Real estate agents are pivotal players in the property market, facilitating transactions between buyers and sellers. Their earnings are primarily derived from commissions, a percentage of the property’s selling price.

If you are here, chances are, you either want to know how real estate agents make money or what the potential earnings of this job can provide. This article explores the intricacies of how agents make money, the factors affecting their income, and the different payment structures within the industry.

Key Takeaways

- Most real estate agents earn income through commission-based payments, often a percentage of the property’s sale price.

- Commission splits between agents and brokers vary based on their agreement, and agents also share commissions with buyer’s agents and their brokers.

- Agents’ earnings are influenced by market conditions, the number of transactions completed, and their experience level.

- While most agents work on commission, some may receive a base salary with bonuses, particularly those employed by certain real estate companies.

- Brokers earn money not only from their share of commissions but also from additional services and the overall operation of their brokerage.

Answer Revealed: how real estate agents make money

Real estate agents primarily earn through commission-based income, which is a portion of the sale price of a property. This commission can either be a percentage of the selling price or a flat fee, tailored to the agreement between the agent and their client. The potential for higher earnings is directly tied to an agent’s performance and the value of the properties they sell.

- A typical commission split between an agent and their broker might vary from 90/10 to 70/30

- Experienced agents often negotiate a larger share of the commission.

- Gross Commission Income (GCI) is the total amount earned before expenses and taxes are deducted.

The commission model incentivizes agents to achieve higher sale prices, aligning their interests with those of the sellers.

Commission payments are usually processed through the selling party’s brokerage, which then distributes the funds according to the agreed-upon splits. These splits are not only between the agent and their broker but may also involve the buyer’s agent and their broker, making the dynamics of commission payouts a multi-layered process.

Commission Structures: Percentage vs. Flat Fee

Real estate agents can earn their income through different commission structures, each with its own set of advantages and challenges. The choice between a percentage-based commission and a flat fee can significantly impact an agent’s earnings.

In a percentage-based commission structure, agents receive a portion of the final selling price of a property. This rate typically ranges from 1% to 2% for flat-fee services, this means if a property agent manages to close a $1 million deal, they make $10,000 in commission. That’s pretty good!

For some buyers, they may feel this amount is outrageous and expensive. However, buyers should note that such clients are hard to come by and agents are probably spending 30% of their income on marketing alone.

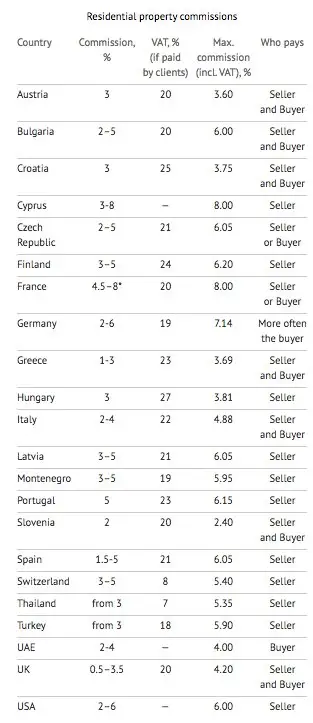

Also, it’s important to know that Singapore’s property agent commission rate is one of the lowest in the world.

Traditional models in the US hover between 4 to 6 percent. The percentage approach aligns the agent’s incentives with the seller’s goal of maximizing the sale price.

Conversely, a flat fee commission is a predetermined amount paid to the agent regardless of the property’s selling price. An example of this would be a broker charging a flat fee commission of $20,000 on their listings. This model can be appealing to sellers who prefer a straightforward, predictable cost.

For rental transactions, commission structures differ. An agent’s fee might be a percentage of the annual rental amount, offering a different dynamic compared to sales transactions.

When choosing a commission structure, it’s essential to consider market conditions, property value, and the level of service provided by the agent. Negotiation is often possible, and understanding these models is key to making an informed decision.

The Role of Brokers in Agent Commissions

Brokers are the gatekeepers of commissions, ensuring that all transactions adhere to legal and ethical standards. Agents, who are licensed to operate under a broker, must funnel their earned commissions through their employing broker, who then disburses the agent’s share.

