What’s it going to take to start investing early for retirement?

Early retirement isn’t about not having to work which many people will think, it means having the financial capability to not have to work for money. And most individual would love to work without having to look at their bank account, right?

FIRE which stands for Financially Independent Retire Early. Is a financial movement where people save and invest as much as they can to achieve early retirement. Some of these FIRE activists can achieve a million-dollar portfolio early by cutting down as much as they can by cutting down on their desire and lowering their necessary expenses.

Is it possible for the average person to get to that goal? Here’s a breakdown guide on how anyone can start learning to start investing early for retirement.

What is Early Retirement?

The study has shown that working till old age is a good thing for you and many of those who quit working start losing their sanity which may cause people to die sooner.

To the FIRE movement, achieving early retirement is having the financial capability to work at your own pace without having to be worried if you would get fired the next day.

It is important to know the purpose of retiring early. Whether it is to pursue your hobbies or passion or maybe just spend more time with family. Early retirement can also be good for you if you can plan what you wish to achieve after achieving it.

Early Retirement Strategy

The strategy to retire early is pretty simple. Get good at managing these 3 things

- Build your income. Whether it’s increasing your salary or finding other sources of income

- Keeping expenses at a minimum and not being inclined by lifestyle inflation

- Save and invest as much as possible and as early as possible to let compound interest do the work

How to Increase Income?

Increasing income is not a simple thing that can overnight give you an extra $100 a month. The rule on increasing your income is the more value you provide, the more money you will be able to make.

There is a rule called the 90|10. Which states that 90% of the world’s population owns 10% of the wealth whereas 10% of the world’s population owns 90% of the wealth. To be in the top 10%, they all have one thing in common. They build businesses and invest in them.

The ESBI Quadrant stands for employee, self-employed, businessman, and investor. The ESBI quadrant states that if you want to make more money with less effort over time. People need to learn to get from the E and S side to the B and I side.

Easier said than done, most businesses fail within the first 5 years and the amount of effort you invest would be for nothing. This is why most people would rather take the safer path of being an employee for a steady paycheck. In this digital era, it is really simple to start a business or start investing. Want to learn more about how to make money? Do look at our Money Talk for money-making tips and advice.

Side Hustle

Start a Side hustle to earn during your free time, there are many websites and apps out there that allow you to work a gig to earn some money. Want to know more about a side hustle and which one is suitable for you? Do look at our HustleventureSG side hustle 101 to know more!

Think you good with software, website building, or graphic design? Try being a seller on Fiverr, you can use my referral code by clicking the link here!

Think tech stuff is not for you? Try pet sitting with Petbacker, and find clients of your choice that is near your location to start taking care of. Want to try pet sitting with PetBacker? Use my referral code by clicking the link here!

Provide more value

The best way to provide more value is by educating oneself.

Either by pursuing higher education or mastering another skill. By providing more value to your employer, you would have a higher chance of getting a pay raise. By providing more value to your customers, your customers would be more willing to reach out for your service and skills.

Managing Expenses

Managing expenses can be really tough when adulting takes over. I get it… Having to pay your rent, friends gathering, car loan, and many others. Managing expenses can be done by controlling your desire, that is called lifestyle inflation.

The first step to managing lifestyle inflation is tracking your spending habits. You can try using the Money Manager app to track your income and expenses. This way, you would know where all your money is going! Differentiate want is classified as a ‘need’ and ‘want’. Learn to not overkill on spending too much on the things you want and learn to find ways to cut costs on things you need.

Cashback Apps and Credit card

There are plenty of cashback apps and cards out there in the market. Learning how to use them correctly can help you save 1 to 2% on every purchase. Over the long run, if you make most of your purchases on those service platforms instead of cash, you will save more money in the long run.

Don’t take any Debt

If you are bad at controlling your spending, you shouldn’t be taking on any debt. Since you are starting your financial journey, learning how to control your expenses should be the priority.

