Level 3 options trading represents a significant progression for traders who seek to expand their strategic capabilities in the options market. This advanced level of trading approval unlocks the potential to execute more complex strategies like credit spreads, iron condors, and butterflies, which can lead to greater returns but also carry higher risks.

While you could unlock more trading benefits, traders need to understand what is essential for those looking to advance in the options trading hierarchy.

Key Takeaways

- Level 3 options trading allows for advanced strategies such as credit spreads, iron condors, and butterflies, offering greater potential for returns.

- Traders must meet specific criteria including experience, knowledge, and financial stability to qualify for Level 3 trading on platforms like Robinhood.

- Gaining Level 3 approval is a significant milestone that provides enhanced trading flexibility and the ability to engage in complex options combinations.

- Risk management and continuous education are crucial when engaging in Level 3 trading to make informed decisions and navigate increased risks.

- Before moving to Level 3, traders should understand the mechanics, risks, and strategies involved in advanced options trading and ensure they have a high-risk tolerance.

What Is Level 3 Options Trading

Options trading on platforms like Robinhood is structured into different levels of approval, each unlocking a range of strategies that traders can employ. Level 1 typically involves the most basic options trades, such as buying calls and puts, which allow traders to speculate on the direction of a stock. As traders gain experience and demonstrate financial preparedness, they can apply for higher levels of trading approval.

The hierarchy of options trading approval is designed to protect both the trader and the brokerage. It ensures that individuals are equipped with the necessary knowledge and risk management skills before engaging in more complex strategies. Here’s a simplified breakdown of the levels:

- Level 1: Basic options for buying

- Level 2: Includes more strategies like covered calls and cash-secured puts

- Level 3: Advanced strategies such as credit spreads and iron condors

To progress through the levels, traders must meet certain criteria set by the brokerage, which typically includes a review of trading experience, understanding of risks, and financial resources. This tiered approach aligns with the principle that options trading allows for more control over risk exposure and potential profits.

Moving from one level to the next is a significant step in a trader’s journey. It opens up new possibilities for strategy and profit, but also requires a deeper commitment to learning and risk management.

Looking to start investing, why not try Tiger Broker?

Tiger Brokers offers competitive commission fees for trades across different markets.

It is also practically fee-less in these aspects: no custody fees, deposit (or withdrawal) fees, currency exchange fees, inactivity fees, or account maintenance fees to contend with!

Criteria for Achieving Level 3 Status

To ascend to Level 3 options trading, traders must satisfy a set of prerequisites that typically encompass investment knowledge, trading experience, and financial robustness. The criteria are designed to ensure that traders are well-equipped to handle the complexities and risks associated with advanced options strategies.

- Investment Knowledge: A deep understanding of options and the mechanisms of various trading strategies is crucial.

- Trading Experience: Prior experience with Level 1 and Level 2 strategies, such as covered calls and long puts, is often required.

- Financial Criteria: Traders must demonstrate the financial capacity to sustain potential losses that may arise from complex trades.

It is the level for those investors who own underlying assets and are prepared to engage in more sophisticated options spreads.

Brokers may also assess a trader’s risk profile, adjusting eligibility based on the trader’s approach to speculative trading and capital needs. A thorough review of one’s risk profile questionnaire responses can be instrumental in meeting the eligibility for Level 3.

The Benefits and Capabilities of Level 3 Trading

Achieving Level 3 options trading approval unlocks a new horizon of possibilities for traders. This advanced level allows for the execution of sophisticated strategies that can enhance portfolio diversification and provide additional income streams. Among these strategies are credit spreads and iron condors, which offer a balance between risk and potential return.

- Access to advanced strategies like credit spreads and iron condors

- Ability to execute multi-leg options trades

- Enhanced potential for portfolio diversification

- Additional income generation opportunities

With Level 3 trading, investors gain the flexibility to tailor their trading approach to market conditions, leveraging complex strategies to capitalize on market movements.

It’s important to note that while Level 3 trading offers significant advantages, it also requires a deep understanding of options mechanics and a commitment to ongoing education. Traders must continuously research their options and play it safe to navigate the complexities of advanced options trading successfully.

Importance of Continuous Learning

The journey through the various levels of options trading is not just about unlocking new strategies; it’s about embracing a mindset of continuous learning. As traders gain access to Level 3, they must recognize that the complexity of strategies like iron condors and credit spreads demands ongoing education to adapt to market dynamics and manage risk effectively.

