If you are looking to transition from private property to resale HDB, you must wait 15 months from the date of disposal or sale of your private property to apply to purchase an HDB resale apartment after all of your residential private property has been sold.

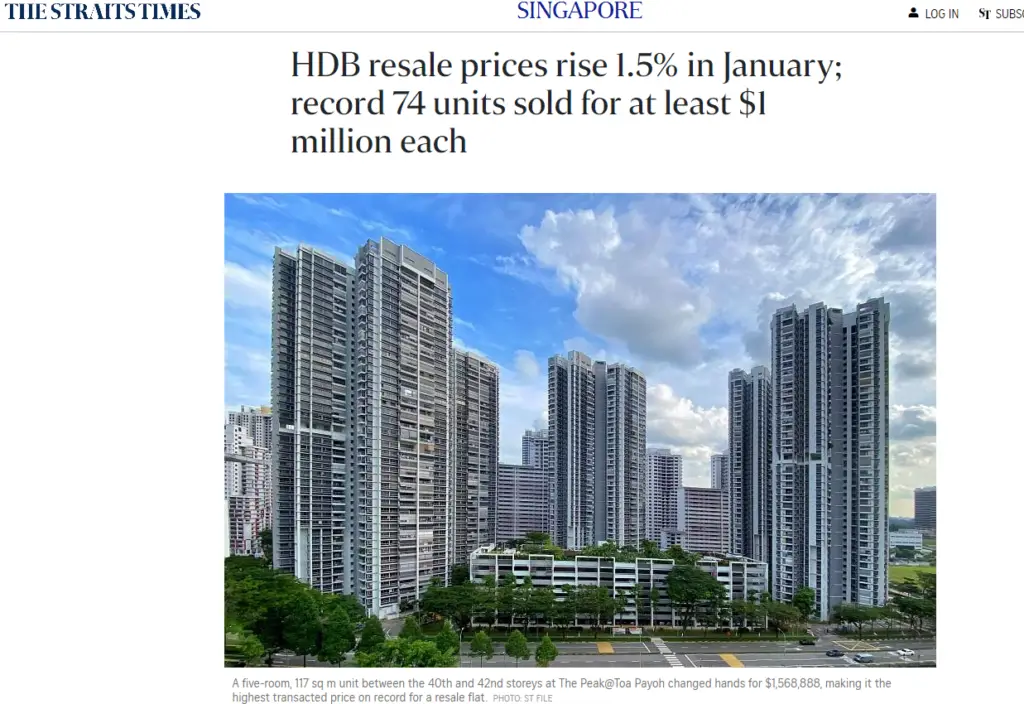

Before the implementation of this restriction, housing prices, particularly in areas close to good amenities and city centers like Clementi, Toa Payoh, and Kallang, were rapidly increasing. Properties, even HDB flats, were reaching million-dollar prices.

This surge was driven by retirees downsizing from private property to HDB flats to access grants and enjoy retirement. However, this trend has made it difficult for young Singaporeans to afford properties in the resale market.

Despite regulations to slow down this effect(which is likely to accelerate since Singapore has an aging population), we are still seeing prices of resale HDB increasing over the last few years despite lower demand.

If you want to know more about the resale market and what it means for homeowners looking to buy a resale HDB after selling their private property, this article is for you.

The trend of the resale HDB market

The resale HDB market has been experiencing a consistent rise in prices, with the latest data indicating a 1.1% increase in the past quarter. This marks the fifteenth consecutive quarter of price growth, reflecting a sustained demand for resale flats.

Despite this upward trend, the rate of increase has shown signs of moderation, with a 4.8% rise in 2023 compared to a more significant 10.4% climb in the previous year.

In terms of supply, approximately 15,000 units are expected to reach their Minimum Occupation Period (MOP) in 2023, which may influence the market dynamics. Buyers should be aware of the median resale prices, which vary by town and flat type, as these figures are crucial for financial planning and determining fair value for potential purchases.

While the resale HDB market remains robust, potential buyers should conduct thorough research and consider the median resale prices to make informed decisions.

