In today’s world, unexpected financial needs can arise at any moment, leaving you in need of quick funds. The advent of $50 loan instant apps offers a convenient and efficient solution to this problem, allowing you to access small loans rapidly, often without the need for a credit check.

Here are the current top 10 loan instant apps available in the US:

- MoneyLion: MoneyLion offers loans ranging from $250 to $5000 with competitive interest rates.

- Cleo: Cleo provides instant cash advances of up to $1000, depending on your financial profile.

- Dave: Dave offers advances of up to $100 without any interest or credit checks.

- Payactiv: Payactiv allows users to access up to 50% of their earned wages in advance, typically up to $500.

- Chime: Chime offers early access to direct deposits, allowing users to get paid up to two days earlier than traditional banks.

- Brigit: Brigit provides advances of up to $250 with no interest or credit checks.

- Earnin: Earnin offers advances of up to $100 per day or up to $500 per pay period, based on the hours you’ve worked.

- DailyPay: DailyPay allows employees to access their earned wages before payday, with the amount depending on their earnings.

- Branch: Branch offers advances of up to $150 per day or up to $500 per pay period, based on your work schedule.

- Albert: Albert offers cash advances of up to $100 without any interest charges or credit checks.

These apps are designed to provide a short-term financial buffer in emergencies, giving you the ability to cover urgent expenses until your next paycheck arrives.

Key Takeaways

- Instant loan apps provide a quick solution for small, short-term financial needs, often without requiring a credit check.

- It’s essential to review the app’s reputation, interest rates, fees, and user experience before choosing one to ensure reliability and affordability.

- Understanding the repayment terms is crucial; look for apps with flexible repayment options and minimal late payment penalties.

- Privacy and security are paramount; only use apps with strong privacy policies and data protection measures to safeguard your personal information.

- In emergency situations, a $50 loan instant app can be a valuable resource, but it’s important to select the right app that aligns with your immediate financial needs and capacity.

10 Best $50 Loan Instant Apps

1) MoneyLion

MoneyLion is a financial technology company that offers various financial products and services, including loans, credit monitoring, investment accounts, and more.

Their loans typically range from $250 to $5000 with competitive interest rates. MoneyLion’s loan application process is fast and straightforward, often providing instant decisions and quick access to funds.

2) Cleo

Cleo is a financial app that offers instant cash advances of up to $1000, depending on your financial profile.

The app analyzes your spending habits and financial situation to determine your eligibility for a cash advance. Cleo does not require a credit check for its cash advances and aims to provide users with quick access to funds when needed.

3) Dave

Dave is a financial app that offers advances of up to $100 without any interest or credit checks. It works by analyzing your spending patterns and paycheck schedule to predict when you may run short on funds.

Dave aims to provide users with a convenient and affordable way to access small amounts of cash to cover unexpected expenses or bridge the gap until their next paycheck.

4) Payactiv

Payactiv is a financial app that allows users to access up to 50% of their earned wages in advance, typically up to $500.

It aims to help users avoid costly overdraft fees, late bill payments, and high-interest payday loans by providing an affordable and convenient alternative for accessing their earned wages before payday. Payactiv integrates with employers’ payroll systems to provide employees with instant access to their wages.

