Are you looking for a quick buck? In today’s fast-moving world, the need for quick financial solutions is more prevalent than ever. Whether you’re facing an unexpected expense or simply looking to boost your savings, making an extra $200 can significantly impact your financial situation.

This article will guide you through various methods on how to make 200 dollars fast, from engaging in-game and survey apps to leveraging gig economy opportunities, and from generating a passive income to selling and renting your possessions. We’ll also touch on the importance of financial planning to prevent future cash crunches.

Key Takeaways

- Utilize game and survey apps to potentially win real money and earn through quick tasks.

- Explore freelance and gig economy opportunities such as writing, food delivery, and pet services for rapid earnings.

- Consider passive income strategies and smart investments like high-yield savings, real estate crowdfunding, and stock market offers.

- Sell or rent out personal items, space, or services online for immediate profit.

- Engage in financial planning, including building an emergency fund and smart budgeting, to avoid needing quick cash in the future.

how to make 200 dollars fast

With the internet, finding ways to make a quick buck is easier than ever!

Win Real Money with Mobile Gaming

Mobile gaming apps have revolutionized the way we think about earning quick cash. CashPirate and Lucktastic are prime examples of PayPal games that reward users for engaging in various activities such as downloading apps, playing games, and watching ads. These platforms offer a fun and interactive way to accumulate cash rewards, which can be redeemed for PayPal cash or other rewards.

For those who enjoy a challenge, apps like Solitaire Cash and Bingo Cash provide opportunities to win real money through skill-based competitions. Solitaire Cash pits you against other players with the same deck, testing your strategy and speed, with the potential to win up to $200 per game. Similarly, Bingo Cash offers daily and weekly tournaments with substantial prize pools.

If you’re looking for a more casual gaming experience that can still yield real cash, consider trying out Bubble Cash. This classic bubble shooter game is designed to be both entertaining and rewarding, with colorful graphics and the chance to win money.

It’s important to note that while these games can be a quick way to make money, they should not be seen as a guaranteed income stream. Always play responsibly and within your means. For a more consistent approach to earning, explore other options such as surveys, selling old items, or simple investments like those offered by robo-advisors.

Earn Through Surveys and Quick Tasks

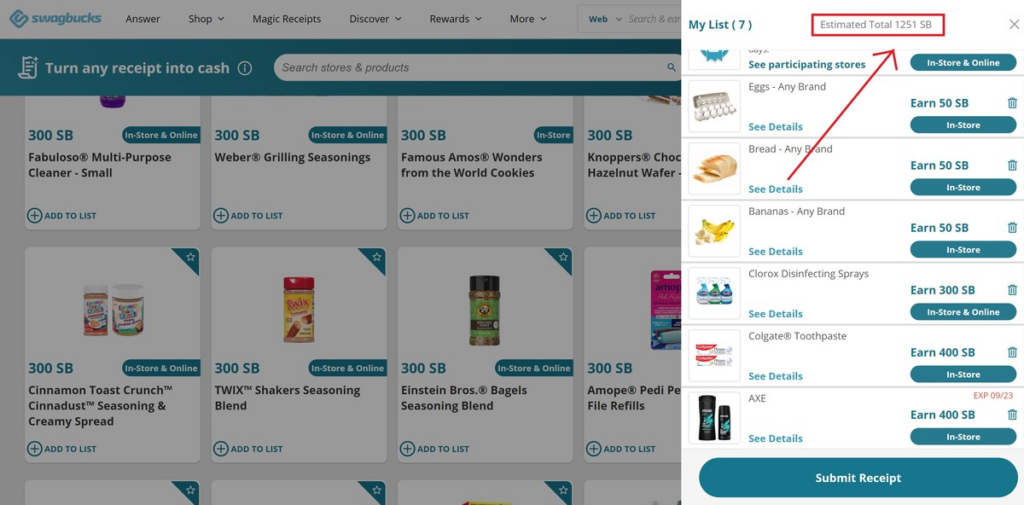

Making an extra $200 can be as simple as sharing your opinion online. Online surveys and quick tasks offer a flexible way to earn cash from the comfort of your home. Websites like Swagbucks, Survey Junkie, and InboxDollars reward users for activities such as completing surveys, watching videos, and shopping online. By dedicating a few hours each week, you can accumulate earnings and reach your financial goal.