- Understanding risks and aligning them with financial goals

- Conducting thorough research to stay informed about market trends

- Practicing with paper trading to refine strategies without financial risk

- Using broker apps to gain practical experience in a controlled environment

The path to success in options trading is paved with dedication to learning and strategic evolution. It’s a process that involves balancing risk and reward, managing leverage, and resisting the temptation of greed.

Continuous learning is the cornerstone of not just options trading, but any form of investment. Whether it’s through investment clubs, online courses, or self-study, expanding one’s knowledge base is essential for staying ahead in the dynamic landscape of the financial markets.

Level 3: Advanced Strategies Unveiled

Level 3 options trading opens the door to a realm of complex options strategies that go beyond the basic calls and puts. Traders can now engage in sophisticated techniques such as credit spreads, debit spreads, iron condors, and iron butterflies. These strategies allow for the creation of positions that can benefit from various market conditions, including limited market movement and time decay.

The leap to Level 3 signifies a significant milestone, granting access to an advanced suite of options strategies.

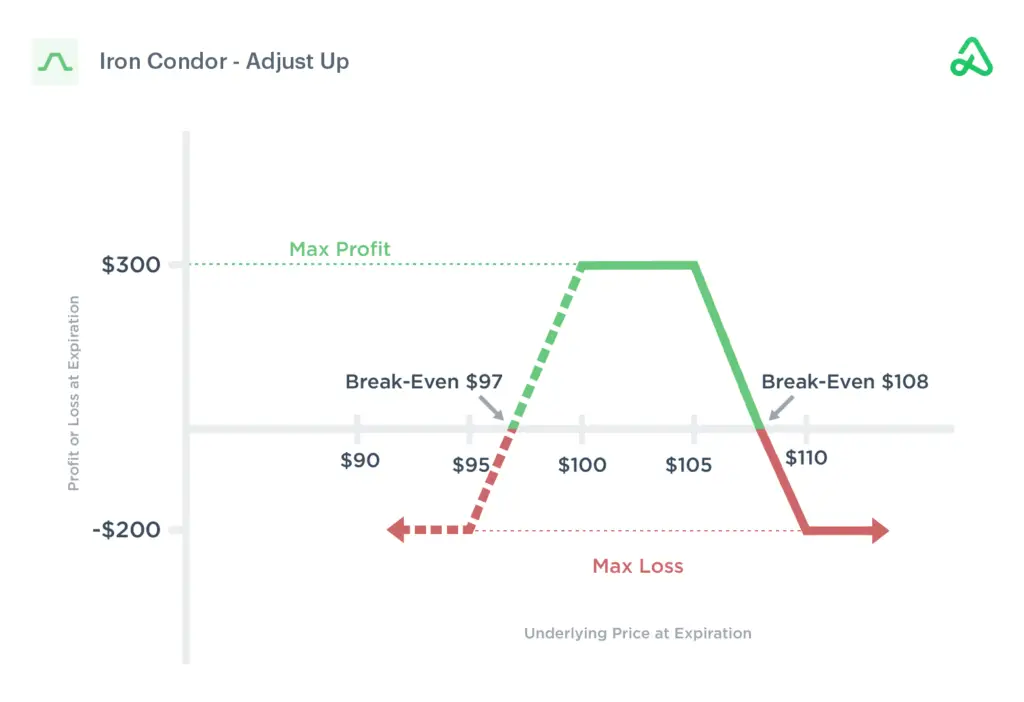

Understanding the nuances of these strategies is crucial. For instance, the iron condor is a combination of a bear call spread and a bull put spread, designed to profit from low volatility in the underlying asset. Similarly, the iron butterfly strategy is structured to capitalize on the non-movement of the underlying stock. Here’s a quick overview of some strategies and their primary focus:

- Credit Spreads: Aim to receive premium upfront with the goal of options expiring worthless.

- Debit Spreads: Pay premium upfront for the potential of a larger payoff at expiration.

- Iron Condors: Benefit from low market volatility and limited price movement.

- Iron Butterflies: Profit from the underlying asset’s price staying close to the strike price.

Each strategy carries its own set of benefits and risks, and it’s imperative for traders to make rational decisions based on their investment goals and risk tolerance. As Warren Buffet’s approach suggests, successful options trading involves a blend of strategic planning and disciplined execution.

Credit Spreads and Iron Condors: A Closer Look

Credit spreads and iron condors represent two sophisticated strategies available to traders with Level 3 options trading approval. Credit spreads involve selling a higher premium option and buying a lower premium option with the same expiration date but different strike prices. The goal is to profit from the premium decay over time, as long as the underlying asset’s price remains between the strike prices.

