New launch vs. resale condo; which is better?

When it comes to investing in a condominium, the decision between a new launch and a resale condo can be a significant one. We are now talking about investing more than a million dollars just for a property!

Investing in private property is no small sum, that’s why having a proper checklist is essential when it comes to knowing what to pick for yourself. Each option comes with its own set of advantages and considerations that can impact your long-term satisfaction and investment returns.

Understand this Checklist

Having a checklist does give a certain assurance of your investment decision.

In this guide, we’ll walk you through the essential checklist that you must have when evaluating the choice between a new launch and a resale condo. Whether you’re a first-time buyer or a seasoned investor, this comprehensive guide will help you make a well-informed decision.

1. Pricing and Budget

Before you can even talk about buying a property, the primary factor influencing your choice is your budget. How much can you afford?

New launch properties are typically priced higher than resale properties due to their novelty and modern features.

Buyers that invest in new launches typically don’t mind waiting for 3~5 years.

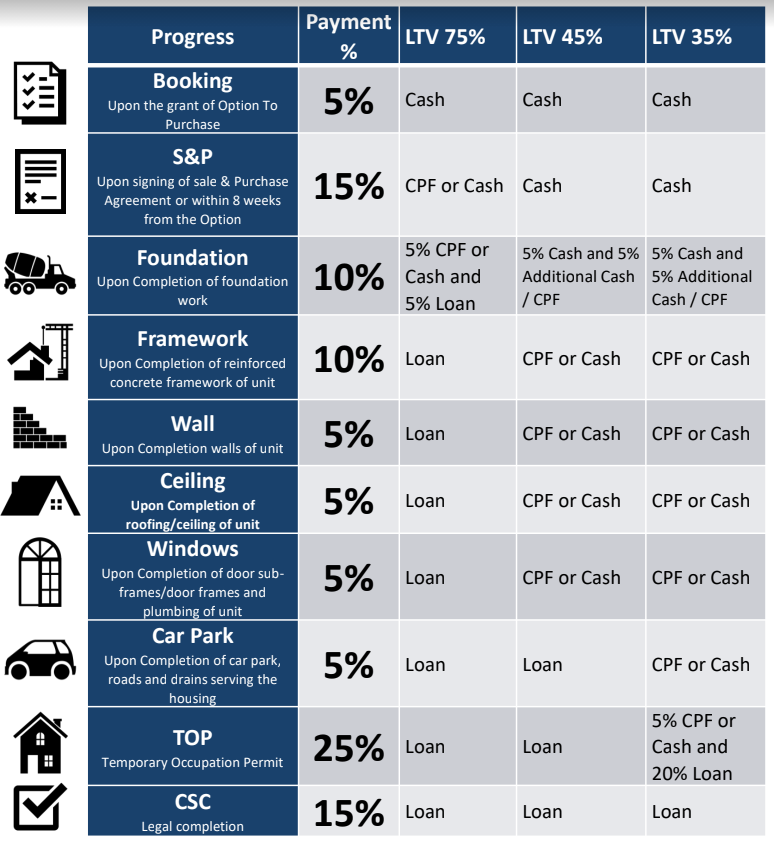

While the cost of buying a new launch may be higher, buyers can look into paying for the PPS (Progressive Payment Scheme) which allows buyers to pay as the property is being constructed.

If you would like to know more about the finances regarding whether you are able to afford a private property, do read our full breakdown of how much income must I make to buy a condo in Singapore.

Now, if you just want to jump straight into the private property market, you can look into the resale market. Resale properties might offer more room for negotiation, especially in a buyer’s market.

2. Location and Accessibility

Location, location, and location.

These are the 3 important criteria when buying any property. Always look for properties with good amenities, great locations to travel around, and where people often travel. These were to old saying that has and always will be applicable in real estate.

New launch properties are often situated in up-and-coming neighborhoods with potential for future growth.