It’s important to choose surveys wisely. Some may pay up to $5 for more in-depth studies, while others offer smaller amounts for quick and easy tasks. Knowing the potential earnings beforehand allows you to maximize your time and profits.

Here’s a quick rundown of potential earnings from popular survey sites:

- Swagbucks: Varied tasks with different payout rates

- Survey Junkie: Earn $0.10 – $1 for short surveys

- InboxDollars: Complete surveys and other tasks for cash

- Opinion Outpost: Quick surveys with payouts around $0.50 – $1

Remember, while you won’t get rich from these activities, they can be a steady source of income for those looking to make money in their spare time.

Sign-Up Bonuses and Cash Rewards

In the quest to make $200 quickly, leveraging sign-up bonuses and cash rewards can be a lucrative strategy. Many apps and websites offer instant financial incentives just for registering as a new user. For instance, cashback and rewards sites like Rakuten and Swagbucks provide welcome bonuses that can add up to a significant amount with minimal effort.

- Rakuten: $10 welcome bonus for shopping at over 2,500 stores.

- MyPoints: $10 welcome bonus, similar to Rakuten’s rewards.

- InboxDollars: $5 welcome bonus, plus earnings from surveys and games.

- Swagbucks: $10 welcome bonus with various earning methods.

- Ibotta: $20 welcome bonus, earn cash back on everyday purchases.

Credit card companies also entice new customers with cash rewards. For example, some offer a $600 bonus for opening an account with a minimum deposit. However, it’s crucial to avoid accumulating debt to ensure that the rewards outweigh the costs.

By strategically signing up for multiple platforms that offer these bonuses, you can accumulate a tidy sum without significant time investment. Just remember to read the terms and conditions to understand the requirements for claiming your bonus.

Looking to start investing, why not try MooMoo?

MooMoo, a relative newcomer in the US stockbroker market, provides commission-free US stock, ETF, and options trading with no inactivity fees.

Freelance and Gig Economy Opportunities

Now if you are looking to become a side hustler or eventual business owner, joining the freelance and gig economy is a great way for you to dip your toes as a small-time entrepreneur.

Leverage Your Writing Skills

If you have a flair for writing, leveraging your writing skills can be a lucrative way to make $200 quickly. Freelance writing offers the flexibility to work from anywhere and choose projects that align with your interests. To start, focus on building a strong portfolio that showcases your best work. This can include articles, blog posts, or any other written content you’ve created.

Platforms like Fiverr and Upwork are great places to find freelance writing gigs. Here’s a simple guide to get started:

- Create a compelling profile that highlights your writing expertise.

- Browse job listings and apply to those that match your skills.

- Communicate effectively with clients to understand their needs.

- Deliver high-quality work on time to build a positive reputation.

Remember, success in freelance writing doesn’t happen overnight. It requires dedication, time management, and continuous learning. Websites that guide you on becoming a freelance writer can be invaluable resources. They often cover essential topics such as diversifying your services, increasing your rates, and effectively using freelancing platforms.

Earning $200 as a freelance writer is achievable with the right approach and persistence. Start by identifying your niche and marketing your services to potential clients.

Food Delivery & Ride-Sharing for Fast Earnings

In the gig economy, food delivery and ride-sharing have emerged as popular ways to earn money quickly. Platforms like DoorDash, Uber Eats, and Instacart have revolutionized the way we think about food delivery, offering flexible work schedules and the potential to earn significant income on a part-time basis. Ride-sharing apps such as Uber and Lyft also provide opportunities for car owners to make money by transporting passengers around the city.

With the rise of these services, especially during times of increased demand, individuals can capitalize on the convenience they offer to consumers. By becoming a freelance delivery agent or a ride-share driver, you can start earning without the need for a long-term commitment.

Here’s a quick look at what you might expect to earn with some of the leading apps:

- DoorDash: Dominates with a 65% market share, delivering meals from a variety of restaurants.