Brokers not only provide oversight but also offer valuable support services to agents, including marketing assistance and access to a broader network of potential buyers. While this relationship is beneficial, it does mean that agents share a portion of their earnings with their brokers. The exact split varies and is often outlined in the agent’s contract with the brokerage.

- The broker receives a commission payment

- Broker splits commission with agent

- The split percentage varies by contract

Agents should weigh the pros and cons of working with a broker, considering the expertise and resources offered against the commission fees incurred. The decision to partner with a broker can significantly impact an agent’s take-home pay and overall career trajectory.

Factors Influencing Commission Rates

The commission rates for real estate agents are not set in stone and can be influenced by a variety of factors. Property value and location are significant determinants, as higher-priced homes may attract lower commission rates due to the larger absolute amount of money involved. Market conditions also play a crucial role; in a competitive seller’s market with limited inventory, agents may be more open to negotiating their rates.

Agent experience and expertise are also pivotal in determining commission rates. Seasoned agents with a proven track record may command higher fees for their services. However, the complexity of the transaction and the level of service provided can also impact the rate. For instance, an agent handling both the buying and selling sides of a deal might offer a reduced rate due to the increased earnings from combined commissions.

When considering commission rates, it’s beneficial to explore various options. Interviewing multiple agents and looking into low-commission real estate companies can lead to substantial savings without compromising on service quality.

The Earnings of Real Estate Agents

The income of real estate agents can vary widely, influenced by factors such as experience, location, and market conditions. While some agents may struggle to make ends meet, others enjoy substantial earnings, reflecting the unpredictable nature of the industry.

In Singapore, interestingly enough there are more than 35,251 in 2024. According to Indeed Salaries, the average base salary for a real estate agent is $3,292 per month. The amount of money you make, however, is largely dependent on the housing market, as well as your level of experience.

Real estate agents typically earn money through commissions, which are often a percentage of the property’s sale price. However, these commissions can be subject to negotiation and can also vary depending on the agent’s agreement with their brokerage.

The variability in income highlights the importance of agents being well-informed and adaptable to changing market dynamics.

The Impact of Market Conditions on Earnings

Real estate agents’ earnings are closely tied to the ebb and flow of market conditions. Market trends, such as shifts in supply and demand or changes in interest rates, can significantly influence the number of transactions and the prices at which properties sell.

During periods of high demand and low supply, agents may experience a surge in earnings due to increased sales volume and higher property values. Conversely, in a sluggish market, agents might find it challenging to maintain their income levels.

However, looking at this year’s 2024 new launches, we can expect real estate agents to still be making good income from these projects. Here are all the latest projects for 2024:

| No. | Project Name | Region | Location | District | Tenure | Est. No. of Unit |

|---|---|---|---|---|---|---|

| 1 | TBC (Marina Gardens Lane GLS) | CCR | Marina Lane | 1 | 99 LH | 790 |

| 2 | Marina View Residences | CCR | Maina View | 1 | 99 LH | 683 |

| 3 | Newport Residences | CCR | Anson Road | 2 | FH | 246 |

| 4 | Former Peace Centre | CCR | Sophia Road | 9 | 99 LH | 240 |

| 5 | Skywaters Residences | CCR | Shenton Way | 1 | 99 LH | 215 |

| 6 | 21 Anderson | CCR | Anderson Road | 10 | FH | 18 |

| 7 | 32 Gilstead Road | CCR | Gilstead Road | 11 | FH | 14 |

| 8 | Former Kew Lodge | CCR | Kheam Hock Road | 11 | FH | TBC |

| 9 | TBC (Jalan Tembusu GLS) | RCR | Jalan Tembusu | 15 | 99 LH | 840 |

| 10 | TBC (Lorong 1 Toa Payoh GLS) | RCR | Lorong 1 Toa Payoh | 12 | 99 LH | 800 |

| 11 | TBC (Pine Grove GLS) | RCR | Pine Grove | 21 | 99 LH | 565 |

| 12 | Former Central Mall / Central Square | RCR | Havelock Road | 1 | 99 LH | 366 |

