Am I the only one noticing it?

In recent years, Singapore has witnessed a remarkable transformation in its real estate market, with a significant surge in young condo owners. This phenomenon is closely linked to the “Great Wealth Transfer,” a generational shift in assets and wealth that is reshaping the country’s property market.

Is it safe for the country and what will happen over the next 5 to 10 years?

In this comprehensive article, we delve into the factors driving this trend, the impact on the housing sector, and how it presents an attractive investment opportunity for young individuals seeking to establish their foothold in the property market.

The Great Wealth Transfer: A New Era Dawns

The Great Wealth Transfer refers to the transfer of wealth from the older generation to the younger one.

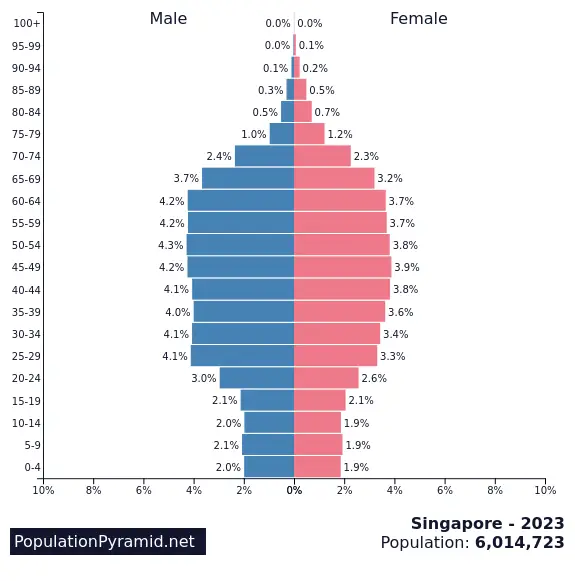

Singapore, a country with slightly over 6 million people, currently has:

- 24% aged over 60 and above

- 40.1% aged 50 and above

These stats are worrying especially since Singapore recently announced that 2022 was the worst recorded birthrate and we are also seeing a slowdown in the workforce participation rate by the MOM(Minister of Manpower).

In Singapore, as the baby boomer generation enters retirement and looks to pass on their assets, a substantial amount of wealth is being transferred to their millennial and Gen Z descendants. This transfer of assets, including real estate properties, has opened up new possibilities for the younger generation to become homeowners and investors.

The result of the slowdown in the workforce can be derived from the result of the great wealth transfer phenomenon where multiple property owners in Singapore who didn’t have the impact from ABSD(additional buyer stamp duty) before 2011 had passed on and the asset was given to their loved ones.

With large tax-free assets being passed down to the younger generation, it’s understandable that some of them would choose to live off the passive income rather than having to work.

Tangible Asset is the Best Asset

In the past before buying stocks and other assets were available through smartphones, people had to buy tangible assets. Apart from buying gold, properties were seen as one of the best investments for wealth accumulation.

The idea of buying freeholds only was seen as the only investment by investors.

