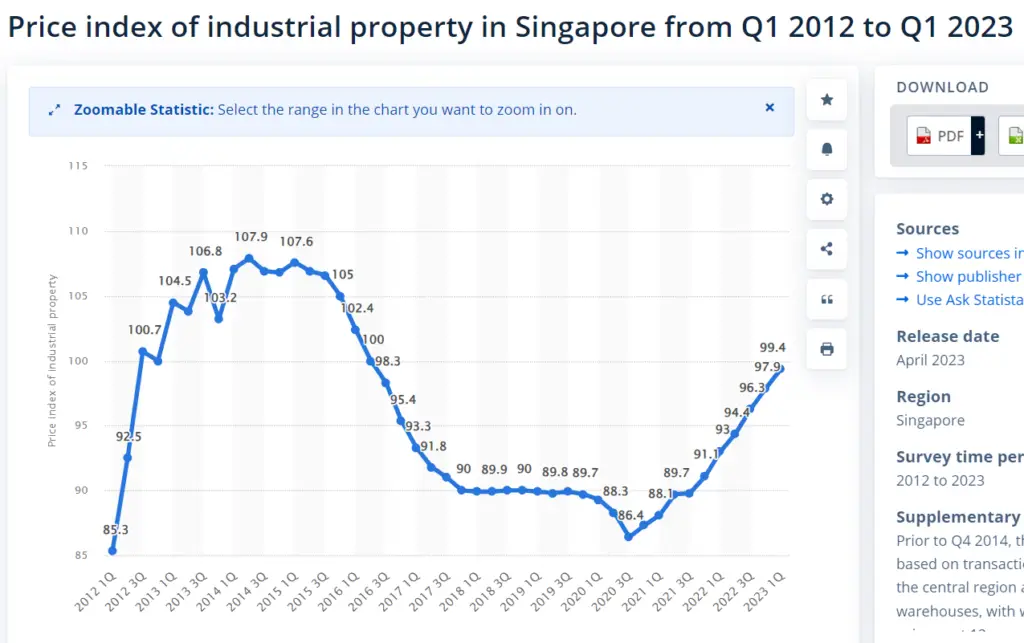

Determining the right price for buying, selling, or renting industrial property is a critical decision that can significantly impact your investment’s profitability. Over the last 3 years since 2020, we have seen huge volatility in the industrial property market.

When the COVID-19 lockdown affected Singapore, many businesses and investors thought the industrial market would be badly knocked down. However, with cooling measures affecting residential properties and demand for commercial properties as a means of investment, the industrial property market has seen a MAJOR RECOVERY.

With the ever-changing market dynamics, understanding how to accurately value industrial properties is essential for making informed decisions.

This article will guide you through the nuances of market analysis, valuation strategies, and the best practices for marketing and negotiating deals in the industrial real estate sector.

Key Takeaways

- Understanding local and international market dynamics is crucial for setting the right price for industrial properties.

- Valuation strategies such as the Sales Comparison Approach and Cost per Rentable Square Foot Analysis are vital for determining property values.

- Effective marketing, including utilizing commercial property MLS and considering brokerage services, can significantly influence the sale process.

- Setting competitive lease rates and negotiating favorable lease terms are key to successful leasing of industrial and retail spaces.

- Special considerations must be given to different property types, such as retail or residential, to accurately assess their value and marketability.

Understanding Market Dynamics

To accurately gauge the local demand for industrial properties, it’s essential to conduct thorough market research. Understanding the nuances of the local market is key to setting a price that reflects both the property’s worth and the current demand. For instance, if you’re considering a freehold or leasehold property in Singapore, factors such as ownership rights, investment goals, and market trends will significantly influence your decision.

- Review recent sales and leasing transactions in the area

- Analyze vacancy rates and absorption rates

- Consider the impact of local economic drivers

The local demand for industrial properties can vary greatly depending on a multitude of factors, including demographic trends and the specific needs of potential tenants.

It’s also important to look at studies and reports that provide insights into future leasing decisions, such as the U.S. Industrial Tenant Demand Study by JLL. This can help predict potential shifts in the market and adjust your pricing strategy accordingly. Remember, choosing the right commercial property goes beyond location; it involves a deep dive into local demand based on property type and additional market elements.

Evaluating Regional & International Market Trends

When determining the price for industrial real estate, it’s crucial to evaluate both regional and international market trends.

Regional factors such as local economic growth, infrastructure developments, and industrial demand can significantly influence property values. On the international front, global economic shifts, trade policies, and foreign investment flows are key indicators of market health.

In the context of international trends, properties that fail to meet environmental standards may face market discounts. This highlights the importance of sustainability in maintaining property value.

