Financial literacy is the ability to understand and use financial concepts. Financial literacy includes managing personal finances, money and investing, and using credit wisely. According to a study by the National Foundation for Credit Counseling (NFCC), nearly two-thirds of Americans do not feel confident in their ability to manage their finances. This lack of confidence can lead to poor financial decisions that can have lasting effects. There are a number of ways to improve your financial literacy. Taking classes, reading books or articles, or working with a financial planner are all good options. The most important thing is to start learning as much as you can about personal finance.

At HustleVentureSG, we are committed to providing the best financial knowledge and tools to accelerate your growth and understanding toward building wealth. We have books that we recommend and investment tools to get you started on your financial journey. We really love reading and we believe you will too! HustleVentureSG provides an easy to hard difficulty level to allow all to enjoy reading.

The Importance Of Financial Literacy In Your Life.

The importance of personal finance and financial literacy in our daily lives is often overlooked. Many people don’t realize that they’re already walking around with a tool to teach them about money: the wallet! This article talks about the most important steps you can take to have a stronger financial future.

Financial literacy is not just important for those who have to deal with finances on a day-to-day basis. It is also important for anyone who wants to improve their overall financial situation. There are a lot of different ways to learn about financial literacy. You can read books, watch videos, or attend workshops. However, the best way to learn is by doing. There are a lot of resources available online, so you can learn at your own pace. The goal of financial literacy is to help you understand your finances and make smart decisions. If you can master these skills, you will be in a better position to achieve your financial goals.

Types of Financial Literacy.

There are a few different types of financial literacy, and everyone needs to be aware of them in order to be successful in their financial lives. Basic Financial Literacy: This is the first step on the road to becoming financially successful. Individuals need to understand how money works, what expenses are necessary, how to save money, and how to invest their money. Goal-Based Financial Literacy: This type of financial literacy helps people develop specific financial goals, identify strategies to achieve them, and learn about the costs associated with achieving those goals. Behavioral Financial Literacy. This type of financial literacy deals with changing personal finance behaviors in order to improve one’s overall financial situation. It teaches individuals how to make sound decisions about spending and investing, and how to deal with difficult money issues.

Key Concepts to Understand about Financial Literacy

In Rich Dad: Guide to Investing, one of Rich Dad’s most important messages to the author is this. What differentiates the rich and the poor is the understanding of financial vocabulary. Having the basic fundamental knowledge goes a long way in using the skill in your lifetime. Here are some key concepts that everyone should learn.

Budgeting

Creating a budget is one of the most important steps in managing your finances. A budget can help you track your spending, save money, and make sure you are living within your means. Creating a budget is usually the first step toward building your wealth. By learning to budget, you will be able to actively pay off your debt through means such as the snowball or avalanche method.

Tools such as Money Manager can be a great money tracker to help you keep track of where you earn and spend your money. That way, you will better understand your finances and learn to budget properly next time.

Investing

Investing is a way to grow your money over time. When you invest, you are buying assets such as stocks, bonds, or mutual funds. These assets can provide you with income or capital gains over time. Investing may seem intimidating with all the fancy words and crazy charts to look at. It is not that hard to understand. Once you understand the fundamental of stock.

At HustleVentureSG, we promote personal finance and investing. Learn more about investing and ways to grow your wealth in our two categories. Money Talk and Investing 101.

Retirement planning

Retirement planning is the process of figuring out how much money you will need to have saved in order to cover your costs during retirement. This includes estimating your future expenses and income, as well as determining how much you need to save each month to reach your goal.

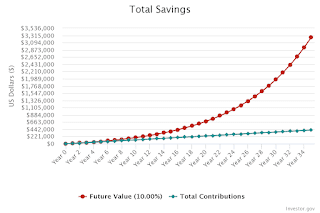

If you understand compound interest, you will know that the sooner you start investing, the more it grows. Compound interest is an Elbert Einstein called it the 8th wonder of the world. It doesn’t take a genius to see why. Money that is invested in the US S&P500 stock market grows an average of 10% per annum. Savings on the other hand cause your money to lose its value to inflation, which is on average 2% per annum. However, in 2022, our inflation right now in June soar a record 8.6%. Therefore, investing your money is the only way not to lose your money to inflation.

Tax

Understanding the tax code can help you save money on your taxes. There are a number of deductions and credits that you may be eligible for, depending on your situation. Check your country’s tax code and ways to reduce your tax.

It’s crazy how taxes are not taught in school. Then again, personal finance isn’t. Therefore, learning about taxes and how to reduce it should be your number 1 priority as a working adult. There are multiple channels depending on which country you are in to learn about your country’s tax system. If you would like to read more. Check out Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your Taxes

As Singaporeans, we are lucky enough to have government tax funds such as CPF and SRS which are similar to that of America IRA. These government tax funds can help to greatly reduce the money that would have been taxed and leave it to compound till retirement. Click here to read why I believe most Singaporean will be able to financially retire.

