For first-time homebuyers looking to buy a BTO flat, it can be complicated. We manage to break down a total of 10 steps before you can take on the next stage of adulting. If this is your first time applying for a BTO, you may find the process tedious and challenging especially having to meet certain timelines or risk losing your OTP which could be worth anywhere from $1 up to $1,000.😱

Since 9 May 2023, HDB announced that they will replace the HLE (HDB Loan Eligibility) with the HFE (HDB flat eligibility) which aims to provide homebuyers with a more holistic view of their options beyond financing. This has made the process of buying/selling public housing a lot easier but at the same time requires more checks in between.

Fret not! Here’s what you should take note of!

What is the meaning of BTO flat?

A BTO (Build-To-Order) flat is a housing option offered by Singapore’s Housing and Development Board (HDB), specifically designed for eligible buyers, typically first-time homeowners. These flats are a crucial component of Singapore’s public housing program, providing affordable and quality housing for the majority of the population.

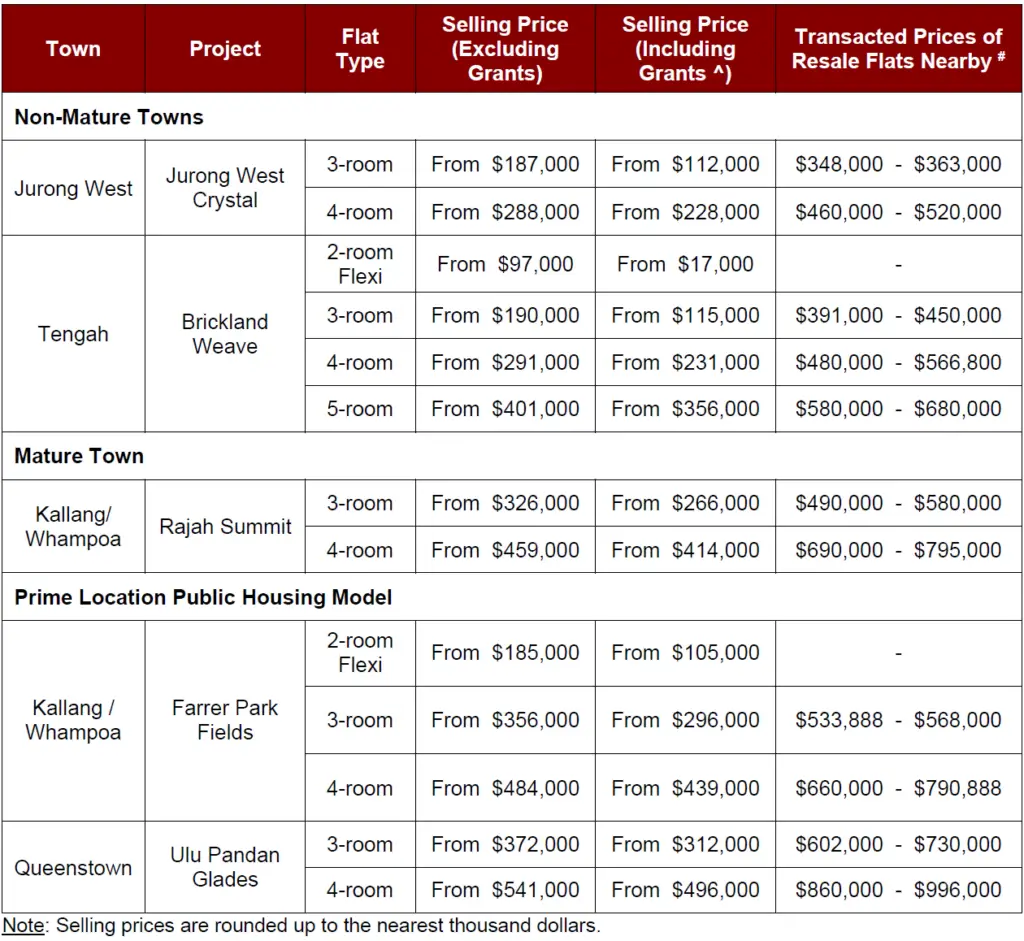

Prices of New BTO

The HDB BTO flat prices can range anywhere from $97,000 for a 2-room flexi in Tengah Brickland Weave up to $996,000 for a 4-room in the Queenstown area. Prices of the new BTO are expected to cool off as the new Prime Plus model will be introduced in Q2 2024 and will significantly reduce the lottery effect for BTO applicants.

