With the CPF Housing Grant, Singaporeans have been able to receive substantial financial aid to offset the cost of buying resale flats. Under CPF, homeowners can leverage the OA(Ordinary Account) to make payments for their residential property. Easing homeowners of having to depend on their cash at hand.

Understanding the extent to which CPF can be utilized, the impact of recent policy changes, and the strategies to maximize CPF usage are critical for prospective homebuyers. We all want to live a comfortable standard of living right?

Key Takeaways

- The CPF Housing Grant has been instrumental for 41,600 households in purchasing HDB resale flats, with a marked increase in grants disbursed after recent enhancements.

- HDB resale market trends indicate a moderation in price growth and a decrease in transaction volume, influenced by increased housing supply and property cooling measures.

- Recent policy changes have increased CPF Housing Grant amounts, with up to S$80,000 available for eligible buyers of resale flats, significantly reducing the need for cash payments.

- The Enhanced CPF Housing Grant and Proximity Housing Grant have been introduced or enhanced to streamline financial support, with S$1.22 billion in grants awarded in 2023.

- Future outlooks suggest continued support for first-time buyers through CPF grants, with potential policy changes aimed at making resale HDB flats more affordable.

How Much CPF Can I Use For HDB Resale?

When purchasing a Housing and Development Board (HDB) resale flat in Singapore, you can use your Central Provident Fund (CPF) savings to downpayment for hdb and finance for it. The amount you can use depends on various factors, including your age, the remaining lease of the flat, and whether you are taking an HDB loan or a bank loan.

| Buyer’s Age | CPF Usage Limit |

|---|---|

| Under 55 years old | Up to 100% of the valuation price or purchase price, whichever is lower |

| 55 to 60 years old | Up to 90% of the valuation price or purchase price, whichever is lower |

| 60 to 65 years old | Up to 80% of the valuation price or purchase price, whichever is lower |

| 65 years old & above | Up to 60% of the valuation price or purchase price, whichever is lower |

Here’s a general overview:

- Using CPF for the flat’s purchase price: You can use your CPF Ordinary Account (OA) savings to pay for the purchase price of the flat, including the downpayment and monthly mortgage installments.

- CPF usage limits: There are limits on how much CPF you can use for purchasing an HDB flat. These limits are based on the valuation of the flat and your age at the time of purchase. If you’re taking an HDB loan, the CPF usage limit is higher compared to if you’re taking a bank loan.

- Remaining lease: If the remaining lease of the flat is less than 60 years, there are restrictions on how much CPF you can use.

- Valuation limit: CPF usage is also subject to the valuation limit, which is the lower of the purchase price or the HDB valuation of the flat.

- Minimum sum: There’s a requirement to set aside a minimum sum in your CPF accounts, which may affect the amount available for the flat purchase.

Now before taking on the principle amount for your HDB, its important to also look at the grants available for your property investment.

Overview of CPF Housing Grant

The Central Provident Fund (CPF) Housing Grant is a form of financial assistance provided by the Singapore government to help citizens afford the purchase of HDB resale flats. The grant amount varies depending on the flat type and buyer’s eligibility, with significant enhancements made in recent years to make housing more accessible.

