If you’re one of the Singaporeans who have complained about the ‘shrinking’ BTO flat sizes, then an HDB executive apartment might just be your dream come true.

These apartments are among the largest types of HDB flats available, offering a generous amount of space that ranges from 140 sq m to 150 sq m (1,776 to 2,034 square feet). Not only do they provide ample living space, but they also come with a unique appeal and potential investment opportunities.

While they are not created anymore for BTO(build-to-order), you can still find them in the resale market and have been a popular pick by young couples looking for an immediate stay and ample living space.

In this article, we will delve into the various aspects of HDB executive apartments, from understanding what they are to exploring their financial and lifestyle benefits.

Key Takeaways

- HDB executive apartments offer a spacious alternative to the increasingly compact BTO flats, with sizes ranging from 1,475 to 2,616 square feet.

- Location significantly impacts the price of executive apartments, with properties in central and city fringe areas commanding higher prices due to mature estates and amenities.

- Executive apartments provide investment opportunities through rental income, but factors like lease decay need to be considered when evaluating long-term value.

- These apartments offer the experience of landed living at a lower cost, presenting a unique charm and lifestyle benefits associated with multi-storey HDB living.

- Prospective buyers need to navigate the resale market, understand renovation costs, and consider future prospects of executive apartments in Singapore’s housing landscape.

What Is HDB Executive Apartment?

An HDB Executive apartment is a unique type of public housing in Singapore, offering a generous amount of space and a multi-storey layout. Although not available in BTO units, you can still find them in the resale market.

Typically, an EA features multiple bedrooms and sizeable living areas, providing families with the comfort of a spacious home environment. Since these apartments are no longer built, making them a sought-after commodity in the resale market.

Executive apartments are great for those who prioritize space and the experience of ‘landed living’ within the public housing scheme. They offer a unique blend of privacy and community living, often found in mature estates with established amenities.

While Executive Condominiums (ECs) are also a form of upscale public housing, they differ from EAs as they are strata-titled apartments built and sold by private developers and are subject to different eligibility requirements.

How big is a HDB Executive flat?

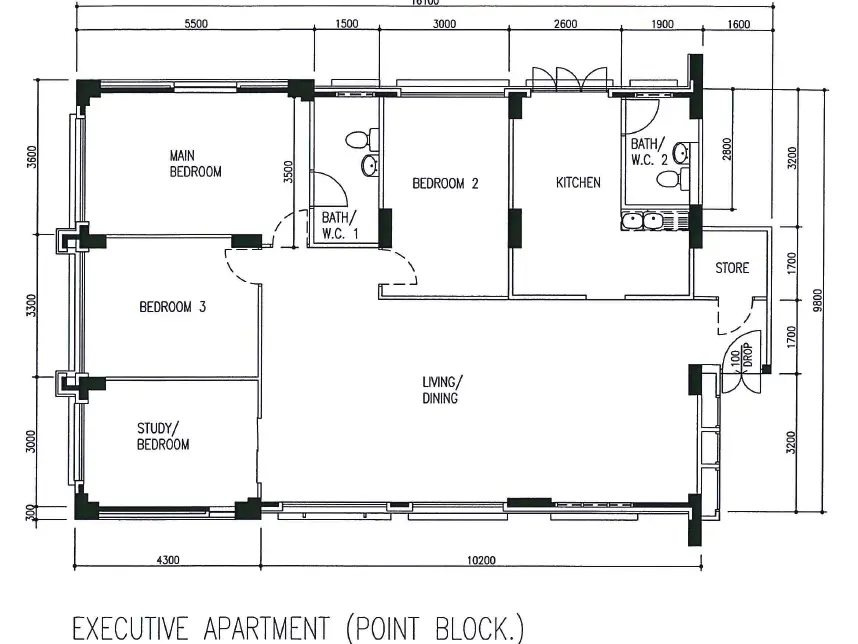

When it comes to space, HDB executive apartments stand out with their generous floor plans. Typically ranging from 141 to 156 sqm( 1,475 to 2,616 square feet), these units are significantly larger than the average HDB flat. For comparison, a 4-room Built-To-Order (BTO) flat usually spans between 970 to 1,200 square feet. This stark difference in size is a key factor for families seeking more living space.

Here’s a quick comparison of HDB flat sizes:

| HDB Flat Type | Size Range (sqft) |

|---|---|

| 4-room BTO | 970 – 1,200 |

| Executive apartment | 1,475 – 2,616 |

Executive apartment offer a unique blend of space and affordability, making them a coveted choice for many homebuyers.