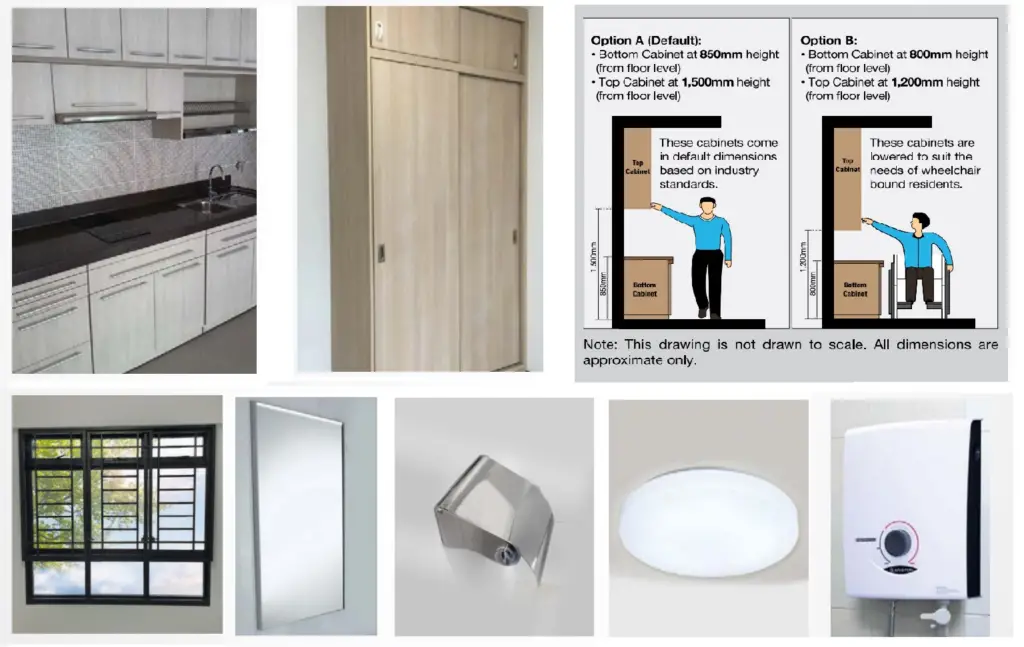

What is included in the BTO flat?

A BTO (Build-To-Order) flat typically includes the basic elements needed for a functional and livable home. The specific features may vary, but here are common inclusions:

- Rooms and Living Spaces: Comes with various room configurations, including bedrooms, living rooms, kitchens, and bathrooms, designed to accommodate different family sizes.

- Basic Fixtures and Fittings: The flat is equipped with basic fixtures such as lighting points, power sockets, switches, and bathroom fittings. These may include a sink, toilet, shower, and basic lighting.

- Flooring: Basic flooring materials are provided, covering areas like living spaces, bedrooms, and bathrooms. The type of flooring can vary and may include tiles, laminate, or other materials.

- Doors and Windows: The flat comes with doors for bedrooms, bathrooms, and the main entrance. Windows are typically provided for ventilation and natural light.

- Kitchen Fixtures: Include a basic kitchen setup with essential fixtures such as a sink and countertop. Some flats may come with built-in cabinets or storage spaces.

- Utility Services: Units are connected to utility services such as water, electricity, and gas (if applicable). These services are essential for daily living.

- Paintwork: The flat is usually painted with a basic coat of paint. Residents may have the option to customize or repaint the walls according to their preferences after taking possession.

- HDB Warranty: HDB flats often come with a warranty period during which any defects or issues arising from construction are addressed by the Housing and Development Board.