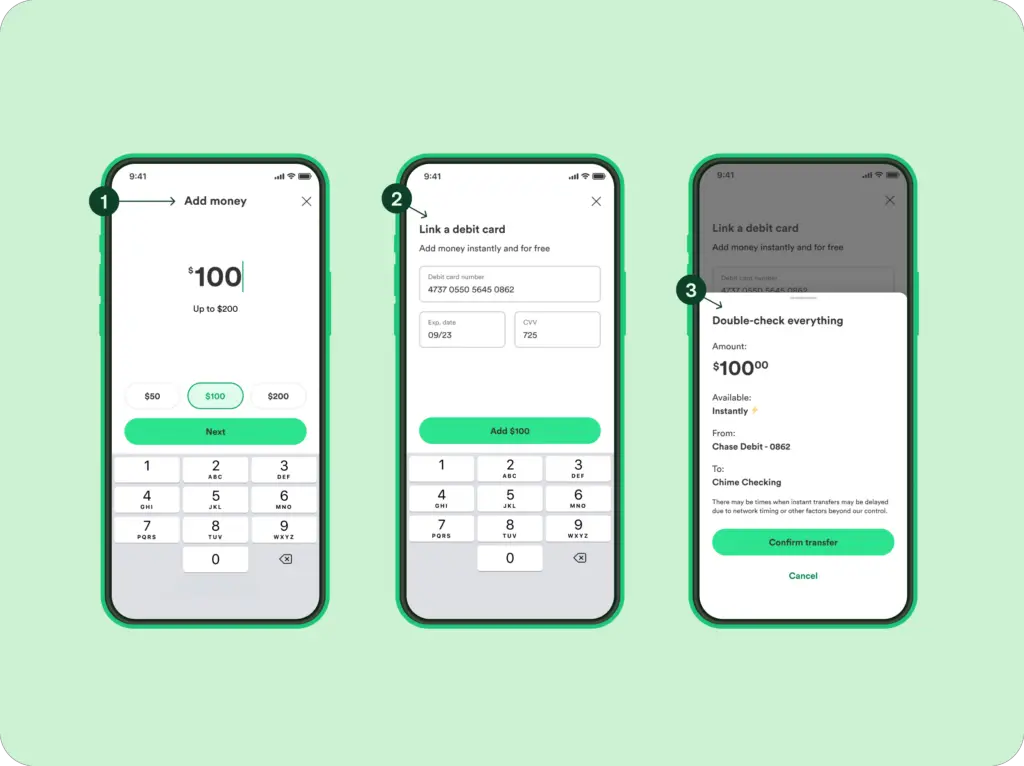

5) Chime

Chime is not primarily an instant loan app; instead, it’s a mobile banking platform that offers early access to direct deposits.

Users can receive their paychecks up to two days earlier than traditional banks, allowing them to access their funds sooner to cover expenses or emergencies. Chime does not charge overdraft fees, monthly fees, or require a minimum balance, making it an attractive option for those seeking a more flexible and affordable banking experience. However, Chime itself does not offer loans or cash advances directly.

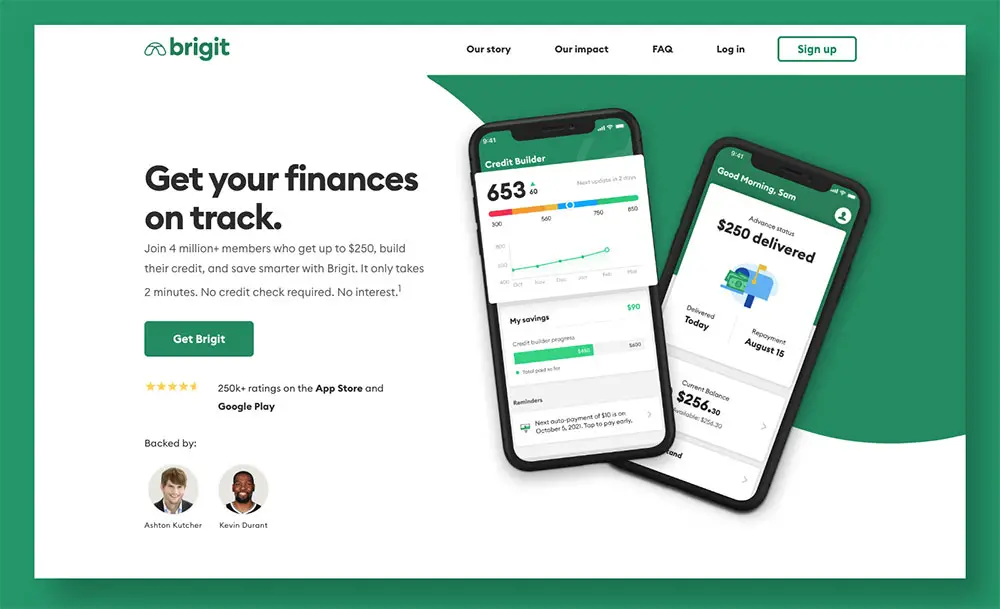

6) Brigit

Brigit is a financial app that provides instant cash advances of up to $250 with no interest or credit checks.