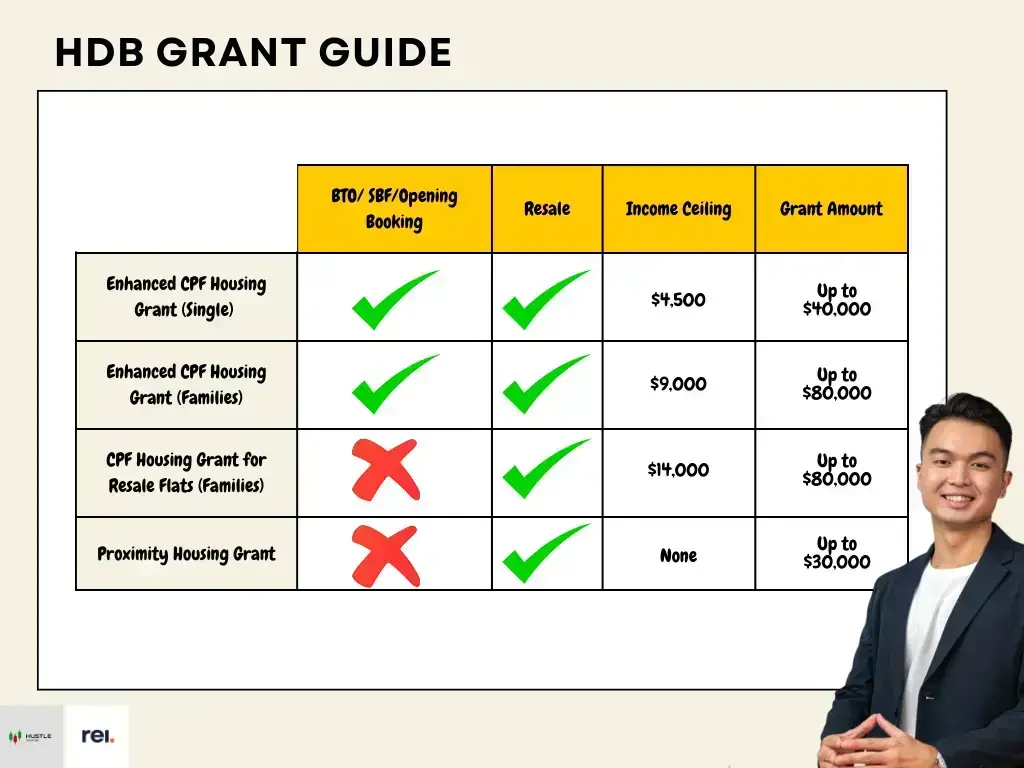

Eligible first-time home buyers can receive up to $80,000 in grants through the Enhanced CPF Housing Grant (EHG), which was introduced to consolidate previous grant schemes. Additionally, the Proximity Housing Grant offers up to $30,000 for those who choose to live near their parents or children, promoting family cohesion.

The CPF Housing Grant has been instrumental in supporting Singaporeans in their pursuit of homeownership, particularly in the resale market where prices can be a barrier.

Understanding the eligibility criteria and the grant amounts is crucial for potential buyers, as it directly affects the affordability of a resale flat. Here’s a quick overview of the grant amounts for different flat types:

| Flat Type | CPF Housing Grant Amount |

|---|---|

| 2- to 4-room | Up to $80,000 |

| 5-room or larger | Up to $50,000 |

It’s important to note that these grants are subject to revisions, and staying informed about the latest changes is essential for making informed decisions.

Recent Changes to Grant Amounts

The landscape of CPF Housing Grants has seen significant changes, particularly in the recent year. In 2023, the CPF Housing Grant for resale flats was increased, providing substantial support for Singaporeans facing high resale flat prices. This adjustment has made a notable impact on the affordability of resale flats for many buyers.

Previously, the grant amounts were set at $50,000 for two- to four-room flats and $40,000 for five-room or larger units. After the revision, the grant for smaller flats was boosted to $80,000, while larger flats saw an increase to $50,000. This enhancement reflects the government’s commitment to keeping housing within reach for first-time buyers.

The Enhanced CPF Housing Grant, introduced in 2019, and the Proximity Housing Grant, increased in 2018, are part of a suite of measures aimed at providing targeted assistance to homebuyers.

The distribution of grants has also scaled up, with HDB disbursing a total of S$1.22 billion in 2023, a rise from the S$1.13 billion in the previous year. Over the span of four years, from 2020 to 2023, more than S$4.5 billion in housing grants were allocated to assist 41,600 households.

Eligibility Criteria for CPF Grants

To be eligible for CPF Housing Grants when purchasing a resale HDB flat, applicants must meet certain criteria. Income ceiling is a pivotal factor; for the Enhanced CPF Housing Grant (EHG), the household income must not exceed S$9,000. This grant is tiered, providing different levels of support based on income brackets.

Another key eligibility requirement is the household composition. HDB assesses the incomes of all persons listed in the HDB Flat Eligibility (HFE) letter application. This comprehensive assessment ensures that the household’s eligibility aligns with the intent of the grants to support those in need.

From May 9, 2023, a new approach to the distribution of HDB grants for couples was introduced, affecting all grants including the EHG.

Additionally, applicants must not have disposed of any private property within the last 30 months before their HFE application. This condition is in place to prioritize the grants for genuine first-time buyers or those who do not currently own a private property.