It’s important to note that while the necessities are provided, residents often have the flexibility to customize and furnish their flats according to their preferences.

Step-By-Step Guide to Buying an HDB BTO Flat in Singapore

Buying your first BTO is a huge financial commitment. The excitement to have a couple of photos taken at the HDB hub is both exciting and scary for most Singaporean young adult taking their first step into adulting.

In case you need a step-by-step guide to understand the process to obtain your BTO. Here is an infographic timeline to help you understand what you will need to do to purchase a BTO:

Now we understand that sometimes readers would prefer more content to gain clarity and would like a full breakdown of what you will need to follow:

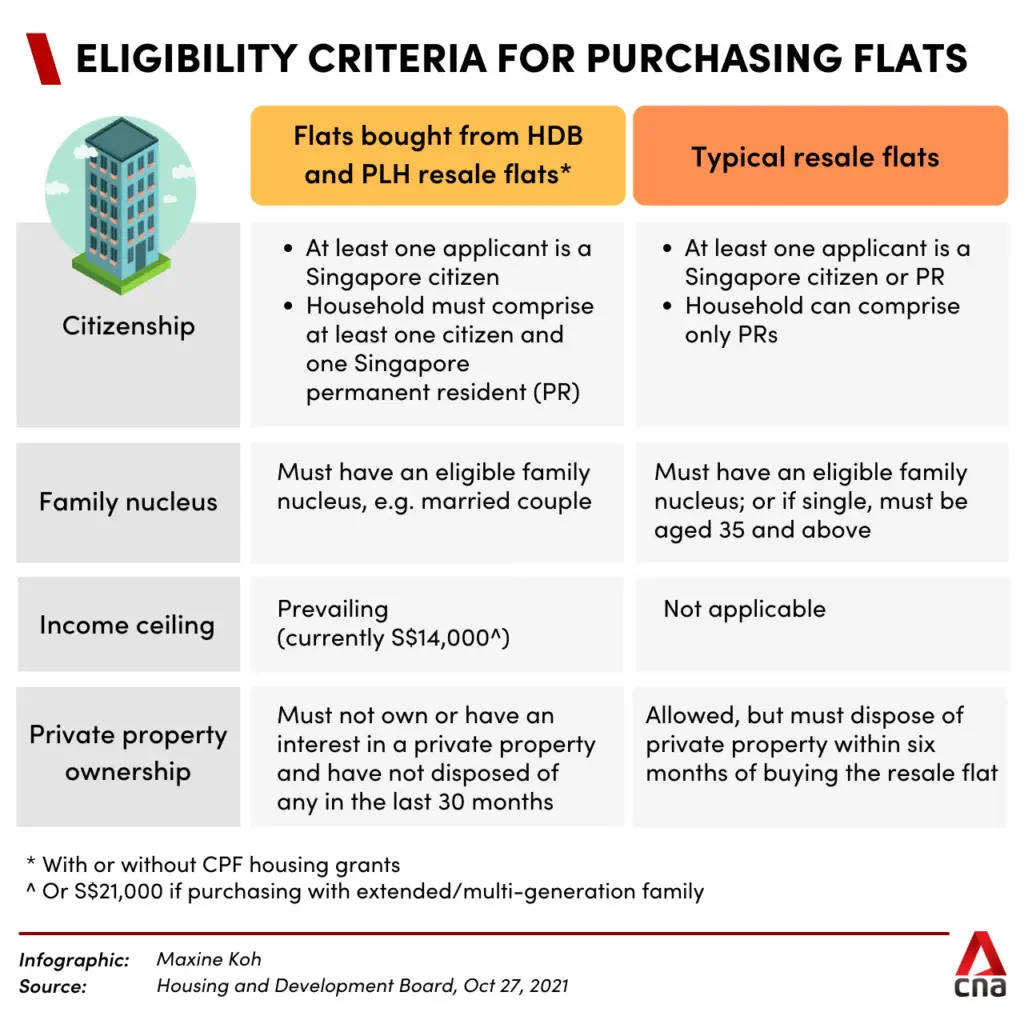

1. Eligibility for HDB BTO

The eligibility rules for HDB (Housing and Development Board) flats in Singapore are designed to ensure that public housing is allocated to those who need it and to promote stable and harmonious communities.