It analyzes your spending habits and financial situation to predict when you may need extra funds and offers advances to help you avoid overdraft fees and late payments. Brigit aims to provide users with a convenient and affordable way to access short-term cash when needed, with transparent fees and flexible repayment options.

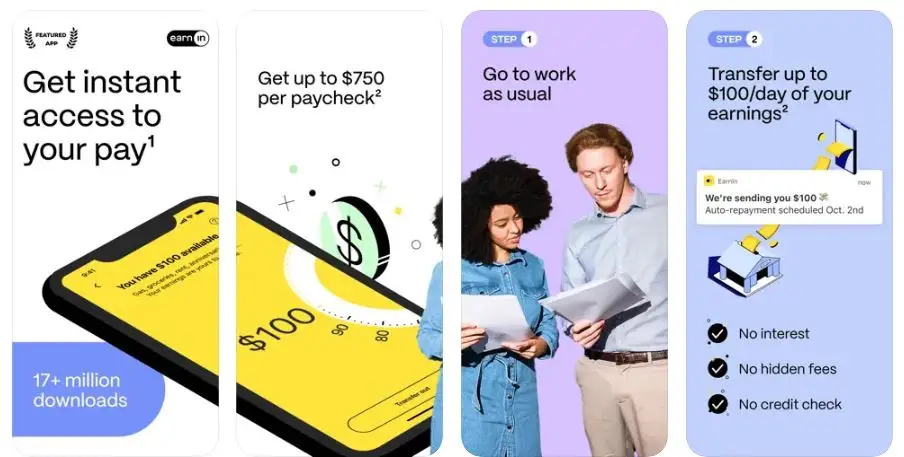

7) Earnin

Earnin is a financial app that allows users to access their earned wages before payday. It enables employees to withdraw up to $100 per day or up to $500 per pay period, based on the hours they’ve worked.

Earnin does not charge fees or interest on the amounts withdrawn but instead offers users the option to tip for the service. It integrates with users’ employment and banking information to verify earnings and facilitate quick and convenient access to funds. Earnin aims to provide users with greater financial flexibility and stability by allowing them to access their earned wages when needed.