| 13 | Former Meyer Park | RCR | Meyer Road | 15 | 99 LH | 230 |

| 14 | The Arcady at Boon Keng | RCR | St. Barbabas Lane | 12 | FH | 172 |

| 15 | TBC (Bukit Timah Link GLS) | RCR | Bukit Timah Link | 21 | 99 LH | 160 |

| 16 | The Hill @ One-North | RCR | Slim Barracks Rise | 5 | 99 LH | 142 |

| 17 | Former La Ville | RCR | Tanjong Rhu Road | 15 | FH | 107 |

| 18 | Keppel Bay Plot 6 | RCR | Keppel Island | 4 | 99 LH | 86 |

| 19 | The Hilshore | RCR | Pasir Panjang Road | 5 | FH | 59 |

| 20 | Ardon Residence | RCR | Haig Road | 15 | FH | 35 |

| 21 | Former Golden Mile Complex | RCR | Beach Road | 7 | 99 LH | TBC |

| 22 | TBC (Tampines Avenue 11 GLS) | OCR | Tampines Avenue 11 | 18 | 99 LH | 1,190 |

| 23 | Former Chuan Park | OCR | Lorong Chuan | 19 | 99 LH | 900 |

| 24 | Lentor Mansion | OCR | Lentor Gardens | 26 | 99 LH | 533 |

| 25 | TBC (Clementi Avenue 1 GLS) | OCR | Clementi Avenue 1 | 5 | 99 LH | 501 |

| 26 | TBC (Lentor Central GLS) | OCR | Lentor Central | 16 | 99 LH | 475 |

| 27 | SORA | OCR | Yuan Ching Road | 22 | 99 LH | 440 |

| 28 | TBC (Champions Way GLS) | OCR | Champions Way | 25 | 99 LH | 350 |

| 29 | Hillhaven | OCR | Hillview Rise | 23 | 99 LH | 341 |

| 30 | Kassia | OCR | Flora Drive | 17 | FH | 276 |

| 31 | Lentoria | OCR | Lentor Hill Road | 26 | 99 LH | 267 |

| 32 | Former Bagnall Court | OCR | Upper East Coast Road | 16 | FH | 113 |

| 33 | (EC) Lumina Grand | OCR | Bukit Batok West Avenue 5 | 23 | 99 LH | 496 |

As you can see, there is a healthy amount of new launches in Singapore and we can expect a good amount of commission from these closures.

However, economic factors also play a crucial role in shaping an agent’s income. For instance, during an economic downturn, the real estate market often slows down, which can lead to fewer transactions and a more competitive landscape for agents seeking clients.

Right now in 2024, we are seeing a strong downward trend in the property market index, signaling more pain to come in the coming few quarters until the market finds its bottom.

During such times, agents need to adapt their strategies to remain profitable. In a way, the real estate market isn’t as “evergreen” as what some might say.

Agents must be adept at navigating through various market conditions, understanding the nuances of each to optimize their earning potential.

Here are some key points that illustrate how market conditions impact real estate agent earnings:

- Market fluctuations directly impact agent earnings, with changes in housing supply and demand, and interest rates being significant factors.

- Following market slumps, some regions may see a rapid increase in home values due to strong demand, while others may struggle to rebound.

- Agents need to be aware of broader economic trends and how they affect local real estate markets to forecast potential challenges and opportunities.

Additional Costs: Taxes and Business Expenses

While the commission-based income of real estate agents can be substantial, it’s important to account for the additional costs that can significantly impact take-home pay. These costs encompass various expenses necessary for agents to operate effectively and comply with legal requirements.

Real estate agents are often considered self-employed, which means they are responsible for their income, expenses, and taxes. This requires diligent bookkeeping and financial management.

For instance, agents must set aside a portion of their income for federal and state taxes, which are typically paid quarterly. A common recommendation is to save around 30% of gross income for taxes, although the actual tax rate may vary.

Business expenses for real estate agents are diverse and can include items such as marketing costs, professional fees, and travel expenses. These outlays are essential for maintaining a competitive edge and providing high-quality services to clients.

Here is a list of common business expenses that real estate agents may incur:

- Marketing and Advertising: Expenses related to promoting properties such as online ads, print ads, flyers, and signage.

- Transportation: Costs associated with traveling to property viewings, meetings with clients, and networking events. This includes fuel, parking fees, and public transportation fares.

- Office Rent or Home Office Expenses: If the agent operates from a physical office space, rent, utilities, and maintenance costs apply. Alternatively, if they work from home, a portion of home office expenses like internet bills, utilities, and office supplies may be deductible.