Understanding the nuances of different markets is essential. For instance, the Asia Pacific region has shown varying transaction volumes and capital sources over the years, reflecting its dynamic nature. Here’s a snapshot of recent trends:

- Research and stay updated on market conditions

- Diversify investments across regions and property types

- Network with industry professionals and seek expert advice

- Consider market factors such as interest rates and environmental standards

By keeping these points in mind, investors can better navigate the complexities of the industrial real estate market and make informed decisions.

Impact of Economic Conditions on Property Values

The effects of tightening financial conditions on commercial property prices can be significant, as they influence investor risk appetite and capital availability. For instance, during economic downturns, property values may decline due to reduced demand and increased capitalization rates.

Economic trends and policies, such as the introduction of the Seller’s Stamp Duty (SSD) in Singapore to curb market manipulation, directly impact industrial property valuations. High property taxes and financing challenges are additional economic factors that can deter potential buyers.

- Assess the economic cycle stage

- Consider local and international economic policies

- Evaluate the property’s alignment with investment objectives

It is essential to understand that the intrinsic value of a property is not solely determined by its price tag but also by the opportunities it presents to the owner, such as the potential for consistent rental income.

Valuation Strategies for Industrial Real Estate

The Sales Comparison Approach is a cornerstone of industrial real estate valuation.

This method involves comparing the property being appraised with similar properties that have recently been sold in the same area. By analyzing these transactions, appraisers can estimate the market value of a property by adjusting for differences in size, condition, location, and amenities.

The key to a successful sales comparison analysis is the quality and relevance of the data used. It’s essential to select comparables that closely match the subject property to ensure an accurate valuation.

To effectively apply this approach, consider the following steps:

- Identify recent sales of comparable properties in the area.

- Adjust the sale prices of these properties to account for differences.

- Analyze the adjusted prices to arrive at an estimated market value for your property.

Remember, while this approach provides a solid starting point, it’s often used in conjunction with other valuation methods to determine the most accurate price for buying, selling, or renting industrial real estate.

Cost per Rentable Square Foot Analysis

When determining the value of industrial real estate, the cost per rentable square foot analysis is a pivotal method. It involves calculating the cost for each square foot that can be rented out, excluding common areas. For example, a property priced at $5 million with 25,000 total square feet, including 4,000 square feet of common areas, would have a cost per rentable square foot of approximately $227. This figure is derived by dividing the asking price by the rentable square footage (21,000 SF in this case).

To assess the investment potential, compare this cost to the current market rent. A property’s gross rental income forecast can be significantly influenced by this comparison. Here’s a simplified breakdown:

| Asking Price | Total Square Footage | Common Area SF | Rentable SF | Cost per Rentable SF |

|---|---|---|---|---|

| $5,000,000 | 25,000 | 4,000 | 21,000 | $227 |

The cost per rentable square foot analysis provides a clear metric to evaluate the potential return on investment for a property, taking into account the rentable area versus the total area.

Remember, while this method offers a straightforward metric, it does not account for other factors such as building age, unit types, or deferred maintenance, which can also affect a property’s value.

Calculating Internal Rate of Return

The Internal Rate of Return (IRR) is a critical metric for gauging the profitability of industrial real estate investments. It reflects the annualized effective compounded return rate and can help investors compare the potential yield of different properties. To calculate IRR, one must consider the initial investment, the series of cash flows, and the eventual sale or disposition value of the property.

The IRR is particularly useful for understanding the long-term yield of a property, making it a valuable tool for strategic planning.

Here’s a simplified process to calculate IRR:

- Estimate the total initial investment for acquiring the property.

- Project the annual net cash flows from operations.

- Determine the potential sale price at the end of the investment period.

- Use an IRR calculator or financial software to input these figures and compute the IRR.

Remember, real estate investing requires research, consideration of economic conditions, and overcoming emotional attachments. Stay informed, plan ahead, and consider long-term goals for success.

Marketing and Selling Your Property

Before listing your industrial property on the market, it’s crucial to ensure it’s in top condition to attract serious buyers and secure the best possible price. Address any deferred maintenance issues promptly; these are red flags for potential buyers and could significantly impact the sale. Consider making strategic capital improvements that could enhance the property’s value and appeal.

- Assess the property’s condition

- Address maintenance issues

- Consider capital improvements

In addition to physical preparations, organizing all relevant documents and understanding your financial expectations are key. An appraisal can provide a clear picture of your property’s market value, which is essential for setting a realistic price. Remember, thorough preparation can lead to a smoother sales process and better outcomes.

By taking the time to prepare your property meticulously, you’re not only enhancing its marketability but also paving the way for a more efficient and potentially more profitable sale.

