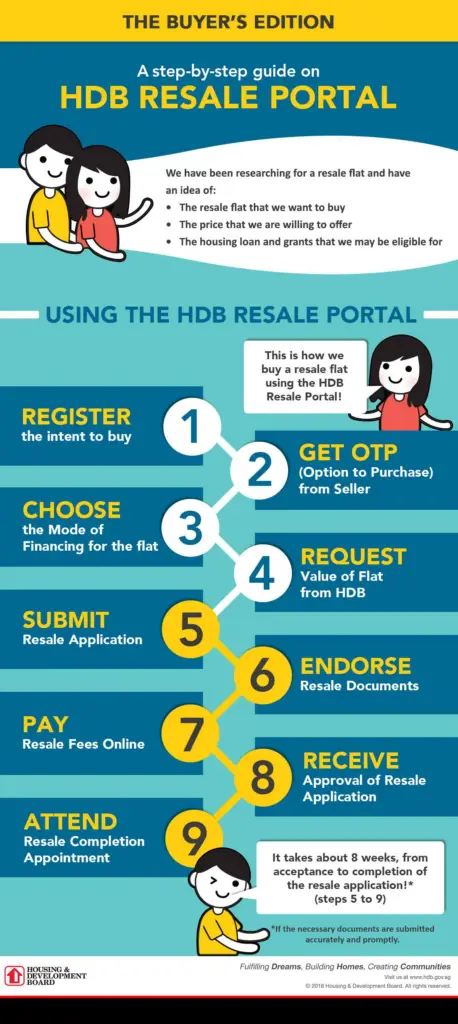

The prospect of buying a resale flat from the Housing & Development Board (HDB) in Singapore is exciting yet daunting. While many homebuyers would go with the approach of getting a BTO, others with more capital and who don’t want to wait for a home to be built would pick the resale property route.

But it can be complicated.

Understanding the key steps and requirements is crucial in making this significant financial decision. This guide outlines the process of purchasing an HDB resale flat in 2024, providing you with the essential information needed to navigate this journey.

Key Takeaways

- Begin by determining your eligibility for a resale HDB and exploring financing options, including the crucial Home Financing Eligibility (HFE) Letter.

- Research and visit various neighbourhoods to find a suitable flat, utilizing the expertise of a realtor to assist in making an informed decision.

- Secure the purchase by obtaining the Option to Purchase (OTP) from the seller and submit a Request for Value to HDB to understand the flat’s valuation.

- Prepare and submit a detailed resale application to HDB, adhering to submission timelines and requirements to ensure a smooth transaction.

- Finalize the resale transaction by signing all required documents, settling fees, and attending the completion appointment to receive official approval from HDB.

How To Buy HDB In Singapore

Determining Your Eligibility for a Resale HDB

Before diving into the housing market, it’s essential to determine if you’re eligible to purchase a resale HDB flat. Eligibility criteria include citizenship, age, family nucleus, and income ceilings. At least one applicant must be a Singapore Citizen, and additional applicants can be either Singapore Citizens or Singapore Permanent Residents (PRs).

- Citizenship: At least one Singapore Citizen applicant

- Family Nucleus: Required composition (e.g., married couple, family)

- Age: Minimum age requirement

- Income Ceilings: Limits on total household income

Eligibility is the first gate you pass through on your journey to homeownership. It sets the stage for the options available to you and the grants you may qualify for.

Once you’ve confirmed your eligibility, you can explore the various grants and subsidies that can make your purchase more affordable. Remember, Resale HDB flats offer immediate availability and the opportunity for price negotiation, which can be advantageous compared to the longer wait times and fixed pricing of BTO flats.

Financing Options and the HFE Letter

When planning to purchase a resale HDB flat, understanding your financing options is paramount. The HDB Flat Eligibility (HFE) letter is a pivotal document that outlines your loan eligibility and the maximum loan amount you can borrow from HDB. It’s essential to apply for this letter early in your buying process through the My Flat Dashboard on the HDB website.