- Professional Fees: Membership dues for professional organizations, licensing fees, and subscriptions to industry publications.

- Client Entertainment: Expenses for meals, coffee meetings, or entertainment with clients or potential clients.

- Technology and Software: Costs for real estate software, customer relationship management (CRM) systems, website hosting, and other tech tools used for property listings and client management.

- Training and Education: Fees for attending workshops, seminars, courses, and obtaining certifications to stay updated with industry trends and regulations.

- Insurance: Professional liability insurance, errors and omissions insurance, and other types of insurance to protect against potential risks in the real estate business.

- Legal and Professional Services: Fees for legal consultations, contract drafting, and accounting services.

- Office Supplies: Expenses for stationery, printing, postage, and other office supplies necessary for day-to-day operations.

- Commission Splits: If the agent works for a brokerage, a portion of their commission may go towards brokerage fees or splits.

- Miscellaneous Expenses: Any other relevant expenses such as client gifts, photography for property listings, or staging costs.

In Singapore, for example, real estate agents must also charge GST on the brokerage fees they receive, adding another layer to their financial considerations.

Looking for marketing services to help you boost awareness?

Here at HustleVenture, we are a finance and side hustle newsletter business. So if you are reading this, chances are, we can help you grow your side hustle/business through some of our online services such as:

- SEO writing [Popular⭐]

- Web design

- Videography [Singapore Only]

- Advertising [Popular⭐]

- Copywriting

- Guest post promotion

These are just some ways we can do to promote your business/side hustle. Interested to know more, be sure to schedule a Zoom call with us down below!

New Agents vs. Experienced Agents

The disparity in earnings between new and experienced real estate agents is significant. Experienced agents often command higher commission rates due to their proven track record of selling homes above market value and securing properties for buyers at lower prices. Conversely, new agents may be more flexible with their commission rates to attract business, but this does not necessarily mean a compromise in quality.

New Agents:

- More likely to negotiate commission rates.

- May face challenges in generating consistent income.

- Often rely on building a client base and reputation.

Experienced Agents:

- Justify higher commission rates with experience.

- Typically have a robust client network.

- Can leverage their market knowledge for better deals.

The income of a real estate agent is highly dependent on their sales volume and commission rates. Agents who consistently close a high number of sales and work with higher-value properties tend to earn more.

Clients need to consider the value an experienced agent brings to the table, which often justifies their higher fees. However, new agents, driven by the need to establish themselves, can also offer unique advantages, such as personalized attention and innovative marketing strategies.

Payment Dynamics in Real Estate Transactions

One of the biggest worry as a real estate agent is not knowing when the commission will arrive.

Real estate agents typically receive their commission after the closing of a property sale and it can take anywhere from a week up to 6 months before payout. The commission is paid out once all contractual obligations are fulfilled and the sale is officially completed. This payment structure ensures that agents are motivated to see a transaction through to its successful end.

Commissions are generally paid only when a transaction settles, aligning the interests of the agent with the successful closure of the deal.

If a sale does not close, agents may not receive a commission, although certain listing agreements might stipulate otherwise. Agents need to understand the specifics of their brokerage’s payment policies and any contractual contingencies that could affect their earnings. (It’s really painful!!!)

Here is a simplified breakdown of the commission payment process:

- The property sale is finalized on closing day.

- The seller’s portion of the sale is paid out.

- The commission is sent to the seller’s real estate brokerage.

- The seller’s brokerage distributes the buyer’s brokerage share.

- Each brokerage then pays their respective agents, minus any applicable fees.

Splitting Commissions: Who Gets What?

The commission split a particular agent receives depends on the agreement with their sponsoring broker. Typically, a commission is shared between the listing and buying agents and their respective brokers. For example, a $500,000 home sale at a 1% commission rate would generate $5,000 in commission, which is then divided among the involved parties.

Commission splits can vary widely, but a common arrangement might see 90% going to the agent and 10% to the broker. More experienced agents often negotiate for a higher percentage.