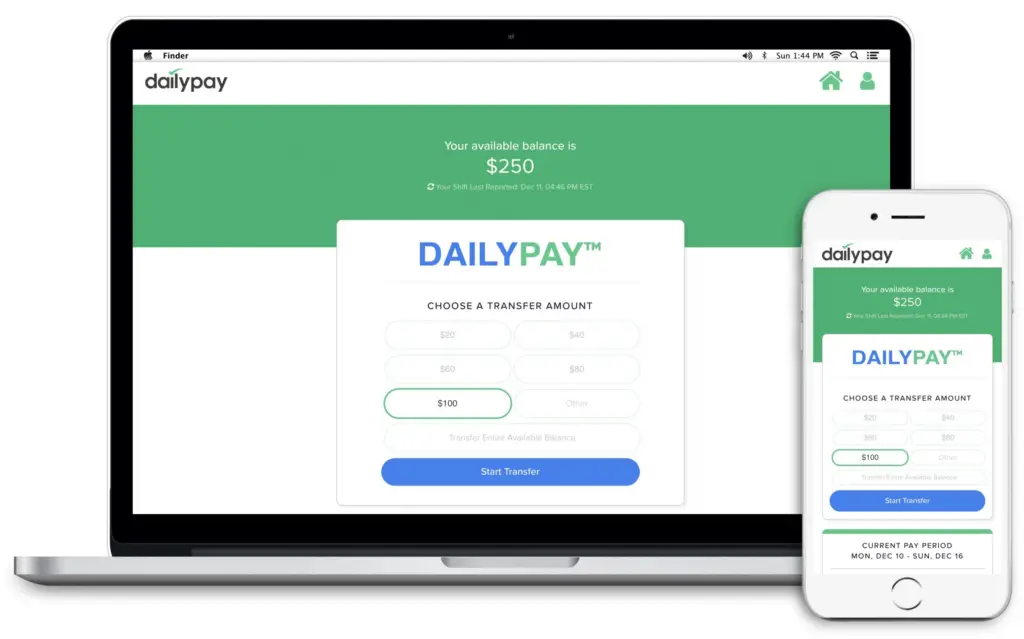

8) DailyPay

DailyPay is a financial service that allows employees to access their earned wages before payday. It partners with employers to offer employees the option to receive their earned wages on-demand, typically through a mobile app.

DailyPay aims to provide employees with greater financial flexibility by allowing them to access their earnings as they accrue, rather than having to wait until their scheduled payday. However, it’s important to note that DailyPay is not a loan app; it simply provides early access to earned wages.

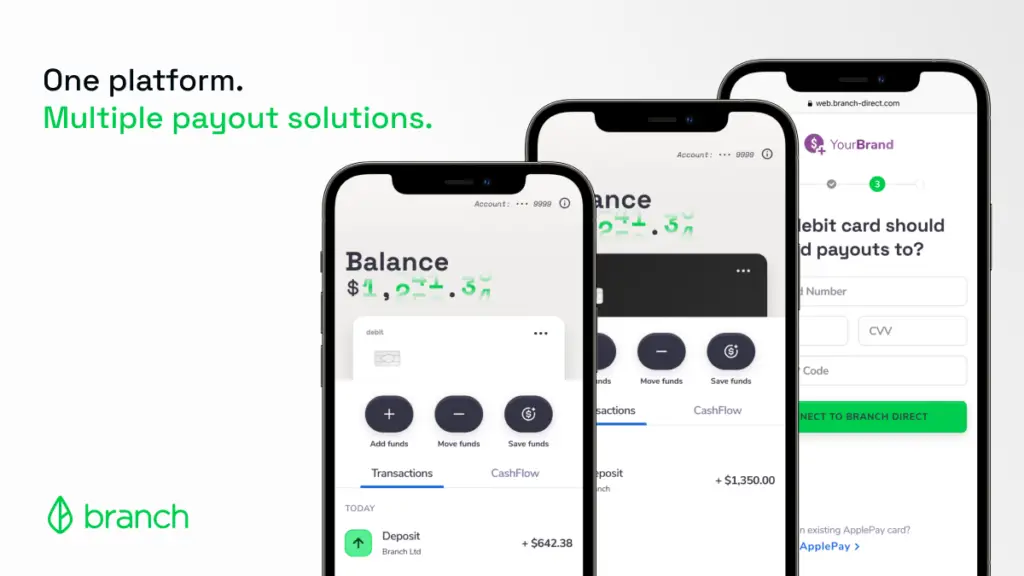

9) Branch

Branch is a financial app that provides instant cash advances to users based on their work schedule and earnings. Users can typically access advances of up to $150 per day or up to $500 per pay period.

Branch aims to help users bridge the gap between paychecks and cover unexpected expenses without resorting to high-interest payday loans or overdraft fees. The app analyzes users’ employment and banking information to determine eligibility for advances and offers transparent fees and flexible repayment options.

10) Albert

Albert is a financial app that offers instant cash advances of up to $100 without any interest charges or credit checks. The app analyzes users’ financial behavior and income to determine eligibility for advances.

Albert aims to provide users with a convenient and affordable way to access small amounts of cash to cover unexpected expenses or emergencies. However, it’s important to note that Albert is not primarily a loan app; it focuses on helping users improve their financial health through budgeting, saving, and managing expenses.