Here are the key rules:

- Citizenship:

- At least one applicant must be a Singapore citizen or a Singapore Permanent Resident (PR).

- Family Nucleus:

- Applicants must form a family nucleus to be eligible. This can include spouses, parents, and children.

- Age Requirements:

- There is a minimum age requirement for applicants. Generally, singles must be at least 35 years old to buy a flat directly from HDB. There are exceptions for certain schemes.

- Income Ceilings:

- Eligibility is subject to income ceilings, which vary based on the type of flat and the composition of the household. The income ceiling is the maximum gross monthly income a household can have to qualify for public housing.

- Ownership of Private Property:

- HDB flat buyers must not own or have disposed of any private residential property within 30 months before the date of application.

- Ownership of HDB Flat:

- Current HDB flat owners or essential occupiers must have fulfilled the Minimum Occupation Period (MOP) before they can apply for a new flat.

- Non-Ownership of Other Property:

- Applicants and essential occupiers must not own any other property locally or overseas.

- CPF Contribution:

- Applicants must be contributing members of the Central Provident Fund (CPF) and have sufficient CPF savings to pay for the downpayment and other costs.

- Completion of Debarment Period:

- Individuals who have previously enjoyed housing subsidies or CPF housing grants are subject to a debarment period before they can apply for another subsidized flat.

- MOP for Resale Flats:

- If an applicant is buying a resale flat, there is a Minimum Occupation Period (MOP) during which they must live in the flat before they are eligible to sell it or buy another HDB flat.

Please be aware that these regulations apply to all individuals and must be observed diligently before committing to purchase a BTO.