In some scenarios, the commission may not be split between multiple agents. If a broker also acts as the listing and buying agent, they could retain the entire commission. Here’s a simplified breakdown of how a commission might be distributed in a typical sale:

- Listing Agent’s Share: 3%

- Listing Broker’s Share: 3%

- Buyer’s Agent’s Share: 3%

- Buyer’s Broker’s Share: 3%

This structure ensures that both the seller’s and buyer’s interests are represented, and the professionals involved are compensated for their services.

Understanding Closing Costs and Agent Fees

Closing costs are a significant part of a real estate transaction, encompassing various fees required to finalize the sale. Typically, these costs range from 8% to 10% of the home’s purchase price. A portion of these costs includes real estate commissions, also known as realtor’s fees, which are usually covered by the seller but ultimately can be reflected in the home’s sales price, indirectly affecting the buyer.

Real estate commissions are a critical element of closing costs and are often the largest single expense incurred during the transaction.

The table below breaks down the typical distribution of closing costs:

| Expense Category | Percentage of Purchase Price |

|---|---|

| Title Insurance, Taxes, Fees | 2-4% |

| Real Estate Commissions | ~6% |

Both buyers and sellers need to understand these costs and negotiate manageable terms. Sellers often roll the closing costs into the final sale price to ensure they can cover these expenses comfortably. Buyers should be aware that while they may not be directly paying the realtor’s fees, the inclusion of these costs in the sale price means they are indirectly contributing to them.

Negotiating Commissions with Your Agent

When it comes to negotiating the commission with your real estate agent, understanding the typical structure and rates in your area is crucial. Here are some strategies that might help you secure a lower commission rate:

- Know your local average commission rate to set a baseline for discussions.

- Offer the full buyer’s agent fee to incentivize agents to bring buyers.

- Engage the same agent for both buying and selling to potentially reduce overall costs.

- Enhance your home’s appeal to make it an easier sell, which could justify a lower commission.

It’s essential to approach commission negotiations with respect and awareness of the agent’s expertise and efforts. Experienced agents may command higher rates, but their expertise can be invaluable.

Remember, while it’s possible to persuade your agent to lower their fees, they are not obligated to do so. If a fee seems unreasonable, discuss it with your agent or their broker. Comparing agents and asking about all potential fees during interviews can also provide leverage in negotiations.

Salary Structures for Real Estate Professionals

Real estate is a dinosaur. The system of commissioning an income hasn’t changed much since forever. And rightfully so since it has worked out alright!

Commission-Only vs. Base Salary Models

In the real estate industry, compensation models can significantly impact an agent’s financial stability and motivation. Commission-only models are prevalent, where agents earn solely from the sales they close.

This model is akin to being self-employed, with income directly tied to performance. On the other hand, some agencies offer a base salary model, providing agents with a steady income plus bonuses for sales, which can offer more financial security but potentially lower overall earnings.

Real estate agents must consider their personal financial needs and work preferences when choosing between these models. A base salary may alleviate the stress of inconsistent income, while a commission-only approach could yield higher rewards for those with strong sales skills.

The choice between commission-only and salary-based compensation is a strategic decision for real estate professionals, reflecting their confidence in their sales abilities and their need for financial predictability.

While some agents thrive on the adrenaline of commission-only work, others prefer the predictability of a salary. Here’s a quick comparison:

- Commission-Only: High earning potential, greater risk

- Base Salary: Consistent income, potentially lower earnings

How Bonuses Complement Base Salaries

Bonuses are often tied to performance metrics, such as the number of sales completed, customer satisfaction ratings, recruitment numbers, or achieving certain revenue targets. This structure encourages agents to exceed their basic duties, fostering a competitive and high-achieving work environment.

Bonuses can vary greatly among real estate professionals, reflecting the diverse nature of the market and individual performance. For instance, an agent employed by a company like Redfin may receive a salary with bonuses based on the sale price of each home they close. Here’s a simplified example of how bonuses might complement a base salary in real estate:

| Base Salary | Bonus for Sale Price Range |

|---|---|

| $40,000 | $1,000 (Homes under $250k) |

| $40,000 | $2,000 (Homes $250k-$500k) |

| $40,000 | $3,000 (Homes over $500k) |

While bonuses provide a clear financial advantage, they are not guaranteed and are subject to market conditions and individual performance. Agents must consistently perform well to maximize their earnings from bonuses.