Besides the HDB loan, you can consider various financing options, including bank loans and using your Central Provident Fund (CPF) savings. It’s important to compare the different loan packages available, taking into account the Mortgage Servicing Ratio (MSR) and Total Debt Servicing Ratio (TDSR), which are key factors in determining your loan eligibility.

While exploring your options, keep in mind that the property market in Singapore offers a range of possibilities, from Executive Condominiums (ECs) to private properties. Grants and co-borrowing programs can also aid in making property purchase more affordable.

Remember to assess all possible avenues and seek professional advice if necessary to secure the best financing for your new home.

Assessing Loan Amounts and Budget Planning

When planning to purchase a resale HDB flat, it’s essential to assess your financial readiness and determine the loan amounts you are eligible for. Start by using HDB’s financial tools and calculators to estimate your finances and the housing loan you may need. This will give you clarity on your budget and help you make informed decisions about the flats you can afford.

To work out your financial plan, consider the following payments:

- Downpayment

- Monthly mortgage repayments

- Stamp duty

- Legal fees

- Agent fees

Ensure you also account for other long-term expenses such as maintenance and renovation costs, which can impact your overall budget.

Remember, your Total Debt Servicing Ratio (TDSR) will be a key factor in determining your loan eligibility. This framework ensures that your monthly debt obligations do not exceed a certain percentage of your income. It’s important to gather all necessary income documents and understand the income guidelines set by HDB for a smooth credit assessment process.

Finding Your Ideal Resale Flat

Researching Neighbourhoods and Amenities

When searching for your ideal resale HDB flat, it’s crucial to research neighbourhoods and the amenities they offer. This step is not just about finding a place to live; it’s about discovering a community that fits your lifestyle. Consider the proximity to schools, shopping centres, healthcare facilities, and public transport.

For instance, if you’re looking for resale flats with the best views, you might want to explore areas near Paya Lebar Airbase or along Upper Serangoon View. These locations offer scenic overlooks of the river and greenery, providing a serene living environment.

It’s also important to consider the investment potential of the neighbourhood. Resale flats in high-demand areas with limited supply can offer better opportunities for asset progression.

Here’s a quick checklist to help you evaluate potential neighbourhoods:

- Accessibility to public transport

- Proximity to schools and educational institutions

- Availability of shopping and dining options

- Presence of parks and recreational facilities

- Future development plans for the area

Remember, while amenities like Sengkang Riverside Park add to the appeal of a neighbourhood, it’s essential to balance these with practical considerations such as your budget and the flat’s condition.

Viewing Potential Flats and Making Comparisons

Once you’ve narrowed down your choices, viewing potential flats becomes the next critical step. It’s essential to visit each flat to assess its condition, layout, and the surrounding environment. Take note of renovation needs and the remaining leasehold, as these will impact your living experience and the flat’s resale value.

When making comparisons, consider creating a checklist of your priorities, such as proximity to amenities, public transport, and schools. Here’s an example of what your checklist might include:

- Condition of the flat

- Size and layout

- Remaining leasehold

- Proximity to amenities

- Accessibility to public transport

- Distance to schools

Remember, the decision to buy a resale HDB flat is not just about the price. It’s about finding a balance between affordability and your ideal living conditions.

After viewing, consolidate your observations and compare them against your checklist. This will help you make an informed decision on which flat best suits your needs and budget. Engaging a realtor can provide additional insights, especially when it comes to understanding the nuances of the property market and the potential for capital appreciation.

Engaging a Realtor for Professional Assistance

When considering the purchase of a resale HDB flat, engaging a realtor can provide invaluable assistance throughout the process. A realtor’s expertise can simplify the complexities of the housing market, ensuring that you make informed decisions. Realtors like AE Realtor offer a comprehensive service that includes guiding clients through eligibility criteria, property searches, and the nuances of Executive Condominium (EC) eligibility.