Looking to start investing, why not try Tiger Broker?

Tiger Brokers offers competitive commission fees for trades across different markets.

It is also practically fee-less in these aspects: no custody fees, deposit (or withdrawal) fees, currency exchange fees, inactivity fees, or account maintenance fees to contend with!

the Basics of $50 Loan Instant Apps

What Are $50 Loan Instant Apps?

$50 loan instant apps are digital platforms that offer small, short-term loans to individuals in need of quick financial assistance. These apps are designed to provide a streamlined borrowing experience, allowing users to obtain a loan with minimal paperwork and often without a traditional credit check. The process is typically fast, with funds being deposited directly into the user’s bank account.

- Repayment Terms: It’s crucial to understand the repayment terms, including the duration, flexibility in repayment dates, and any penalties for late payments.

- Privacy and Security: Ensuring the app has robust privacy policies and security measures is essential to protect your personal and financial information.

When faced with unexpected expenses or short-term financial gaps, a $50 loan instant app can be a convenient solution. These apps can bridge the gap until your next payday, helping you avoid overdraft fees or late payment penalties.

How Do These Apps Work?

Instant loan apps provide a streamlined process for obtaining a small cash advance, typically around $50, which can be a lifesaver in times of financial strain. Users simply download the app, create an account, and link their bank account to get started. The app then evaluates the user’s financial situation, often considering factors like income stability and banking history, to determine eligibility for the loan.

Once approved, the funds are usually deposited directly into the user’s bank account. The entire process is designed to be quick and hassle-free, with some apps offering funds in as little as a few minutes. Here’s a general outline of the steps involved:

- Download the app and sign up

- Link your bank account

- Request a loan

- Get approval

- Receive funds

It’s important to note that while these apps offer convenience, they also come with responsibilities. Users must ensure they understand the terms of the loan, including repayment schedules and any associated fees or interest rates.

Benefits of Using Instant Loan Apps

Instant loan apps have revolutionized the way we access small loans, offering a plethora of advantages over traditional lending methods. Quick and convenient access to funds is perhaps the most significant benefit, as these apps provide instant loan approval, often without the lengthy wait times associated with conventional loans. Users can enjoy flexible loan tenure and transparent fees, ensuring they can tailor the loan to suit their individual needs.

Another key advantage is the ability to track transactions and monitor loan status in real-time. This feature allows borrowers to stay informed about their loan applications and repayment schedules, fostering a sense of control and financial responsibility. Moreover, the security of personal data is a top priority for these apps, giving users peace of mind that their sensitive information is protected.

Instant loan apps are not just about quick cash; they also serve as a gateway to better financial management. Many apps come equipped with tools that help users track expenses, budget effectively, and optimize investments.

Lastly, for those concerned about credit history, many instant loan apps offer services to individuals with poor or no credit, making them an inclusive option for a wide range of borrowers.

How to Pick a good Loan Instant Apps

Reputation and Reliability

When choosing a $50 loan instant app, reputation and reliability are paramount. It’s essential to select an app that has garnered positive feedback from users and exhibits a strong track record of customer satisfaction. To assess an app’s reputation, consider reading customer service reviews on platforms like Trustpilot, where real users share their experiences.

- Read Customer Service Reviews of grid.app – Trustpilot

- Guide to securing the right car loan

- Safety Concerns with Instant Loan Apps

- Beware of predatory fin(tech)

Remember, a reputable app not only provides financial services but also ensures a high level of customer support and transparent communication. This can be a good indicator of the app’s reliability and commitment to serving its users effectively.

Before making a decision, it’s also wise to compare the app’s offerings with other financial products in the market. Check for any promotional offers such as no-interest or fee-free first loans, and be wary of apps that may have hidden fees or unusually high interest rates. The goal is to find an app that balances cost-effectiveness with dependable service.