The variability in bonuses also reflects the broader economic climate. For example, during times of economic downturn, bonuses may stagnate, affecting the overall income of real estate agents. Conversely, in a thriving market, bonuses can significantly boost an agent’s income, sometimes even surpassing their base salary.

The Pros and Cons of Different Pay Structures

Real estate agents can choose from various pay structures, each with its own set of advantages and challenges. Commission-only models are prevalent, where agents earn money solely from the commissions on the sales they close. This model can be highly lucrative for successful agents but also unpredictable, as income is directly tied to sales performance.

In contrast, some companies offer a base salary with potential bonuses based on sales. For example, Redfin agents receive a salary plus bonuses, providing more financial stability but potentially lower overall earnings than commission-only agents.

Here are some pros and cons of these pay structures:

Pros:

- Commission-only: High earning potential, rewards performance

- Salary plus bonuses: Steady income, less financial risk

Cons:

- Commission-only: Income variability, no guaranteed earnings

- Salary plus bonuses: May cap earning potential, less incentive for high performance

Agents must consider their personal financial goals, market conditions, and tolerance for risk when choosing a pay structure. The right choice can lead to a rewarding career, but it’s important to understand the implications of each option.

Real Estate Companies Offering Salaries to Agents

While the traditional commission model dominates the real estate industry, some companies are innovating by offering salary-based compensation to their agents. Redfin is a notable example, providing its agents with a base salary and bonuses tied to the sales they close. This hybrid model can offer more financial stability, especially in fluctuating markets.

In addition to base salaries, some agents may also receive benefits that are not typically available to commission-only agents. These can include health insurance, retirement plans, and paid time off, which can be significant factors when choosing an employer.

The shift towards salary-based compensation reflects a changing landscape in real estate, where companies are seeking to attract and retain talent by offering more predictable income streams.

It’s important for agents to consider the long-term implications of their compensation structure. While a salary may provide immediate security, commission-based roles have the potential for higher earnings, especially in robust markets.

Broker vs. Agent: A Financial Comparison

Brokers typically retain a portion of the commissions earned from property sales, which serves as their primary source of income. The exact share that a broker receives can vary significantly, depending on the agreement with their agents.

For example, a common commission split might allocate 70% to the agent and 30% to the broker. However, this ratio can be adjusted to reflect the experience and performance of the agent, with top producers often negotiating a more favorable split. In some instances, a broker who is directly involved in a sale may keep the entire commission, particularly if they represent both the seller and the buyer.

The commission structure is not only pivotal for the income of agents and brokers but also influences the overall cost of real estate services for clients.

Here’s a simplified breakdown of how commissions might be shared in a typical transaction:

- Seller’s agent and buyer’s agent each have an agreement with their respective brokers.

- The commission is divided according to the agreed split, which could be 50/50, 60/40, 70/30, etc.

- In cases where the broker is also the selling agent, they may retain the full commission.

How Brokers Make Money Beyond Agent Commissions

While a significant portion of a broker’s income is derived from the commissions of their agents, brokers have additional revenue streams that bolster their earnings. Brokers often engage in their real estate transactions, directly representing buyers and sellers, which allows them to earn full commissions. Moreover, brokers can generate income through various fees charged for the use of their facilities and services(marketing, apps, research team info).

Brokers may also capitalize on their expertise by offering training or consulting services to new agents or investors. This not only provides a source of income but also strengthens the brokerage’s reputation and network. Additionally, some brokers invest in real estate themselves, creating a portfolio that can yield rental income or profits from property sales.

The financial health of a brokerage is not solely dependent on agent commissions; it’s a multifaceted business model that includes direct sales, service fees, and strategic investments.

It’s important to note that the revenue from agents is typically reinvested into the business, covering operational costs such as rent, utilities, and technology. This reinvestment is crucial for maintaining the brokerage’s infrastructure and supporting its agents.

Comparing Broker and Agent Earnings

When comparing the financial outcomes of real estate brokers and agents, it’s essential to recognize the variability in their income sources. Brokers often have a more stable income due to their base salary and a share of the commissions from the agents they oversee. However, this doesn’t mean that brokers always earn more than agents. In some cases, particularly successful agents can surpass the earnings of their brokers, especially when they close a high volume of contracts.

