Eigenlayer represents a groundbreaking innovation in the Ethereum landscape, aiming to enhance scalability, security, and efficiency through its unique restaking mechanism.

This protocol, conceived by Sreeram Kannan, offers a shared security model that allows for the simultaneous securing of multiple services with staked ETH. As it garners traction with significant ETH staked and attracts developers and users alike, Eigenlayer stands poised to potentially revolutionize the Ethereum ecosystem.

Key Takeaways

- Eigenlayer introduces a novel restaking mechanism to the Ethereum network, enabling stakers to secure multiple services concurrently and earn additional rewards.

- The shared security model of Eigenlayer can significantly reduce the burden on developers to secure their infrastructure, potentially leading to a more dynamic Ethereum ecosystem.

- Eigenlayer’s token airdrop aims to incentivize participation and engagement within the ecosystem, with strategies in place to maximize benefits for stakeholders.

- The protocol’s impact on Ethereum’s infrastructure is substantial, offering new possibilities for cross-chain transactions and enhancing trust across networks.

- Under the leadership of Sreeram Kannan and with robust community support, Eigenlayer’s vision is to foster growth, collaboration, and innovation on the Ethereum blockchain.

Exploring the Core of Eigenlayer

The inception of EigenLayer marked a transformative moment for Ethereum, introducing the groundbreaking concept of restaking. This innovation allows stakers to amplify the utility of their staked ETH by securing multiple services simultaneously, fostering a more robust and interconnected ecosystem.

Restaking is not merely a feature; it’s an evolution in blockchain participation. It extends the impact of staked assets across various networks without the need for additional tokens, thus broadening the scope of what stakers can achieve. This mechanism is pivotal in addressing the fragmentation of trust networks and bootstrapping new applications on Ethereum.

With approximately 2.46 million ETH already staked in EigenLayer, the protocol demonstrates a strong vote of confidence from its users. The increasing volume of staked ETH is a clear indicator of the network’s burgeoning security and reliability.

Understanding the Shared Security Model

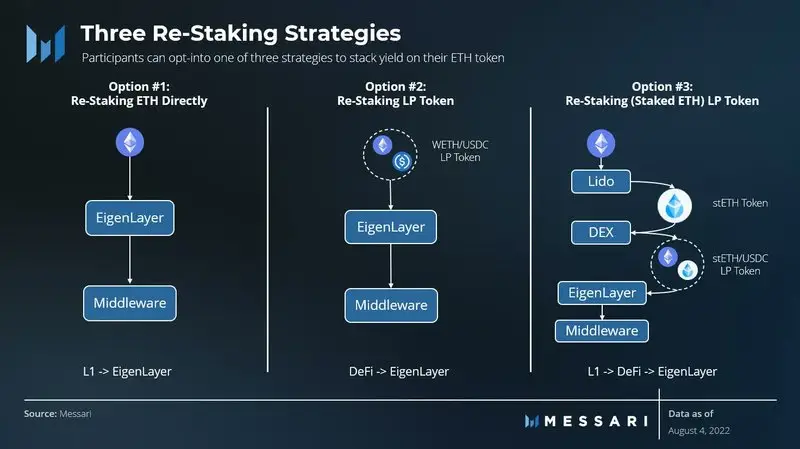

Eigenlayer introduces a shared security model that fundamentally alters how decentralized applications (dApps) leverage Ethereum’s robust security framework. By allowing dApps to utilize Ethereum’s economic security, Eigenlayer fosters a more interconnected and resilient ecosystem. This model enables dApps to operate without the need to establish their security measures, which can be both costly and complex.

The shared security model operates on a simple yet powerful premise: staked ETH can be ‘re-staked’ to provide security for multiple services simultaneously. This not only improves capital efficiency but also enhances the overall security of the network. Validators play a crucial role in this ecosystem, as they assess the risks and rewards of securing various services and allocate their staked assets accordingly.

The shared security model represents a significant step forward in the evolution of Ethereum’s infrastructure, promising to bring about a new era of decentralized growth and innovation.

