Investing in Singapore real estate as a foreign investor can be a lucrative opportunity, but it’s essential to understand the market and navigate the buying process effectively. Whether you are a Singaporean, PR, or Foreigner, here is a 7-step guide to buying property in Singapore.

Key Takeaways

- Research property listings thoroughly to find the right investment opportunity.

- Engage with reputable real estate agents who have a good understanding of the market.

- Be aware of the legal requirements and restrictions for foreign investors when purchasing real estate in Singapore.

- Understand the property taxes and fees involved in the buying process to avoid any surprises.

- Ensure all necessary steps are completed accurately and timely to secure a successful transaction.

What Makes Singapore Property a Good Investment

Unlike other countries where owning a property means splitting ownership with a local entity, private property in Singapore is a lot less complicated to buy. However, because of the ease of transacting properties, the cost of owning real estate in Singapore can be expensive.

Buying a property in Singapore is considered a luxury status most foreigners already know. A 1 bedder property in the CCR (Core Central Region) can fetch as much as $1.5 million SGD.

In order to afford a private residential unit, buyers will need to earn a minimum of $4,500 per month in order to live that lifestyle. Needless to say, buying private property here is not for everyone.

Even then, the homeownership rating in Singapore is one of the highest in the world where averaging 90% over the last 10 years. Singaporeans believe that owning real estate is the greatest leverage to build resilient wealth.

From Mar 1976 to Dec 2023, Singapore property has grown at an average growth rate of 4.9%. With cooling and easing measures actively in place to prevent a real estate bubble and improve demand as and when needed. Singapore real estate is one of the more consistent investments to consider.

Guide to Buying Property in Singapore

Before diving into the vibrant Singapore real estate market, foreign investors should know several key factors that can influence their investment decisions.

Market trends and economic indicators are crucial in assessing the potential growth and risks associated with real estate investments in Singapore.

- Location: Proximity to business districts, schools, and amenities can significantly impact real estate value.

- Property Type: Residential, commercial, and industrial properties each come with their own set of considerations.

- Regulatory Climate: Understanding the legal landscape, including restrictions on foreign ownership, is essential.

- Financing Options: Explore the availability of loans and mortgages for foreigners.

It’s important to conduct thorough due diligence and consider the long-term implications of your investment. Singapore’s real estate market is competitive, and strategic planning can make a substantial difference in the success of your investment.

Investors love buying a house in Singapore because of its ease of transaction. Generally, you do not need to pay tax or report overseas income received in Singapore, including income deposited into a Singapore bank account.

With ease of transaction, it’s common to find foreigners looking to buy a house in Singapore. However, with Singapore’s latest cooling measure, foreigners looking to buy a residential property will have to pay an additional 30% ABSD (Additional Buyer Stamp Duty).

1) Legal Requirements

Foreign investors interested in Singapore real estate must navigate a series of legal requirements to ensure compliance with local laws.

Ownership restrictions are significant to understand, as they can vary depending on the type of real estate. For instance, foreign individuals and entities are generally not allowed to purchase landed residential properties without the express permission of the Singapore Land Authority.

- Residential property: Approval required for landed homes

- Non-residential property: Generally no restrictions

It is crucial for investors to conduct due diligence and seek legal counsel to avoid potential pitfalls in the purchasing process.

Additionally, foreign investors are subject to the Additional Buyer’s Stamp Duty (ABSD) which varies based on the investor’s nationality and the number of properties owned. The ABSD rates are as follows:

| Property Count | Foreigners | Permanent Residents | Singapore Citizens |

|---|---|---|---|

| First Property | 30% | 5% | 0% |

| Second Property | 30% | 25% | 17% |

| Third and Subsequent Properties | 30% | 30% | 25% |

Understanding these legal nuances is essential for a smooth investment experience in Singapore’s real estate market. Right now, we are facing the heat of cooling measures to slow down the property market, over the next few years, hopefully, ABSD will come down and allow more foreign property buyers in Singapore.

Types of Singapore Property Available to Buy

Singapore properties are broken down into two categories for residential units; they are private and public property.

There are different types of property available in Singapore and foreigners, PR, and Singaporeans are taxed differently. Here’s what you need to know:

| Property Type | Foreigner | Permanent Resident | Singaporean |

|---|---|---|---|

| Condominium | Allowed | Allowed | Allowed |

| Executive Condo | After 10 year from TOP | Allow only new launch with Singaporean | Allowed |

| Landed | Need Government Approval | Allowed | Allowed |

| HDB (BTO & Resale) | Not allowed | Certain Restrictions Involve | Allowed |

| Commercial Property | Allowed | Allowed | Allowed |

If you are looking to buy property in Singapore but don’t know where to look, here are the top 5 emerging areas in Singapore over the next 10 years.