For example, Altura EC, which was recently launched in July, is located within 1km of ACS Primary School. The school is considered an elite school which may help to raise the value of surrounding properties.

When it comes to resale properties, on the other hand, maybe in established areas with well-developed infrastructure and amenities. Choose based on your preference for convenience and proximity to schools, workplaces, public transportation, and other essential facilities.

3. Age and Condition of the Property

Which one would you like to live in?

New launch properties boast modern designs and state-of-the-art facilities, offering a brand-new living experience. Buyers looking to buy a new launch are generally looking for a modern lifestyle approach. This means sky pools, sauna rooms, karaoke rooms, and unique pool facilities.

While resale properties will never be able to have those features, resale properties do come with their own unique charm and character, especially if they are older homes with historical significance. Access your preference for contemporary living versus a touch of nostalgia.

4. Potential for Capital Appreciation

Property buyer often considers the potential for capital appreciation when choosing between new launch and resale properties. Who doesn’t want to make money?

Unlike existing properties, new launches have limited historical price data. This factor can work in favor of capital appreciation, as the absence of extensive price history prevents potential buyers from comparing the property to past market values. Consequently, investors are more likely to accept higher prices, contributing to the appreciation of the property’s value.

There’s a saying when it comes to buying executive condos(EC): Sure make money!

Even though property agents aren’t technically allowed to advertise ECs as such, looking at the past 10 properties that recently hit their MOP, the numbers speak for themselves.

| Name of Condo | Number of Transaction | MOP Date | Profitable Transaction | Non-profitable Transaction |

|---|---|---|---|---|

| The Visionaire | 685 | 14 June 2023 | 52 | 1 |

| Parc Life | 685 | 29 March 2023 | 57 | 0 |

| Wandervale | 588 | 14 March 2023 | 53 | 0 |

| Sol Arces | 222 | 12 March 2023 | 215 | 0 |

| The Criterion | 574 | 26 Feb 2023 | 65 | 0 |

| The Brownstone | 136 | 30 October 2022 | 135 | 0 |

| Westwood Residence | 562 | 24 October 2022 | 78 | 0 |

| Signature at Yishun | 644 | 14 July 2022 | 112 | 0 |

| The Terrace | 163 | 25 May 2022 | 151 | 0 |

| Bellewaters | 204 | 03 May 2022 | 189 | 0 |

| The Vales | 688 | 02 May 2022 | 166 | 0 |

Depending on other various factors, newly launched properties generally do have better odds of making higher capital appreciation than the resale property market.