Interest Rates and Fees

When considering a $50 loan instant app, it’s crucial to understand the interest rates and fees involved, as they directly affect the cost of borrowing. Interest rates can vary widely based on factors such as your credit score and the lender’s policies. Additionally, fees are often charged for services like loan origination, ATM usage, and late payments. Here’s a quick breakdown of common costs associated with these apps:

- Origination fees for processing applications

- ATM withdrawal and usage fees

- Late payment fees for missed deadlines

- Prepayment fees for early loan payoff

- Annual Percentage Rate (APR), which includes all costs of borrowing

Remember, the APR reflects the true cost of your loan, combining both interest and fees. It’s essential to compare APRs from different lenders to find the most cost-effective option.

Some apps may offer lower fees but compensate with higher interest rates, or vice versa. For instance, the B9 Banking App provides loans ranging from $30 to $500, with the average advance for Basic and Premium plans being $82 and $267, respectively, as of December 2023. Always evaluate the trade-off between lower fees and higher interest rates to ensure you’re getting the best overall value for your needs.

User Experience and App Functionality

When choosing a $50 loan instant app, the user experience and app functionality play a crucial role in ensuring a smooth and hassle-free process. Ease of use and intuitive design are paramount, as they allow users to navigate the app without confusion, making the borrowing experience straightforward and efficient.

Features that enhance the user experience include fast funding options, the ability to borrow less than the approved amount, and positive customer ratings. Apps that offer additional financial tools, such as budgeting and saving features, can provide long-term value beyond the immediate loan.

Customer support is another vital aspect of the user experience. A reliable $50 loan instant app should offer comprehensive support through various channels, including chat, email, or phone, ensuring that any queries or issues are promptly addressed.

Here’s a quick checklist to consider for app functionality:

- Fast and fee-free funding

- Flexible borrowing amounts

- High customer ratings

- Budgeting and saving tools

- Multiple customer support channels

The right app not only meets immediate financial needs but also supports better financial habits and management.

Repayment Terms & Conditions

Repayment Duration and Flexibility

When considering a $50 loan instant app, the repayment duration and flexibility are crucial factors that can significantly impact your financial planning. A flexible repayment schedule can give you the peace of mind that comes with knowing your loan payments are manageable, which can free up some of your budget for other expenses or savings.

It’s important to understand that while longer repayment terms may offer smaller monthly payments, they could also result in higher overall interest costs. Conversely, shorter repayment periods typically mean larger monthly payments but lower total interest.

Here are some key points to consider when evaluating repayment options:

- Assess your financial situation to determine how much flexibility you have in your budget.

- Understand the terms of repayment, including any potential late payment penalties.

- Consider the trade-offs between longer repayment terms and the total cost of the loan.

Remember, the right choice on your loan repayment timeline will vary depending on your individual financial circumstances.

Understanding Late Payment Penalties

When you’re strapped for cash, a $50 loan instant app can be a lifesaver, but it’s crucial to be aware of the potential pitfalls. Late payment penalties are one such pitfall that can quickly escalate the cost of borrowing. These fees are charged when a payment deadline is missed, and they can vary significantly between lenders. It’s essential to read the terms and conditions carefully to understand the fees you might incur.

For instance, some apps may charge a flat late fee, while others might impose additional interest charges. Here’s a quick breakdown of typical late payment fees you might encounter:

- Flat late fee: $5 – $20

- Additional interest: Varies by lender

Remember, these penalties are in addition to the amount you already owe, so it’s in your best interest to prioritize repayment to avoid any extra charges.

Comparing lenders is key to finding the most favorable terms. Look for apps with transparent fee structures and consider those that offer grace periods or flexible repayment options to accommodate unexpected financial hiccups.

Aligning Repayment Terms with Your Financial Capacity

When considering a $50 loan instant app, it’s crucial to align the repayment terms with your financial capacity. This means conducting a thorough analysis of your income sources, expenses, and existing debt obligations. By comparing your cash inflows and outflows, you can gauge your ability to meet the loan’s obligations without overextending yourself.

- Calculate your current income and expenses to determine your net cash flow.

- Consider the loan’s interest rates and fees, and how they fit into your budget.