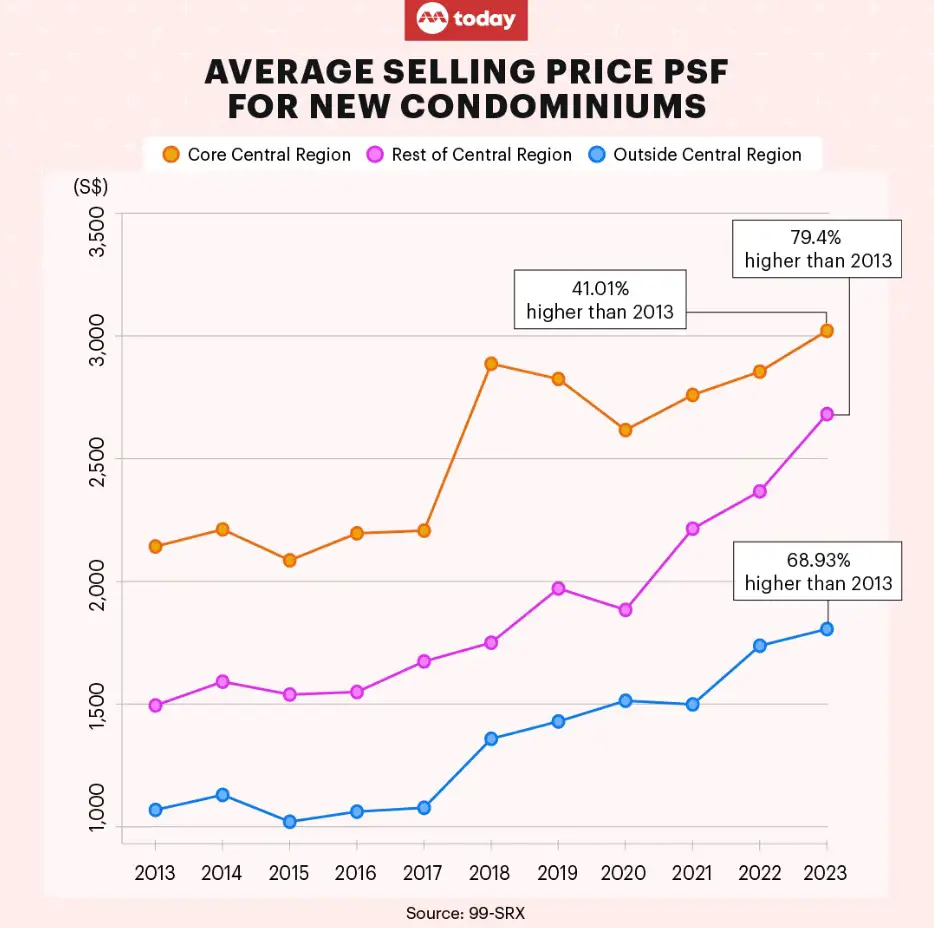

While it has been getting even harder to own a property in Singapore, people still believe that owning tangible assets is the best way to have safe wealth accumulation.

Owning a property in Singapore has consistently beat inflation and is a great way to build passive income through rental income.

Changing Mindsets and Financial Literacy

One crucial factor contributing to the rise of young condo owners is the shifting mindset towards homeownership and financial literacy among the younger demographic.

Unlike their predecessors, millennials and Gen Z are more inclined to view property ownership as a viable long-term investment and a means of wealth accumulation. The increasing emphasis on financial literacy and investment education has empowered these young individuals to make informed decisions about entering the real estate market.

The FIRE movement; or financial independent retire early, is a community of like-minded people looking to save and invest as much to retire early. It has been a growing trend among the younger generation to understand financial literacy which the education system often misses out on.

The Appeal of Condominium Living

Condominiums, also known as condos, have emerged as a popular choice among young homebuyers for several reasons:

- Amenities and Facilities: Condo developments often boast a wide range of amenities, such as swimming pools, gyms, recreational areas, and 24/7 security, offering a desirable lifestyle for young professionals and families.

- Convenience: Many condos are strategically located near business districts, educational institutions, and public transportation hubs, providing easy access to essential services and reducing commuting time.

- Community and Networking: Condo living fosters a sense of community and networking opportunities, allowing young residents to connect with like-minded individuals and professionals.

Mixed-used development has come out on top as the top choice for property investment over the last few years with it easy access to amenities and transportation.

In order to make the cut to own a condominium, the younger generation can be quite savvy with their money. For those looking to invest in private property, two factors that come into play are the monthly income and having the required downpayment.

Jumping Straight to Luxury Living

While living in HDB(Housing Development Board) does offer great government to stay, living in a private estate has perks many people would find enticing. Not to forget, the constant issue of having to ballot more than once for an HDB property has been a really troubling issue among young couples looking to settle down.

Therefore, if their parents are willing to down pay for their loved ones’ property to quickly settle down. Why not? Every parent would love to have their grandchild as soon as possible(I hope so!😅🫡).

Embracing the Future of Property Ownership

The rise of young condo owners in Singapore marks a transformative shift in the real estate landscape, driven by changing mindsets, financial literacy, and the support of government initiatives.

As the Great Wealth Transfer continues to shape the property market, the prospects for young individuals to enter the condo market as homeowners and investors have never been more promising.

By recognizing the allure of condo living, harnessing technology for property search, and leveraging government incentives, the young generation can pave their path to successful homeownership and a financially secure future. As the trend gains momentum, it is clear that the great wealth transfer will leave a lasting impact on the property market and the lives of countless young condo owners in Singapore.