The size of an executive apartment not only provides ample room for comfortable living but also allows for greater flexibility in interior design and renovation. This is particularly appealing for those who value a spacious environment and wish to personalize their home to suit their lifestyle.

What is the difference between HDB Maisonette and EAs?

In Singapore, both HDB Maisonettes and Executive Apartments are types of public housing offered by the Housing and Development Board (HDB), but there are some differences between the two:

- Size and Layout: HDB Maisonettes are typically larger than Executive Apartments. Maisonettes are two-storey units, whereas Executive Apartments are single-level units. Maisonettes often have more bedrooms and living space due to their two-level layout.

- Ownership Restrictions: Maisonettes were built in older HDB estates and are usually found in older towns. Executive Apartments were introduced later and are generally found in newer HDB estates. Maisonettes were originally sold under the Design, Build and Sell Scheme (DBSS), while Executive Apartments were sold under the Executive Condominium (EC) scheme.

- Availability: Maisonettes are less common than Executive Apartments, as they were built in limited numbers in specific older HDB estates. Executive Apartments are more widespread, especially in newer HDB developments.

- Price: Maisonettes tend to command higher prices on the resale market compared to Executive Apartments due to their larger size and two-storey layout.

Overall, while both HDB Maisonettes and Executive Apartments are forms of public housing in Singapore, Maisonettes offer larger living spaces with a two-storey layout, while Executive Apartments are typically single-level units found in newer HDB estates.

The Appeal of Spacious Living

The spaciousness of HDB Executive apartments is a significant draw for many homebuyers. These units are often compared to ‘unicorns’ within the HDB property landscape due to their rarity and generous space per square foot.

The appeal extends beyond mere size; it encompasses the potential for creative interior design, allowing homeowners to transform their apartments into functional and stylish living spaces.

The increased privacy offered by the apartment layout is another aspect that enhances the living experience. With separate floors for living and sleeping areas, residents enjoy a level of separation that is uncommon in standard apartment living.

For families, the extra space can be a game-changer, providing ample room for children to play and for adults to entertain guests without feeling cramped. The following list highlights some of the key benefits of the spacious living provided by HDB Executive apartments:

- Enhanced privacy and separation of living spaces

- Ample room for family activities and entertaining

- Flexibility in interior design and customization

- A sense of exclusivity due to their limited availability

While the spaciousness is a clear advantage, it’s important to consider the financial implications and investment potential of such properties, which will be discussed in the following sections of this article.

Financial Considerations for Executive Apartment Buyers

Unlike BTO projects where 4 bedder units can cost anywhere from $400,000 to $890,000 for non-mature and mature estate, executive apartments do cost a lot more which ranges from $550,000 to $1,290,000. What’s more, executive apartments have less than 70 years of lease remaining.

For many Singaporeans, this is a lot more pricier for having a larger space than going for BTO. And these executive apartments are less likely to appreciate higher than BTO projects.

However, some young couples still want this type of housing as they see themselves not living until 99 years old and want to have a large accommodation space to invite friends and family over.

Impact of Location on Price

The location of an HDB executive apartment significantly influences its price. Properties in central or city fringe areas are typically more expensive, reflecting their proximity to the Central Business District (CBD) and abundance of amenities. For instance, apartments in mature estates like those near Marsiling Park command a premium for their blend of greenery and convenience.

Conversely, executive apartments in non-mature estates may offer more affordable options, albeit with potential trade-offs in terms of amenities and public transport accessibility. Prospective buyers must weigh their priorities, such as space versus location, and consider their lifestyle needs when evaluating the price.

When considering an executive apartment, it’s crucial to reflect on personal preferences and daily habits, as these will dictate the value you place on location versus other factors.

Here’s a quick comparison of executive apartment prices in different locations:

| Location | Price Range (SGD) |

|---|---|

| Central | High |

| City Fringe | Moderate to High |

| Non-Mature Estates | More Affordable |

Understanding the nuances of location can help buyers make informed decisions and ensure they invest in a home that suits their needs and budget.

