The FIRE movement is always badly understood and misrepresented. There are some FIRE movement activists who preach cutting down on Starbucks coffee or enjoying fancy dinners with friends and family to save up more money. I do not agree with what they do entirely. I believe that there are some days when we should cut down some slack and enjoy spending money to enjoy. By showing the other types of ways to achieve FIRE. I hope that people will pursue the FIRE movement to achieve a level of financial freedom.

5 Types of FIRE

Here are 5 different forms of FIRE and each has its own take to reach FI. By the end of this blog, I hope you can find what kinds of FIRE you will wish to achieve.

Related Post:

- FIRE. Why it is becoming a popular movement?

- 5 Financial Independence Sweet Spots

- Is Hustle Culture Bad?

- The Easiest Rule to Manage Your Money

- Escaping the Rat Race

Regular FIRE

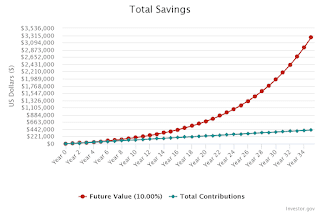

Most FIRE activists follow the regular FIRE which is to accumulate an investment portfolio where it pays enough money passively to cover your living expenses using the 4% Rule. Using simple rules such as the 50-30-20 method to distribute their income.

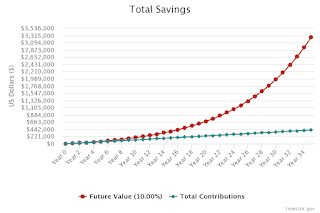

Invest $1000 a month at 20 to 55. By the time you are 55, you would have $ 3.25 million invested!

Coast FIRE

Coast FIRE is an easier method to follow and I would recommend it to those in their early 20s. It involves heavily investing at the start so that you can take a breather and ease of having to invest once you have reached the lump sum to invest.

If you have $100,000 in the S&P500 invest at 30 and do nothing. You would have a $1 million dollar portfolio at 55.

Lean FIRE

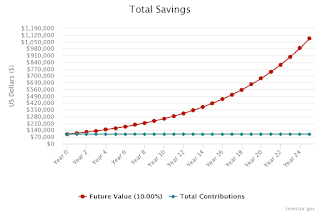

Lean FIRE is having enough invested to cover essential expenses. This is a great strategy for activists who do not want to cut down heavily on their spending. Instead, only invest a small portion of their income. This strategy works great to achieve a small level of financial freedom to cover small expenses. Most FIRE activists pursuing Lean FIRE are people who love their job and are enjoying what they do.

$300 per month for 35 years. By the time you reach 55, you would still have close to a million-dollar worth invested which still allows you to retire comfortably.

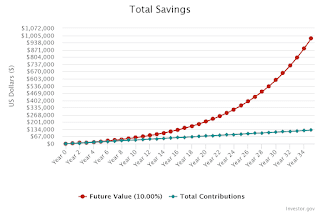

Fat FIRE

Fat FIRE involves having to invest as much as you can whenever you can to retire way earlier. This is the movement that I feel has created a bad image for FIRE activists. It portrays FIRE activists as cheap, cutting down on almost all expenses to the bare minimum. Worst still, using other people’s expenditures for their own. This method of FIRE is having to cut down heavily on needs and wants to invest a lot more.

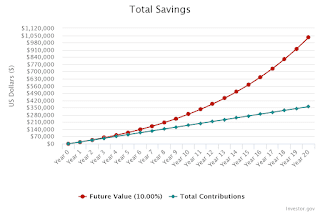

This chart shows that by investing $1500 a month for 20 years, you would be able to get a million-dollar invested.

Most newcomers to the FIRE movement do assume that this strategy would be the ideal way to invest their income. However, they will soon find themselves having to cut down significantly on spending quality time traveling and spending on events that helps bond with their friends and family.

Barista FIRE

Barista FIRE involves not retirement simply because you are passionate about your job and simply wish to invest to have a little bit of financial freedom. I would recommend following this FIRE movement because of how more lay back it gets you to financial freedom. With better financial security, barista FIRE activists would have the option to work part-time for his/her company instead so they can pursue whatever they want with better financial security.

Similar to lean FIRE in terms of the way they invest. It requires a small sum of monthly investment of $200 ~ $300 but for a longer period compared to lean FIRE.

Why FIRE has gained popularity among Gen Z

The FIRE movement (Financial Independence, Retire Early) has gained popularity among Generation Z for several reasons:

Financial Independence

Gen Z is witnessing the challenges faced by previous generations, such as student loan debt, rising living costs, and uncertain job markets. They are actively seeking financial independence to avoid these struggles and gain control over their financial futures.

Lifestyle Flexibility

The FIRE movement promotes the idea of achieving financial independence at an early age, which allows individuals to have greater control over their lives. Gen Z values experiences and personal fulfillment over traditional career paths, and FIRE offers the opportunity to design a lifestyle that aligns with their values.

Entrepreneurial Mindset

Gen Z has grown up in a digital era that emphasizes entrepreneurship and self-employment. They are more inclined to start their own businesses or pursue freelance work, which aligns well with the FIRE movement’s focus on generating passive income streams and building wealth.

Access to Information

The internet has made information more accessible than ever before. Gen Z can easily access blogs, podcasts, forums, and social media platforms dedicated to the FIRE movement, providing them with guidance, strategies, and success stories that inspire them to pursue financial independence and early retirement.

Long-Term Financial Security

Gen Z is aware of the changing dynamics of the job market and the uncertainty surrounding government retirement benefits. By embracing the FIRE movement, they aim to achieve long-term financial security and reduce reliance on traditional pension plans or social security.

Environmental and Social Awareness

The FIRE movement encourages a minimalist and frugal lifestyle, which aligns with Gen Z’s concerns about the environment and social impact. By living a more sustainable and mindful life, they contribute to the reduction of consumerism and its associated negative effects.

What Form of FIRE am I Pursuing

In my first year of FIRE, I was chasing FAT FIRE in order to retire early. However, I realize that I was affected badly, I made the mistake of cutting down too much on my wants and needs. Leading me to not being able to enjoy the lifestyle I once had.

It was then that I realize I wanted to pursue Coast FIRE. I set a realistic goal for myself, to reach a $200,000 net worth by 30. It may sound very high for some of you but continue reading my blog and I will show you some advanced skills to learn to accelerate your net worth. I was able to achieve $100,000 at 24 years old by pursuing coastal FIRE.

I love the Coast FIRE activist lifestyle as it involves putting in a ton of work in your early years so that you can ease off on the investment. Having to not worry about your investment is one of the greatest feelings of financial achievement.

Related Post:

- FIRE. Why it is becoming a popular movement?

- 5 Financial Independence Sweet Spots

- Is Hustle Culture Bad?

- The Easiest Rule to Manage Your Money

- Escaping the Rat Race

What does this tell you about Investing

Albert Einstein once describes Compound Interest as the eighth wonder of the world. By investing early, you allow time to compound your wealth. Time is your greatest ally when it comes to investing, so start as early as possible because when you are older you will have other future expenses (raising a kid, mortgage payment, car loan) that will slow down your goal of financial freedom.