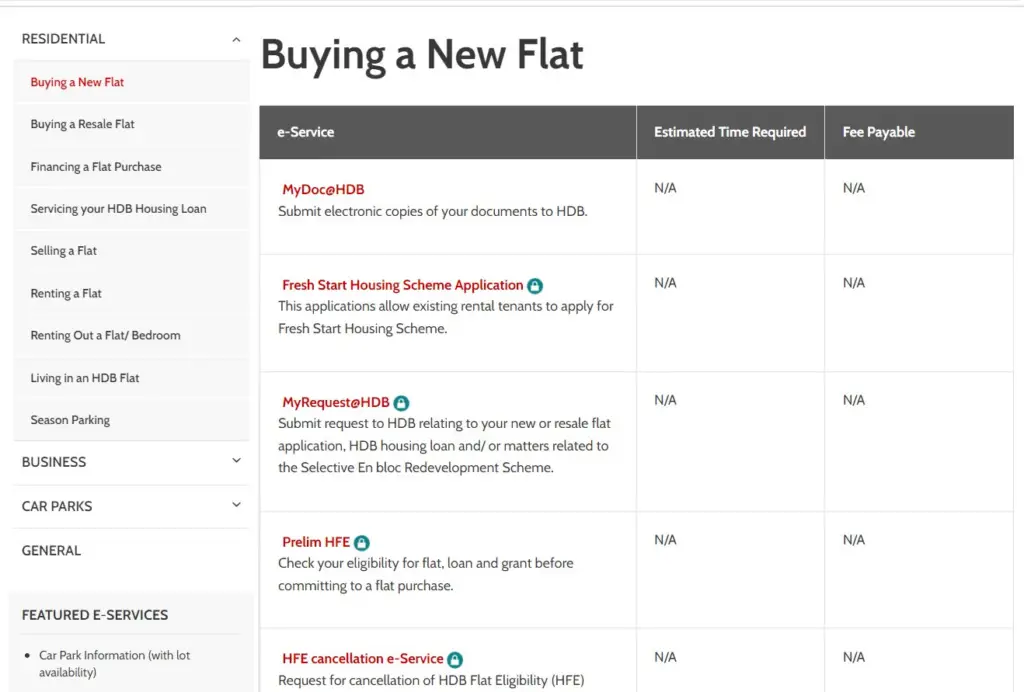

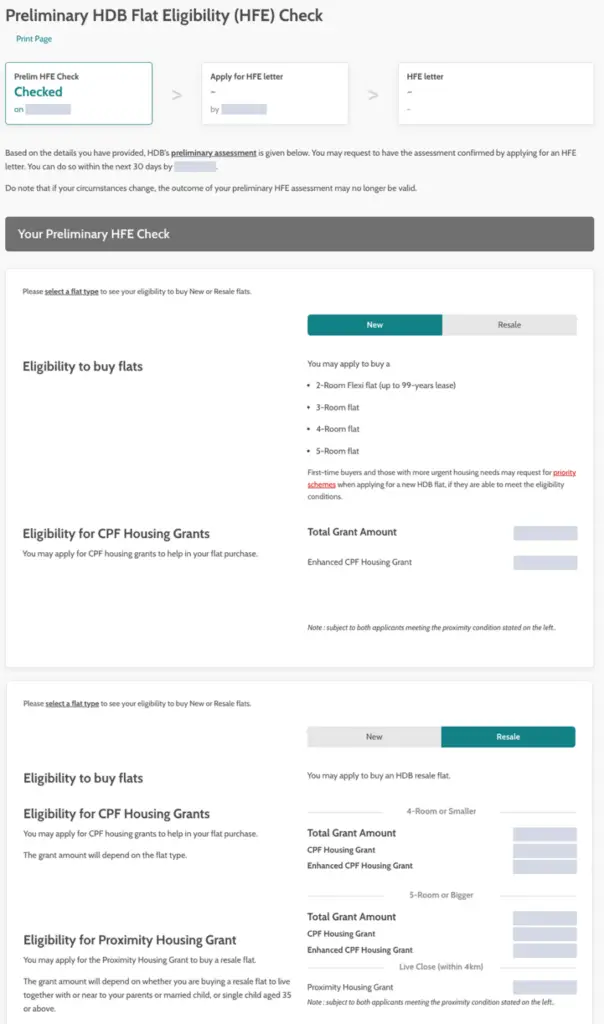

2. Apply for HFE Letter

To obtain an HFE (HDB Financial Education) letter, you can log in to the HDB portal> E-service> Residential> Buy a new flat> Prelim HFE.

Once done, follow these two simple steps to complete your HFE:

Step 1: Conduct a Preliminary HFE check. Based on the information provided, you’ll receive a quick assessment of your eligibility to purchase an HDB flat, avail of CPF housing grants, and secure an HDB housing loan. This initial evaluation serves as a guide for your financial planning. If you’ve decided to proceed with a flat purchase, move on to the next step and apply for an HFE letter.

Step 2: Apply for the HFE letter within 30 calendar days of initiating the preliminary HFE check. Failure to do so will require restarting the preliminary HFE check. Utilize the HFE letter to determine your flat budget before commencing your home search. If possible, submit the HFE letter application in the same calendar month as the preliminary HFE check to avoid updating employment details for all individuals in your application.

3. Flat Types

The flat can range anywhere from 2-room Flexi to 5-room and 3Gen flats, catering to different family sizes and needs. The preliminary HFE checks will allocate the type of flat you are eligible to purchase. During this stage, it is important to carefully evaluate your budget and long-term goals when choosing a unit in a certain location.

If you have decided to buy an HDB flat, you will need to proceed to Step 2, which is to apply for an HFE letter. This must be done within 30 calendar days of starting your preliminary HFE check.

4. Location and Pricing

To check out the latest BTO launch, you can find them at HDB Flat Portal.

BTO projects are launched in various towns and estates, with prices influenced by location, flat type, and market conditions. They are generally priced lower than comparable resale flats, with subsidies to keep them affordable.

5. Balloting for your BTO

Once you agree on the evaluation, you will need to submit the application within the first week and pay a non-refundable administrative fee of $10 (cash). Confirmation of the balloting result will be announced after 1.5 months (BTO) and 2.5 months (SBF).