Brokers typically have a cap on the commission they can earn from each agent, which can range from $15,000 to $30,000 annually. This cap ensures that while brokers benefit from the success of their agents, there is a limit to this revenue stream. For instance, a broker with 10 agents under a $20,000 cap could earn a maximum of $200,000 from agent commissions alone.

The top earners in both roles can achieve significant incomes, with the highest 10% of agents and brokers earning well into six figures. However, these figures are not the norm and depend on various factors, including market conditions and individual performance.

Agents have the potential to earn for every deal they close, with no upper limit. This performance-based income structure can lead to years where agents out-earn brokers within the same brokerage.

The Business Costs of Running a Brokerage

Running a real estate brokerage involves a variety of expenses that can significantly impact profitability. While the main source of revenue for brokerages is the commissions from property transactions, these funds are essential for covering the operational costs of the business. A brokerage’s expenses are not just limited to office rent and utilities; they encompass a wide range of costs necessary for daily operations and long-term sustainability.

The amount a brokerage charges varies, but it is crucial for covering the myriad of operational costs that ensure the brokerage’s functionality and competitiveness in the market.

Some of the common expenses include:

- Broker Fees

- MLS Fees

- National Association of Realtors (NAR) Fees

- Errors and Omissions (E&O) Business Insurance

- Extended Auto Insurance

- Self-Employment Tax

- State Licensing Fees

- Advertising Fees

- Showing Service Fees

- Website Fees

- Assistant’s Salaries

- Yard Signs

- Office Supplies

These costs can be substantial, and they highlight the importance of effective financial management within a brokerage. With average yearly revenue for real estate businesses and varying start-up costs, brokerages must carefully balance their budget to remain profitable.

Looking to be a real estate agent?

While the potential for earnings can be significant, it’s important to remember that agents also face expenses such as taxes, business costs, and fees that impact their net income. Moreover, while most agents work on a commission-only basis, some may receive a base salary with bonuses.

Ultimately, the real estate profession offers a complex and varied income structure that reflects the effort and success of individual agents in navigating the property market. If you are interested in learning more, be sure to reach out to Aaron.

Aaron Oon is a Senior Associate Director at Propnex and Founder of Real Estate Insider. A consistent Top Producer in the competitive world of real estate, Armed with a Finance degree from NUS, Aaron is more than just a real estate agent; he’s a strategic thinker and a creative problem solver.

If you are looking to invest in a property here in Singapore or would like to know more about Singapore’s property market. Be sure to reach out through the Calendy video link below:

Aaron Oon is a Senior Associate Director at Propnex and Founder of Real Estate Insider. A consistent Top Producer in the competitive world of real estate, Armed with a Finance degree from NUS, Aaron is more than just a real estate agent; he’s a strategic thinker and a creative problem solver.

If you are looking to invest in a property here in Singapore or would like to know more about Singapore’s property market. Be sure to reach out through the Calendy video link below:

Frequently Asked Questions

How do real estate agents earn money?

Most real estate agents make money through commissions based on a percentage of the property’s selling price. Agents work under brokers, and the commissions are paid directly to the brokers, who then split it with the agents according to their agreement.

What is the typical commission structure for real estate agents?

The typical commission structure for real estate agents is a percentage of the sale price of the property. While flat fees can also be used, they are much less common. The exact percentage can vary and is agreed upon before an agent contract is signed with a client.

Do real estate agents receive a base salary?

Most real estate agents are paid on a commission-only basis. However, some agents, such as those employed by companies like Redfin, may receive a base salary in addition to bonuses.

When are real estate commissions paid?

Real estate commissions are typically paid at the time of closing. They are deducted from the sale proceeds and paid directly to the brokers, who then distribute the agreed-upon shares to the agents involved in the transaction.

How is a real estate commission split?

A single real estate commission is usually split multiple ways among the listing agent, the listing broker, the buyer’s agent, and the buyer’s agent’s broker. The specific split depends on the agreements the agents have with their sponsoring brokers.

How do real estate brokers make money compared to agents?

Real estate brokers make money by taking a share of the commissions earned by the agents working under them. Additionally, brokers can earn income through their own sales and various other services provided by their brokerage. The broker’s earnings also support the operational costs of running the business.