Insurance

Insurance is a way to protect yourself financially in case of an unexpected event such as an accident, illness, or death. There are many types of insurance, so it is important to understand your needs and choose the right policy for you.

Insurance should not be a hard subject for all. It is always advisable to get the insurance that you can afford and does not affect your daily lifestyle. Approach your financial advisors each from different advisory and discuss what are some policies you would need. Buying insurance should be a one-time deal and you wouldn’t have to pay attention to it unless an issue has occurred. Put in the effort to research and know the in-depth information on what policy you are buying because you may be paying for it for 10 to 20 years.

Credit

Credit is a loan that you can use to finance purchases. When you use credit, you will have to pay interest on the loan. It is important to manage your credit wisely by only borrowing what you can afford to pay back and making your payments on time. Start learning to use a credit card to your advantage. As you pay off your credit on time and hold it for an extended period of time. Naturally, your credit score will increase. This allows you as a credit owner to take on more loans to invest more.

Credit can be one of the greatest ways in building wealth when used correctly. Over-leverage and not being able to pay off debt can be detrimental. Therefore, learning to take on low-interest rate credit and having the ability to pay on time is crucial as an investor.

Finding out other Financial Literacy words

As mentioned, there is plenty of financial vocabulary one must know to grow their financial knowledge. Those keywords above sum up the more important ones to remember and learn. If you would like to read more about financial literacy and know-how to start investing. We recommend Rich Dad’s: Guide to Investing as a great beginner book to read to learn more about investing.

Why You Should Be Financially Literate.

Financial literacy is important for everyone, regardless of their current level of wealth. In fact, becoming financially literate can help you achieve your financial goals sooner and reduce the risk of future financial problems. Here are 10 reasons why you should become financially literate:

It helps you make better choices when it comes to spending and investing your money

When you understand the basics of finance, you can better assess what’s important to you and how much money you need to save for your long-term goals.

Protects you from risky financial decisions

If you know how to read a financial statement and understand the different types of investments, you’re less likely to fall victim to scams or overspending on needless items.

Financial literacy can help you stay disciplined with your finances

When you understand how your money works, it becomes easier to stick to a budget and avoid impulse buys. This will help you build a healthy savings account and reach your financial goals more quickly.

Financial literacy can give you peace of mind when it comes to your finances

When you have a clear understanding of your financial situation, you’re less likely to panic in the event of a sudden monetary windfall. Even if you don’t have any cash saved, you can rest easy knowing you have an emergency fund to fall back on.

Financial literacy gives you better control over your personal finances and makes it easier for you to make financial decisions

While there are many options for managing a budget and saving money, having basic financial literacy gives you a big head start toward making smart money decisions.

Financial literacy can help your children learn about responsible personal finance habits early on in life

They will learn how much they need to save each month to reach their goals, what they can do with their earnings or gifts, and how to get the most out of their money. They will learn the value of financial responsibility and will be able to develop a solid future financially.

With financial literacy, you can work toward your own financial goals

You won’t just be working toward earning enough income to meet your basic needs, but also being able to cover the important bills in life and pay down debt as quickly as possible.

Financial literacy helps you avoid getting into trouble with credit card debt or other forms of debt

If you’ve had problems with credit cards in the past, learning more about how to manage your finances through a budget and a plan for paying off debt will help you avoid them again.

When people are financially illiterate, they often forget that they need money in the first place

When people don’t have enough money to meet their needs, they often turn to credit cards or other forms of debt in order to buy things that are not necessary or even emergency items. This is a dangerous cycle that can be easily avoided by simply learning how money works and knowing the importance of budgeting. If you learn how to budget, you will become more aware of your expenses and will be able to cut spending down while also reducing debt.

It’s easy to get stuck in a financial hole when you’re not financially literate

Learning how finances work is essential for helping you avoid getting into trouble with credit cards or loans from family members. If know what’s going on with your finances, you won’t fall

How to Become Financially Literate.

Financial literacy is the ability to understand and use financial tools and information to make sound financial decisions. Financial literacy can help you save for your future, protect your finances from risk, and build a healthy financial foundation. There are many ways to become financially literate, but some basic steps include understanding your budget, tracking your spending, and setting realistic goals. Additionally, be sure to access reliable sources of information when making financial decisions, such as the internet, newspapers, or magazines. It’s important to keep up with the latest news and developments in the financial world so that you can make sound choices for yourself and your family.

Financial Literacy is a must for all Adults

Financial literacy is an important skill that everyone should learn. There are a number of resources available to help you improve your financial literacy. The most important thing is to get started and start learning as you can about personal finance.