Next, Pray for your dream home!

It’s important to understand that not all first-time applications will be lucky enough to pass on their first try and many Singaporeans do raise concerns that getting a BTO these days can be difficult.

So if you have received confirmation through your email, congrats! The next thing you will need to do is to book your flat within 1 ~ 2 weeks. Buyers will need to pay an option fee of $500 to $2,000(cash) depending on the type of flat. And within 4 months of booking your flat, you will need to make payment. Buyers will need a downpayment of either:

- an HDB Loan 20% cash/CPF + Legal and stamp fees (cash/CPF)

- or a Bank Loan 5% cash + 20% CPF) + Legal and stamp fees (cash/CPF)

Buyers apply for a BTO flat during a sales launch, and a ballot system determines the order of flat selection where first-timer applicants enjoy higher priority.

6. Financial Planning

If you are in this stage, congratulations on getting your BTO!

Buyers can use CPF Ordinary Account savings to finance the purchase. It’s advisable to keep monthly housing installments within 25% of gross monthly income to avoid financial strain. During this estate planning process, you can either consult your real estate agent or visit the HDB tool to understand more about your underlying finances.

7. Additional Costs

While the purchase price covers the basic cost of the flat, there are additional expenses that buyers should be aware of:

- Stamp Duty and Legal Fees:

- Stamp duty is a tax on the legal documents needed for the flat purchase. Legal fees may also apply for conveyancing services. These costs can add up, so it’s important to budget for them.

- Home Insurance:

- While not mandatory, it’s advisable to get home insurance to protect your belongings and the structure of your flat. The cost will depend on the coverage and insurer.

- Renovation and Furnishing:

- The BTO flat will come in a basic, unfurnished condition. Budget for renovation and furnishing costs to make the space livable according to your preferences.

- Additional Optional Upgrades:

- If you want additional features or finishes beyond the standard offerings, such as premium flooring or built-in wardrobes, these upgrades may come with extra costs.

- Appliances and Fixtures:

- The basic fittings and fixtures are included, but you may need to budget for additional appliances, lighting, and other fixtures.

- Utilities and Service Activation:

- Budget for the activation of utility services, such as water, electricity, and gas. Some service providers may charge activation fees.

- Moving Costs:

- Include expenses related to moving your belongings to the new flat, whether you hire a moving company or rent a vehicle.

- Maintenance and Repairs:

- While new BTO flats come with a defect liability period, consider setting aside funds for future maintenance and repairs, especially as the flat ages.

- Contribution to CPF for Monthly Installments:

- If you’re using your CPF (Central Provident Fund) to pay for the flat, remember that the monthly repayments will contribute to your CPF, reducing the amount available for other purposes.

- Property Tax:

- Property tax is an annual tax levied on the annual value of the property. Be aware of this ongoing cost.

- Parking Fees (if applicable):

- If you own a car and plan to park it at the HDB car park, budget for the associated parking fees.

It’s crucial to plan and budget for these potential hidden costs to ensure a smooth transition into your new BTO flat and to avoid any financial surprises.