Age Limit and Why it Can Affect Loan Amount

Apart from knowing the type of property to look into, age is another factor to look into when buying property in Singapore for a few reasons.

Firstly, it may affect eligibility for certain housing schemes or grants. For example, some housing programs have age restrictions or specific criteria based on age.

Secondly, age can influence the loan tenure available to the buyer. Banks may consider the borrower’s age in determining the maximum loan tenure. Older individuals might have a shorter loan tenure compared to younger buyers.

Additionally, age could impact the buyer’s financial stability, influencing the loan approval process. Lenders may assess an individual’s income stability over the remaining working years, which can vary with age.

Grants Available [Singaporean & PR Only]

In Singapore, there are various grants available to assist individuals when buying public housing, which is typically provided by the Housing and Development Board (HDB). Here are some key grants:

![Grants Available [Singaporean & PR Only]](https://hustleventuresg.com/wp-content/uploads/2024/02/image-5.png)

These grants aim to make homeownership more accessible and affordable, especially for first-time buyers or families with specific needs. The specific eligibility criteria and grant amounts can vary, so it’s essential to check the latest information from HDB or relevant authorities.

Finding the Right Property in Singapore

With thousands of properties listed on various online platforms, it can be not very clear to find the right property. And for those looking to invest in Singapore without much knowledge about our landscape, it can be pretty daunting.

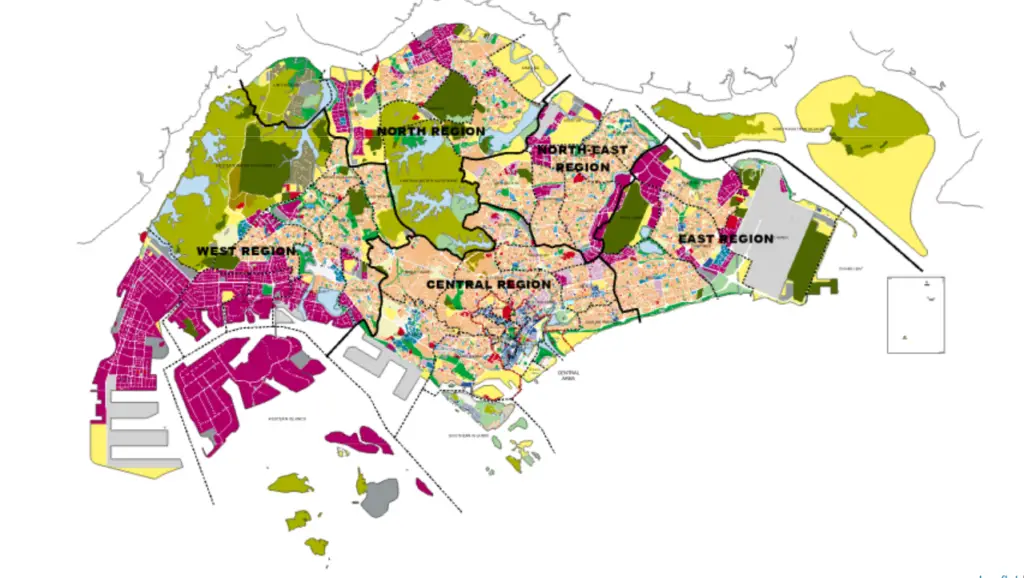

2) Property Landscape

Singapore’s landscape can be broken down into 28 different districts, they can then be further classified under 3 different regions, they are:

- CCR (Core Central Region) – Properties in CCR are typically higher-end, with luxury condominiums, upscale residences, and proximity to key business and entertainment districts. Due to their central location, CCR properties often come with a premium price tag.

- RCR (Rest of Central Region) – RCR properties are a middle ground, offering proximity to central amenities while being relatively more affordable compared to CCR.

- OCR (Outside Central Region) – Properties in OCR are often considered more affordable compared to those in the central regions. They may include suburban areas and towns, providing a mix of residential and commercial spaces.