The implications of this model are profound, with the potential to attract a wider array of users, stakers, and builders to the Ethereum platform. It is a move towards a more unified and economically efficient blockchain landscape, where the security of one is the security of all.

Enhancing Ethereum’s Scalability

Eigenlayer introduces a transformative approach to Ethereum’s scalability through its restaking mechanism. By allowing staked ETH to secure multiple networks, it not only enhances security but also scalability. This is because the protocol enables the efficient use of staked assets, which can now serve additional applications beyond Ethereum’s main chain.

The shared security model of Eigenlayer is a game-changer for developers. It simplifies the process of securing new applications by leveraging the existing security of Ethereum. This model reduces the barriers to entry for builders, potentially leading to a surge in innovation and user engagement within the Ethereum ecosystem.

- Efficient Staking: Stakers can earn rewards from multiple networks.

- Trust Network: Builders can focus on innovation without the overhead of securing infrastructure.

- Shared Security: Attracts more developers and users, strengthening the Ethereum network.

Eigenlayer’s scalability enhancement is not just about handling more transactions but also about creating a robust, interconnected ecosystem where security and trust are decentralized and democratized.

The Eigenlayer Token Airdrop

The Eigenlayer airdrop represents a significant milestone in the project’s roadmap, aiming to incentivize participation and enhance the network’s robustness. To partake in the airdrop, users must engage with the platform through a series of steps that ensure fair distribution and alignment with the project’s long-term goals.

- Verify Eligibility: Stay informed about your points on the Eigenlayer platform to remain eligible for the airdrop.

- Claim Process: Adhere to the instructions provided by Eigenlayer to claim your airdrop, which typically involves wallet integration and completion of the claim steps.

By understanding the mechanics and actively participating, users can leverage the airdrop to potentially amplify their influence within the ecosystem and contribute to the overarching vision of a more scalable and secure Ethereum.

Strategies for Maximizing Airdrop Benefits

To fully capitalize on the Eigenlayer airdrop, a strategic approach is essential. Diversifying your engagement across multiple platforms within the ecosystem can significantly enhance your potential rewards. By staking on various platforms like SwellNetwork, EtherFi, and KelpDAO, you increase your exposure and chances to earn more from the airdrop.

It’s not just about earning rewards; it’s about being part of a transformative project in the DeFi landscape.

Ensuring you safeguard your wallet and personal information is paramount when participating in airdrops. Regularly verify your eligibility and follow the claim process meticulously to avoid any pitfalls. Additionally, consider the following steps to maximize your airdrop benefits:

- Stay informed about announcements and staking platform updates.

- Choose a staking platform that aligns with your investment strategy and stake ETH or LSTs accordingly.

- Monitor your points within the platform to meet the airdrop criteria.

- Follow detailed instructions to claim your airdrop rewards.

Implications of the Airdrop on the Ethereum Ecosystem

The Eigenlayer airdrop has far-reaching implications for the Ethereum ecosystem, not only in terms of user engagement but also in how it may influence the network’s security and scalability. The airdrop acts as a catalyst for growth, encouraging users to participate in the restaking process, which in turn could lead to a more robust and decentralized network.

- Increased user participation in restaking mechanisms

- Potential for a more decentralized and secure network

- Enhanced scalability through collective action

The airdrop showcases the power of collective action, with significant amounts of Ethereum being re-staked, which could lead to a more resilient Ethereum ecosystem.

Furthermore, the airdrop could serve as a precedent for future token distributions on Ethereum, setting a standard for rewarding network participation and fostering a sense of community among stakeholders. As the ecosystem evolves, monitoring the long-term effects of such initiatives will be crucial for understanding their impact on Ethereum’s infrastructure.