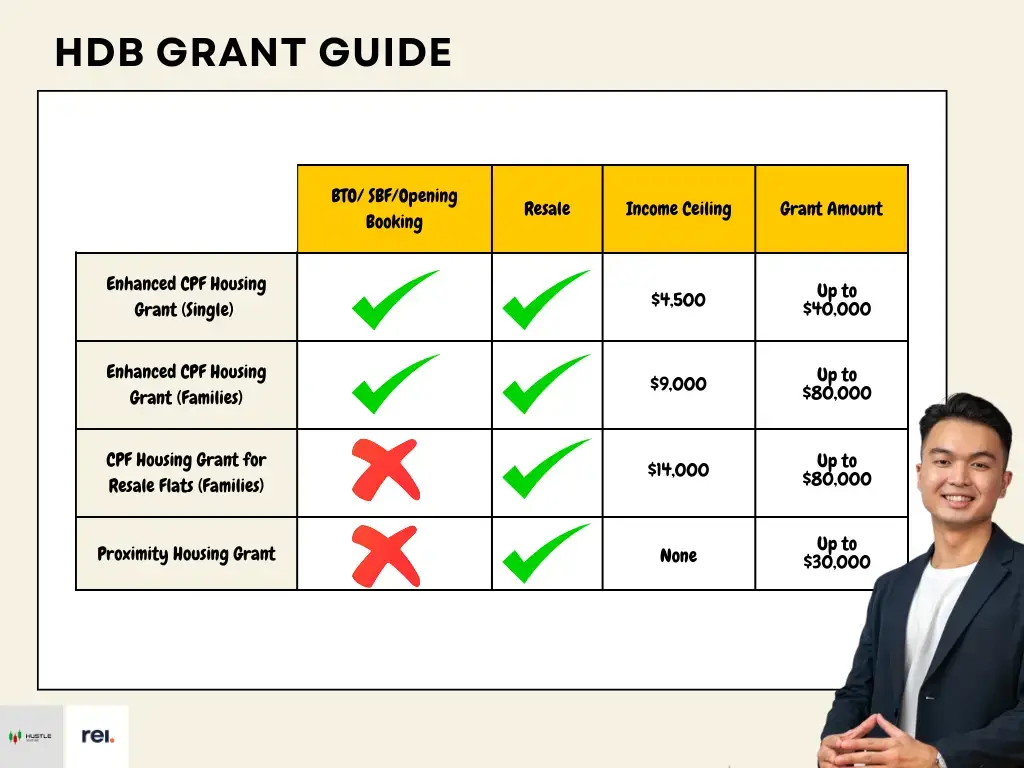

8. Grants

Eligible buyers, especially first-timers, can benefit from various grants like the Enhanced CPF Housing Grant (EHG), which can provide up to $80,000 in subsidies.

9. Waiting Time

Almost 90% of the BTO flats, in 4 out of the 5 projects on offer, have a waiting time from 3 years 1 month to 3 years 8 months. Once your apartment is ready, HDB will notify you when it’s time to pick up your keys.

10. Sale of Balance Flats (SBF)

SBF HDB scheme is essentially an exercise that pools unsold flats from past BTO launches, surplus flats from Selective En bloc Redevelopment Scheme (SERS) projects, and any flats repurchased by HDB. The SBF exercise occurs twice yearly, usually in May and November. While it can be a great way to snatch up BTO that are building, don’t depend on this method of sales as the competition can be steep.