These 3 regions are a great classification to know when it comes to property prices. Some of these districts are a mix of either of the 3 different regions.

| No. | District | No. | District |

| 1 | Raffles Place, Marina, Cecil, People’s Park | 15 | Joo Chiat, Amber Road, Katong |

| 2 | Anson, Tanjong Pagar | 16 | Bedok, Upper East Coast, Eastwood, Kew Drive |

| 3 | Tiong Bahru, Queenstown | 17 | Changi, Loyang |

| 4 | Telok Blangah, Harbourfront | 18 | Tampines, Pasir Ris |

| 5 | Pasir Panjang, Hong Leong Garden, Clementi New Town | 19 | Punggol, Hougang, Serangoon Gardens |

| 6 | High Street, Beach Road | 20 | Ang Mo Kio, Bishan |

| 7 | Middle Road, Golden Mile | 21 | Upper Bukit Timah, Ulu Pandan, Clementi Park |

| 8 | Little India | 22 | Jurong |

| 9 | Orchard, Cairnhill, River Valley | 23 | Choa Chu Kang, Dairy Farm, Hillview, Bukit Panjang |

| 10 | Ardmore, Bukit Timah, Holland Road, Tanglin | 24 | Lim Chu Kang, Tengah |

| 11 | Watten Estate, Novena, Thomson | 25 | Kranji, Woodgrove |

| 12 | Toa Payoh, Serangoon, Balestier | 26 | Upper Thomson, Springleaf |

| 13 | Macpherson, Bradell | 27 | Sembawang, Yishun |

| 140 | Geylang, Eunos | 280 | Seletar |

Understanding these regions helps buyers and investors navigate the diverse real estate landscape in Singapore based on their preferences, budgets, and lifestyle needs.

3) Researching Property Listings

When delving into the Singapore real estate market, researching property listings is crucial. It’s not just about finding a property that meets your aesthetic preferences or space requirements; it’s about understanding the market trends, average prices, and the locations that offer the best potential for investment growth.

A good example of this is the recent spike in growth in demand for properties in Clementi. With the future development of JLD (Jurong Lake District) and CIL (Cross Island Line) all to be built by 2030, we can expect more growth in the surrounding area.

Before committing to any property, you should familiarize yourself with popular property portals and online marketplaces that showcase various options:

- PropertyGuru: One of the largest and most widely used property portals in Singapore, offering a comprehensive range of residential and commercial property listings.

- 99.co: Another major property portal providing a user-friendly platform with a wide selection of real estate listings, including condos, HDB flats, and landed properties.

- EdgeProp: EdgeProp features property listings, news, and market trends, providing valuable insights for both property seekers and investors.

- SRX Property: SRX Property offers a range of real estate listings and provides tools for real estate valuation and market insights.

- iProperty Singapore: iProperty is part of the iProperty Group, offering a platform for property buyers, sellers, and renters to explore listings and related services.

- STProperty (Straits Times Property): STProperty is affiliated with The Straits Times newspaper and provides property listings along with real estate news and guides.

- OhMyHome: A platform for buyers and sellers to list their property for free

Have a checklist ready! Here’s a simple guide to help you navigate these platforms effectively:

- Identify your preferred real estate and location.

- Set a realistic budget based on current market rates.

- Use advanced search filters to narrow down your options.

- Take note of the amenities and facilities associated with each listing.

- Monitor the listings regularly for price changes or new opportunities.

Remember, the more thorough your research, the better equipped you’ll be to make an informed decision. While online listings provide a good starting point, they should be complemented with on-the-ground research to get a true feel for the investment potential.

4) Engaging with Real Estate Agents

Engaging with a reputable real estate agent can be invaluable when purchasing real estate in Singapore. Agents provide local market expertise, and guidance through the buying process, and can help negotiate the best possible deal on your behalf.

- Understand the agent’s fees: Before committing to an agent, ensure you are clear on their commission structure and any other potential costs.

- Check credentials: Verify that the agent is licensed with the Council for Estate Agencies (CEA) in Singapore.

- Communicate your needs: Clearly outline your investment goals, preferred locations, and type of real estate you are interested in.

Real estate agents in Singapore are well-versed in the nuances of the market and can offer insights that are not immediately apparent to foreign investors. Their network and knowledge can significantly streamline your property search and acquisition process.

Navigating the Buying Process

Now that you have done 99% of the work(hopefully you did😅), your next step is understanding the buying process.

5) Making an Offer

From buyers looking to buy a new launch private property, luck plays a huge role in determining if you can get to draw early. Once you have thrown a cheque, it shows your interest and the week after would be the balloting process. Typically, the early few lucky to get picked would have a higher discount compared to the ones afterward.

If you are looking for a resale property, negotiating the purchase price is a critical phase where having a good real estate agent can be invaluable if you are looking to buy a resale property. They can provide insights into the market value and help you formulate a competitive offer.

- Determine your initial offer based on comparable market analysis.

- Consider any contingencies you may want to include, such as financing or inspection results.

- Communicate your offer formally through a Letter of Intent (LOI) or an Option to Purchase (OTP).

It’s important to be prepared for counter-offers. Stay flexible but know your limits. The negotiation process can be complex, and it’s essential to understand that the first offer is often not the final agreement.