Impact on Ethereum’s Future

The trajectory of Eigenlayer’s growth has been nothing short of extraordinary, with its Assets Under Management (AuM) experiencing a meteoric rise. This surge is a testament to the protocol’s robustness and the burgeoning interest in Ethereum’s Layer 2 solutions. The following table encapsulates the remarkable expansion of Eigenlayer’s AuM and Total Value Locked (TVL):

| Date | AuM (in billions) | TVL (in billions) |

|---|---|---|

| Launch | $0.019 | N/A |

| February | $3.91 | $6.1 |

Eigenlayer’s innovative restaking model has not only attracted a significant influx of capital but has also expanded Ethereum’s asset portfolio, introducing new liquidity staking options. The protocol’s shared security model further solidifies its position by enabling developers to build on Ethereum without the added burden of securing their infrastructure.

The introduction of Frax Ether, Mantle Staked Ether, and Liquid Collective Staked Ether by Eigenlayer is more than an expansion of Ethereum’s asset portfolio; it’s a leap towards a more interconnected and fluid ecosystem.

As Eigenlayer continues to evolve, it remains crucial to monitor its development closely. The full roadmap is expected to unfold over several years, involving meticulous increments in staked ETH capacity and continuous enhancement of the protocol’s features.

Predicting the Long-Term Effects on Ethereum’s Infrastructure

The advent of Eigenlayer could herald a new era for Ethereum’s infrastructure, with profound implications for its scalability, security, and overall efficiency. As a re-staking protocol, Eigenlayer enables users to leverage their staked ETH to secure multiple protocols, potentially increasing the total value locked (TVL) and enhancing network robustness.

- Scalability: By facilitating additional layers of staking, it may reduce the burden on the main Ethereum chain, leading to faster transaction times and lower fees.

- Security: Shared security models could deter attacks by increasing the cost and complexity for potential attackers.

- Decentralization: Eigenlayer’s approach to staking could promote a more decentralized network by allowing a broader participation base.

The integration of Eigenlayer with upcoming Ethereum Improvement Proposals (EIPs) like EIP-4844, which introduces proto-danksharding, could further amplify these effects, setting the stage for a more scalable and efficient Ethereum ecosystem.

As the crypto market matures, with DeFi and other innovations driving mainstream adoption, the role of protocols like Eigenlayer in supporting this growth becomes increasingly critical. The potential for Eigenlayer to lift the staking cap and attract significant inflows of capital, as seen with the surge past $3 billion in TVL, underscores its capacity to transform Ethereum’s infrastructure in the long run.

Monitoring Metrics and Developments for Informed Decisions

In the dynamic landscape of Ethereum and its evolving protocols, monitoring key metrics and developments is crucial for stakeholders to make informed decisions. Eigenlayer’s impact can be assessed through various indicators that reflect its growth and integration within the Ethereum ecosystem.

For instance, tracking the restaked ETH volume provides insights into the adoption of Eigenlayer’s restaking innovation. Similarly, evaluating the ratio of staking rewards to restaked assets can offer a perspective on the financial incentives driving participation in the protocol. These metrics, among others, serve as vital signs of the health and potential of Eigenlayer.

It is essential to not only focus on quantitative data but also to consider qualitative factors such as market conditions, regulatory impact, and community sentiment. These elements can significantly influence the trajectory of Eigenlayer and Ethereum at large.

By staying attuned to these metrics and developments, investors, developers, and users can navigate the complexities of the crypto market with greater confidence and strategic foresight.

The Technical Underpinnings of Eigenlayer

Delving into the Restaking Mechanism

At the heart of Eigenlayer’s innovation lies the restaking mechanism, a process that allows Ethereum stakers to pledge their assets again, extending their influence and earning potential across multiple services. This not only bolsters the security of the Ethereum network but also opens up avenues for stakers to support various blockchain networks simultaneously, thereby amplifying the utility and yield of their staked assets.

To address the challenge of liquidity that comes with restaking, the introduction of Liquid Restaked Tokens (LRT) has been a game-changer. LRTs are synthetic tokens representing restaked ETH, providing a solution to the liquidity issue by enabling these assets to be traded and to provide security support across multiple services.

The symbiotic relationship between LRTs and restaking is pivotal, as it allows stakers to maintain liquidity while participating in the security and verification processes of multiple networks, enhancing rewards and returns.