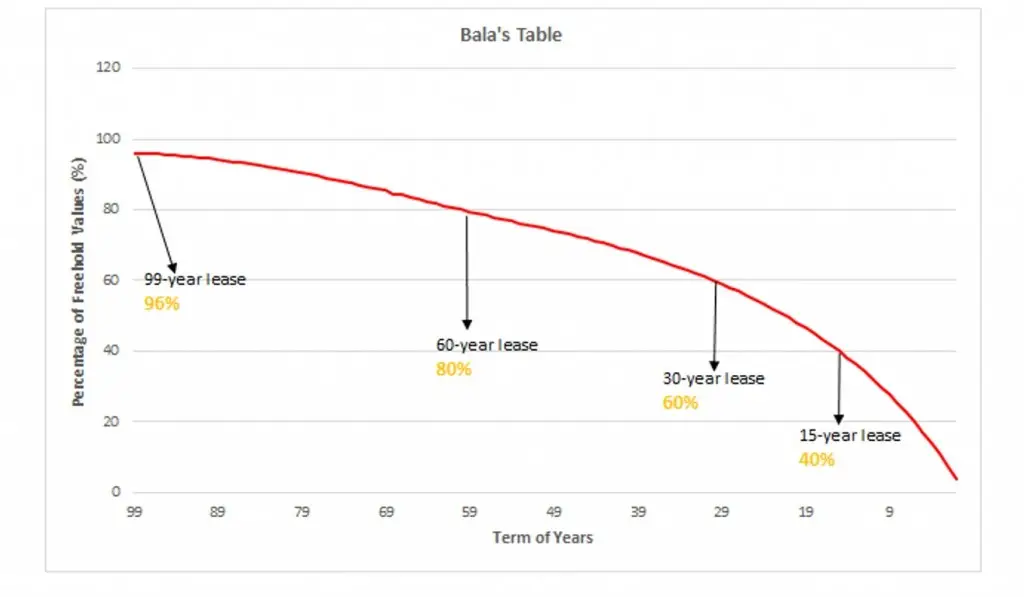

Next, new launches have the advantage to gets to enjoy potential higher capital appreciation. Using Bala’s table, we know that properties will lose their value over time within the leasehold agreement. Therefore, buyers getting new launches do have a higher chance of capital appreciation for their investment.

Although resale properties may have lower odds for capital appreciation, resale buyers generally are looking for immediate stay and would stay for the long term. While these types of properties may be older, they are generally more spacious to play around with.

However, resale properties in well-established and sought-after locations may also experience steady appreciation due to their desirability. Some sellers that are looking to cash out their property may be an opportunity for a resale buyer. However, these opportunities do not come easy.

5. Amenities and Facilities

New launch properties often come with an array of modern amenities and facilities such as swimming pools, gyms, and smart home features. These days, new launch condos even offer grill stations and karaoke rooms to offer more features in the condo itself.

While new launches may have a wide array of amenities, older private condos have the luxury of space for residents to enjoy. Older condos have larger pools and multiple tennis and basketball courts for their residents.

While older condos may require higher MCST(Management Corporation Strata Title) to upkeep the maintenance, it does somewhat justify the amenities provided in the condo.

6. Customization and Personalization

When considering a real estate investment, one crucial factor to examine is the level of customization and personalization offered by the property. Both new launches and resale properties come with their own set of advantages and limitations in terms of tailoring the unit to your preferences.

New launch properties often offer a higher degree of customization due to their modern designs and architectural innovations. Developers anticipate the diverse preferences of buyers and design units that can be easily adapted to different styles and needs.

These can include choices related to flooring materials, paint colors, kitchen fittings, and bathroom fixtures. Buyers can personalize their units to match their lifestyle and design preferences.

While resale properties might come with limitations, they offer the opportunity for extensive renovations. Buyers can undertake remodeling projects to transform the property according to their vision, although this often comes with a higher investment of time and money.

7. Occupancy Date and Rental Yield

If you are looking for immediate occupancy or rental income, new launch properties may have a longer wait time due to construction. This can take anywhere from 2 to 5.9 years to construct a private property.

During such time, there is no rental income coming in and buyers are required to make a monthly payment for the mortgage. And if you are taking on the PPS (Progressive payment scheme), the monthly mortgage payment increases as the condo is being built.

Resale properties; on the other hand, can provide a quicker move-in option or immediate rental yield if it comes with existing tenants. Rental income is also based on market trends which means your income can passively pay you.

8. Developer Reputation and Track Record

Although not as important as the rest. Some buyers do look at and research the developer’s track record such as:

- Reliability and Trustworthiness

- Quality Assurance

- Resale and Rental Value

- Amenities and Facilities

- Legal and Regulatory Compliance

- Financing Opportunities

- Market Perception

- Transparency and Communication

- Lower Risk Profile

- Long-Term Investment Strategy

When considering real estate investment in Singapore, it’s wise to prioritize developers with a solid reputation and a successful track record. This approach can lead to a safer, more valuable, and potentially more profitable investment experience.

Especially when it comes to older resale condos, the maintenance can be a real troublesome issue faced by residence. Having a reliable condo developer can help to mitigate such issue by having the right contractors to maintain the condo facilities. Thereby, maintaining strong demand for the private property.