- Uber Eats: A strong competitor in the food delivery space, often offering promotions to new drivers.

- Instacart: Specializes in grocery delivery, allowing shoppers to earn by fulfilling and delivering orders.

- Uber: The pioneer in ride-sharing, offering flexible driving opportunities.

- Lyft: Another key player in ride-sharing, known for its driver-friendly policies.

Whether you’re looking to make a quick $200 or more, these platforms can be a starting point. Remember, your earnings will depend on factors such as the time of day, your location, and the number of deliveries or rides you complete.

Pet Sitting and Dog Walking Services

Turning your love for pets into a profitable side hustle is more accessible than ever. Platforms like Rover and Wag! make it simple to connect with pet owners who need your services. With the potential to earn $35-$70 per night for pet sitting and $15-$25 per walk, this gig can quickly add up to substantial earnings.

Starting a pet care business is surprisingly affordable. Most entrepreneurs can begin with less than $500, focusing on building trust and a local client base.

Here’s a quick breakdown of potential earnings:

- Pet sitting: $35-$70 per night

- Dog walking: $15-$25 per walk

Remember, your earnings will vary based on location, demand, and the number of clients you can manage. To maximize your income, consider offering additional services such as pet boarding, which can significantly increase your monthly revenue.

Interested in starting a side hustle as a pet sitter/groomer/taxi/walker?

PetBacker is a great side hustle for anyone to start earning and meeting people.

Passive Income and Smart Investments

Investing in High-Yield Savings Accounts

In the quest to make $200 fast, placing your funds in a high-yield savings account (HYSA) can be a smart move. Unlike traditional savings accounts, HYSAs offer significantly higher interest rates, allowing your money to grow more rapidly without any additional effort on your part.

For example, while the national average interest rate for savings accounts hovers around 0.46%, some HYSAs offer rates as high as 4.35% APY. This difference can mean earning 17 times more interest on your savings, which is a substantial boost if you’re looking to increase your funds quickly.

It’s important to note that while HYSAs are a safer investment compared to stocks or real estate, they still provide a return that can contribute to your financial goals.

When considering an HYSA, look for accounts with no minimum deposit requirements and no monthly maintenance fees to maximize your earnings. Additionally, some banks offer sign-up bonuses that can provide an immediate increase to your balance. Here’s a quick comparison of two popular options:

| Bank Name | Interest Rate (APY) | Sign-Up Bonus |

|---|---|---|

| Capital One 360 | 4.35% | None |

| Chime | 0.5% | None |

Remember, every little bit helps when you’re trying to grow your savings. By choosing the right HYSA, you can ensure that your money is working for you, paving the way to reach your $200 goal faster.

Looking to start investing, why not try Tiger Broker?

Tiger Brokers offers competitive commission fees for trades across different markets.

It is also practically fee-less in these aspects: no custody fees, deposit (or withdrawal) fees, currency exchange fees, inactivity fees, or account maintenance fees to contend with!

Real Estate Crowdfunding Platforms

Real estate crowdfunding platforms have opened the doors for individuals to invest in property without the need for substantial capital. Fundrise stands out as a popular choice for both seasoned and novice investors, offering a user-friendly experience and a low entry point of just $10 to start. With an average return of 8.7 – 12.4 percent last year, it’s an attractive option for those looking to make their money work for them.

Investing in real estate through crowdfunding can provide stable gains and potential rental income, contrasting with the stock market’s liquidity and diversity. Platforms like Yieldstreet and EquityMultiple cater to different investor types, with the former being favorable for nonaccredited investors and the latter for accredited ones.

When considering real estate crowdfunding, it’s essential to compare platforms to find the best fit for your investment goals. Factors such as transparency, costs, and services play a significant role in determining the right choice.

For those ready to dive into real estate crowdfunding, here’s a quick list to get started:

- Sign up for an account on a platform like Fundrise.

- Review the investment options and potential returns.

- Start with a manageable investment to test the waters.

- Monitor your investments and adjust your strategy as needed.