Working with a professional realtor can help you navigate the property-buying process with confidence and ease, ultimately finding you the place you deserve.

Here are some key benefits of engaging a realtor:

- Expertise in the local real estate market

- Assistance with understanding eligibility and financing options

- Guidance through the viewing and selection of potential flats

- Help with obtaining the Option to Purchase (OTP)

Remember, while a realtor can provide flexibility and a sense of ownership in your property search, it’s important to be disciplined in your approach to ensure you find a home that aligns with your budget and long-term goals.

Securing the Purchase

Obtaining the Option to Purchase (OTP)

Once you’ve set your sights on a resale flat, the next crucial step is to obtain the Option to Purchase (OTP) from the seller. This document grants you the exclusive right to purchase the property within a specified period, typically 21 calendar days. To secure the OTP, you must pay an option fee, which can range from $1 to $1,000 and is part of the overall purchase price.

During the option period, it’s essential to review your financial arrangements and finalize them. If you decide to proceed, you will need to exercise the OTP by paying an option exercise fee, which is usually between 1% to 3% of the purchase price and counts towards your down payment. Should you choose not to purchase the flat, the option fee will be forfeited.

It’s important to note that before you can issue the OTP, you must first register your Intent to Buy (ITB) with HDB. This is a mandatory step and, in the case of multiple buyers, only one needs to complete the ITB.

Here’s a quick rundown of the steps involved in the OTP process:

- Step 1: Negotiate and agree on the resale price with the seller.

- Step 2: Sellers grant you the OTP.

- Step 3: Review your purchase decision during the option period.

- Step 4: Exercise the OTP by paying the option exercise fee, or let it lapse if you decide against the purchase.

Submitting a Request for Value to HDB

Once you have the Option to Purchase (OTP) in hand, the next critical step is to submit a Request for Value to HDB. This is a formal valuation of the resale flat that will influence the amount of CPF funds you can utilize and the size of the housing loan you may receive. The valuation report, which has a validity period, is a key component in your financial planning for the purchase.

To initiate the process, you must submit the Request for Value via the My Flat Dashboard on the HDB website. Ensure that you do this by the next working day following the Option Date. It is important to include a scanned copy of Page 1 of the OTP as part of your submission.

The steps to submit your resale application, which includes the Request for Value, are as follows:

- Navigate to the e-Resale system’s ‘Online Submission of Resale Applications and Request for Value’ page.

- Log in using your NRIC number and Singpass.

- Fill in all the required fields in the application form.

- Submit the resale application along with the Request for Value.

Remember, the cost for this valuation is typically the buyer’s responsibility, and it’s crucial to adhere to the submission deadlines to avoid any delays in your purchase journey.

Understanding the Valuation and Its Impact

Once you and the seller have agreed on a price for the resale flat, a Request for Value must be submitted to HDB. This valuation is pivotal as it influences the amount of CPF funds you can utilize and the size of the housing loan you’re eligible for. It’s essential to understand that the valuation can only be done after the price agreement, and the buyer typically bears the cost.

The valuation determines if there will be any Cash Over Valuation (COV), which is the excess amount the buyer pays over the HDB’s assessed value of the flat. A lower or no COV can be a sign of a favorable resale market for buyers. Here’s how the valuation impacts your purchase:

- Determines loan quantum: The loan amount you can borrow may be capped at the valuation limit.

- Affects CPF usage: The CPF amount you can use for the purchase is limited by the valuation.

- Influences cash outlay: If COV is applicable, you’ll need to prepare additional cash on top of the purchase price.

Remember, a prudent assessment of the valuation’s impact on your finances will ensure a smoother transaction and prevent overstretching your budget.