Utilizing Commercial Property MLS

When it comes to marketing your industrial real estate, a commercial property MLS (Multiple Listing Service) is an invaluable tool. These platforms allow you to list your property where it can be seen by a wide audience of potential buyers or tenants. Services like LoopNet, CoStar, and Xceligent are among the top choices for commercial listings.

To maximize exposure, consider the following steps:

- Ensure your listing includes detailed information and high-quality images.

- Highlight unique features or selling points of your property.

- Regularly update your listing to keep it visible and engaging.

By leveraging a commercial property MLS, you can streamline the process of finding the right buyer or tenant, making it a critical component of your sales strategy.

Remember, the goal is to make your property stand out in a sea of listings, so take the time to craft a compelling narrative that showcases its full potential.

Working with a Broker: Pros and Cons

Brokers bring expertise and access to a network that can significantly widen the pool of potential buyers. They are adept at marketing properties and can provide valuable insights into the current market conditions. However, brokers work on commission, which means part of the sale’s proceeds will go to them. This can affect the overall return on investment for the seller.

Brokers’ ability to provide a broker price opinion can be crucial in setting a competitive price. They have their fingers on the pulse of the market and can guide negotiations effectively. On the flip side, the seller’s control over the sale process may be reduced, and finding the right broker who aligns with your goals is essential.

It’s important to weigh the pros and cons of working with a broker, as their involvement can either streamline the sale or introduce new complexities.

Here are some considerations when working with a broker:

- Expertise in marketing and negotiations

- Access to a wider network of potential buyers

- Guidance on pricing and market dynamics

- Commission fees reducing net proceeds

- Potential loss of control over the sale process

- The need to find a broker whose approach and values align with yours

Aaron Oon is a Senior Associate Director at Propnex and Founder of Real Estate Insider. A consistent Top Producer in the competitive world of real estate, Armed with a Finance degree from NUS, Aaron is more than just a real estate agent; he’s a strategic thinker and a creative problem solver.

If you are looking to invest in a property here in Singapore or would like to know more about Singapore’s property market. Be sure to reach out through the Calendy video link below:

Leasing Industrial and Retail Spaces

Setting Competitive Lease Rates

To maintain a strong position in the industrial rental market, it’s essential to align lease rates with current market conditions. This involves a thorough analysis of local demand, economic factors, and the specific characteristics of your property. A graduated lease structure may be beneficial, allowing for periodic adjustments to the rent in response to market changes.

- Keep track of rental rates in your area and adjust your rent increase schedule accordingly.

- Analyze cap rate changes and macroeconomic factors that could influence your pricing strategy.

- Define your ideal tenant profile to ensure your lease terms meet the needs of potential renters.

By staying informed and flexible, you can set lease rates that are both competitive and reflective of the value your property offers.

Remember, setting the right lease rate is not just about covering costs but also about attracting and retaining the right tenants. Regularly review and compare your rates with those of similar properties to ensure your industrial space remains an attractive option for businesses.

Marketing Strategies for Attracting Tenants

The right marketing campaigns will attract the right tenants, ensuring a good fit for both parties. Utilize a mix of traditional and digital marketing techniques to reach a broader audience.

Creative property marketing and advertising can set your property apart from the competition. Consider the following strategies:

- Develop an on-ground marketing plan that includes open houses and networking events.

- Create digital assets such as a dedicated website, virtual tours, and high-quality photographs.

- Use social media platforms to engage with potential tenants and showcase your property.

- Build an email marketing strategy to keep prospects informed and interested.

- Analyze metrics to understand the effectiveness of your campaigns and make data-driven improvements.

By leveraging big data and AI, you can uncover new opportunities and tailor your marketing efforts to meet the specific needs of your target audience.

Remember, a well-executed marketing strategy not only fills vacant spaces but also contributes to the long-term value of your property by establishing a strong tenant base.

Negotiating Lease Terms and Conditions

Start early to allow ample time for discussions and to understand the landlord’s renewal profits, which can influence the negotiation dynamics.

- Understand your business’s needs.

- Research market conditions.

- Learn about the property and landlord.

It’s essential to negotiate terms that favor your business, such as rent reduction, tenant improvement allowances, or favorable exit clauses.

Remember, flexibility can be key. Distinguish between your must-haves and wants, and be prepared to compromise on less critical aspects to achieve a mutually beneficial agreement.

Special Considerations for Different Property Types

Selling and Leasing Retail Properties

Selling a retail property requires a deep knowledge of the consumer market, as well as the retail industry’s current state. It’s important to consider factors such as foot traffic, store visibility, and the demographic of the surrounding area.