Loan Eligibility & Down Payment Requirements

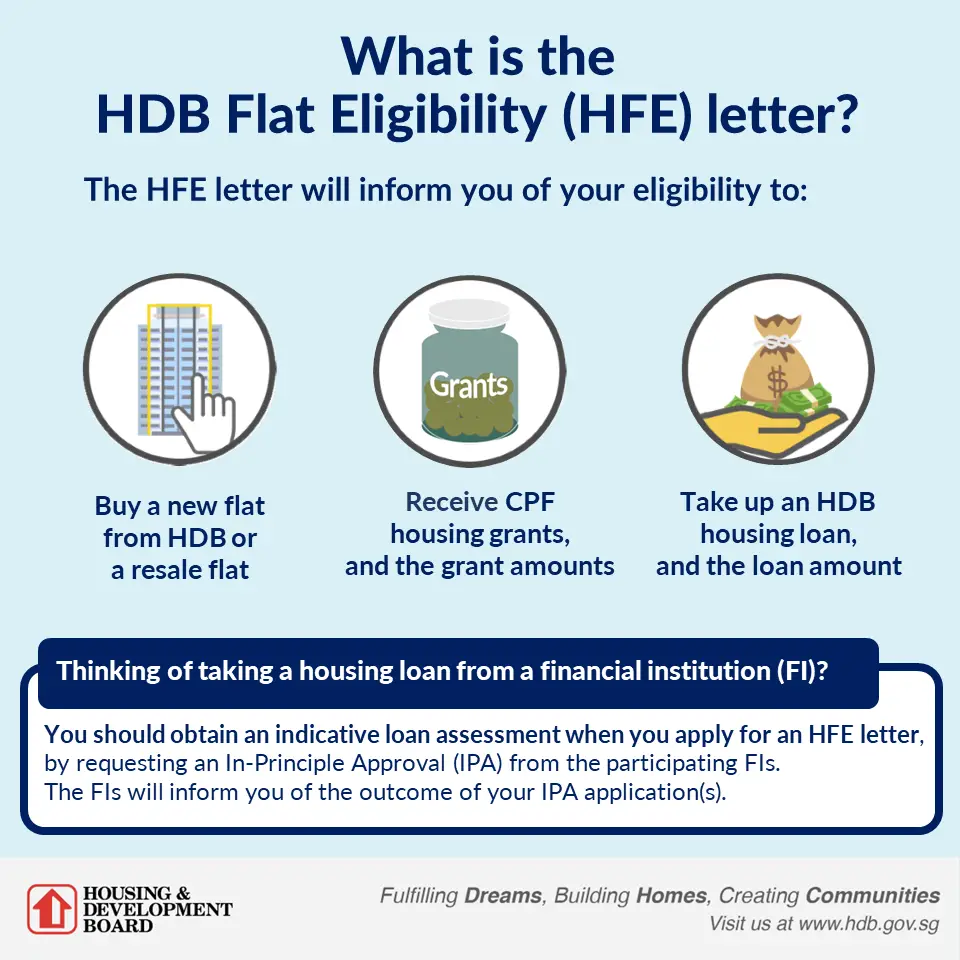

Before purchasing an HDB executive apartment, buyers will need to understand the loan eligibility and down payment requirements.

For HDB loans, the loan-to-value (LTV) limit is set at 80%, allowing borrowers to finance up to 80% of the lower of the property’s value or purchase price. However, to qualify for the maximum LTV, the property’s lease must extend until the youngest buyer is at least 95 years old; otherwise, the LTV will be prorated.

The down payment for an executive apartment can be a significant sum, especially if the property is older and the LTV is prorated. Prospective buyers must evaluate their financial readiness, considering both CPF funds and cash reserves.

For those considering a bank loan, the down payment is typically higher at 25%, and buyers are subject to the Mortgage Servicing Ratio (MSR) and Total Debt Servicing Ratio (TDSR) limits. It’s essential to ask yourself key questions about your financing strategy and the liquidity needed for ongoing mortgage repayments

Using CPF Funds for Purchase

Purchasing an HDB Executive apartment often involves using the Central Provident Fund (CPF) Ordinary Account (OA) savings for the down payment and monthly mortgage repayments. The amount of CPF OA savings you can use is contingent on the property’s remaining lease and the age of the youngest buyer. The lease must be at least 20 years, and it should cover the youngest buyer until they are 95 years old to utilize CPF funds without proration.

When considering the use of CPF funds, it’s crucial to understand the implications of any CPF housing grants you may be eligible for. For example, acquiring an Executive Condominium (EC) with a CPF housing grant could subject you to a resale levy when purchasing another subsidized property in the future. Additionally, the CPF OA savings usage may be prorated if the remaining lease of the property cannot cover the youngest buyer up to the age of 95.