9. Maintenance Fees and Sinking Fund

A few hundreds of dollars can make all the difference

As a private property investor, an aspect buyers look into is the cost of maintenance and sinking funds. These days, buyers do look at properties with over 300 units or more in order to lower the cost of MCST. While new launch properties may initially have lower maintenance fees compared to older properties, the cost does over time build up, especially after the 10-year mark where more maintenance is required.

10. Exit Strategy

Finally, we come to the most important part of the checklist, knowing how to exit.

A common mistake buyers often miss out on is understanding the demand of your property when looking to exit the market. There are only a few types of buyers that would look into the resale of private property, they are:

- HDB upgraders

- Foreigner

- Families looking to buy the property for the location

- PR(permanent resident)

- couples looking to get their own stay immediately

These types of buyers often depict whether the property has a good resale value.

To understand more about the demand for resale property, an easy way for you to do your own research is by looking at either EdgeProp or Propertyguru’s website to check out the number of transactions for the units. Apart from that, learning how much capital appreciation these properties have earned is a good indicator of the value this location has.

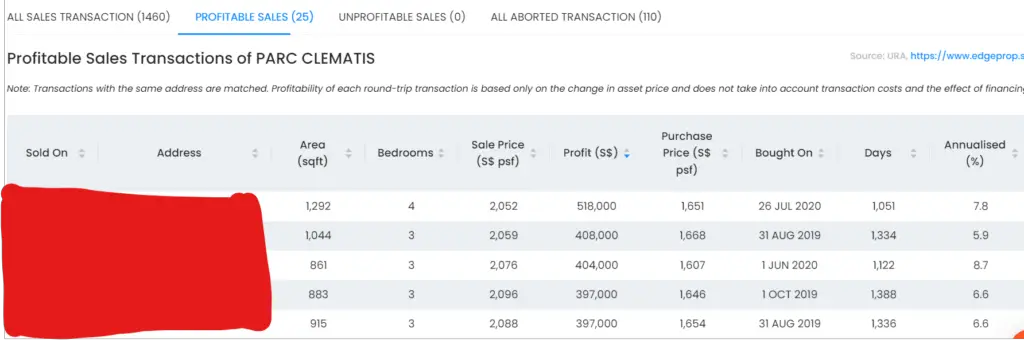

A good example of this would be Parc Clematis, located within 1km of Nan Hua Primary School in Clementi. Given how Singaporeans are willing to pay more for their kid’s education, profits in this property which recently MOP went as high as $518,000 in 3 years.

Which is Better? New Launch or Resale Condo

This decision heavily depends on your financial situation but having these 10 checklists should give you a better edge when it comes to property investment decisions. If you would like to learn more about making the right decision when it comes to buying private properties, be sure to check out some of our related articles below.

What’s Install and how can you get started with Property Investing?

Hope you have gotten a rough idea of what you can look out for.

If you would like to know more what other potential growth happening around the area, be sure to contact Aaron or fill in your contact information here.

Aaron Oon is a Senior Associate Director at Propnex and Founder of Real Estate Insider. A consistent Top Producer in the competitive world of real estate, Armed with a Finance degree from NUS, Aaron is more than just a real estate agent; he’s a strategic thinker and a creative problem solver.

In his company Real Estate Insider, he shares the latest market updates and trends happening in the world and Singapore to keep us within the loop.

FAQ

Is it cheaper to buy a new launch or resale property?

New launch properties are usually priced higher than resale properties due to their novelty and modern features.

Do new launch properties have better facilities?

New launch properties often come with modern amenities and facilities, making them attractive to buyers seeking a contemporary lifestyle.

Which option offers quicker occupancy?

Resale properties offer quicker occupancy as they are usually ready for immediate move-in.

Are new launch properties better for investment?

New launch properties may have higher potential for capital appreciation over time, making them appealing to investors.

Can I negotiate the price of a new launch property?

While negotiating the price of new launch properties may be challenging, you can negotiate with the developer for additional perks or upgrades.

Do resale properties offer more room for customization?

Yes, resale properties may offer more flexibility for customization and personalization compared to new launch properties.