Impact of High Demand on Resale Transactions

The high demand for resale HDB flats has led to a competitive market where buyers often feel the urgency to make quick decisions. Record-breaking sales of million-dollar resale flats early in 2024 exemplify the market’s intensity. This fervor can lead to hasty purchases, underscoring the importance of thorough due diligence when selecting a flat.

Despite the high demand, there has been a noticeable trend of slowing price growth. Reports indicate that while resale prices ended 2023 at an all-time high, the rate of increase has been tapering off. For instance, the fourth quarter of 2023 saw a modest 1.1% rise in resale prices, a deceleration from previous quarters.

Buyers should remain vigilant and informed, as the market’s high demand juxtaposed with slowing price growth presents both opportunities and challenges.

Understanding the dynamics of the current market is crucial for prospective buyers. Here’s a snapshot of the recent trends in resale HDB prices:

| Quarter | Price Increase (%) |

|---|---|

| Q4 2023 | 1.1 |

| Full Year 2023 | 4.9 |

Factors such as subdued housing demand, higher interest rates, and inflationary concerns have been contributing to the slower price growth, suggesting that buyers may have more negotiation power than perceived.

Key Factors Influencing Resale HDB Costs

When considering the purchase of a resale HDB flat, it’s crucial to understand the key factors that influence its cost. These factors can significantly affect the final price you pay and your overall satisfaction with the investment.

- Location: A prime location can command a higher price due to its convenience and accessibility.

- Flat Size and Condition: Larger flats and those in better condition often fetch higher prices.

- Market Trends: Current market trends, such as the comparison between resale HDB and BTO options, can sway costs. Resale flats offer immediate availability and potential for negotiation, while BTO flats might have a lower initial cost but require a longer wait.

- Lease Tenure: The remaining lease of the flat affects its value, with shorter leases typically leading to lower prices.

- Supply and Demand: High demand in established neighborhoods can drive up prices, especially for flats that offer potential for higher value appreciation.

It’s also important to consider the financial implications of your purchase, including the potential for asset progression and the risks associated with depreciation. Weighing the benefits of immediate availability against the long-term investment value is a delicate balance that requires careful thought and planning.

Eligibility Criteria for Purchasing Resale HDB After Selling Private Property

When transitioning from private property to a resale HDB flat, understanding the Minimum Occupation Period (MOP) is crucial.

The MOP is a mandatory period during which you must physically occupy your new HDB flat before considering any further property investments. This period is typically 5 years for most HDB flats, but it can vary depending on the type of flat purchased, such as for Design, Build and Sell Scheme (DBSS) flats or Executive Condominiums (ECs).

After selling your private property, it’s important to plan your housing transition with the MOP in mind. This ensures compliance with HDB regulations and avoids potential penalties.

Eligibility to purchase a resale HDB flat involves several key rules, including citizenship, family nucleus, and income ceilings. Additionally, after acquiring a resale HDB, owners are restricted from investing in private residential property until the MOP has been fulfilled. Here’s a quick reference to understand the MOP for different housing types:

- HDB Flats: 5-year MOP from the date of purchase

- Executive Condominiums (ECs): 5-year MOP from the date of the Temporary Occupation Permit

- DBSS Flats: MOP as stipulated by HDB, typically 5 years

Remember, the MOP starts from the date you take possession of the flat, and it’s essential to adhere to this timeline to maintain eligibility for future property transactions.

Financial Planning After Selling Private Property

After selling your private property, financial planning becomes crucial for a smooth transition to a resale HDB flat. Careful budgeting is essential to ensure that the proceeds from the sale are allocated effectively to cover the costs associated with purchasing a resale HDB. It’s important to consider the resale levy, downpayment, and renovation expenses, as well as the potential need for a home loan.

- Resale Levy: If you have previously bought a subsidized flat or an EC from a developer, you may be required to pay a resale levy when purchasing another subsidized flat.

- Downpayment: The minimum downpayment for a resale HDB flat can range from 10% to 25%, depending on the loan type.

- Renovation Costs: Set aside a budget for renovations to make your new home comfortable and to your liking.

- Home Loan: Assess if you need a home loan and the amount you can afford based on your financial situation.

When planning your finances, remember to account for the long-term implications of your purchase, such as the remaining lease of the flat and its impact on the use of CPF funds.