It’s essential to assess your financial readiness and consider questions such as the type of loan you’re taking, the proration of CPF OA savings, and whether you have sufficient cash to comfortably finance your property.

Investment Potential of Executive Apartments

Before investing in an executive apartment, homeowners should understand the investment potential of an executive apartment.

Rental Income Opportunities

Owning an HDB executive apartment presents a unique opportunity for generating rental income. While public housing is often used for own-stay, some homeowners would use this opportunity to rent out a portion of their home while they are gone for rental income.

The strategic location and size of these units can attract a substantial tenant base, especially in mature estates with good connectivity. Renting out the entire unit or individual rooms can be a viable way to offset mortgage payments and maintain financial flexibility.

For those considering renting out their executive apartment, here are some factors to consider:

- Legal compliance with HDB’s subletting regulations

- Setting competitive rental rates

- Selecting reliable tenants

- Maintaining the property to ensure its appeal

The median rents for 5-room flat HDB rental transactions in Q4 2023 range from $3,200 to $4,300 per month, depending on location. Space is likely to be your biggest selling point.

Investors should also be aware of the broader market, as Singapore real estate offers diverse investment opportunities. Comparing the potential rental yields of an executive apartment with other property types is crucial to making an informed decision.

Lease Decay and Property Value

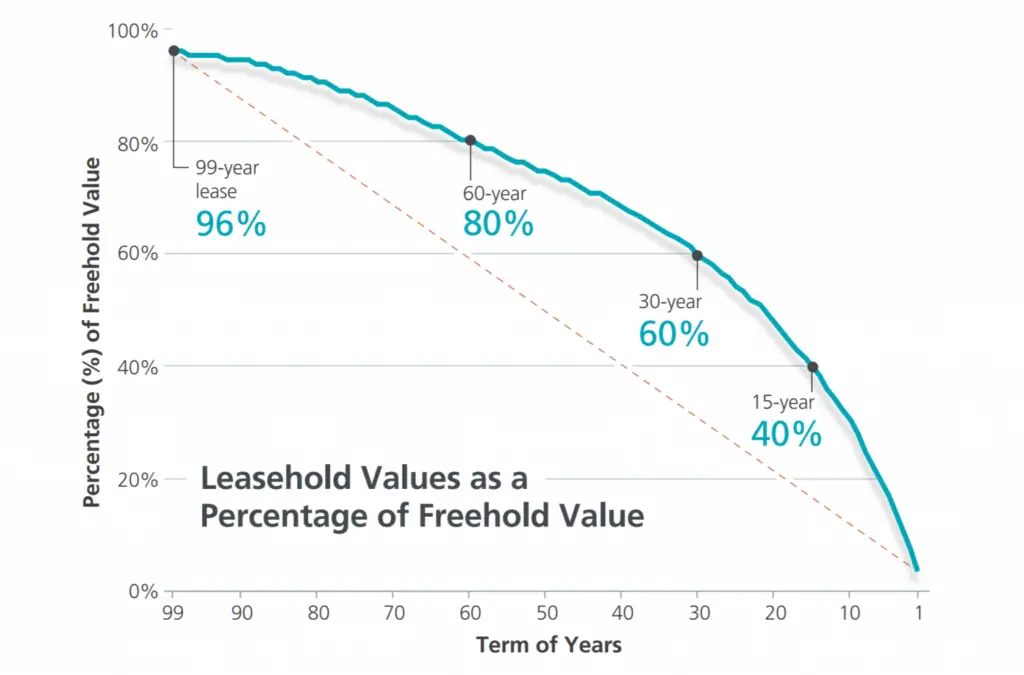

The phenomenon of lease decay is a critical factor for HDB executive apartment owners to consider, particularly when it comes to the property’s long-term value. Every leasehold property in Singapore faces what we call the Bala’s curve; which is as time progresses, the capital appreciation of it slows down and gradually loses its value over time.

As the 99-year lease shortens, the value of the flat may diminish, potentially affecting resale prices unfavorably. This is especially pertinent for executive apartments, which were last constructed in 2000, leaving the newest units with about 75 years on their lease.

- What type of home do I want to upgrade to?

- Am I looking for the best price-to-space ratio when purchasing a property?

