New to finance? At some point in your life, everyone needs to learn the importance of managing finances. Robert Kiyosaki is one of the most popular finance educators who teach personal finance and business education to people. His book is what I would highly recommend to beginners to start learning.

Why should you read books from Robert Kiyosaki?

Robert Kiyosaki did not start off wealthy but he was given the opportunity to spend time with his best friend’s parent who was wealthy. During his early years of spending time with his family. He learned the importance of personal finance and know how to properly grow a business. These skills eventually grew him to start managing his own personal finances properly, investing them into his business, and eventually becoming a millionaire.

Learning from all his life lessons, he made a compilation of what he learned and instill it into his books. Here are what his books are famous for:

It teaches people of all ages

Most of Robert’s books begin with him as a young college student, followed by his service in the military, as a salesman, and then as a businessman. In each of his life stages, he recalls what he learns and how each lesson changes his perspective on money.

With each life stage, he teaches the different life lessons one must learn in order to understand how to build wealth. In his early years, he was taught how to better manage his money. In his mid-years, he was taught how to build his income, manage taxes, and understand investing, and his business. Finally, at an older age, he learns how to spot great investments.

The book simplifies how we should view investing

Investing is always being made complicated by the financial design of financial institutes and the news media. We are often being told that investing is for the big boys and the chances of you investing can easily make you go bankrupt. Investing is not difficult, but made to seem that way so that financial institutions can take advantage to make money out of you. This is why Robert Kiyosaki emphasizes that one of his important rule for investing your money is learning to convert earned income into passive and portfolio income as efficiently as possible.

It is easy to start investing these days, you can invest your money through banks, into ILPs (Investment-link policy), Robo-advisors, or online brokerage. Each has its pros and con, depending on your preferences is to investing. Robert emphasizes investing early into real estate (can’t really work in Singapore so let’s stick to stocks😅). How investing early into a real asset can make you a millionaire if done correctly.

It provides many thought-provoking questions to the readers

In every chapter of the book, Robert Rich’s’s Dad (his friend’s parent) would often ask Robert a thought-provoking question on how we should be viewing money and how can we earn it better. These questions are what the reader will need to learn and understand from reading the book. Most importantly, question the fundamental knowledge you have learned throughout your lifetime on viewing money.

How does his book approach Finance

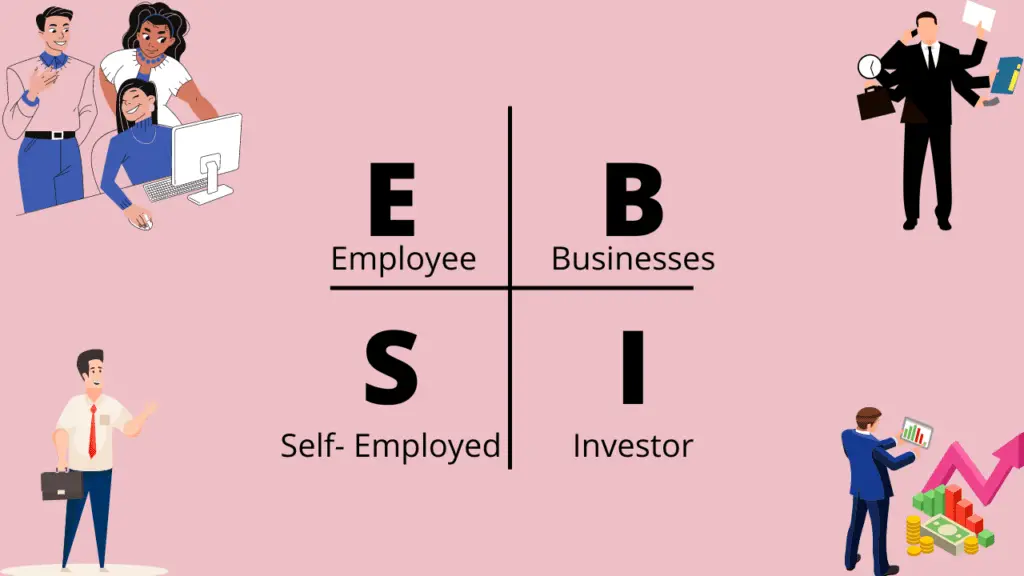

90/10 Investor. 10% of investors make 90% of the money and the other 90% only make 10% of the money

The quote is an important reminder to people on how should one build his/her wealth. Robert emphasizes the importance of learning the EBSI Quadrant. Getting out of the E (employee) and S (Self-employed) is the main priority. As these quadrants are the ones that are making limited income and are heavily taxed. Therefore, making your way up to the B (Business) and I (Investor) should be the number 1 priority of an investor.

Learning to invest early, like the FIRE movement, can significantly accelerate your growth toward building wealth. As Albert Einstein once said, ” compound interest is the 8th wonder of the world.” By investing early, you are hoping that one day your money can be working for you. Paying you a dividend or using the 4% rule to withdraw yearly to retire.

Where should I start?

Learning to start investing is tough, and starting a business is tough. This is why Robert recommends starting a side hustle first. As the side hustle grew larger than your E or S income. Only then will it be safer to transition to the B quadrant as starting a business from scratch is tough. To learn more about investing and money, be sure to subscribe to our webpage, and read up on Money Talks or Investing 101. If you would like to read other Top Recommended Books from Us, do check out our Books to Read!