Understanding the financial intricacies, including CPF regulations and cash requirements, will help you make an informed decision. For instance, if the resale flat’s lease does not cover you until the age of 95, you may face limitations in using your CPF savings and need to prepare for cash payments.

CPF Regulations and Cash Requirements

When transitioning from private to public housing, understanding CPF regulations and cash requirements is crucial. You must not have disposed of a private property at least 30 months before the HDB Flat Eligibility (HFE) date if you’re considering buying a resale flat with CPF housing grants. Additionally, for resale flats or DBSS flats where the remaining lease covers the youngest owner to at least 95 years old, CPF funds can be used more extensively.

It’s important to be aware of the various fees involved in the transaction. For instance, the conveyancing fee is approximately $3,000, which can be paid using CPF, while other costs like the valuation fee and HDB resale application fee must be settled in cash.

Here’s a quick breakdown of potential cash requirements:

- Valuation Fee: $120 (Cash)

- HDB Resale Application Fee: $80 (Cash)

- Conveyancing Fee: Approx. $3,000 (CPF)

Remember, if the resale flat’s lease does not cover you until age 95, CPF usage will be restricted, necessitating a higher cash outlay. Therefore, selecting a flat with an adequate lease is essential to minimize cash payments.

Want to take it a step further and level up your knowledge about real estate and possibly guide people into making good property investments?

“The Millionaire Real Estate Investor” is a New York Times best-selling book and has been around for quite some time now for its universal knowledge in real estate investing applications.

Interested to know more?

Evaluating Resale HDB Flats: What to Look For

Before you commit to any real estate investment, you should know some hard facts about the property that you are buying:

Assessing the Remaining Lease of the Flat

All HDB flats start with a 99-year lease, and as time passes, the lease depletes, influencing the flat’s value and the buyer’s eligibility for using CPF funds.

It’s essential to ensure that the remaining lease covers the youngest buyer until the age of 95 to maximize CPF usage. If the lease falls short, buyers must prepare for additional cash outlays.

Understanding the lease implications is vital for long-term planning. Here’s a quick reference to assess the impact of the remaining lease on financing:

| Remaining Lease | CPF Usage | Cash Requirements |

|---|---|---|

| 95 years or more | Full CPF allowed | Minimal cash needed |

| Less than 95 years | Partial CPF allowed | Higher cash needed |

Remember to factor in the remaining lease when budgeting for your purchase to avoid unexpected financial burdens.

Understand the History of the Flat’s Ownership

When considering a resale HDB flat, it’s crucial to investigate its ownership history. A flat that has changed hands multiple times might indicate underlying issues, ranging from structural defects to less-than-ideal neighbor relations. It’s advisable to have your property agent delve into the flat’s past to uncover any red flags.

Understanding the manner of holding is also essential. For instance, a flat held under joint tenancy means that upon the demise of an owner, the property automatically transfers to the surviving co-owners. Changes in ownership, whether through a transfer or a resale of part-share, are subject to HDB’s regulations and procedures, which include an application process and approval.

It’s important to be aware of any changes in the manner of holding or ownership proportion, as these can affect your rights and responsibilities as a new owner.

Lastly, be mindful of the application procedure for ownership changes, which involves submitting an online application, receiving HDB’s approval, and completing the necessary payments and legal formalities.

Investigating the Living Environment and Neighbourhood Plans

The presence of amenities such as playgrounds, basketball courts, and community halls can indicate a vibrant community but may also suggest potential noise levels. It’s important to assess if this aligns with your lifestyle preferences.

The investment value of your resale unit can be significantly influenced by upcoming neighbourhood developments. MRT stations, shopping complexes, and other infrastructural projects can enhance the desirability and value of your property.

Routine maintenance and estate improvement works, such as landscaping and fitness corners, contribute to the long-term appeal of the area. Contacting the Town Council for information on plans can provide insights into the sustainability and growth of the neighborhood. Additionally, consider the cleanliness and orderliness of the environment; convenience stores and eateries at the block’s base are handy, but they may also lead to a cluttered setting.

Lastly, the presence of CCTV cameras can be a double-edged sword, indicating both security measures and potential issues within the area. It’s essential to weigh these aspects carefully to ensure your future home meets your expectations for comfort and security.