Impact of Grant Enhancements on Resale Market

The enhancements to CPF Housing Grants have had a tangible impact on the HDB resale market. Increased CPF Housing Grants have provided additional financial assistance to first-time buyers, leading to a surge in demand for resale flats. This demand has contributed to a moderation in the rate of resale price growth, as observed in recent years.

The Proximity Housing Grant, which was increased from $20,000 to $30,000, has also incentivized more families to live closer together, affecting the dynamics of the resale market. Despite the increase in grants, some homeowners have deferred upgrading to new and larger HDB flats due to financial uncertainties and a decrease in the number of buyers.

The introduction and enhancement of CPF Housing Grants have been pivotal in shaping the resale market, ensuring affordability while balancing the supply and demand.

The table below summarizes the impact of CPF Housing Grant enhancements on the resale market:

| Year | CPF Housing Grant Increase | Resale Price Growth | Resale Transactions |

|---|---|---|---|

| 2023 | Yes | 4.9% | 26,735 |

| 2022 | No | 10.4% | 27,896 |

While the grants have made resale flats more accessible, the overall volume of transactions has seen a slight decline, indicating a complex interplay between grant policy and market behavior.

Analyzing the Resale HDB Market Trends

Resale Price Growth Moderation

In recent times, the HDB resale market has witnessed a notable moderation in price growth. After a significant surge in prices during the previous years, the increase in resale prices has slowed down considerably.

In 2023, the growth rate was recorded at 4.8%, which is less than half of the 10.4% growth seen in 2022. This trend indicates a shift in the market dynamics, potentially influenced by increased housing supply and the implementation of property cooling measures.

Despite the slowdown, the market concluded the year with resale prices reaching an all-time high, a 5.8% increase from December 2022 to December 2023. This suggests that while the pace of growth has slowed, the overall demand for HDB resale flats remains robust, supported by a strong underlying demand.

The moderation in price growth is a reflection of the market responding to various factors, including policy interventions aimed at stabilizing the property market.

The table below summarizes the quarterly growth in HDB resale prices for 2023:

| Quarter | Price Growth (%) |

|---|---|

| Q1 | 1.5 |

| Q2 | Data Not Available |

| Q3 | Data Not Available |

| Q4 | 1.0 |

Transaction volumes also experienced a dip, with a 4.2% decrease in the number of resale flats sold in 2023 compared to 2022. This could be indicative of buyers’ cautious sentiment and a wait-and-see approach in anticipation of further market adjustments.

Volume of Resale Transactions

The HDB resale market has shown a notable shift in transaction volumes over the past year. The number of resale flats transacted in 2023 saw a decrease of 4.2%, from 27,896 flats in 2022 to 26,735 flats in 2023. This moderation in volume may be attributed to a combination of factors, including the introduction of property cooling measures and a stabilization in housing supply.

Despite the overall decrease, certain segments of the market witnessed remarkable activity. January 2023, in particular, recorded a significant event with 74 units sold for at least $1 million each, indicating a sustained interest in premium HDB resale flats.

The moderation in resale transactions is reflective of a market that is adjusting to new norms post-pandemic and the government’s efforts to balance supply and demand.

The table below summarizes the key statistics for HDB resale transactions over the past two years:

| Year | Total Transactions | % Change |

|---|---|---|

| 2022 | 27,896 | – |

| 2023 | 26,735 | -4.2% |

Effect of Property Cooling Measures

The Singaporean government’s latest set of cooling measures, introduced on 30 September 2022, has been pivotal in shaping the HDB resale market. Aimed at moderating demand, these measures seek to maintain affordability for potential buyers. Notably, the measures have led to a call for a review of the wait-out period policy, particularly from industry leaders like PropNex, who also advocate for a realignment of the Additional Buyer’s Stamp Duty (ABSD) remission for HDB upgraders.

The impact of these cooling measures is evident in the market’s response. While some feared a drastic downturn, the market has shown resilience with a stable outlook. Prices are expected to grow at a moderate pace of 3 to 5 percent in 2024, suggesting that the measures are effectively tempering excessive price growth without stifling the market.