Spending Bucket

After you get your paycheck, learn to separate your money between needs, wants, and savings. A good rule of thumb is the 50,30,20 rule which is 50% needs, 30% wants, and 20% saves. To retire earlier, the best way is to lower your needs and wants to save and invest more!

Investing Strategy

I am sure you would be flooded by investing news by your peers around you on wanting the next real estate or stock opportunity out there, we get it! Before you even start investing, do some research. If you need to know more about what to invest in, do read up here on what type of investment suits you.

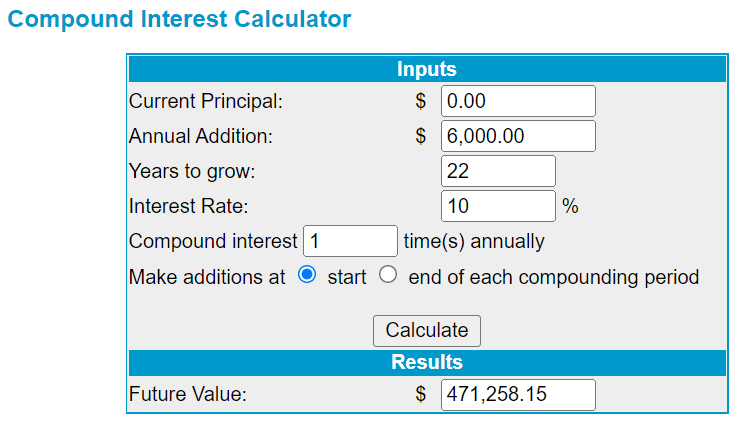

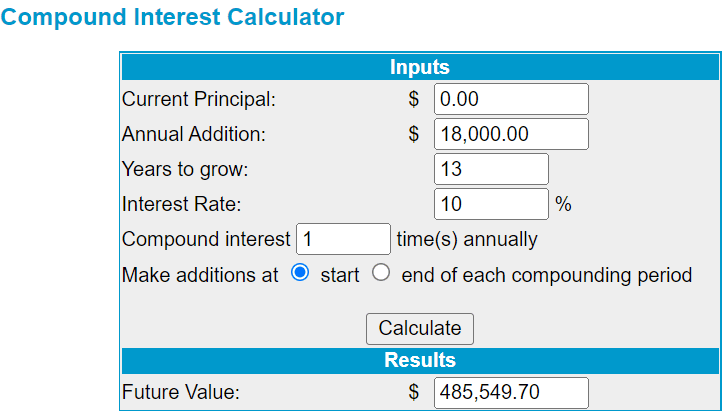

Investing is not complicated, but it does have a lot of noise surrounding it. If aren’t sure what investment you would want to take on, you can start by investing in the US S&P500 index fund. This investment tracks the top 500 companies listed in the US which provide a historic average return of 10% a year. You can start investing using a broker (I use Tiger Broker and MooMoo for my brokerage) or consult your financial consultant for more information.

Retiring with $50 a day

As the heading says, retiring with $50 a day, that’s $1500 a month or $18,000 a year. There are a few formulas to use to know how much you need to get there. First is the FIRE formula, which is the number to retire.

FIRE Amount = 25 years X monthly requirement to leave off of X 12 (12months= 1year) = 25 X $1500 X 12 = $450,000

The FIRE Amount is a formula that assumes you invested in the S&P500 which generates about 10% per annum. So our goal is to achieve $450,000. We will need to find out how much and how long it takes to reach that amount.

The more you invest, the faster you retire. Putting in more effort to invest early while not having any commitment when you are young is really important.

Are You Investing Early for Retirement?

Retiring early is not tough, it is about staying committed to following your goal. A person doesn’t get stronger in 1 gym training session, it takes consistent years of effort for him/her to achieve a level of higher physique.

Unlike training in the gym to get bigger, investing is a lot easier to see results. Compound interest will take over at some point in your investment journey and will be the main push for your investment. As you continue to invest, you can even ease investing as compound interest does all your heavy lifting.