Stock Market Apps and Free Stock Offers

In the digital era, stock market apps have revolutionized investing, making it accessible to the masses. Beginners can start with user-friendly platforms that offer educational resources and tools to understand the market. For instance, a website page introduces investment tools for beginners, reviews brokerage apps, and offers investment education on various assets like stocks, real estate, and crypto.

Many apps incentivize new users with sign-up bonuses, such as free stocks upon account creation. For example, Robinhood provides free stocks worth up to $200, potentially boosting your net worth instantly. Similarly, SoFi Invest rewards new users with free stocks valued up to $1,000 when they fund their account with a minimum amount.

To maximize your earnings, consider the following tips:

- Invest in index funds for consistent returns.

- Use Robo-advisors for easy stock investing.

- Explore opportunities in crypto and NFTs.

- Focus on long-term investments for financial freedom.

Remember, while free stock offers are enticing, it’s crucial to research and choose apps that align with your investment goals and risk tolerance.

Selling and Renting for Quick Profit

Declutter and Sell Your Unwanted Items

We all have items lying around that we no longer use. Turning clutter into cash is not only a quick way to make $200, but it also helps to tidy up your living space. Platforms like eBay, Facebook Marketplace, and Craigslist are excellent for listing your items and reaching potential buyers. You might be surprised at how much you can earn from things like old electronics, clothes, or even furniture.

- eBay is great for a wide range of items, including collectibles and electronics.

- Facebook Marketplace and Craigslist are ideal for local sales and usually have no fees.

- Apps like Decluttr specialize in purchasing used electronics directly.

- For fashion items, consider Poshmark or ThredUp.

Remember, the key is to price items fairly and be honest about their condition to ensure a quick sale. If you’re unsure where to start, here are some steps to guide you:

- Sort through your belongings and set aside items in good condition that you no longer need.

- Research the best platform to sell each type of item.

- Take clear, well-lit photos of your items.

- Write detailed descriptions and set competitive prices.

- Respond promptly to inquiries and be prepared to negotiate.

While this isn’t a get-rich-quick scheme, it’s a sustainable way to make money. Focus on selling what you’re good at, and consider the flea market for crafts and unique finds.

Rent Out Your Space or Possessions

Turning unused space or items into a source of income is a smart way to reach your $200 goal quickly. Platforms like Neighbor allow you to rent out storage space in your home, garage, or other buildings you own. This can be a hassle-free way to earn, as you don’t need to share your living space—just the unused areas.

For those with unique or seldom-used items, such as a ping-pong table, consider peer-to-peer rental services. Websites like Zilok facilitate the process, making it easy to monetize nearly anything in your home.

If you’re situated in a high-demand location or have a spare room, short-term rental platforms like Airbnb can provide a significant boost to your income. During peak events or seasons, the earning potential is even greater.

Remember, the rental price can vary based on location and the type of space or item you’re offering. Setting competitive rates is key to attracting renters and ensuring a steady stream of passive income.

Offer Your Expertise or Services Online

In today’s digital age, monetizing your expertise is more accessible than ever. Platforms like Udemy, Teachable, or Skillshare allow you to create and sell online courses, reaching a global audience eager to learn. Similarly, websites such as Upwork, Fiverr, and Freelancer.com offer a marketplace for a variety of freelance jobs, from writing to web development.

By leveraging online platforms, you can transform your knowledge and skills into a profitable venture. It’s not just about the money; it’s about sharing your passion and expertise with others who value it.

If you’re considering freelancing, here’s a simple guide to get started:

- Identify your niche and the services you can offer.

- Create a compelling profile on freelance marketplaces.

- Set competitive rates based on your experience and the market demand.

- Network and market your services through social media and professional connections.

Remember, consistency and quality are key to building a reputation and a client base that will pay for your services.

Financial Planning to Avoid the Crunch

Building an Emergency Fund

Establishing an emergency fund is a proactive step towards ensuring financial stability. It acts as a buffer against unexpected expenses, such as job loss or medical emergencies. To start, determine how much you need to save by tracking your monthly expenses and identifying the minimum amount required to cover three to six months of living costs.

