FIRE is a movement that focuses on achieving financial independence and retiring early (aka FIRE). It’s a revolutionary movement that has become popular over the course of the past year. These people do not want to work anymore, but they also want to live comfortably without all the stress of working. Because of its powerful and impactful message, the movement has gained significant traction among millennials and is continuing to gain traction with older generations. In this blog, we will take a look at FIRE. Why it is becoming a popular movement?

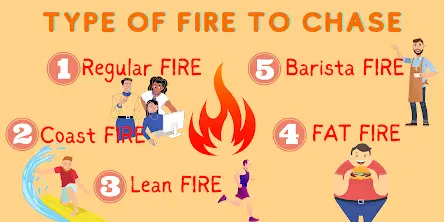

Types of FIRE

There are a total of 5 different types of FIRE. They are regular, fat, baristas, lean, and coastal FIRE. Each of these has a different strategy and a different timeline for reaching financial independence. Depending on one’s urgency to reach financial independence, they are able to take a different approach to reach it. For example, the FAT FIRE movement requires one to save as much as possible early by cutting down expenses heavily in order to invest more.

Why FIRE is gaining popularity

This movement’s success can be attributed to several factors, including the increased awareness of financial topics, increasing education about compound growth strategies and automation tools, positive reinforcement from peers and family, better financial literacy programs offered in high schools, availability of tools such as automated savings apps, financial freedom being viewed as a positive state rather than a negative one.

Apart from that, the cost of living skyrocketed causing many to not be able to afford basic amenities such as housing, food, or water. Therefore, working adults are now thinking smart with their money, some have chosen to live in their vehicles, some are learning ways to make money online while some choose to farm food at home to cut costs.

The minimalism lifestyle has been gaining popularity

Most people who practice minimalism choose to do so for one main reason: simplifying their lives by focusing on the things that matter. The minimalist lifestyle is about living with less in order to prevent distractions from getting in the way of having more time and focusing on important matters. This lifestyle allows one to reduce their expenses drastically to invest their income more to retire early.

Working anywhere you want is gaining popularity

Around the world right now, the great resignation is now affecting many businesses all around the world. As many working adults have learned that there are multiple ways to make money online. In Singapore, the movement is no stranger. As many jobs which allow working from home have spurred Singaporean to chase the early retirement dream. The work-from-home lifestyle has promoted the idea of having multiple side hustles for additional income. There are now many ways to make money from home, whether it is doing pet sitting, trading stocks online, or creating courses online. The internet has become a great source of making money.

What they do to reach Financial Independence

To reach financial independence and retire early. There is a ton of research one must partake in order to understand how to reach early financial independence. While there may be some truth as to why most Singaporeans will be able to financially retire, learning how to get there faster is what every FIRE activist is looking for. Here are some tips and tricks to reach early financial retirement.

Know their FI number

Knowing how much money you need to retire is the first step to learning how to reach financial independence. The 4% rule is the amount that one is able to withdraw from their investment without affecting their portfolio assuming the money invested is in the S&P500.

Monthly Expenses = M

M = $2,000 (example)

Amount needed to be investment for retirement = M x 12 (months) x 25 years

= $2000 x 12 x 25

= $600,000

Using the 4% rule, the investment will grow

Monthly income = $600,000 x 4% x 12 monthly

= $2,000

After finding out your requirement to reach FI, the next step is staying committed to DCA (Dollar-cost average) to grow your investments.

Invest Early

FIRE activists take advantage of time. As time is the greatest ally of compound interest. The sooner you start investing, the more time your money has to grow. Investing early helps you build up wealth faster so you can retire early, become financially independent and take control of your future. Click on the shop now below to find out which investment tools you would like to choose from to invest!

Investment Tools

Keep Learning

Education doesn’t stop once you are done schooling. Learning is a lifelong game in order for one to climb the ladder of success. There are many ways to learn on reaching financial independence. Whether it is from books, tutorial videos, or courses. Here are some ways to create & build Serious Wealth in your 20s. If you would like to find what books to read on achieving financial independence, do click on the books to read down below to find out what books to start reading.

Books to Read

What do people look for once they achieve FIRE?

Many people who achieve financial independence and retire early often think that they can coast for the rest of their lives. But while they might want to stop working, they still have ambitions, aspirations, and goals in life that are bigger than just making money. This can be spending more time with loved ones, traveling around the world, or supporting people in need.