Finalizing the Resale Application

Preparing and Submitting the Resale Application

Once you have obtained the Option to Purchase (OTP), the next critical step is to prepare and submit the resale application to the Housing & Development Board (HDB). This application is a pivotal part of the resale process, as it formally requests the transfer of ownership from the seller to the buyer. Both parties must submit their respective portions of the application, along with the necessary documents, within 7 calendar days of each other.

The resale application is a comprehensive document that requires detailed information about the buyer, the seller, the flat, and the terms of the sale. It’s essential to ensure that all information provided is accurate to prevent any delays.

The application fee varies depending on the flat type, and it’s important to be aware of the costs involved. Adhering to the submission timeline is crucial, as it typically falls within a specific period after exercising the OTP. Failure to comply with this schedule can lead to complications in the buying process. After submission, HDB will review the application to verify eligibility and compliance with regulations, a process that takes about 8 weeks to complete.

Adhering to Submission Timelines and Requirements

When finalizing your HDB resale application, adhering to submission timelines is crucial to ensure a smooth transaction. The resale application must be submitted within 7 calendar days after the OTP is exercised, as per HDB’s guidelines. Failure to comply with this requirement will result in the cancellation of the application, potentially leading to financial losses and the need to restart the process.

- Exercise the OTP and prepare for submission

- Submit the resale application within 7 calendar days

- Pay the application fee, which varies by flat type

It is essential to review and acknowledge all documents provided by HDB, which typically occurs three weeks after application acceptance. This step is vital for both buyers and sellers to avoid any misunderstandings or delays.

Remember, the resale completion timeline is approximately 8 weeks from the date of HDB’s acceptance of the resale application. You will be notified via SMS once the appointment is scheduled. It’s important to keep track of all deadlines and ensure that your financial arrangements are in order before attending the completion appointment.

Accepting the Resale Application and Review Process

Once you’ve submitted your resale application, the Housing & Development Board (HDB) will commence a thorough review to ensure all criteria are met. This review process is crucial as it confirms your eligibility and the legitimacy of the transaction. Typically, the review is completed within 28 working days, during which you will be notified about the status of your application.

After the review, HDB will issue an in-principle approval, signifying the acceptance of your application and allowing you to move forward to the completion appointment.

Remember, it’s essential to provide accurate information and adhere to the submission timelines. Any discrepancies or delays can affect the overall process. The application fee, which varies based on the flat type, should also be factored into your budget planning.

Completing the Resale Transaction

Signing Required Documents and Settling Fees

After diligently following the resale process, you are now at the penultimate step: finalizing the purchase by signing the required documents and settling fees. This crucial stage involves the endorsement of various legal documents, including the transfer document and, if applicable, the mortgage agreement. It is at this point that you will also need to make the final payment for the flat, which may encompass the balance of the purchase price and any additional transaction-related fees.

HDB will facilitate the provision of all necessary documents for both the buyer and seller to sign. These documents are typically prepared about three weeks after the acceptance of the resale application. It is imperative for both parties to thoroughly review, acknowledge, and sign these documents. Additionally, any applicable fees must be settled promptly to avoid any delays in the transaction.

The completion appointment is a significant event that signifies the transfer of ownership. It is essential to ensure that all financial arrangements are in place and that you are fully prepared with all necessary documents.

Remember, the Buyer’s Stamp Duty (BSD) is a tax paid on documents signed when you acquire property in Singapore. It is one of the fees that will be settled during this stage. Once all documents are signed and fees are paid, HDB will issue an in-principle approval for the resale transaction, indicating that your application has been accepted and you are one step closer to owning your resale flat.

Receiving In-Principle Approval from HDB

Once you have successfully endorsed the necessary documents and settled the legal conveyancing fees, HDB will issue an in-principle approval for your resale transaction. This approval is crucial as it signifies that your application is in order and that you can move forward to the final stages of the purchase.

The in-principle approval is a clear indication that HDB has reviewed and accepted your resale application, allowing you to prepare for the completion appointment.