An iron condor, on the other hand, is a more complex strategy that combines a bull put spread and a bear call spread. This strategy is designed to profit from the underlying asset’s price remaining within a certain range, essentially betting on low volatility. The maximum risk in this strategy is the difference between the wider spread and the credit received.

It’s crucial for traders to understand that while these strategies can offer attractive returns, they also come with increased risks. Option credit spreads can be dangerous due to market risks, margin calls, overconfidence, lack of understanding, and liquidity issues.

Implementing these strategies requires a solid grasp of options trading fundamentals and a disciplined approach to risk management. Here are some key points to consider:

- Educate yourself thoroughly before engaging in these trades.

- Start with smaller positions to manage risk effectively.

- Always have a clear exit strategy to cut losses if necessary.

- Diversify your investment portfolio to mitigate potential losses.

Risk vs. Reward: Assessing Advanced Options

When traders ascend to Level 3 options trading, they unlock the ability to execute more complex strategies that can offer higher returns. However, this also introduces greater risk. The risk/reward ratio becomes a pivotal metric, guiding traders to make informed decisions about their trades.

The balance between potential profit and potential loss is a delicate one, and Level 3 traders must be adept at assessing this balance to ensure that each trade aligns with their investment goals and risk tolerance.

For instance, a strategy like the Bear Put Spread has a quantifiable risk/reward ratio that can be evaluated before entering a trade. Here’s a simplified example of how this ratio might look for a Bear Put Spread:

| Entry Price | Stop-Loss | Take-Profit | Risk/Reward Ratio |

|---|---|---|---|

| $50 | $45 | $60 | 1:3 |

Understanding and applying these ratios is essential for navigating the complexities of advanced options strategies. It’s not just about the potential gains; it’s about understanding the potential for loss and managing it effectively.

Implementing Strategies Post-Approval

Once traders receive Level 3 approval, they unlock the ability to execute more sophisticated options strategies. This level permits the use of strategies that involve multiple legs, such as credit spreads and iron condors, which can be tailored to market conditions and individual risk tolerance.

It is essential to align your trading strategies with your approval level to maximize the potential for profitable trades while adhering to risk management principles.

For instance, a trader might choose to implement an iron condor strategy, which capitalizes on market stability. This strategy involves selling a put spread and a call spread on the same underlying asset. The table below outlines the basic structure of an iron condor:

| Position | Type | Strike Price | Expiry |

|---|---|---|---|

| 1 | Sell | Put | Near-term |

| 2 | Buy | Put | Near-term |

| 3 | Sell | Call | Near-term |

| 4 | Buy | Call | Near-term |

After mastering the basics, traders can explore over 15+ new advanced options trading strategies, such as those detailed in educational resources like ‘The Advanced Options Trading Course‘ on Udemy. Understanding the nuances of these strategies, including the risk exposure in strategies like 0DTE options trading, is crucial for success.

Brokerage Discretion

Moving from Level 2 to Level 3 options trading is a pivotal moment for investors seeking to expand their trading capabilities. The transition is not merely a procedural step; it represents a shift towards more sophisticated and potentially more profitable strategies.

- Level 2 traders are typically limited to basic options strategies like covered calls and long puts.

- Level 3 unlocks the ability to execute advanced strategies such as debit spreads, credit spreads, and iron condors.

The process of upgrading involves a careful assessment of the trader’s experience, risk tolerance, and understanding of complex strategies. It’s crucial to invest time in learning about businesses and the intricacies of options before venturing into higher levels. Brokerages may require evidence of a certain number of successful trades or a demonstration of knowledge before granting Level 3 status.

The journey to Level 3 is marked by a commitment to continuous learning and a strategic approach to trading. It’s about rightsizing your trading level to match your expertise and goals.

Looking to start investing, why not try Tiger Broker?

Tiger Brokers offers competitive commission fees for trades across different markets.

It is also practically fee-less in these aspects: no custody fees, deposit (or withdrawal) fees, currency exchange fees, inactivity fees, or account maintenance fees to contend with!

Understanding Brokerage Assessment Criteria

When brokerages determine a trader’s suitability for various options trading levels, they assess multiple criteria. The primary focus is on the trader’s experience, risk tolerance, and financial capacity. These factors are crucial in ensuring that traders engage in strategies that are commensurate with their abilities and risk preferences. For instance, a trader interested in level 3 options trading must demonstrate a solid understanding of more complex strategies beyond the basic call and put buying of lower levels.