Financial Implications of Transitioning from Private to Public Housing

Cost Differences Between Private Property and Resale HDB

Transitioning from private property to a resale HDB flat involves a significant shift in financial dynamics. The cost of a private condominium can be substantially higher than that of a resale HDB flat, with a 3-bedroom private condo fetching around $1.2 million, compared to a resale HDB which may start at a lower price point.

When considering the resale HDB market, it’s important to note that the median resale prices can vary greatly depending on location and flat type. For instance, the median price for a resale flat in a selected town during the fourth quarter of 2023 can serve as a benchmark for potential buyers.

While decoupling in real estate can save on Additional Buyer’s Stamp Duty (ABSD), it incurs other costs. For HDB owners, the challenges in decoupling can affect the financial planning involved in the transition.

Here’s a quick comparison of median resale HDB prices for different flat types in selected towns:

| Town | 3-Room | 4-Room | 5-Room |

|---|---|---|---|

| Town A | $XXX,XXX | $XXX,XXX | $XXX,XXX |

| Town B | $XXX,XXX | $XXX,XXX | $XXX,XXX |

Remember, these figures are median prices, which means the actual cost of the unit you choose may vary. They are, however, essential for setting a realistic budget and determining fair value.

Managing Your Budget for a Resale HDB Purchase

When transitioning from private to public housing, managing your budget is crucial to ensure a smooth financial shift. After selling your private property, it’s important to understand the costs involved in purchasing a resale HDB flat. The resale market can be competitive, with prices influenced by factors such as location, flat size, and remaining lease. Here’s a simplified breakdown to help you plan your finances:

- Assess your financial position: Use tools like the HDB’s sale proceeds calculator to estimate the funds available from selling your private property.

- Understand the costs: Median resale prices can guide your budgeting, but remember that actual costs may vary.

- Plan for additional expenses: Renovation, legal fees, and stamp duties are part of the total cost.

It’s essential to balance your aspirations with practical financial planning to avoid overstretching your budget in the long run.

Lastly, consider the long-term implications of your purchase, such as the potential investment value of the flat and how it fits into your overall financial goals.

Potential Investment Value of Resale HDB Flats

The resale HDB market has shown resilience with prices trending upwards, reflecting a robust demand for public housing. In 2023, resale prices rose by 4.9%, and experts anticipate a continued increase into 2024, though at a more modest pace. This suggests that resale HDB flats can be a sound investment, especially if purchased in high-growth areas.

When evaluating the potential investment value of a resale HDB flat, consider the historical performance of similar properties in the area. For instance, data from new HDB estates like Punggol indicates that early residents often enjoy higher capital gains upon resale.

The valuation of a resale HDB flat is a critical factor in determining its investment potential. It is an estimation of the flat’s worth and plays a pivotal role in the purchasing process. To make an informed decision, buyers should be aware of the median resale prices in various towns and flat types. Here’s a snapshot of median resale prices in selected towns for the fourth quarter of 2023:

| Town | 3-Room | 4-Room | 5-Room |

|---|---|---|---|

| GEYLANG | – | $345,000 | $615,000 |

| HOUGANG | – | $350,000 | $560,000 |

Remember, the investment value of a resale HDB flat is not solely determined by its price. Factors such as the flat’s condition, the town’s development plans, and the quality of local amenities also play significant roles.

Navigating the Resale HDB Buying Process

Steps to Take After Selling Your Private Property

Once you have sold your private property, the journey to purchasing a resale HDB flat begins. Ensure you have a clear understanding of the resale application process and the necessary documents required. The first step is to obtain the Option to Purchase (OTP) from the seller, which includes critical details such as the address of the flat and sellers’ particulars.

Next, submit a complete resale application to HDB, including all supporting documents. HDB will then verify both parties’ eligibility and review the application. Remember, you will need to vacate your current residence before the Date of Completion to allow the new owners to take possession.

Financial planning is crucial at this stage. Consider the costs involved in the transition and how it will affect your budget. It’s important to manage your finances wisely to ensure a smooth transition from private to public housing.