For leasing, setting the right price point is essential to attract and retain tenants. A competitive lease rate can be determined by analyzing comparable properties in the area and understanding the unique value propositions of your property.

Remember, the goal is to balance the return on investment with the attractiveness of the lease terms to potential tenants.

Here are some key steps to consider when selling or leasing retail properties:

- Conduct a thorough market analysis.

- Evaluate the property’s location and condition.

- Develop a marketing strategy tailored to the target audience.

- Negotiate terms that benefit both parties and ensure long-term success.

Residential Property Market Nuances

While industrial and commercial real estate transactions can be complex, the nuances of the residential property market require a different approach. Location and local amenities significantly influence residential property values. The safety of a neighborhood, proximity to schools, and access to shopping centers are just a few factors that can affect the desirability and, consequently, the price of a home.

In Singapore, for example, investors are likely to stay cautious navigating the real estate market due to prolonged market uncertainties and moderate growth. The property market, reflective of global trends and local nuances, is subject to various pitfalls that could impact stakeholders’ decisions and investment strategies.

Residential properties often have lower property tax rates than commercial properties, but this can vary by jurisdiction. Some areas offer tax incentives for commercial development, which can influence investment decisions.

When considering the sale or lease of residential properties, it’s important to understand these market dynamics and how they differ from other property types. For instance, Singapore’s industrial real estate may see rents softening and vacancies increasing, which could lead to a moderation in asset prices. This contrasts with the residential market, where such trends may not be as pronounced.

Navigating International and Collective Sales

When dealing with international and collective sales, understanding the nuances of global markets is crucial. Investment sales are expected to grow, particularly in regions like Singapore, where a 10% year-on-year growth is anticipated due to factors such as the Government Land Sale market.

Collective investments offer a pathway to diversify property portfolios, but they require meticulous planning. Here are some steps to consider:

- Research the local and international demand for the property type.

- Understand the legal and financial implications in different markets.

- Build a network of local experts and advisors.

Real estate is entering a transformative phase, with sustainability and strategic adjustment at the forefront, signaling a positive outlook for mergers and acquisitions.

Navigating the industrial frontier of property investment can position investors as pioneers in a market that is often overshadowed by residential and commercial sectors. It’s essential to stay informed about global trends and adjust strategies accordingly.

Looking to Buy/sell/rent an industrial property?

Determining the right price for selling, buying, or renting industrial real estate is a multifaceted process that requires a deep understanding of the market, a grasp of valuation methodologies, and a strategic approach to positioning the property.

As we’ve explored, there are numerous factors to consider, from the local market pulse to the cost per rentable square foot. Whether you’re a seasoned investor or new to the commercial real estate scene, it’s essential to leverage both data and business acumen to make informed decisions. Remember, the value of commercial property is not just in its physical attributes but also in its potential to meet investment objectives.

If the process seems daunting, don’t hesitate to seek the expertise of a professional broker who can provide valuable insights and guide you through the complexities of the market. Ultimately, the goal is to achieve a price point that reflects the true worth of your property and aligns with your investment goals.

Aaron Oon is a Senior Associate Director at Propnex and Founder of Real Estate Insider. A consistent Top Producer in the competitive world of real estate, Armed with a Finance degree from NUS, Aaron is more than just a real estate agent; he’s a strategic thinker and a creative problem solver.

If you are looking to invest in a property here in Singapore or would like to know more about Singapore’s property market. Be sure to reach out through the Calendy video link below:

Frequently Asked Questions

How do I assess the value of my industrial property?

Get an appraisal and understand the local commercial real estate market dynamics. Consider factors such as demand trends, economic conditions, and comparable sales to determine a realistic price point.

What valuation strategies can I use for my industrial real estate?

Valuation strategies include the Sales Comparison Approach, Cost per Rentable Square Foot Analysis, and Calculating the Internal Rate of Return. Each method offers a different perspective on the property’s value.

Should I use a broker to sell my commercial property?

Using a broker can provide expertise in marketing, pricing, and negotiating. Brokers have a pulse on the market and can guide you through the complexities of the sale process.

How do I set competitive lease rates for my property?

To set competitive lease rates, analyze the local market rates, consider the property’s location, amenities, and condition, and adjust for economic conditions and property-specific factors.

What are the benefits of using a commercial property MLS for selling?

A commercial property MLS expands your marketing reach, increases exposure to potential buyers, and provides access to a network of real estate professionals, enhancing the chances of a successful sale.

What special considerations should I keep in mind for different types of properties?

Different property types, such as industrial, retail, residential, and international properties, each have unique market nuances. Tailor your valuation, marketing, and negotiation strategies accordingly.