Restaking through Eigenlayer is facilitated by smart contracts on Ethereum, which not only simplifies the process but also integrates seamlessly with DeFi platforms, allowing for a more interconnected and efficient ecosystem.

How Eigenlayer Reinforces Trust Across Networks

Eigenlayer’s approach to reinforcing trust across networks is pivotal in the evolution of the Ethereum ecosystem. By leveraging the shared security model, Eigenlayer allows various protocols to benefit from Ethereum’s established trust and security without the need to set up independent validator sets or consensus mechanisms. This not only simplifies the process for builders but also enhances the overall robustness of the network.

- Efficient Staking: Staked ETH can now secure multiple protocols, increasing rewards for stakers.

- Trust Network for Builders: Developers can focus on innovation without the overhead of securing their infrastructure.

- Improved Capital Efficiency: Capital is optimized as staked ETH is utilized more effectively across the ecosystem.

Eigenlayer’s innovative restaking mechanism is a game-changer, enabling a more interconnected and resilient network of decentralized applications.

The protocol’s ability to solve the problem of trust network fragmentation and bootstrapping has opened up new possibilities for Ethereum, making it an attractive platform for developers and users alike. As Eigenlayer continues to grow, it will be crucial to monitor its impact on the Ethereum infrastructure to ensure that it remains a positive force in the ecosystem.

The Significance of Eigenlayer for Cross-Chain Transactions

Eigenlayer is poised to become a pivotal force in the realm of cross-chain transactions. By leveraging its restaking mechanism, it enables the extension of crypto economic security to various blockchain networks. This not only enhances the utility of assets like bitcoins but also instills a deeper level of trust across Proof of Stake (PoS) blockchains.

The protocol’s influence on cross-chain transactions can be summarized as follows:

- Bridging Ecosystems: Eigenlayer facilitates the transfer of assets between different chains, ensuring integrity and expanding the possibilities for future bridges.

- Security and Trust: With meticulous audits and bug bounties, Eigenlayer demonstrates a strong commitment to security, which is crucial for cross-chain interactions.

- Decentralized Governance: Plans for decentralizing governance further bolster the protocol’s trustworthiness in managing cross-chain transactions.

The integration of Eigenlayer into the blockchain infrastructure signifies a step towards a more interconnected and secure digital asset ecosystem.

As the technology matures, the impact of Eigenlayer on cross-chain transactions will likely grow, fostering a more robust and versatile blockchain environment.

Visionary Leadership & Community Engagement

At the forefront of Eigenlayer’s innovative leap is Sreeram Kannan, whose vision and leadership have been pivotal in its development. Kannan’s approach to building Eigenlayer mirrors the ethos of eliminating barriers and fostering a positive environment, reminiscent of the culture advocated by industry leaders like Elon Musk. His personal experience and entrepreneurial spirit have infused Eigenlayer with a mindset geared towards sustainable growth and community engagement.

- The Visionary: Sreeram Kannan’s big-picture thinking has set the direction for Eigenlayer’s mission.

- The Fixer: Addressing Ethereum’s scalability and security challenges.

- The Artist: Crafting a unique solution with the restaking mechanism.

- The Hacker: Innovating within the Ethereum ecosystem to extend trust across networks.

- The Closer: Garnering support and investment to ensure the protocol’s success and adoption.

Eigenlayer’s journey under Kannan’s guidance is a testament to the power of visionary leadership in the blockchain space. The protocol’s ability to unify stakeholders and create new opportunities for Ethereum is a direct result of his strategic foresight and dedication to excellence.

The Importance of Community Support in Eigenlayer’s Evolution

The evolution of Eigenlayer is a testament to the power of community engagement in the blockchain space. A robust community not only contributes to the protocol’s development but also ensures a wider adoption and a more resilient network.

- Community Role: Active participation in discussions and implementation of measures has led to increased staking activities, fostering a sense of ownership among members.

- Funding and Expansion: Community funds have been pivotal in supporting protocol upgrades and innovations, allowing Eigenlayer to expand its staking capacity and resources.

