to seek professional advice from real estate agents, lawyers, and financial advisors before making any investment decisions. They can provide valuable insights and guidance on market conditions, property selection, and legal and financial requirements.

How to Invest in Real Estate in Singapore

There are several ways to invest in real estate in Singapore. The most common ways are:

- Buying a property outright

- Investing in a real estate investment trust (REIT)

- Investing in a real estate crowdfunding platform

Buying a property outright is the most traditional way of investing in real estate in Singapore. This involves purchasing a property with your own funds or taking out a mortgage.

Investing in a REIT is a good option for investors who want to invest in real estate without owning a physical property. REITs are listed on the stock exchange, and investors can buy shares in the REIT.

Investing in a real estate crowdfunding platform is a good option for investors who want to invest in real estate with a smaller amount of capital. Crowdfunding platforms allow investors to pool their funds together to invest in a property.

TOP 7 Best Locations to Invest in Singapore

Location, location, location

The best areas to invest in real estate in Singapore depend on your investment objectives and budget. However, some of the most popular areas include:

1. District 9 – Orchard, River Valley

District 9 is one of the most desirable locations in Singapore due to its central location, vibrant lifestyle, and prestigious schools. Properties in this district include luxury condominiums and landed properties.

2. District 10 – Bukit Timah, Holland Road

District 10 is another high-end residential district with a mix of luxury condominiums and landed properties. It is known for its greenery and proximity to prestigious schools, making it popular among families.

3. District 15 – East Coast, Marine Parade

District 15 is a popular location for both residential and commercial properties. It is known for its scenic coastal areas, trendy cafes and restaurants, and accessibility to the city centre.

4. District 19 – Serangoon, Hougang

District 19 is a residential district that has seen significant development in recent years. It is popular among families due to its affordability, accessibility, and proximity to reputable schools.

5. District 22 – Jurong, Boon Lay

District 22 is a rapidly developing area with a mix of residential and industrial properties. It is home to the Jurong Lake District, Singapore’s largest commercial hub outside the city center, making it a promising location for investment.

6. District 23 – Bukit Batok, Choa Chu Kang

District 23 is a residential district with a mix of public and private housing. It is known for its greenery, recreational facilities, and affordable property prices. With a new MRT that connects to the new Tengah area, Choa Chu Kang real estate prices is expected to grow over the next few years.

7. District 28 – Seletar, Yio Chu Kang

District 28 is a developing area that offers a mix of landed and condominium properties. It is known for its greenery, tranquil environment, and proximity to the Seletar Aerospace Park.

Real Estate Investing Tips for Beginners

If you are a beginner in real estate investing, here are some tips to help you get started:

- Do your research – Before investing in real estate in Singapore, you should do your research to understand the market and the risks involved.

- Set your investment objectives – You should have a clear idea of your investment objectives and risk appetite before investing in real estate.

- Consider working with a real estate investor – Working with a real estate investor can help you navigate the complex real estate market in Singapore.

- Diversify your portfolio – You should not put all your eggs in one basket. Diversifying your real estate portfolio can help you reduce risk and maximize returns.

FAQ

Is it necessary to use a real estate agent when investing in real estate in Singapore?

While it’s not necessary to use a real estate agent when investing in real estate in Singapore, it can be helpful. A real estate agent can help you find suitable properties, negotiate the best deal, and handle the legal paperwork.

What are the financing options available for investing in real estate in Singapore?

The financing options available for investing in real estate in Singapore include taking out a mortgage, using cash reserves, or using a combination of both. Investors should consider the interest rates, repayment terms, and eligibility requirements when choosing a financing option.

Can foreigners invest in Singapore property?

Yes, foreigners can invest in Singapore property. However, there are certain restrictions, such as owning only one residential property at a time. Foreigners are also required to pay a higher stamp duty compared to Singaporean citizens and permanent residents.

What is the stamp duty for buying property in Singapore?

The stamp duty for buying property in Singapore varies depending on various factors, such as the property’s value and whether you are a Singaporean citizen, permanent resident, or foreigner. For example, if you are a foreigner buying a residential property, the stamp duty is 20% of the property value.

Conclusion

Investing in real estate in Singapore can be a smart financial move for investors who have the capital and the willingness to take on the risks involved. The Singapore real estate market is still strong, and there are many opportunities for investors to earn a good return on their investment.

However, before investing any money, investors should do their research, consider their investment objectives and risk appetite, and work with a reputable real estate investor if necessary.

If you are considering investing in real estate in Singapore, I hope that this article has provided you with some useful insights and information. If you also want to check out how to push for rental in Singapore, here is a complete guide for you! Good luck with your real estate investment journey!