- Assess the flexibility of the repayment schedule and whether it accommodates unforeseen financial hiccups.

Ensuring that the loan repayment terms are manageable within your budget will prevent financial strain and potential penalties associated with late payments. Remember, debt can be a powerful tool if used wisely, but it’s essential to differentiate between good and bad debt.

Lastly, be mindful of the importance of a strong repayment capacity. A borrower with a robust repayment capacity is more likely to secure a loan on favorable terms, such as lower interest rates and longer repayment periods. This proactive approach to managing your finances will contribute to a healthier financial future.

Privacy and Security with Loan Apps

The Importance of Robust Privacy Policies

When considering a $50 loan instant app, the privacy policy is a cornerstone of your security. It’s not just about the app’s ability to keep your data safe; it’s about their commitment to your privacy rights. A robust privacy policy should clearly outline how your data is collected, used, and protected. This includes compliance with regulations like the Singapore Personal Data Protection Act (PDPA) for users in that region.

The privacy policy is your assurance that the app respects your personal information and uses it appropriately.

Understanding the privacy policy is crucial, especially in light of recent scams involving fake loan apps that demand excessive permissions. These apps may refuse to process loans if permissions are not granted, putting your personal data at risk. Always ensure that the app provides encryption and the option to delete your data if necessary. Here are some key points to consider:

- Data collection and sharing: What personal information is collected and with whom is it shared?

- Data protection: Is your data encrypted in transit and at rest?

- User rights: Can you request data deletion or opt out of data sharing?

Remember, a transparent and user-friendly privacy policy is indicative of a trustworthy app.

Security Measures to Protect Your Data

When it comes to securing your personal and financial information, loan instant apps must employ rigorous security measures. These measures are designed to safeguard your data from unauthorized access and cyber threats. A robust security framework typically includes multiple layers of protection, such as encryption of data in transit and at rest, regular security audits, and the implementation of user data protection tools.

- Encryption: Ensures that your data is unreadable to unauthorized parties.

- Security Audits: Regular checks to identify and rectify potential vulnerabilities.

- User Data Protection Tools: Additional software to further secure your data.

It is crucial for users to verify that the loan app they choose has implemented these security features effectively. This not only protects your personal information but also provides peace of mind when engaging in financial transactions.

Always look for apps that are transparent about their security practices and offer clear information on how they handle and protect user data. This includes whether they share data with third parties and the types of data collected. Remember, your financial security is paramount, and every measure taken to protect your data contributes to a safer online financial experience.

What to Look for in a Secure Loan App

When selecting a $50 loan instant app, security should be your top priority. Ensure the app employs robust encryption to safeguard your personal and financial data. Here are key features to consider:

- Encryption and Data Protection: The app should use industry-standard encryption methods to protect your information during transmission and storage.

- Privacy Policy: A clear and comprehensive privacy policy should detail how your data is used and shared.

- Secure Authentication: Look for apps that require strong authentication methods, such as biometrics or two-factor authentication, to prevent unauthorized access.

- Regular Security Audits: Opt for apps that undergo regular security audits to ensure continuous protection against threats.

It’s essential to choose an app that not only meets your immediate financial needs but also prioritizes the security of your sensitive information.

Additionally, consider the app’s reputation for customer support and the speed of its approval process. A swift and supportive service can be a lifeline in emergencies. Always read and understand the terms before applying, and prepare necessary documentation to facilitate a quick approval.

Accessing Funds When You Need Them Most

In the face of unforeseen expenses, $50 loan instant apps offer a lifeline, providing rapid access to cash for those critical moments when waiting is not an option. Whether it’s a medical emergency, an unexpected car repair, or a last-minute bill, these apps can be a convenient solution to bridge the gap until your next paycheck.

- Emergency Situations: When time is of the essence, instant loan apps can be the quickest route to obtaining funds.

- Quick Cash Solutions: With streamlined application processes, users can receive funds directly to their bank accounts, often within minutes.