Engaging with Property Agents and the HDB

Once you’ve sold your private property and are looking to purchase a resale HDB flat, engaging with property agents and the Housing Development Board (HDB) is a crucial step. Property agents can provide valuable insights into the market, assist with finding suitable flats, and help negotiate the best price. It’s important to select an agent with experience in the resale HDB market to guide you through the complexities of the transaction.

When dealing with the HDB, you’ll need to manage the purchase process, which includes checking your eligibility, considering your budget, and attending flat viewings. The HDB website offers a comprehensive guide on managing the flat purchase, which can be an invaluable resource for prospective buyers.

Remember, the resale application process with HDB will take about 8 weeks to complete. It’s essential to plan accordingly and ensure all necessary documents are prepared in advance to avoid any delays.

Hiring a conveyancing lawyer is also a recommended step, especially for those unfamiliar with the legal aspects of property transactions. The lawyer will act on your behalf and ensure that all legal requirements are met for a smooth transfer of ownership.

Closing the Deal: Final Checks and Procedures

Once you’ve navigated the complexities of the resale HDB market and found your ideal flat, the final steps are crucial to ensure a smooth transition. Ensure all financial aspects are settled, including the CPF funds and cash payments required. It’s also important to verify that all necessary documents are in order for the completion of the sale.

Before the keys are handed over, a final inspection of the flat should be conducted. This is to confirm that the condition of the flat matches what was agreed upon during the sale. Any discrepancies should be addressed before the final handover.

Remember, the resale completion timeline is typically about 8 weeks after HDB’s acceptance of the resale application. Use this period to prepare for the move and address any final concerns.

Lastly, it’s essential to communicate with your property agent and the HDB throughout this period to ensure that all procedures are followed correctly and to avoid any last-minute surprises.

Got what you need?

From understanding the median resale prices and the impact of the remaining lease on financing to evaluating the living environment and future neighborhood plans, buyers must be diligent in their research. Additionally, the history of the flat’s transactions can provide insight into potential issues.

With the resale market remaining robust and prices reflecting the high demand, it’s crucial to be well-informed and prepared to make a decision that aligns with both financial and lifestyle goals. Remember to consult with property experts and utilize available resources to ensure a wise investment in your next home.

Aaron Oon is a Senior Associate Director at Propnex and Founder of Real Estate Insider. A consistent Top Producer in the competitive world of real estate, Armed with a Finance degree from NUS, Aaron is more than just a real estate agent; he’s a strategic thinker and a creative problem solver.

If you are looking to invest in a property here in Singapore or would like to know more about Singapore’s property market. Be sure to reach out through the Calendy video link below:

Frequently Asked Questions

How much should I expect to spend on a resale HDB flat in Singapore?

The cost of a resale HDB flat in Singapore varies by town and flat type. Median prices can be found on HDB’s website, reflecting the market value for the fourth quarter of 2023. Remember, these are median prices, so the actual cost of the unit you’re interested in may differ based on its condition and other factors.

What is the impact of high demand on resale HDB transactions?

High demand for resale HDB flats, especially larger units, has led to a spike in the number of million-dollar transactions. This can create a sense of urgency among buyers, making it important to carefully evaluate potential purchases rather than rushing into decisions.

What should I consider about the remaining lease of a resale HDB flat?

It’s crucial to check the remaining lease on the flat, as it affects financing options. If the lease expires before you turn 95, you cannot use your CPF savings to fully pay for the flat and will need to cover the shortfall in cash. Choose a flat with a sufficient lease to avoid this scenario.

How can the living environment and future neighborhood plans affect my resale HDB purchase?

The living environment and upcoming developments can significantly impact the investment value of a resale HDB flat. Proximity to MRT stations, malls, and other amenities can enhance the value, as can future town council improvement projects. Researching these factors is key to making a good investment.

Why is the history of the flat’s ownership important when buying a resale HDB?

A resale flat with a history of frequent sales may indicate persistent problems, ranging from structural defects to social issues. Investigating the ownership history can help you avoid buying a problematic flat.

What financial planning should I do after selling my private property before buying a resale HDB?

After selling your private property, you should consider the Minimum Occupation Period (MOP) requirements, CPF regulations, and cash requirements for purchasing a resale HDB. Budgeting for the resale HDB purchase and understanding the cost differences between private and public housing are also critical steps in financial planning.