Despite the challenges posed by lease decay, some owners adopt a proactive approach by renting out their units. A well-located apartment, particularly near MRT stations or city fringes, can still fetch attractive rental income, which can help offset the impact of a dwindling lease.

However, this strategy comes with its own set of considerations, including higher maintenance costs and potentially lower rental yields over time.

While lease decay is an inevitable aspect of HDB ownership, the unique appeal and limited supply of executive apartments can still support their market value. Owners betting on these factors may still find opportunities for appreciation.

Comparing Rental Yields with Other Properties

When considering the investment potential of HDB executive apartments, rental yields are a crucial factor. Executive apartments often offer competitive rental yields, especially when compared to other types of properties. This is due to their generous space and desirable layouts, which are attractive to tenants looking for family-friendly accommodations.

For investors, comparing the rental yields of executive apartments with other properties is essential to gauge potential returns. A city fringe or centrally-located executive apartment near an MRT station can generate substantial rental income, despite a shorter remaining lease. However, it’s important to note that higher upfront costs may result in a lower yield.

The appeal of executive apartments in the rental market remains strong, with their limited supply and bargain price-to-space ratios helping to maintain value.

Here’s a quick comparison of rental yields across different property types:

| Property Type | Average Rental Yield |

|---|---|

| Executive apartment | 3% |

| Private Condominium | 2.5% |

| New Launch Condo | 2% |

Executive apartments can be a wise choice for long-term investment, particularly for those looking to own multiple properties or considering a strategy to counteract lease decay.