Remember, the offer should also stipulate the amount of the option fee, which is a percentage of the purchase price. This fee reserves the property for you while due diligence is conducted. Here’s a simple breakdown of the fees involved:

| Fee Type | Description | Typical Amount |

|---|---|---|

| Option Fee | Initial fee to secure the property | 1% of purchase price |

| Option Exercise Fee | Additional fee to complete the purchase | 4-9% of purchase price |

Finalizing the offer marks the beginning of the legal process to transfer ownership, so ensure all terms are clear and agreed upon by both parties.

6) Understanding Property Taxes and Fees

When investing in Singapore real estate, it’s crucial to account for the various property taxes and fees that can significantly affect your overall investment. Stamp duties are a primary consideration, with different rates applied to residential and commercial properties.

- Buyer’s Stamp Duty (BSD): Levied on all property purchases, the BSD is calculated based on the purchase price or market value of the property, whichever is higher.

- Additional Buyer’s Stamp Duty (ABSD): Applicable to foreign investors and entities, the ABSD rate varies depending on the buyer’s residency status and the number of properties owned.

- Seller’s Stamp Duty (SSD): Imposed on sellers who dispose of their property within a specified period after purchase, designed to discourage short-term speculative activity.

It is essential to factor in these costs early in the investment process to ensure a clear understanding of the financial commitments involved.

Other fees include legal costs, agent’s commissions, and loan-related charges. While these may seem minor in comparison to the property’s price, they can accumulate to a substantial amount. Always consult with a financial advisor or legal professional to get a detailed breakdown of the applicable taxes and fees for your specific situation.

7) Completing the Transaction

Once you have navigated the complexities of the Singapore real estate market, found your ideal real estate and your offer has been accepted, it’s time to complete the transaction. This final step involves a series of important processes to legally transfer ownership of the property to you, the buyer.

Ensure all necessary documents are in order and signed by both parties. This includes the Sales and Purchase Agreement, which should be reviewed by a legal professional. Payment of the remaining purchase price is typically required at this stage, often through a bank transfer or a cashier’s check.

- Finalize the mortgage arrangements, if applicable.

- Pay the Stamp Duty within 14 days of signing the Sales and Purchase Agreement.

- Register the property transfer with the Singapore Land Authority.

It is crucial to adhere to the timelines specified for each step to avoid any penalties or additional charges. Your real estate agent or lawyer can assist you in ensuring that all procedures are completed efficiently and correctly.

Common FAQs about Buying your first real estate in Singapore

Can foreign investors buy real estate in Singapore?

Yes, foreign investors are allowed to buy real estate in Singapore but are subject to certain restrictions and regulations.

What are the legal requirements for foreign investors buying real estate in Singapore?

Foreign investors need to obtain approval from the Singapore Land Authority before purchasing certain types of properties. They may also need to pay additional stamp duties.

How can I research property listings in Singapore as a foreign investor?

Foreign investors can explore online property platforms, work with real estate agents, and attend real estate exhibitions to find suitable listings.

What factors should foreign investors consider before investing in Singapore real estate?

Foreign investors should consider factors such as location, market trends, rental yields, and potential capital appreciation before making an investment decision.

What are the common property taxes and fees that foreign investors need to be aware of in Singapore?

Foreign investors may need to pay property tax, stamp duties, legal fees, agent commissions, and maintenance fees when purchasing and owning real estate in Singapore.

How long does it typically take to complete a real estate transaction in Singapore as a foreign investor?

The timeline for completing a real estate transaction in Singapore can vary but generally ranges from a few weeks to a few months, depending on factors such as financing arrangements and legal processes.

Tough Luck Finding the right property?

Buying real estate in Singapore as a foreign investor can be a lucrative investment opportunity. If you are looking to buy a property, the best suggestion is to avoid the wait-and-see approach, instead, you should consult your real estate agent or find ways to take actionable steps.

With the right research and guidance, foreign investors can capitalize on the diverse opportunities available in Singapore’s real estate sector.

Aaron Oon is a Senior Associate Director at Propnex and Founder of Real Estate Insider. A consistent Top Producer in the competitive world of real estate, Armed with a Finance degree from NUS, Aaron is more than just a real estate agent; he’s a strategic thinker and a creative problem solver.

If you are looking to invest in a property here in Singapore or would like to know more about Singapore’s property market. Be sure to reach out through the Calendy video link below:

Aaron Oon is a Senior Associate Director at Propnex and Founder of Real Estate Insider. A consistent Top Producer in the competitive world of real estate, Armed with a Finance degree from NUS, Aaron is more than just a real estate agent; he’s a strategic thinker and a creative problem solver.

If you are looking to invest in a property here in Singapore or would like to know more about Singapore’s property market. Be sure to reach out through the Calendy video link below: