Investing in real estate is a significant decision, and here in Singapore, it is the largest asset to many Singaporeans and PRs living here. A 4-room BTO flat can even go as high as $500,000 and a 1-bedroom private condo is asking for over $1 million. In Singapore, real estate investing is 40% of a Singaporean investment portfolio, clearly, we understand the importance of having this investment.

However, prices are climbing rapidly and many individuals often delay their real estate purchases. Whether it’s buying a home or investing in property in hopes that property prices might go lower. But why do people wait, and what’s the psychology behind this delay?

The Wait Game: The Psychology of Real Estate Delays

Over the last few years, we have seen multiple cooling measures added in place to curb the huge influx in demand for property such as an increase in ABSD (Additional Buyer Stamped Duty), lower the LTV (loan to value), and most recently, the new Prime-plus model for HDB.

While many buyers told them that “this and that” cooling measure will slow down the real estate market, the recent stats of property purchases show otherwise.

Even as high-interest rates and economic uncertainty loom markets all around the world, investors are still scooping up potential investment properties. J’den; which recently launched in November 2023 had over 88% of units sold during launch day itself. This highlights the point that the waiting game in property investing isn’t wise, buyers should be allowed time to help capital appreciate their assets.

Why you shouldn’t wait when it comes to real estate investing

There are two ways you can make money from real estate investing; either from capital appreciation (many fall under this) or rental income or both.

Instead of taking on the “wait and see” approach and speculating the market, buyers should be looking out for potential property investments to buy and hold instead. This allows time to grow the asset and at the same time not miss out on market opportunities.

Just think about it, based on research conducted by Seedly, Singapore household networth is revealed in 2022 showing more than 40% of net worth being allocated to public and private housing. Also, Singapore has always had a high real estate ownership with nearly 90% of its residents living in their own homes.

If you are one of those still uncertain about property investing, here are some mental blocks you need to watch out for when it comes to real estate investing and ways you can get around it.

1) Economic Uncertainty

Covid-19 lockdown, inflation skyrocketing, and interest rate hitting an all-time high.

The uncertainty surrounding job security and income stability can make individuals hesitant about making such a significant financial commitment. We all want to make sure our money earned is spent effectively, and having an uncertain economy makes everyone more cautious about where our money is spent.

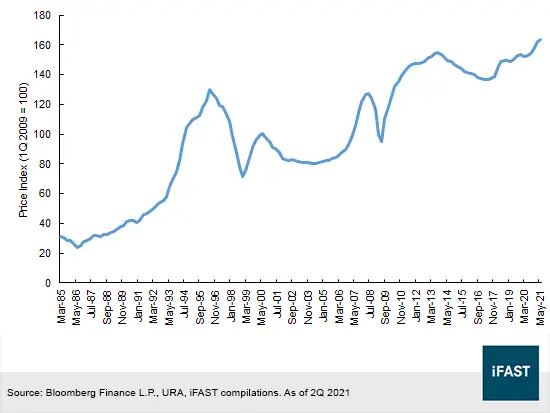

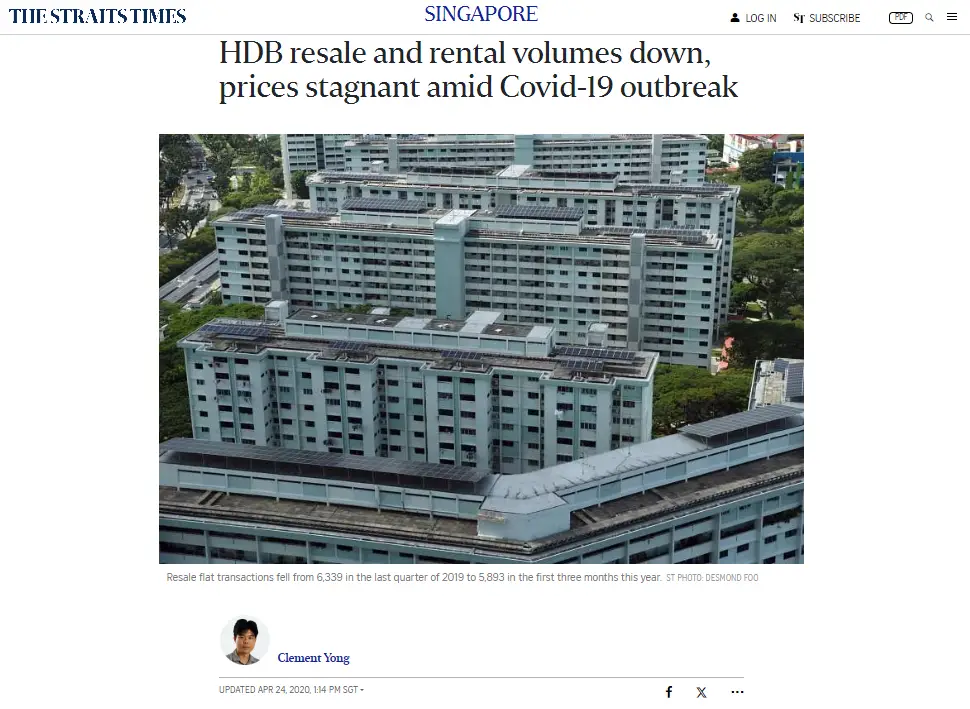

When the Covid-19 pandemic first hit Singapore, I remember everyone thought this was it. The housing market is going to collapse and possibly the whole world. Look where things turn out. Soon after, demand for property picked up and 2020 ~ 2021 was one of the largest real estate market boom, Singapore’s real estate market recorded growth of more than 57% of the total transaction volume; registering sales of USD $2 billion. According to URA flash estimates, Private home prices in Singapore rose by 10.6% in 2021 and 8.4% in 2022 respectively.

Economy uncertainty shouldn’t be your fear factor, in fact, smart investor use them to their advantage!

2) Property Market Trends

Ever follow your investment guru and time the market? How did it go?

Yes, it is true that when it comes to property investing, understanding the entry price psf (per square foot) and potential growth of the area can be a huge market upswing; especially when investors are able to predict or anticipate future plans. Unless you’re someone who keeps track of Singapore’s real estate news on a daily basis, it may take a lot of research in order to jump in on the best deals. However, even if that’s the case, not many will even be willing to take the action needed.

A great example would be Jurong Lake District which is now commonly known as the second CBD (Central business district). Many investors are now betting on the potential Jurong will have in the future. Citing that new developments like J’Den will be a gateway to flourishing property development around the area.

Most buyers that are just starting out real estate investing would have no clue about these changes nor will they buy such properties since the barrier to entry for these investments can be really steep for young couples. Their first step to real estate investing is either BTO or resale HDB.

If you would like to know more what other potential growth happening around the area, be sure to contact Aaron or fill in your contact information here.

Aaron Oon is a Senior Associate Director at Propnex and Founder of Real Estate Insider. A consistent Top Producer in the competitive world of real estate, Armed with a Finance degree from NUS, Aaron is more than just a real estate agent; he’s a strategic thinker and a creative problem solver.

In his company Real Estate Insider, he shares the latest market updates and trends happening in the world and Singapore to keep us within the loop.

3) Fear of Commitment

Okay, so you have saved up enough cash and a boatload in your CPF. But….But… Am I ready?

Many individuals delay their real estate purchases to ensure they are financially prepared. Understandably so, real estate investing is going to probably be one of the largest investment purchases that could span your entire lifetime. The difference between paying for a 3-bedder HDB to a 4-bedder HDB mortgage could go from $300 up to $1,000 extra per month.

Take your time during this process, but at the same time, know who you can seek help from. If you are looking to buy public housing, you can fill up your HFE (HDB flat eligibility) to understand more about what to expect when buying. The best option for you to get instant clarity is to seek your financial advisor or property agent to straighten out your financial commitment.

If you feel that commitment this amount of money is too much and you would like more flexibility in your investment, you can also consider investing in a real estate investment trust or REIT. Unlike investing in a property, REITS allows investors to invest as little as a dollar into the invest, just know that you can’t expect to make more. If you would like to invest in a REIT, you can do online real estate investing through apps such as Syfe REITs+ that provide easy access to REITs.

4) Lack of Clarity

Have you ever had that moment: “Ah I should have done this!”

You are not alone. Property investing can be complicated especially when considering the number of considerations you have to think about. For example, the difference between picking a CPF loan and a bank loan could mean a few percentage differences in interest.

If you don’t have a clear picture of your property investment. Yes, the wisest move you should be doing is to seek clarity.

5) Procrastination

You don’t know what you don’t know unless you ask. That is especially true when it comes to real estate investing.

In real estate investing, there are many factors to consider when buying the property. Most investors will look at location and pricing, others would also consider the layout and even the Feng Shui of the property. Sadly, not everything can come together (if you do, please highly consider getting it).

The best mindset you can have when it comes to real estate investing and avoid the “wait and see” approach is:

- Have a rating system for all the properties you have seen. Rank them based on 1 to 3 with metrics such as location, layout, pricing, etc

- Consult with experts in the field

- Be there on the ground to understand your property better

- Set a checklist of things you need to work on before committing

- Most importantly, set a dateline for yourself to commit to a decision

These steps should help prevent procrastination and force you to take action immediately.

6) External Influences

External factors like family, friends, or societal pressures can lead to delays. It’s easy to be swayed by others’ opinions or expectations.

This is better. No that is better.

Everyone has their own opinion when it comes to real estate investing. It’s important not to blindly follow external influences when it comes to real estate investing in Singapore. External advice may lack a deep understanding of the local market, individual financial situations, and risk tolerances.

Markets are subject to local regulations and short-term fluctuations, and external sources may not have access to all relevant information, potentially leading to incomplete assessments. Emotional decision-making, driven by media hype or speculation, can be detrimental.

Additionally, economic conditions and changing regulations may not be accurately predicted by external influences. To make informed decisions, investors should conduct their own research, consider their unique financial circumstances, and be mindful of local market dynamics, aiming for a personalized and well-thought-out approach to real estate investment.

7) Emotional Attachments

Lastly, emotional attachments to a current residence can lead to delays.

Some of us may not like the idea of buying and selling a property since we do have an emotional connection with our home. I’m sure many of you guys who have bought their first home remembered what it was like. But if you would like to make more money from real estate investing. Sadly, you can only buy a single residential property or you may have to pay an additional 20% for the next property.

There are a few solutions to get over the emotional attachment and get invested, you could:

- Invest in commercial real estate

- Buy REITs

Real estate investing is a big move, and if you would like to make money from real estate investing, you will need to consider your long-term goals to hit your target.

how to get into real estate investing

Economic uncertainty, property market trends, financial preparation, and fear of commitment are just a few factors influencing this decision. We never know what the next 5 to 10 years of the property market will be. But one thing is for sure, the real estate market comes in 4 cycles; recovery, expansion, hypersupply, and recession. However, predicting outcomes may not be the wisest investment strategy.

The key is to stay informed, plan ahead, and not wait for the ‘perfect time’ that may never come.

If you would like to know more what other potential growth happening around the area, be sure to contact Aaron or fill in your contact information here.

Aaron Oon is a Senior Associate Director at Propnex and Founder of Real Estate Insider. A consistent Top Producer in the competitive world of real estate, Armed with a Finance degree from NUS, Aaron is more than just a real estate agent; he’s a strategic thinker and a creative problem solver.

In his company Real Estate Insider, he shares the latest market updates and trends happening in the world and Singapore to keep us within the loop.

FAQs

Can I buy property in Singapore as a foreigner?

Yes, foreigners can buy property in Singapore, but there are some restrictions and additional stamp duties.

What are the common payment methods for property purchases in Singapore?

Common methods include cash, CPF (Central Provident Fund), and bank loans.

Are there tax benefits for real estate buyers in Singapore?

Yes, there are tax benefits like the Additional Buyer’s Stamp Duty (ABSD) and Seller’s Stamp Duty (SSD).

What is the current property market trend in Singapore?

The property market in Singapore has been stable, with opportunities for investors.

Is it better to buy a resale property or a new launch in Singapore?

It depends on your preferences and investment goals. New launches often come with incentives, while resale properties offer immediate occupancy.

What should I look for in a real estate agent in Singapore?

Look for experience, credibility, and a good track record when choosing a real estate agent.

How does a beginner invest in real estate?

For beginners looking to invest in real estate, it’s essential to start with research and education. Understand the market, property types, and investment strategies. Save for a down payment, maintain a good credit score, and consider seeking guidance from real estate professionals or attending workshops. Options include purchasing residential properties, real estate investment trusts (REITs), or crowdfunding platforms.

Is $5,000 enough to invest in real estate in Singapore?

While $5,000 may not be sufficient for traditional property purchases in Singapore, there are alternative options for you to start real-estate investing. Consider investing in real estate investment trusts (REITs) or exploring crowdfunding platforms, which allow investors to pool funds for real estate projects. These options provide exposure to the real estate market with a lower initial investment.. Consider investing in real estate investment trusts (REITs) or exploring crowdfunding platforms, which allow investors to pool funds for real estate projects. These options provide exposure to the real estate market with a lower initial investment.

Is it a good idea to invest in real estate?

Real estate can be a good investment, offering the potential for long-term appreciation, rental income, and portfolio diversification. However, it comes with risks, and market conditions vary. Consider factors such as location, market trends, and personal financial goals. It’s advisable to conduct thorough research, assess risk tolerance, and, if needed, consult with financial advisors.

What are the benefits of investing in real estate?

Investing in real estate offers several potential benefits, including:

Appreciation: Properties may increase in value over time.

Rental Income: Generate income through renting out properties.

Tax Advantages: Enjoy tax benefits, including deductions for mortgage interest and property depreciation.

Portfolio Diversification: Real estate can diversify an investment portfolio.

Control: Investors have more control over real estate compared to some other investments.

How can I invest in real estate online?

Investing in real estate online has become more accessible. Consider the following options:

Real Estate Crowdfunding: Join online platforms that pool funds for real estate projects.

Real Estate Investment Trusts (REITs): Purchase shares of publicly traded REITs on stock exchanges.

Online Real Estate Platforms: Some platforms allow you to buy, sell, or invest in properties entirely online.

Digital Investment Platforms: Explore investment platforms that offer fractional ownership of real estate.