Following the in-principle approval, it is important to stay informed about the next steps:

- Review all documents provided by HDB.

- Ensure that you understand the terms and conditions.

- Prepare for the final completion appointment.

Remember, the in-principle approval is a significant milestone in the resale process, marking the near completion of your journey to becoming a homeowner.

Attending the Completion Appointment

After attending the completion appointment, you are now on the verge of officially owning your HDB flat. This final step, typically scheduled about eight weeks after the acceptance of your resale application, is where you sign the transfer document and, if applicable, the mortgage agreement. It’s crucial to have all your financial arrangements settled and necessary documents at hand.

During this appointment, the remaining balance of the purchase price and any additional fees must be paid. Here’s a quick checklist to ensure you’re ready for the appointment:

- Final payment amount prepared

- Transfer document and mortgage agreement

- Identification documents

- CPF transaction details (if using CPF funds)

Once the documents are signed and payments are made, HDB will issue an in-principle approval for the resale transaction. This approval signifies that HDB has accepted your application and the ownership transfer process is nearly complete.

The completion appointment is not just a formality; it’s the definitive moment when the flat becomes legally yours. Ensure that you are thoroughly prepared to avoid any last-minute hitches.

Looking to Invest in a Property?

Purchasing a resale HDB flat in Singapore is a structured process that requires careful planning and adherence to the guidelines set by the Housing & Development Board (HDB).

From obtaining your Home Financing Eligibility (HFE) Letter to attending the completion appointment, each step is designed to ensure a smooth and transparent transaction. It’s crucial to stay informed about the timeline, costs, and documentation required throughout the process.

By following the steps outlined in this guide and working with professionals realtors, you can navigate the journey of buying your dream HDB resale flat with confidence and ease. Remember to review all documents carefully, adhere to the submission schedules, and prepare for the financial aspects of the purchase. With patience and diligence, you’ll soon be able to call a piece of Singapore your home.

Aaron Oon is a Senior Associate Director at Propnex and Founder of Real Estate Insider. A consistent Top Producer in the competitive world of real estate, Armed with a Finance degree from NUS, Aaron is more than just a real estate agent; he’s a strategic thinker and a creative problem solver.

If you are looking to invest in a property here in Singapore or would like to know more about Singapore’s property market. Be sure to reach out through the Calendy video link below:

Frequently Asked Questions

What is the first step in buying a resale HDB flat in Singapore?

The first step is to check your eligibility and understand your financing options. You should apply for a Home Financing Eligibility (HFE) Letter from HDB on My Flat Dashboard, which will detail your eligibility for an HDB loan and the maximum loan amount you can borrow.

How do I find a suitable resale HDB flat?

Once you have your HFE letter, you can start searching for a suitable resale HDB flat within your budget. Research various neighbourhoods, visit potential flats, and consider factors like location, size, and amenities. You can also engage a Realtor for professional assistance.

What is an Option to Purchase (OTP) and how do I obtain it?

An Option to Purchase (OTP) is a legal agreement between you and the seller that grants you the option to purchase the resale flat. You can obtain the OTP from the seller once you’ve decided on a flat and are ready to proceed with the purchase.

Why do I need to submit a Request for Value to HDB and what does it involve?

After obtaining the OTP, you must submit a Request for Value to HDB to determine the official valuation of the flat. This valuation is essential if you’re using CPF funds or a loan to finance the purchase, as it affects the amount of CPF funds you can use and the size of the loan you can obtain.

What information is required when submitting a resale application to HDB?

The resale application must include detailed information about the buyer and the seller, the flat, and the terms of the sale. It’s a formal request to transfer the ownership of the flat from the seller to you.

What happens after the resale application is accepted by HDB?

Once the resale application is accepted, HDB will provide all the required documents for both you and the sellers to sign. Following the endorsement of fees and payment, HDB will issue an in-principle approval for the resale transaction, and you will be scheduled to attend the completion appointment.