By consistently setting aside a portion of your income, you can build a fund that will give you peace of mind and prevent the need for urgent cash solutions in the future.

Here are some steps to guide you in building your emergency fund:

- Assess your current financial situation.

- Set a clear savings goal based on your regular expenses.

- Create a budget to manage your spending.

- Automate your savings to ensure regular contributions.

- Monitor your progress and adjust your plan as needed.

Remember, the goal is to make saving a habit and to prioritize this fund as part of your overall financial planning. With discipline and a solid plan, you’ll empower yourself to handle life’s surprises with confidence.

Smart Budgeting to Prevent Future Shortfalls

Smart budgeting is not just about cutting expenses, but also about optimizing your financial resources to ensure stability and growth. By setting realistic budgets and living below your means, you can create a buffer against financial emergencies. It’s essential to gain awareness of budgeting techniques that can help you maintain financial freedom in the long run.

- Stop budgeting in your head; use apps like Quicken Simplifi to visualize and manage your finances effectively.

- Invest in an emergency fund with your initial savings to protect yourself from unforeseen expenses.

- Follow the 50-30-20 rule for budgeting: allocate 50% of your income to necessities, 30% to wants, and 20% to savings and debt repayment.

Implementing these strategies can lead to a more secure financial future, where the need for quick cash becomes less frequent and more manageable.

Investing in Personal Development

Investing in personal development is a strategic move that can yield significant returns over time. By enhancing your skills and knowledge, you position yourself for higher earning potential and career advancement. It’s not just about immediate gains; it’s about setting the stage for continual growth and success.

- Pursue further education or professional certifications.

- Attend workshops and seminars relevant to your field.

- Read books and consume content that expands your expertise.

- Network with professionals and mentors who can guide your development.

Investing in yourself is the cornerstone of personal and professional growth. It’s an investment that pays dividends in the form of better job opportunities, increased job satisfaction, and the ability to adapt to changing industries.

Remember, the journey to financial independence is not just about making money; it’s about making smart decisions with the money you have. Diversifying your investments to include your own growth is just as important as any financial asset. As the guide by Rich Dad Poor Dad suggests, it requires time, dedication, and a long-term commitment to learning.

Conclusion

From playing game apps to win real cash, to delivering food, or participating in market research, there are numerous legitimate ways to boost your income quickly. Remember, while some methods may provide instant gratification, others might require a bit more time and effort.

It’s important to choose the option that best suits your skills, resources, and time availability. By exploring the ideas presented in this article and taking action, you’re well on your way to earning that extra cash. Whether it’s for an unexpected expense or a personal savings goal, the opportunity to make $200 fast is within reach.

Frequently Asked Questions

How quickly can I earn 200 dollars using game and survey apps?

The timeframe for earning 200 dollars with game and survey apps varies. Some users may win significant amounts quickly through luck-based gaming apps, while others might accumulate earnings over time with surveys and tasks. Sign-up bonuses can also provide an immediate boost.

What freelance opportunities can help me make 200 dollars fast?

Freelance writing, graphic design, or programming can help you make 200 dollars quickly if you have the skills and can find immediate work. Gig economy jobs like food delivery and ride-sharing offer quick payouts as well.

Can passive income investments help me make 200 dollars fast?

Passive income streams from high-yield savings accounts, real estate crowdfunding, or stock market investments typically take time to grow. However, some stock market apps offer free stock bonuses that could be worth around 200 dollars.

How can I make 200 dollars by selling or renting my possessions?

You can sell unwanted items online through marketplaces or hold a garage sale. Renting out a spare room, parking space, or personal items can also generate quick cash, depending on demand and availability.

What financial planning tips can prevent the need to make 200 dollars fast?

Building an emergency fund, practicing smart budgeting, and investing in personal development can strengthen your financial stability and reduce the urgency for quick cash in the future.

Are the methods to make 200 dollars fast reliable and safe?

While many methods are reliable, it’s important to do your research and use trusted platforms. Be cautious of scams, especially with offers that seem too good to be true. Always ensure you understand the terms and conditions of any service you use.