The cooling measures have also influenced the strategies of buyers and sellers alike. For buyers, understanding the implications of these policies is crucial when securing their dream HDB resale flat. Sellers, on the other hand, must navigate these regulations to maintain the attractiveness of their properties in a more regulated market environment.

Maximizing CPF Usage for HDB Resale Purchases

Calculating CPF Withdrawal Limits

When purchasing a resale HDB flat, it’s crucial to understand the limits on the amount of CPF you can use. These limits are determined by factors such as the type of flat (new or resale) and the remaining lease of the property. For instance, if the remaining lease is less than 60 years, the CPF withdrawal limits are adjusted accordingly.

To calculate your CPF withdrawal limit, consider the following steps:

- Check the remaining lease of the HDB flat.

- Use the CPF Accrued Interest Calculator to estimate the accrued interest on your CPF savings.

- Determine if the flat’s lease will last until you are at least 95 years old to ensure maximum CPF usage.

- Factor in any applicable CPF Housing Grants, which can significantly reduce the cash needed for the down payment.

By carefully planning and understanding these limits, you can optimize your CPF usage and minimize the need for cash payments, enhancing your financial flexibility during the home-buying process.

Understanding the Terms and Conditions

When using CPF funds for a resale HDB flat purchase, it’s crucial to understand the terms and conditions that govern such usage. The CPF withdrawal limits are designed to ensure that Singaporeans retain sufficient savings for retirement. For instance, the Valuation Limit (VL) is the maximum amount of CPF that can be used, which is capped at the lower of the purchase price or the property’s valuation at the time of purchase.

Another key term is the Withdrawal Limit (WL), which is the maximum CPF that can be used for property payment, including the VL and any additional CPF usage for housing beyond the VL, up to 120% of the VL. It’s important to note that once the WL is reached, further payments must be made in cash.

Here’s a simplified breakdown of the CPF usage terms:

- Valuation Limit (VL): Lower of purchase price or valuation

- Withdrawal Limit (WL): 120% of the VL

- Excess CPF usage: Payments beyond WL in cash

Understanding these conditions helps in planning finances and avoiding unexpected cash outlays during the property transaction process.

It’s also essential to be aware of the Minimum Occupancy Period (MOP) which dictates that flats purchased with CPF housing grants have a mandatory occupancy period before they can be sold. This ensures that the grants are used for long-term housing needs rather than short-term investment.

Strategies for Minimizing Cash Payments

To optimize the use of CPF funds for HDB resale purchases and minimize cash outlays, consider the following strategies. Maximize the CPF grants you are eligible for to reduce the initial cash needed for down payment. For instance, Ms. Chua’s experience of fully offsetting her down payment with grants and CPF savings exemplifies the potential to conserve cash for other expenses like renovations.

When structuring your financing, aim to balance your loan tenure with your repayment capabilities. A shorter loan term means less accrued interest and can lead to significant savings over time. However, ensure that the monthly installments remain manageable within your budget to avoid cash top-ups.

To ease the financial load of your HDB loan, consider paying a portion in cash, opting for a shorter loan term, or reducing the duration of your existing loan to save on interest.

Lastly, be strategic about your loan repayments. Payments for monthly loan installments and partial capital repayments can be made using CPF funds, but making occasional cash payments can reduce the overall interest paid. Remember, once your mortgage is fully paid, your CPF funds will be ‘stuck’ in your HDB, limiting liquidity compared to private property.

Comparing CPF Housing Grants: Past and Present

Historical Overview of CPF Grants

The CPF Housing Grant has undergone significant transformations to better assist Singaporeans in their pursuit of homeownership. Initially, the grant amounts were more modest, with buyers of two- to four-room resale flats receiving $50,000, while those purchasing larger units were granted $40,000. The introduction of the Enhanced CPF Housing Grant (EHG) in 2019 marked a pivotal change, consolidating previous grants into a more substantial offering.

The EHG not only simplified the grant landscape but also increased the maximum grant amount to $80,000 for eligible first-time buyers, regardless of whether they were purchasing new or resale flats.

The Proximity Housing Grant, aimed at encouraging families to live closer together, was also enhanced, increasing from $20,000 to $30,000 in 2018. These strategic enhancements reflect the government’s commitment to making housing more affordable and accessible, particularly for first-time buyers.

Here’s a quick look at the CPF Housing Grants over the years:

- 2019: Introduction of the Enhanced CPF Housing Grant (EHG)

- 2018: Increase of the Proximity Housing Grant from $20,000 to $30,000

- Prior to 2019: CPF Housing Grant provided $50,000 for smaller flats and $40,000 for larger units

Enhanced CPF Housing Grant vs. Previous Grants

The Enhanced CPF Housing Grant (EHG), introduced in September 2019, represents a significant shift from the previous grant system. It consolidates the Additional CPF Housing Grant (AHG) and the Special CPF Housing Grant (SHG) into a single, more streamlined grant. This change simplifies the process for first-time homeowners and offers higher financial support, with up to S$80,000 available for eligible buyers of both new and resale flats.

The EHG is designed to be more inclusive, catering to a wider range of income groups and providing more substantial assistance to those purchasing resale flats.

Here’s a quick comparison of the grants:

| Grant Type | Amount (up to) | Eligibility |

|---|---|---|

| EHG | S$80,000 | First-time buyers, income ceiling applies |

| AHG | S$40,000 | First-time buyers, income ceiling applies |

| SHG | S$40,000 | First-time buyers, purchasing new flats |

The EHG not only offers a higher maximum grant amount but also extends eligibility to a broader spectrum of homebuyers, including those purchasing resale flats, which was not the case with the SHG.

Proximity Housing Grant: Benefits and Qualifications

The Proximity Housing Grant (PHG) is a significant boon for families looking to purchase resale flats close to their loved ones. With the PHG, eligible buyers can receive up to $30,000 to facilitate their move. This grant is part of a suite of measures aimed at keeping families together, thereby fostering stronger family support networks.

The PHG has been revised to be more inclusive, reflecting the government’s commitment to support familial ties through housing policies.

Eligibility for the PHG hinges on several factors, including the monthly household income ceilings and the proximity to family members. The grant amount varies depending on whether you are living with or near your parents or married children. Here’s a quick breakdown of the qualifications:

- Citizenship status: At least one buyer must be a Singapore Citizen.

- Family nucleus: Applicants must form a valid family nucleus as defined by HDB.

- Age: Buyers must be at least 21 years old.

- Income ceiling: The monthly household income must not exceed the stipulated ceiling.

- Proximity condition: The resale flat must be within 4km of the parents’ or married child’s home.

To confirm your eligibility for the PHG and other housing grants, obtaining an HDB Flat Eligibility (HFE) letter is a necessary step. This document is a testament to meeting the criteria set forth by HDB, and it can be applied for online. Once you have the HFE letter and have found a suitable resale flat, the next step is to acknowledge and endorse the resale documents before the HDB can approve your application.

Future Outlook and Additional Support Measures

As the HDB resale market enters 2024, analysts have observed a continuation of the moderating price growth that characterized the previous year. In 2023, the market saw a 4.9% increase in resale prices, a significant slowdown from the 10.4% surge in 2022. This trend is expected to persist, with projections suggesting a further deceleration in price growth.

The market is adjusting to a new equilibrium, with fewer flats reaching their Minimum Occupation Period (MOP) and a range of property cooling measures taking effect.

According to industry experts, the volume of resale transactions could influence the pace of price increases. With an estimated 25,000 to 27,000 units projected to change hands, the increase in resale prices might hover around 3% to 5% for the year. This is in line with the slower 1% pace observed in the last quarter of 2023.

| Year | Projected Transactions | Projected Price Growth |

|---|---|---|

| 2023 | 26,735 | 4.9% |

| 2024 | 25,000 – 27,000 | 3% – 5% |

Upcoming Policy Changes and Their Implications

As the HDB resale market evolves, upcoming policy changes are anticipated to have significant implications for potential buyers and the overall market dynamics. These changes aim to ensure that public housing remains affordable and accessible, while also addressing the long-term sustainability of the CPF system.

- Review of CPF policies: Continuous monitoring and potential adjustments to CPF usage rules to align with housing affordability.

- Property market oversight: Commitment to intervene with measures if market conditions warrant.

- Enhanced support for first-time buyers: Possible introduction of new grants or revisions to existing ones to aid new entrants into the market.

The government’s proactive stance in reviewing and potentially revising policies underscores the importance of maintaining a balanced and stable housing market.