The simplicity of these apps means that during stressful times, financial relief is just a few taps away, without the need for complex paperwork or lengthy approval times.

The Process of Getting a $50 Loan Instantly

Obtaining a $50 loan through an instant app is a straightforward process designed for speed and convenience. First, you’ll need to download the app of your choice from a reputable provider. Once installed, you’ll typically go through a quick registration process, providing necessary personal and financial information.

Next, you’ll enter the amount you wish to borrow – in this case, $50 – and submit your loan request. The app will then perform a rapid assessment, often bypassing traditional credit checks, to determine your eligibility. Upon approval, the funds are usually deposited directly into your bank account, sometimes within minutes.

It’s essential to review the terms and conditions carefully before accepting the loan to ensure you understand the repayment schedule and any associated fees.

Finally, make sure to repay the loan according to the agreed terms to avoid any late payment penalties and to maintain a good standing with the loan provider.

Choosing the Right App for Immediate Financial Needs

When the need for a quick $50 arises, selecting the right instant loan app can be crucial. Consider the app’s reputation and user reviews to ensure reliability. Look for apps that offer clear terms and conditions, and prioritize those with no hidden fees or high-interest rates.

These apps have been highlighted by users for their efficiency in providing short-term loans. It’s important to choose an app that aligns with your financial situation, especially if you’re dealing with an emergency.

Remember, the best app for you is one that offers the flexibility and terms that fit your immediate financial needs without compromising your future financial health.

$50 Loan Instant Apps: You Got It?

In the quest for financial relief, $50 loan instant apps emerge as a beacon of hope for those facing monetary constraints. These apps offer a swift and accessible means to secure a small loan, bypassing traditional credit checks and bureaucratic hurdles. With the information provided, individuals can make informed decisions, ensuring they select an app that offers favorable repayment terms, prioritizes privacy and security, and stands out for its reputation and reliability.

It’s essential to weigh the interest rates and fees, as they can vary significantly among different apps. Ultimately, these innovative platforms can provide a much-needed financial lifeline, enabling users to navigate through unexpected expenses with ease and confidence.

Looking to start investing, why not try Tiger Broker?

Tiger Brokers offers competitive commission fees for trades across different markets.

It is also practically fee-less in these aspects: no custody fees, deposit (or withdrawal) fees, currency exchange fees, inactivity fees, or account maintenance fees to contend with!

Frequently Asked Questions

What are $50 loan instant apps?

$50 loan instant apps are mobile applications that offer small, short-term loans, typically around $50, to individuals who need quick cash for emergencies or unexpected expenses. They usually have a straightforward application process and can provide funds directly to your bank account or debit card without a credit check.

How do $50 loan instant apps work?

These apps allow you to apply for a loan through your smartphone. After providing some personal and financial information, the app will determine your eligibility. If approved, the loan amount is deposited into your bank account, sometimes within minutes, and you’ll be required to repay it by a specified date, often by your next payday.

What should I consider when choosing a $50 loan instant app?

When selecting an instant loan app, consider its reputation and reliability, interest rates and fees, and whether the repayment terms match your financial ability. It’s also important to ensure the app has robust privacy policies and security measures to protect your personal and financial data.

Can I get a $50 loan instantly with poor credit?

Yes, many $50 loan instant apps do not require a credit check, making them accessible even to individuals with poor credit. These apps focus on your current financial situation rather than your credit history to determine eligibility for a loan.

Are there any risks associated with using a $50 loan instant app?

As with any financial product, there are risks. These include high-interest rates and fees, the potential for getting into a cycle of debt, and the possibility of data breaches. It’s important to read the terms and conditions carefully and only borrow what you can afford to repay on time.

What happens if I can’t repay my $50 loan on time?

Failing to repay your loan on time can result in additional fees and interest charges. Some apps offer flexibility in repayment dates, but it’s crucial to understand the late payment penalties before taking out a loan. Always try to align repayment terms with your financial capacity to avoid any negative consequences.