Brokerages also consider the quality of the trader’s decision-making process and their ability to adapt to changing market conditions. This is particularly important for level 3 trading, which involves strategies such as spreads and writing covered calls. The table below outlines the typical assessment criteria used by brokerages:

| Criteria | Description |

|---|---|

| Experience | Prior trading history and familiarity with options |

| Risk Tolerance | Willingness to take on financial risk |

| Financial Capacity | Available capital and financial stability |

| Strategic Understanding | Knowledge of advanced options strategies |

It is essential for traders to align their trading strategies with their risk tolerance and financial goals to ensure a sustainable and responsible trading journey.

As traders progress from level 2 to level 3, they unlock the ability to execute more sophisticated trades. This transition requires a thorough understanding of the strategies involved and a careful assessment of the potential risks and rewards.

The Role of Experience in Gaining Approval

Experience plays a pivotal role in the transition to Level 3 options trading. Brokerage firms, like Robinhood, assess a trader’s experience level and risk tolerance before granting approval for advanced strategies. This evaluation is not just a formality; it’s a safeguard for both the trader and the brokerage to ensure readiness for the complexities of Level 3 trading.

- Understanding the Approval Process:

- Review your investment profile.

- Ensure your financial standing is solid.

- Align your trading strategies with your current approval level.

The approval process is a comprehensive evaluation that considers your trading history, financial acumen, and strategic understanding. It’s a step towards responsible trading and risk management.

Once you’ve demonstrated proficiency with Level 2 strategies, such as covered calls and long puts, you may feel ready to apply for Level 3. This level unlocks the potential for more sophisticated strategies, like debit spreads and iron condors, which can offer significant upside potential while limiting losses to the option’s premium.

Case Study: A Trader’s Journey to Level 3

The journey to Level 3 options trading is often marked by a series of strategic steps and a deepening understanding of the options market. One trader’s story highlights the importance of a structured approach to mastering options strategies. After achieving consistency with Level 2 strategies, the trader sought to expand their repertoire to include more complex trades such as debit spreads and iron condors.

The transition to Level 3 is not just about learning new strategies; it’s about evolving as a trader and understanding the nuances of the market.

The table below outlines the trader’s progression:

| Level | Strategies Mastered | Trades Completed | Outcome |

|---|---|---|---|

| Level 1 | Basic Calls and Puts | 10 | Foundation Set |

| Level 2 | Covered Calls, Long Puts | 20 | Consistent Profits |

| Level 3 | Debit Spreads, Iron Condors | 5-10 | Advanced Trading |

This progression underscores the ladder option success stories that often begin with a solid foundation and culminate in the sophisticated use of advanced strategies. The trader’s journey also emphasizes the benefit of doing an options trading course, which can provide the necessary education to navigate the complexities of the options market. Despite the allure of high returns, it’s crucial to remember that a good percentage return for full-time traders is one that balances risk with reward, and that consistent money-making remains a challenge for many in the options trading arena.

Venturing Advanced Trades: Diving into Options Strategies with Level 3 on Robinhood

Achieving Level 3 options trading status on platforms like Robinhood opens the door to a new realm of trading possibilities. Traders are empowered with a broader range of strategies, allowing for more nuanced and sophisticated market maneuvers. This level of trading is characterized by the introduction of advanced strategies such as credit spreads, iron condors, and iron butterflies, each tailored to different market conditions and risk appetites.

The flexibility in strategy that comes with Level 3 trading is a significant advantage. It enables traders to combine different price levels and timing to optimize their positions. For instance, ladder options allow for adjustments to be made as the market evolves, providing a dynamic approach to options trading.

With the enhanced trading flexibility of Level 3, traders can more effectively manage risk while seeking potential higher returns.

Moreover, the transition to Level 3 trading is not just about access to new strategies; it’s also about the ability to execute trades with greater precision. The timing of trades can be fine-tuned, leveraging options to capitalize on market dips and rallies with increased control.

Advanced Options Strategies Available on Robinhood

Robinhood’s platform caters to traders looking to engage in more sophisticated options strategies beyond the basics. Level 3 trading on Robinhood unlocks the ability to execute a variety of advanced strategies that can potentially enhance portfolio diversification and risk management.

- Multi-leg options: Traders can construct positions involving multiple options contracts, such as straddles, strangles, and butterflies.