Lifestyle Benefits of Executive Apartments

Space To Play Around With

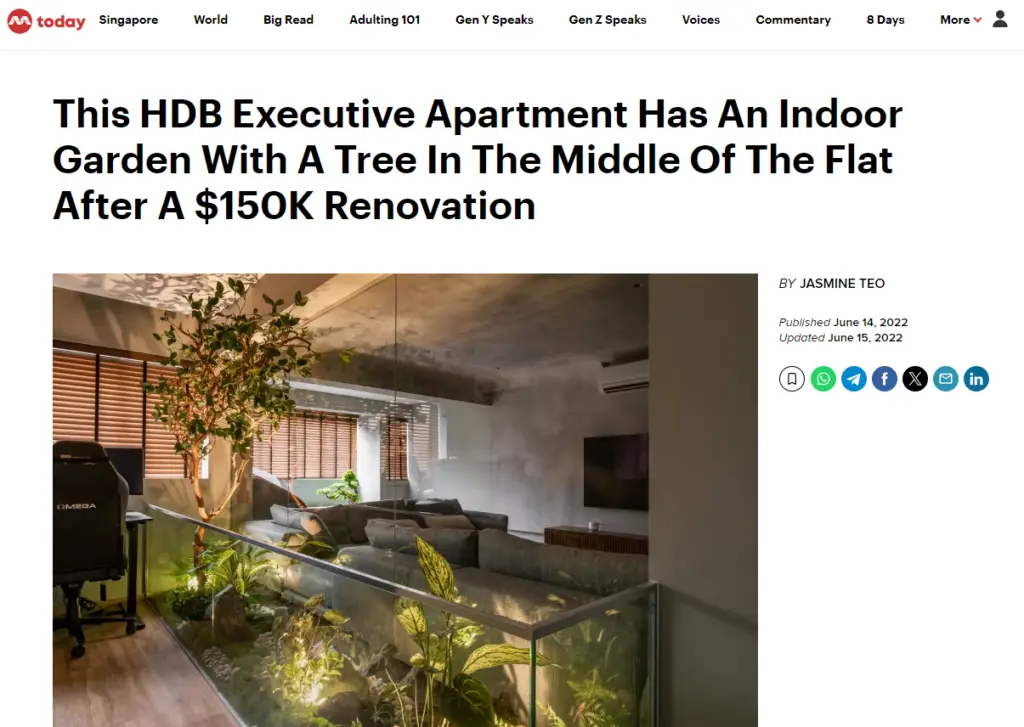

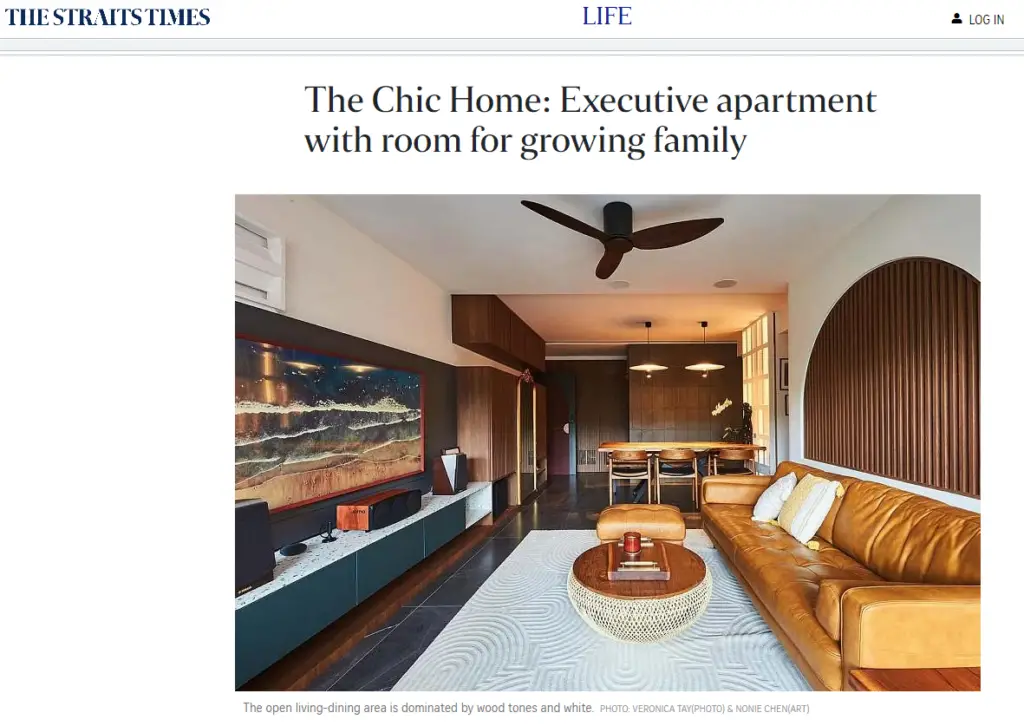

One of the main attractions of HDB executive apartments is the opportunity to enjoy spacious living. Many resale buyers have renovated these old homes to make them majestic.

When comparing the cost of HDB apartments to private properties, the price per square foot (PSF) is significantly lower, making it an attractive option for those looking for more space on a budget. For instance, a private landed property in the same neighborhood could cost substantially more for equivalent square footage.

Moreover, government initiatives and the trend of young individuals in Singapore shifting towards private estate living suggest that the desire for more exclusive and spacious homes is on the rise, making executive apartments a prudent choice for those considering prospects in homeownership.

Amenities and Accessibility in Mature Estates

Executive apartments in mature estates offer a unique blend of convenience and community. Residents enjoy a plethora of amenities, including shopping malls, schools, and recreational facilities, all within walking distance. The established public transport networks in these areas ensure that commuting is a breeze, making them highly attractive for families and working professionals alike.

Mature estates like Clementi and Serangoon are known for their vibrant community spaces and green parks, adding to the quality of life for their residents. Here’s a quick comparison of recent transactions in mature estates:

| Estate | Price Range |

|---|---|

| Serangoon | $815,000 – $1,110,000 |

| Tampines | $773,000 – $1,025,000 |

| Toa Payoh | $830,000 – $1,120,000 |

The established character of mature estates, coupled with the comprehensive amenities, makes them a coveted location for executive apartment buyers.

While the initial investment might be higher compared to non-mature estates, the long-term benefits of living in a mature estate are undeniable. The convenience of having everything at your doorstep cannot be overstated, and it is this aspect that often tips the scales for potential buyers.

Navigating the HDB Market

When considering the resale of an HDB executive apartment, it’s crucial to prepare your HDB flat for sale by ensuring it’s well-maintained and getting an accurate valuation. Engaging with potential buyers through effective marketing and negotiating with empathy and firmness can significantly impact the final sale price.

The resale market for executive apartments is dynamic, with prices influenced by factors such as location, age of the flat, and remaining lease. Recent records show a 32-year-old executive apartment in Bishan being resold for a staggering $1.48 million, setting a new benchmark for executive flats.

Understanding the resale statistics is essential for both buyers and sellers. The median resale price can provide a better idea of market movements and help in making a more informed decision. Here are some key points to consider:

- Location and its impact on price due to remaining lease, access to amenities, and public transport.

- The age of the property and potential lease decay affecting resale value.