Buyers should stay informed about these changes as they could affect the CPF amounts usable for HDB resale purchases, as well as the terms and conditions associated with housing grants. It is crucial to understand how these policy shifts could impact one’s ability to finance a home using CPF savings.

Additional Financial Support for First-Time Buyers

First-time homebuyers in Singapore can benefit from a range of CPF Housing Grants tailored to ease the financial burden of purchasing a resale HDB flat. The Enhanced CPF Housing Grant (EHG) offers up to S$80,000, which is available to both new and resale flat buyers, making it a significant form of support for first-timers.

For singles purchasing their first home, the grants are equally substantial. Singles are eligible for up to S$40,000 when buying four-room or smaller units, and S$25,000 for five-room units. This increase in grant amounts reflects the government’s commitment to supporting singles in their homeownership journey.

The Proximity Housing Grant (PHG) further supports buyers who wish to live near their parents or children, providing up to S$30,000 in additional aid.

Families looking to upgrade from public rental flats to a resale flat can consider the Fresh Start Housing Scheme, which is designed to assist second-timer families with young children. Moreover, there are specific grants for those living in 2-room flats in non-mature estates aiming to upgrade to 3-room resale flats in the same category of estates.

The table below summarizes the key grants available to first-time buyers:

| Grant Type | Eligible Buyers | Grant Amount (S$) |

|---|---|---|

| Enhanced CPF Housing Grant | New or Resale Flat Buyers | Up to 80,000 |

| Singles Grant | Singles (4-room or smaller units) | 40,000 |

| Singles Grant | Singles (5-room units) | 25,000 |

| Proximity Housing Grant | Buyers living near family | Up to 30,000 |

It is essential for potential buyers to stay informed about the latest policy changes and to understand how these grants can be maximized to reduce the cash outlay required for a resale flat purchase.

Buying a HDB Resale?

With the grant’s increase in 2023, more households have been able to afford resale properties, as evidenced by the 31% uptick in grant utilization. The moderation in resale price growth and the enhanced grant amounts reflect the government’s commitment to making housing more accessible.

As a result, eligible buyers now have greater financial support, with up to S$80,000 for two- to four-room flats and S$50,000 for larger units, ensuring that the dream of homeownership remains within reach for many. It’s important for potential buyers to stay informed about the latest updates and understand how these grants can be maximized to their benefit.

Aaron Oon is a Senior Associate Director at Propnex and Founder of Real Estate Insider. A consistent Top Producer in the competitive world of real estate, Armed with a Finance degree from NUS, Aaron is more than just a real estate agent; he’s a strategic thinker and a creative problem solver.

If you are looking to invest in a property here in Singapore or would like to know more about Singapore’s property market. Be sure to reach out through the Calendy video link below:

Frequently Asked Questions

How much has the CPF Housing Grant been increased to for resale flats?

First-time buyers of two to four-room HDB resale flats can receive up to S$80,000, while those purchasing five-room or larger units can get up to S$50,000. First-timer singles can get S$40,000 for four-room and smaller units, and S$25,000 for five-room units.

What is the Enhanced CPF Housing Grant and how much can buyers receive?

The Enhanced CPF Housing Grant provides up to S$80,000 to families buying their first new or resale flat. It was rolled out in 2019 to streamline two older grants.

What is the Proximity Housing Grant and who is eligible for it?

The Proximity Housing Grant offers up to S$30,000 for buyers of resale flats who choose to live with or near their parents or children. It was increased from $20,000 to $30,000 in 2018.

How has the resale HDB market been affected by the CPF Housing Grant enhancements?

The CPF Housing Grant enhancements have led to more people tapping into the grant to buy resale flats, with over 11,000 households benefiting from the grant from February 14, 2023, to December 2023, marking a 31% increase from the same period in 2022.

Can buyers service their HDB loans without cash payments using CPF contributions?

Yes, buyers aged 35 and below can allocate 23% of their total CPF contributions to their CPF Ordinary Account, which can be used for housing, potentially allowing them to service their HDB loans with little or no cash payments.

How much has the HDB given out in housing grants from 2020 to 2023?

The HDB gave out more than $4.5 billion in housing grants to buyers of new or resale flats from 2020 to 2023. Around 63,700 households received the Enhanced CPF Housing Grant during this period.