- Partnerships: Collaborations with key players in the decentralized finance (DeFi) space have broadened Eigenlayer’s influence, attracting more users and assets.

The voice of the community has never been more relevant, shaping the trajectory of Eigenlayer’s growth and the broader Ethereum ecosystem.

Monitoring the developments and engaging with the community are crucial for the sustained success of Eigenlayer. As the protocol continues to solve trust network fragmentation, the community’s role in shaping its future cannot be overstated.

Future Collaborations and Partnerships in the Eigenlayer Ecosystem

The Eigenlayer ecosystem is poised for significant expansion through strategic partnerships and collaborations. These alliances are not just about growth but about creating a more interconnected blockchain ecosystem, where the strengths of one platform amplify the capabilities of another.

- Decentralized blockchain infrastructure provider that operates an array of nodes and validators globally distributed across over 50 Proof-of-Stake networks.

- Collaborations with leading entities in the decentralized finance space have expanded EigenLayer’s reach and influence.

- The active participation of the community in discussing and implementing measures has fostered a sense of ownership and commitment to the platform’s success.

The synergy between Eigenlayer and its partners is expected to drive innovation, with each collaboration bringing new users, assets, and ideas to the table. This is not just about adding numbers but about enriching the ecosystem with diverse capabilities and perspectives.

As Eigenlayer continues to bridge ecosystems, particularly in the realm of asset transfers between contracts on different chains, the potential for co-venturing, affiliate programs, and industry-specific tools becomes increasingly apparent. These partnerships will likely be a catalyst for mutual growth and prosperity, leveraging the power of business partnerships in various fields.

Eigenlayer’s future

As we have explored throughout this article, Eigenlayer represents a significant leap forward for the Ethereum ecosystem. Its innovative restaking mechanism not only enhances the scalability and security of Ethereum but also opens up a myriad of possibilities for developers and stakers alike.

With a substantial amount of ETH already staked, the trust in Eigenlayer’s vision is evident. The protocol’s potential to unify security across applications and its impact on the future of decentralized finance cannot be overstated.

While the crypto space is known for its volatility and unpredictability, the trajectory of Eigenlayer suggests a bright and transformative future. It is an exciting time for Ethereum enthusiasts and the broader blockchain community as we witness the evolution of a more interconnected and efficient network, thanks to the pioneering efforts of projects like Eigenlayer.

Frequently Asked Questions

What is Eigenlayer and how does it benefit Ethereum?

Eigenlayer is a transformative project on the Ethereum blockchain that introduces a ‘restaking’ mechanism, allowing users to stake their ETH or Liquidity Staking Tokens (LSTs) to participate in securing multiple networks simultaneously. This enhances Ethereum’s scalability and security by creating a pooled security model and offers stakers potential rewards for their contributions.

Who is behind the development of Eigenlayer?

Eigenlayer is the brainchild of Sreeram Kannan. It was launched in June 2023 with the vision to extend the security and trust of the Ethereum mainnet to other applications and services, fostering a faster-growing and more dynamic ecosystem.

What is the shared security model of Eigenlayer?

Eigenlayer’s shared security model allows developers to build on Ethereum without the need to secure their own infrastructure. It enables stakers to pool their security contributions, thereby attracting more users, stakers, and builders to the Ethereum ecosystem.

How does the Eigenlayer token airdrop work?

The Eigenlayer token airdrop is a mechanism to reward participants who stake their ETH or LSTs in the network. It is designed to incentivize the community’s involvement and enhance the protocol’s growth by distributing tokens to contributors.

What impact does Eigenlayer have on Ethereum’s cross-chain transactions?

Eigenlayer enhances cross-chain transactions by providing a unified interface for stakeholders to commit security across different protocols. This has opened up new possibilities for asset transfers between chains, improving the integrity and trust of bridges in the blockchain ecosystem.

How can I monitor the progress and development of Eigenlayer?

To monitor the progress and development of Eigenlayer, you can follow official updates, track the amount of staked ETH, participate in the community, and review metrics that reflect the network’s growth and impact on the Ethereum ecosystem.