- The record-breaking resale prices in mature estates, such as the recent sale in Bishan.

With these considerations in mind, navigating the resale market for executive apartments can be a more strategic and informed process.

Renovation Considerations and Costs

When it comes to renovating an HDB executive apartment, understanding the financial implications is crucial. Renovation costs can vary widely, depending on the extent of the work and the quality of materials chosen. According to a 2024 homeowner’s guide, the average renovation cost for a resale HDB flat is approximately $67,000. For executive apartments, which are larger, costs can be expected to be on the higher end.

It’s essential to be aware that homeowners are responsible for ensuring that renovations adhere to HDB guidelines. Non-compliance can lead to unnecessary expenses and legal issues. Here’s a quick checklist for renovation planning:

- Confirm the renovation guidelines set by HDB.

- Set a realistic budget based on average costs and personal preferences.

- Choose a reputable contractor who is familiar with HDB regulations.

- Plan for contingencies to cover unexpected expenses.

While the initial outlay for renovations can be significant, a well-planned renovation can enhance the comfort and value of your home, making it a worthwhile investment.

Remember, the resale value of your apartment can be influenced by the quality and appeal of renovations, so it’s important to consider both current enjoyment and future prospects when planning your renovation project.

Future Prospects of EAs in Singapore

The future of HDB executive apartments in Singapore remains a topic of interest for potential homeowners and investors alike. With the evolving landscape of the Singapore housing market, these properties are often considered for their unique blend of space and affordability. As the city-state continues to develop areas like the Jurong Lake District, the potential for growth in the value of executive apartments in these regions cannot be overlooked.

Given the recent changes to the occupancy cap, allowing up to eight unrelated individuals to reside in larger flats, executive apartments could see an increase in demand as rental properties. This temporary policy adjustment reflects a shift in housing needs and could influence the market dynamics for these spacious units.

Moreover, the resale market for executive apartments is influenced by factors such as the Minimum Occupation Period (MOP) for executive condos. As certain executive condos reach their MOP, they enter the resale market, potentially affecting the supply and demand for executive apartments.

The investment in executive apartments must be weighed against considerations such as lease decay and the age of the property. While some of the highest-priced flats are older, including apartments from the ’80s, their spaciousness and design continue to attract buyers.

In conclusion, the executive apartment remains a distinctive housing option in Singapore, with its investment potential and lifestyle benefits continuing to draw interest. However, buyers must stay informed about market trends, policy changes, and the implications of property age on value.

Looking to Buy an Executive apartment?

While they may come with a higher price tag in prime locations and older units may affect loan amounts and CPF usage, their unparalleled price-to-space value compared to private property makes them an attractive option for many. Additionally, the possibility of renting out these units can be a strategic move to counter lease decay.

As one of the largest HDB types available, executive apartments present an opportunity for Singaporeans to experience the feel of landed living without the exorbitant cost. Whether they are worth the investment will depend on individual circumstances but for those looking for space and value, an HDB executive apartment could be the dream home they are searching for.

Aaron Oon is a Senior Associate Director at Propnex and Founder of Real Estate Insider. A consistent Top Producer in the competitive world of real estate, Armed with a Finance degree from NUS, Aaron is more than just a real estate agent; he’s a strategic thinker and a creative problem solver.

If you are looking to invest in a property here in Singapore or would like to know more about Singapore’s property market. Be sure to reach out through the Calendy video link below:

Frequently Asked Questions

How does the location affect the price of an HDB executive apartment?

The price of an HDB executive apartment is significantly influenced by its location. Properties in city fringe areas and centrally-located HDB estates, especially within mature estates with ample amenities, tend to command higher prices.

Can CPF funds be used to purchase an HDB executive apartment?

Yes, CPF funds can be used to purchase an HDB executive apartment. However, the amount that can be used is dependent on the remaining lease of the property and the age of the youngest buyer, with restrictions applied to ensure coverage until the age of 95.

What are the potential rental income opportunities for HDB executive apartments?

HDB executive apartments can offer rental income opportunities, especially if they are located near city fringes or central areas and MRT stations. Despite lease decay, well-maintained properties in good locations can still command high rental prices.

What lifestyle benefits do HDB executive apartments offer?

HDB executive apartments provide the experience of landed living at a lower cost, with the added benefits of a high price-to-space value, accessibility to amenities in mature estates, and the unique charm of spacious HDB living.