- Writing uncovered options: This strategy allows for the selling of options contracts without owning the underlying asset, introducing a higher risk/reward dynamic.

- Complex combinations: Level 3 users can create custom combinations of options to tailor their market views and risk preferences.

The Options Strategy Builder on Robinhood is a pivotal tool that empowers experienced investors to visualize and assess the potential outcomes of their complex strategies before execution.

It’s essential for traders to understand the intricacies of these strategies and their associated risks. The platform provides educational resources to guide users through the nuances of advanced options trading, ensuring they are well-equipped to make informed decisions.

Maximizing Potential Gains with Level 3 Strategies

With Level 3 options trading, investors unlock the potential to maximize gains through advanced strategies. These strategies, such as long straddles, credit spreads, and iron condors, allow for sophisticated market plays that can lead to significant profits if executed correctly. For example, a long straddle aims to capitalize on market volatility by purchasing both a call and put option at the same strike price, ideally positioned at-the-money.

By employing a series of small trades, traders can gradually build up to Level 3, where they can implement more complex strategies with multiple strike prices and expiration dates.

Understanding and leveraging these strategies requires a deep dive into the specifics of each. The table below outlines some effective strategies and key considerations for Level 3 traders:

| Strategy | Key Consideration |

|---|---|

| Long Straddle | Anticipate significant price moves |

| Credit Spread | Manage risk with defined exit points |

| Iron Condor | Profit from range-bound markets |

| Ladder Option | Generate profits at various price levels |

It’s essential for traders to establish clear profit targets and understand the risk-reward ratio inherent in these advanced options. Continuous education and a solid grasp of market dynamics are crucial for those looking to leverage Level 3 strategies on platforms like Robinhood.

Educational Resources for Level 3 Traders

As traders ascend to Level 3 options trading, a wealth of educational resources becomes indispensable for mastering advanced strategies. Recognizing the importance of continuous learning, several platforms offer comprehensive courses tailored to various skill levels.

For instance, the ‘Options Education Center‘ at TradeStation empowers traders to explore the power of options, while ‘The 7 Best Options Trading Courses in 2024 – Stock Analysis’ provides a quick look at the best options courses, including those focused on selling options for income. Similarly, ‘The 5 Best Options Trading Courses [2024 Review] – WikiJob’ and ‘Best Options Trading Courses – Benzinga’ offer guided tracks and diverse educational tools for traders at different stages of their journey.

It is crucial to familiarize oneself with the intricacies of each strategy and understand the associated risks before executing trades. Continuous monitoring and informed decision-making based on market conditions are key to leveraging Level 3 strategies effectively.

Learning how to trade options is all about understanding the small details and reasoning behind each trade. I enjoy this book about options trading and I believe you will learn tremendously from it.

Read the book and let me know what you think:

Crucial Considerations Before Diving In

Comparing Level 2 and Level 3 Trading Strategies

Transitioning from Level 2 to Level 3 options trading represents a significant step up in terms of strategy complexity and potential risk/reward scenarios. Level 2 strategies typically involve basic options trades, such as buying or selling calls and puts, and writing covered calls. These are relatively straightforward and serve as a foundation for more advanced trades.

Level 3 trading, on the other hand, unlocks a variety of complex strategies that require a deeper understanding of the options market. Traders gain the ability to execute debit spreads, credit spreads, iron condors, and iron butterflies. These strategies allow for more nuanced market positions and can be tailored to a trader’s specific risk tolerance and market outlook.

It is essential for traders to recognize that with the increased flexibility and potential for higher returns at Level 3, there also comes a heightened responsibility for risk management and a thorough analysis of each trade.

Understanding the differences between these levels is crucial for traders aiming to progress in their options trading journey. While Level 2 assets are often more straightforward, Level 3 strategies involve a more intricate interplay of multiple options positions, often designed to capitalize on specific market conditions or to hedge existing positions.

Understanding the Underlying Assets in Options Trading

At the heart of every options contract lies the underlying asset, which is the financial instrument that the option derives its value from. This could be a stock, a bond, an index, or any other type of financial product. The performance of the underlying asset is pivotal, as it directly influences the value of the option and, consequently, the potential return on investment.

In Level 3 options trading, the complexity of strategies often involves a deeper analysis of the underlying assets. Traders must not only understand the basics but also the nuanced factors that can affect asset performance.

For instance, when dealing with stocks as underlying assets, factors such as company earnings, news events, and market sentiment can play significant roles. In the case of indices, broader economic indicators and sector performance are key considerations. Here’s a simple breakdown of common underlying assets and their characteristics:

- Stocks: Individual company shares, sensitive to company-specific news and earnings.