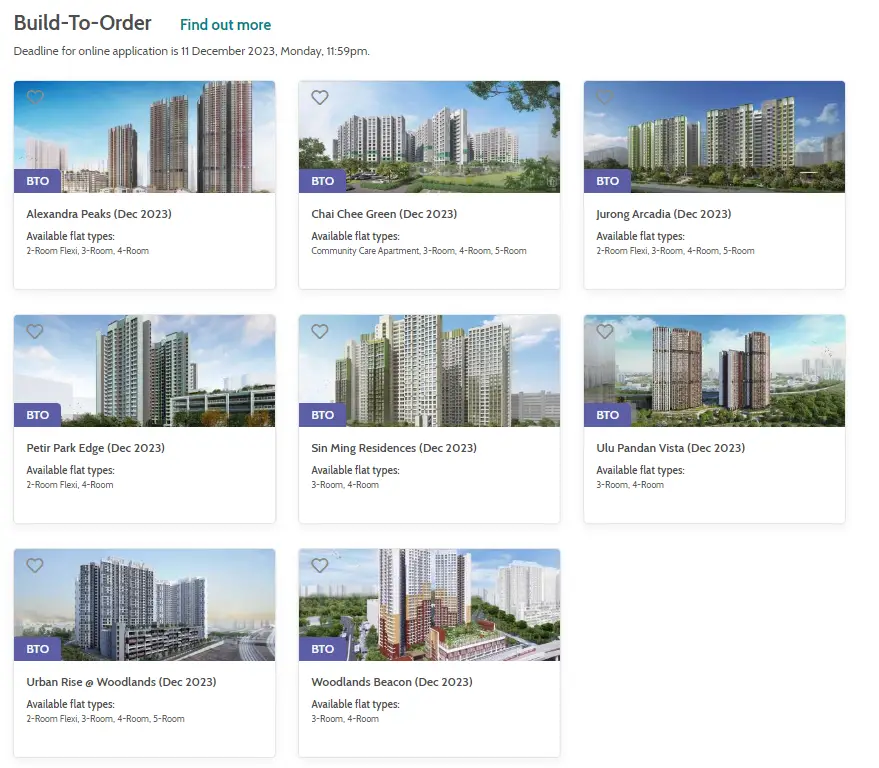

Where is the BTO in 2023?

To find the latest BTO launches happening, you can check out the HDB website on upcoming developments. Here are the Locations of the December BTO 2023 projects:

| Locations of the December BTO 2023 projects | BTO flat types |

| Bedok | Community Care Apartments, 2-room Flexi, 3-room, 4-room, and 5-room |

| Bishan | 3-room and 4-room |

| Bukit Merah | 2-room Flexi, 3-room, and 4-room |

| Bukit Panjang | 2-room Flexi and 4-room |

| Jurong West | 2-room Flexi, 3-room, 4-room, and 5-room |

| Queenstown | 3-room and 4-room |

| Woodlands | 2-room Flexi, 3-room, 4-room, and 5-room |

| Total number of unit | About 6,300 |

Looking to Grow your Real Estate Portfolio?

Hope you have gotten a rough idea of what you can look out for.

If you would like to know more what other potential growth happening around the area, be sure to contact Aaron or fill in your contact information here.

Aaron Oon is a Senior Associate Director at Propnex and Founder of Real Estate Insider. A consistent Top Producer in the competitive world of real estate, Armed with a Finance degree from NUS, Aaron is more than just a real estate agent; he’s a strategic thinker and a creative problem solver.

In his company Real Estate Insider, he shares the latest market updates and trends happening in the world and Singapore to keep us within the loop.

faq

What you need to know about BTO?

BTO (Build-To-Order) is a public housing program in Singapore which are offered in new housing developments and must be applied for during specific launch periods. These flats are typically more affordable than resale flats since they are more heavily subsidies.

What is included in BTO flat?

– Basic fixtures such as lighting, power sockets, and bathroom fittings.

– Rooms for living, bedrooms, kitchen, and bathrooms.

– Flooring, doors, windows, and kitchen fixtures.

– Utility services like water, electricity, and gas (if applicable).

– Basic coat of paint.

What is the meaning of BTO flat?

BTO stands for Build-To-Order. It refers to new public housing units built by the government in response to demand. Buyers apply for flats during specific launch periods, and construction begins based on demand.

What are the requirements to buy a BTO?

At least one applicant must be a Singaporean citizen.

Applicants must form a family nucleus (e.g., spouse, parents, children).

Age and income criteria apply.

What is the maximum salary to buy BTO?

Because BTO apartments are regarded as subsidized housing, there is an income ceiling. Your whole monthly household income, which includes all of the people you specified in your apartment application, is limited to $14,000 by the BTO income cap.

How much is the downpayment for BTO?

The downpayment for BTO is 15% of the flat’s purchase price which can be paid using the CPF (Central Provident Fund) or cash.

Can I use CPF for BTO downpayment?

Yes, CPF savings can be used for the downpayment.

Is BTO cheaper than resale?

Generally, BTO are more affordable than resale flats as they are more heavily subsidies.

Can I buy resale then buy BTO?

Yes, but there are conditions. Buyers must fulfill the Minimum Occupation Period (MOP) for the resale flat before being eligible to apply for a new BTO flat.

Who is eligible for BTO 2 room?

Typically, 2-room BTO flats are designed for first-timer singles or elderly citizens. Eligibility criteria include citizenship, age, and income requirements.