- Indices: Represent a basket of stocks, reflecting the broader market or specific sectors.

- Commodities: Physical goods like gold or oil, influenced by supply and demand dynamics.

- Currencies: National currencies traded in pairs, impacted by economic policies and geopolitical events.

Understanding these assets is not just about recognizing what they are; it’s about comprehending how they interact with the market and how they can be leveraged in advanced options strategies.

Looking to start investing, why not try Tiger Broker?

Tiger Brokers offers competitive commission fees for trades across different markets.

It is also practically fee-less in these aspects: no custody fees, deposit (or withdrawal) fees, currency exchange fees, inactivity fees, or account maintenance fees to contend with!

The Importance of Risk Management at Level 3

At Level 3 options trading, risk management becomes paramount. Traders engage in more complex strategies, where the potential for both reward and risk escalates. It’s essential to protect your capital by diversifying your portfolio, setting stop-loss orders, and hedging positions to mitigate potential losses.

Effective risk management involves assessing potential risks, setting appropriate position sizes, and implementing stop-loss orders to limit losses. By carefully managing these elements, traders can navigate the intricate landscape of Level 3 trading with greater confidence and control.

Balancing risk and reward is a fundamental principle in options trading. At this advanced level, understanding the inherent risks and aligning them with personal financial goals is crucial.

Lastly, monitoring the market and analyzing closing quotes are vital practices that can help gauge market sentiment and identify price trends, contributing to informed trading decisions.

Preparing Financially and Psychologically for Advanced Trading

Transitioning to Level 3 options trading requires not only financial readiness but also a psychological fortitude to handle the complexities and pressures of advanced strategies. It’s essential to have a solid risk management plan in place, which includes setting clear stop-loss orders and having a predefined risk tolerance for each trade.

- Recognize the role of emotions in trading decisions

- Develop a disciplined trading routine

- Establish a robust risk management framework

- Continuously educate oneself on advanced strategies

As traders progress to Level 3, the importance of psychological resilience becomes paramount. The ability to maintain discipline, manage fear and greed, and stay objective can significantly impact trading outcomes.

Before venturing into Level 3 trading, ensure that your financial situation can support the potential risks. It’s advisable to have a buffer of capital that you can afford to lose, as advanced options strategies can lead to substantial financial fluctuations.

Get Started Trading

With the ability to execute complex strategies such as credit spreads, iron condors, and iron butterflies, traders can navigate the markets with a more sophisticated approach. However, this level of trading requires a thorough understanding of options mechanics, a high-risk tolerance, and compliance with specific financial criteria.

As traders unlock Level 3, it is imperative to continue educating themselves and to approach these advanced strategies with diligence and informed decision-making to capitalize on their benefits while managing the inherent risks.

Learning how to trade options is all about understanding the small details and reasoning behind each trade. I enjoy this book about options trading and I believe you will learn tremendously from it.

Read the book and let me know what you think:

Frequently Asked Questions

What is Level 3 options trading?

Level 3 options trading allows traders to implement more complex strategies such as credit spreads, debit spreads, iron condors, and iron butterflies. These strategies involve multiple options contracts and require a higher level of knowledge and experience in options trading.

What are the requirements to qualify for Level 3 trading on Robinhood?

To qualify for Level 3 trading on Robinhood, users must demonstrate knowledge and experience in trading options, have a minimum account value indicating financial stability, and possess a high tolerance for risk.

How does Level 3 trading differ from Level 2 trading?

Level 2 trading allows for basic options strategies like covered calls and long puts, involving ownership of the underlying asset. Level 3 trading unlocks more advanced strategies that involve complex combinations of multiple options contracts, offering increased potential rewards but also higher risks.

What are some of the advanced strategies available with Level 3 trading?

Advanced strategies available with Level 3 trading include credit spreads, debit spreads, iron condors, and iron butterflies. These strategies allow for nuanced and sophisticated trading approaches that can lead to higher potential returns.

Why is continuous learning important in Level 3 options trading?

Continuous learning is crucial in Level 3 options trading because the market trends and trading strategies are complex and constantly evolving. Staying informed helps traders make better decisions and manage risks effectively.

Can Level 3 trading increase potential returns?

Yes, Level 3 trading can increase potential returns by allowing traders to execute more complex and nuanced strategies. However, it comes with increased risks, and traders must be well-informed and cautious in their approach.